- Gold

- Brent Oil

- WTI Crude Oil

- Silver

- Natural Gas

- Platinum spot

- Palladium spot

Power Trading: Top Instruments and Techniques for Energy Market Practitioners

The world of power trading continues to evolve with technological advancements and market changes. For professionals seeking to improve their performance in electricity trading, understanding the right tools and methodologies is crucial. This article examines the most effective approaches to energy market participation.

Understanding Power Trading Fundamentals

Power trading involves buying and selling electricity in various market environments. Traders analyze supply and demand patterns, weather forecasts, and regulatory changes to make informed decisions. Success in this field requires both technical knowledge and practical expertise with specialized platforms.

| Trading Type | Time Frame | Risk Level | Capital Required |

|---|---|---|---|

| Day-ahead | 24 hours | Medium | Moderate |

| Intraday | Same day | High | Moderate-High |

| Forward contracts | Weeks to years | Low-Medium | High |

| Futures | Months to years | Medium-High | High |

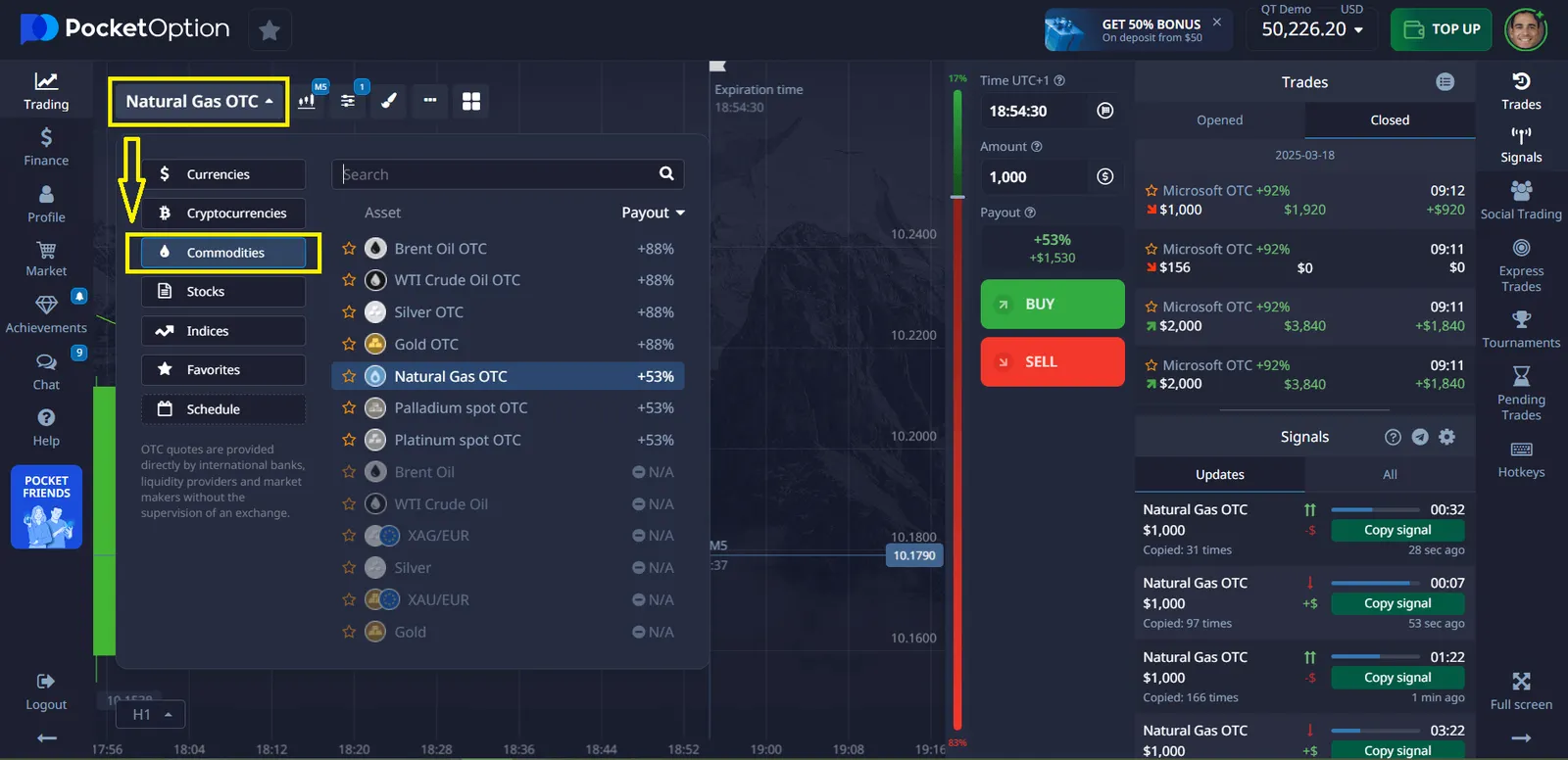

Trading Commodities on Pocket Option

Pocket Option offers traders access to a diverse range of commodity markets, allowing investors to diversify their portfolios beyond traditional forex and stock assets. Commodities represent physical goods and raw materials that are fundamental to the global economy, making them attractive investment vehicles during various market conditions. These commodity markets are available through the platform’s intuitive trading terminal, which provides real-time pricing, technical analysis tools, and various order types to help traders execute their commodity trading strategies effectively.

The commodities available for trading on Pocket Option include:

Traders on Pocket Option can access these commodity markets through various contract types, including standard CFDs and Quick Trading, depending on their trading preferences.

Quick Trading allows traders to profit from price movements without owning any underlying assets! You only need to make a forecast about whether the price will go up or down. If your forecast is correct, you will receive up to 92% profit ✔️

Pocket Option provides traders with:

- Detailed market analysis

- Economic calendars and news feeds specifically relevant to commodity markets

- Helping traders stay informed about factors affecting commodity prices (weather events, geopolitical tensions)

- Production reports

- Inventory data

Technical Analysis Tools for Electricity Market Trading

Successful electricity trading relies on robust analytical capabilities. These tools help traders identify patterns and make forecasts about market movements.

