- Short trade duration – trades close within 60 seconds.

- High dynamics – the ability to make multiple trades in a short period.

- Use of technical analysis – traders apply indicators, support, and resistance levels.

- Quick decision-making – the strategy requires rapid decision execution.

- Access to educational materials – the Guides and Tutorials section on the platform contains instructions on effectively using indicators.

Pocket Option Strategy 1 Minute: Quantitative Analysis for Rapid Trading

The 1-minute Pocket Option strategy is popular among short-term traders, helping them make faster, data-driven decisions for potentially better outcomes.

Basic Information About the 1-Minute Strategy on Pocket Option

The Pocket Option Strategy 1 Minute is designed for traders who prefer fast trades with minimal trade duration. This tactic allows traders to execute deals lasting 60 seconds, using the Quick Trading mode. This approach relies on an instant reaction to market changes and requires high concentration, proper analysis, and strict adherence to strategy.

Features of the 1 Minute Strategy

Key Parameters of the Strategy

| Parameter | Value |

|---|---|

| Trade Duration | 1 minute (60 seconds) |

| Trading Mode | Quick Trading |

| Required Tools | Charts, indicators, analysis |

| Required Deposit | Depends on the chosen trade amount |

| Trading Platform | Pocket Option |

Principles of the 1 Minute Strategy

When trading with this strategy, it is important to consider market volatility. To minimize risks and increase profit potential, traders use indicators, support, and resistance levels.