- Price chart analysis software for identifying trends

- Weather pattern integration systems

- Grid condition monitoring platforms

- Supply-demand modeling applications

| Analysis Tool | Primary Function | Integration Options | Data Sources |

|---|---|---|---|

| Genscape | Real-time monitoring | API available | Proprietary sensors |

| PowerBI | Customizable dashboards | Multiple connectors | Various databases |

| Energy Exemplar | Market simulation | Limited | Historical and forecast |

| Bloomberg EMSX | Execution management | Extensive | Bloomberg Terminal |

Practical Steps for Effective Power Trading

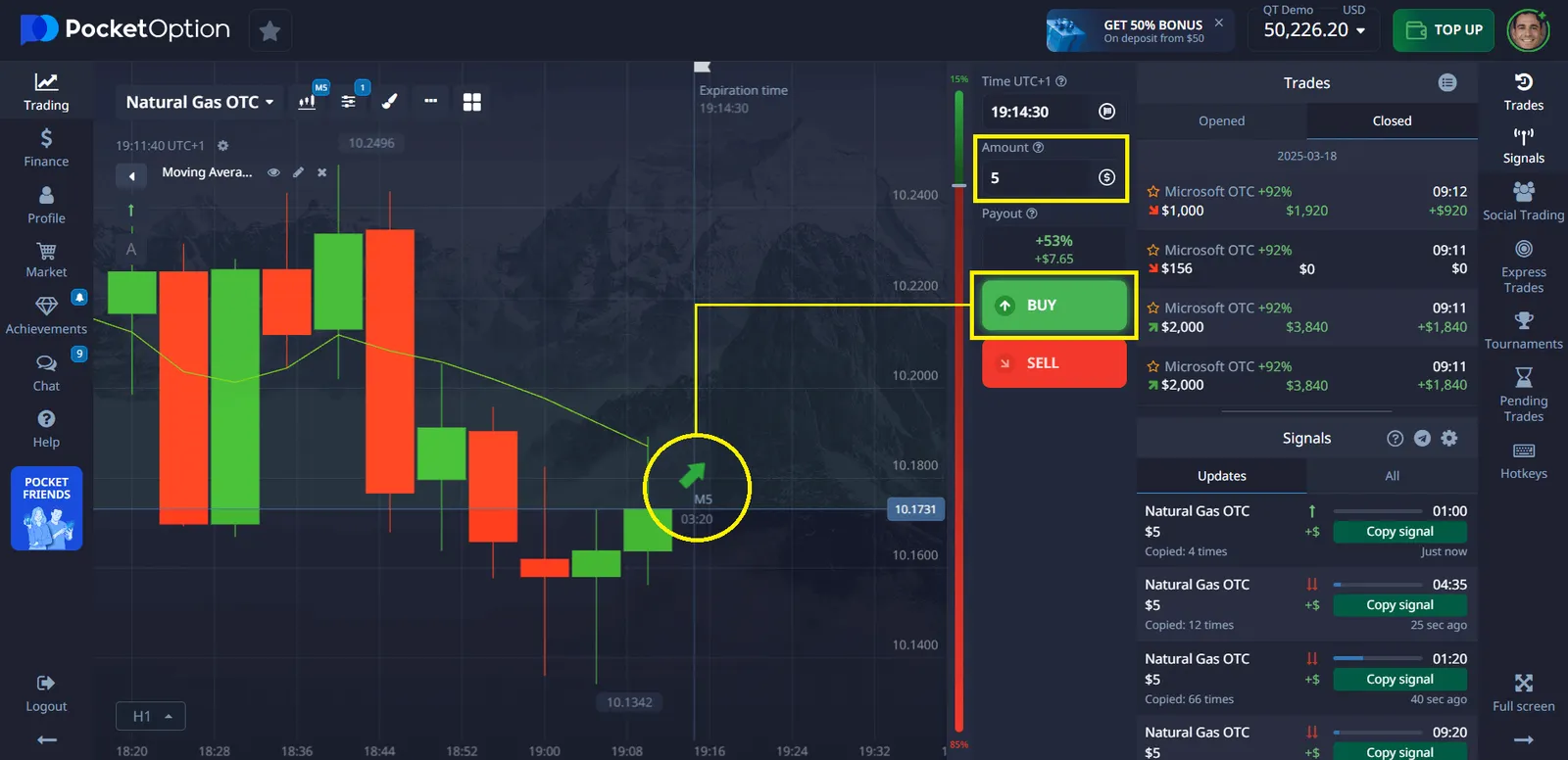

To trade commodities on Pocket Option, you can select them from the list of trading assets available on the platform. You can browse by category or use the instant search function to find a specific commodity:

Once you select a commodity, analyze the market and place your trade based on your forecast:

The trade will close as soon as the time specified when opening the trade has passed. If the forecast is correct, you get a profit – up to 92%. This percentage can be seen in advance when choosing an asset for trading.

⚡Tip: In addition, commodities can also be included in express trades. This allows you to combine forecasts across multiple assets for potentially higher payouts!

Risk management:

Implementing a structured approach to electricity market trading improves performance and reduces risk. Consider these practical steps:

- Establish clear trading objectives based on risk tolerance

- Develop standardized analysis protocols

- Create position sizing rules

- Implement strict risk management procedures

| Trading Phase | Key Actions | Tools Required |

|---|---|---|

| Pre-market analysis | Review weather, news, previous settlements | News feeds, weather services |

| Strategy development | Define entry/exit points, position size | Technical analysis software |

| Execution | Place orders according to plan | Trading platform |

| Post-trade review | Analyze performance, adjust strategy | Journal, performance metrics |