Indicators for the Strategy

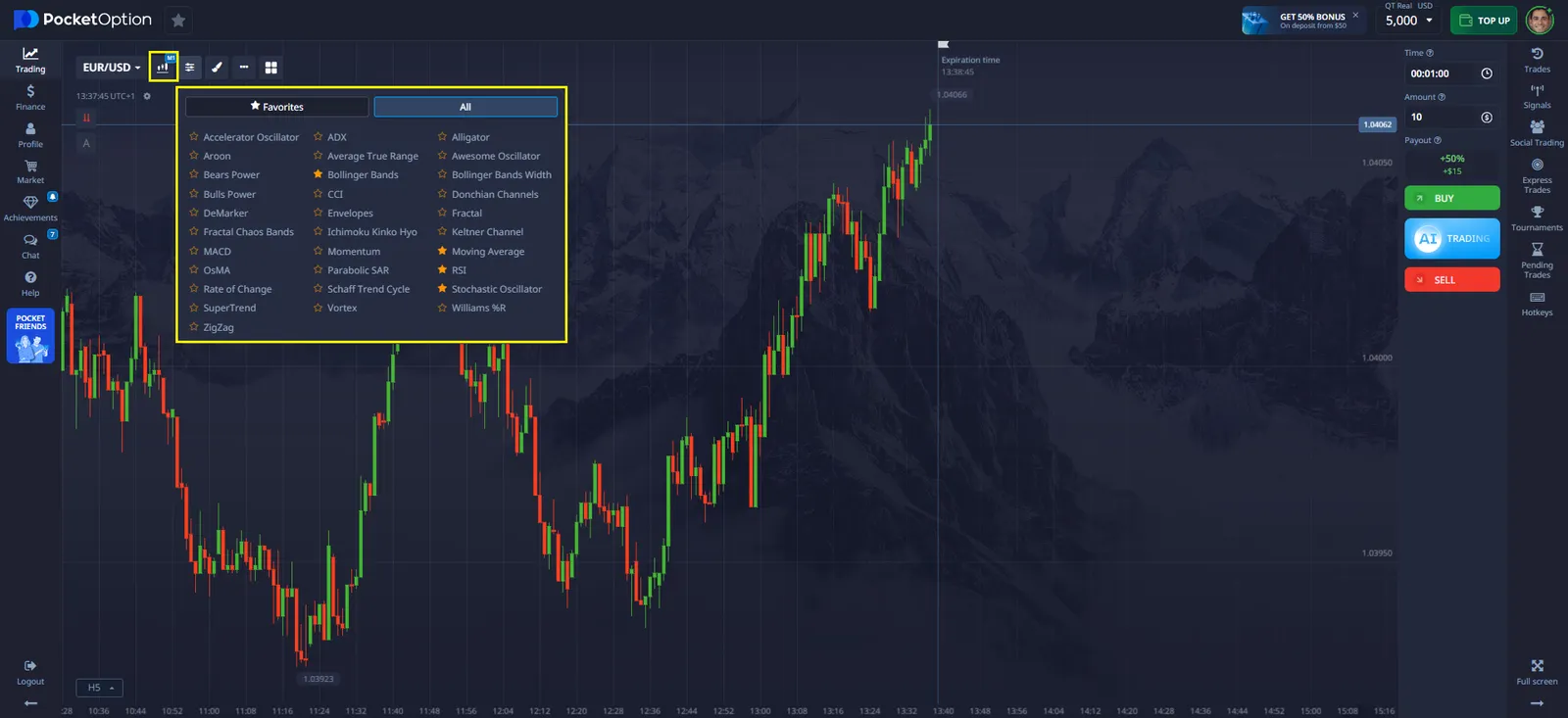

The Pocket Option platform provides various tools for technical analysis. For trading with the 1-minute strategy, you can use:

- RSI Indicator – helps determine overbought and oversold levels.

- Stochastic – signals possible trend reversals.

- Moving Averages (MA) – identify the main price movement direction.

- Bollinger Bands – help define volatility boundaries.

Trading Algorithm

- Select an asset – determine the most liquid asset with high volatility.

- Set up the chart – set the time frame to 1 minute.

- Apply indicators – configure indicators for market analysis.

- Wait for a signal – wait for a confirmed signal to enter a trade.

- Execute the trade – enter the amount and open a position.

- Analyze the results – evaluate the trade outcome and adjust the strategy if necessary.

Example Trade Using the 1 Minute Strategy (For Beginners)

Suppose you decide to try the 1-Minute Strategy on the Pocket Option platform and choose the most popular asset – the EUR/USD currency pair.

Trade Details

| Parameter | Value |

|---|---|

| Asset | EUR/USD |

| Trade Duration | 1 minute (60 seconds) |

| Selected Indicator | RSI (shows market condition) |

| Trade Signal | RSI below 30 (indicates price may rise) |

| Investment Amount | $5 |

| Trade Outcome | Closed with profit |

Trade Process

- Open the Pocket Option platform and select the EUR/USD currency pair.

- Set the trade duration – 1 minute.

- Add the RSI indicator (available in the indicators section).

- Wait for the RSI line to drop below 30 – this signals a possible price increase.

- Once the signal appears, open a buy (UP) trade.

- After 60 seconds, the trade closes. If the price has risen, you earn a profit.

This method helps quickly test the strategy and understand how signals work on the chart. It is best to start with small amounts and try the strategy on a demo account to learn its features.

FAQ

What is the Pocket Option strategy 1 minute?

The Pocket Option strategy 1 minute is a short-term trading approach that focuses on making trades within a one-minute timeframe, often using binary options on platforms like Pocket Option.

What are the most important metrics to consider in this strategy?

Key metrics include price velocity, price acceleration, Relative Strength Index (RSI), and Bollinger Bands. These help traders identify potential entry and exit points for trades.

How can I manage risk when using this strategy?

Risk management involves setting strict stop-loss and take-profit levels, limiting exposure per trade, using proper position sizing, implementing a favorable risk-reward ratio, and regularly reviewing strategy performance.

What statistical techniques are useful for this strategy?

Useful techniques include moving averages, standard deviation calculations, correlation analysis, regression analysis, and time series decomposition.

How often should I evaluate the performance of my strategy?

It's recommended to evaluate your strategy's performance regularly, ideally daily or weekly. Key performance metrics to track include win rate, profit factor, Sharpe ratio, and maximum drawdown.

Can the 1 Minute Strategy be used without indicators?

Yes, but this increases risks. Indicators help confirm signals and improve forecast accuracy.

What is the minimum deposit required for trading with the 1 Minute Strategy?

The minimum deposit depends on Pocket Option platform conditions, but most traders start with small amounts, such as $10.

Is the 1 Minute Strategy suitable for beginners?

This strategy requires quick reactions and knowledge of technical analysis, so beginners are recommended to practice on a demo account first.

How to apply Pocket Option strategy 1 minute in Brazil effectively?

Use fast indicators like RSI or Bollinger Bands and place short expiry trades during active market hours.