Risk Management in Trading Electricity

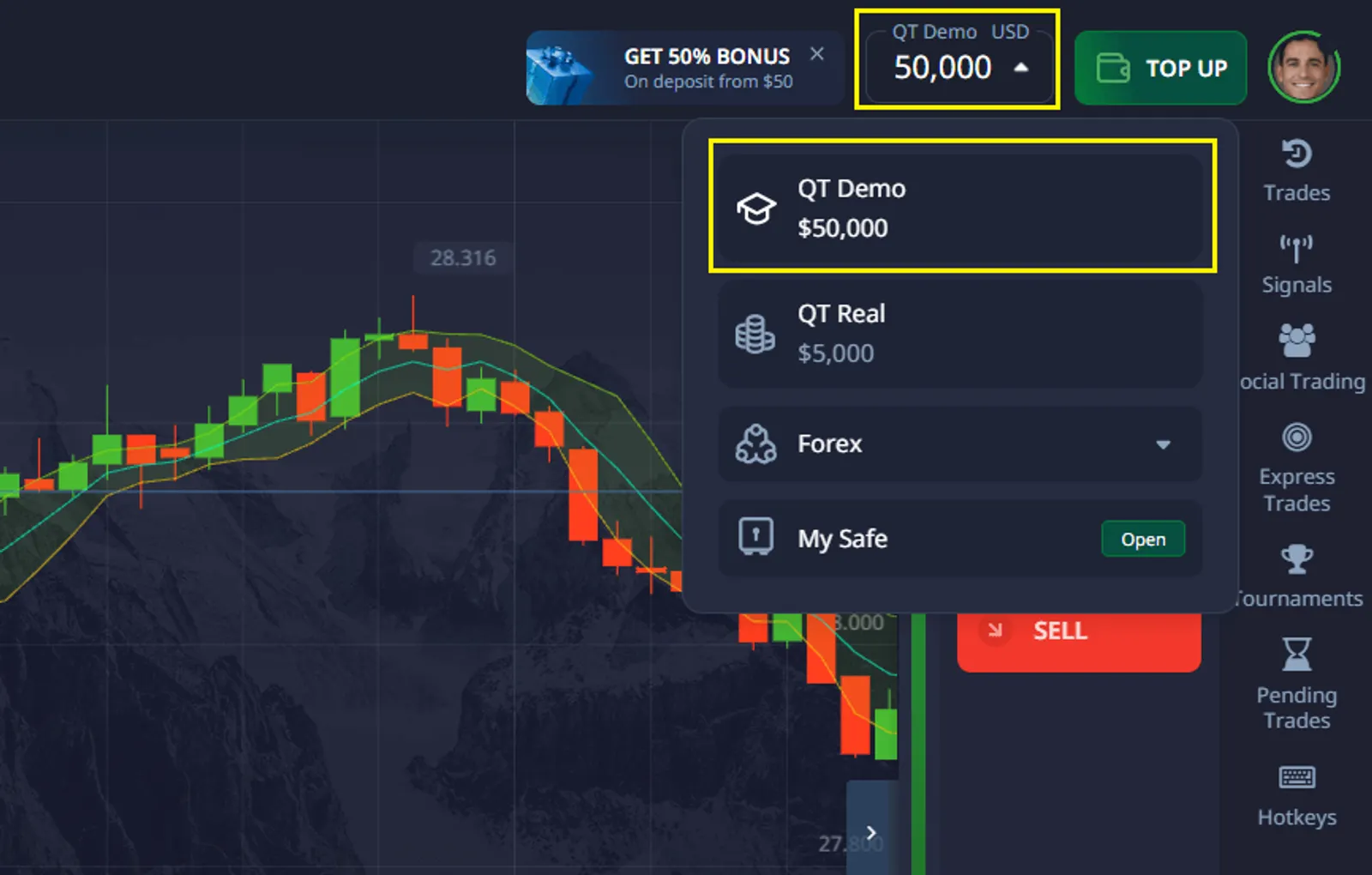

With Pocket Option, traders gain access to a no-cost practice demo account loaded with $50,000 of virtual currency, enabling risk-free trading experimentation. This simulation gives you the practice before you get to the actual trading environment. Pocket Option demo account contains similar layouts, analytical instruments, graphical displays, market signals, and operational capabilities – not much different from the real money platform.

The unique volatility of energy markets makes risk management essential in power trading. Effective traders implement comprehensive frameworks to protect capital.

- Position limits based on market conditions

- Diversification across time periods and regions

- Hedging techniques using options and futures

- Regular portfolio stress testing

| Risk Type | Mitigation Approach | Monitoring Method |

|---|---|---|

| Price volatility | Stop-loss orders | Price alerts |

| Liquidity risk | Market depth analysis | Volume indicators |

| Counterparty risk | Credit checks | Exposure reports |

| Regulatory risk | Compliance protocols | Policy updates |

Conclusion

Success in power trading requires a combination of technical knowledge, strategic thinking, and appropriate tools. By understanding market fundamentals, utilizing robust platforms, and implementing structured risk management, traders can navigate the complexities of electricity market trading effectively. Regular assessment and adaptation remain key to long-term success in this dynamic field.

FAQ

What qualifications do I need to start electricity commodity trading?

Most professionals have backgrounds in energy economics, engineering, or finance. While formal qualifications vary by employer, understanding of energy markets, technical analysis, and risk management is essential. Many traders also pursue certifications like the Energy Risk Professional (ERP).

How much capital is required to begin power trading?

Capital requirements depend on the trading approach. Institutional traders may manage portfolios worth millions, while individual traders working through brokerages might begin with $10,000-$50,000. Always ensure you have sufficient capital to withstand market volatility.

Which power trading platform is best for beginners?

Beginners often find Pocket Option accessible due to its user-friendly interface and educational resources. Other platforms like EPEX Spot offer demo environments where you can practice without financial risk.

How do seasonal factors affect electricity trading?

Seasonal patterns significantly impact electricity prices through changing demand (heating in winter, cooling in summer) and supply factors (hydropower availability, renewable generation). Successful traders incorporate seasonal analysis into their strategies.

Is algorithmic trading common in electricity markets?

Yes, algorithmic trading has become increasingly prevalent in power trading. These systems analyze market data and execute trades based on predefined parameters, often capturing opportunities faster than manual trading. However, they require sophisticated development and constant monitoring.