- Education is Key: Successful traders who started with minimum deposits emphasize the importance of continuous learning. Understanding market trends, developing trading strategies, and staying updated with financial news can significantly improve your chances of success.

- Risk Management: Many experienced traders recommend using tools like stop-loss orders and position sizing to limit potential losses. Even with a small deposit, protecting your capital is crucial for long-term success.

- Start Small and Scale Gradually: While it’s tempting to make large trades with small deposits, successful traders advise against this. Instead, starting with smaller trades, gaining experience, and gradually increasing your exposure is a safer approach.

- Use Demo Accounts: Most trading platforms offer demo accounts where traders can practice without risking real money. This is especially beneficial for those who are new to trading with minimum deposit.

What is the minimum deposit for Pocket Option?

The days of needing a fortune to start trading are over. Want to begin trading with just $20, $10, or even as little as $5? Now you can dive into the markets with a minimum deposit, taking control without the heavy cost. Ready to start? Open your account today and take the first step towards financial freedom!

Article navigation

How Trading with Minimum Deposit Works

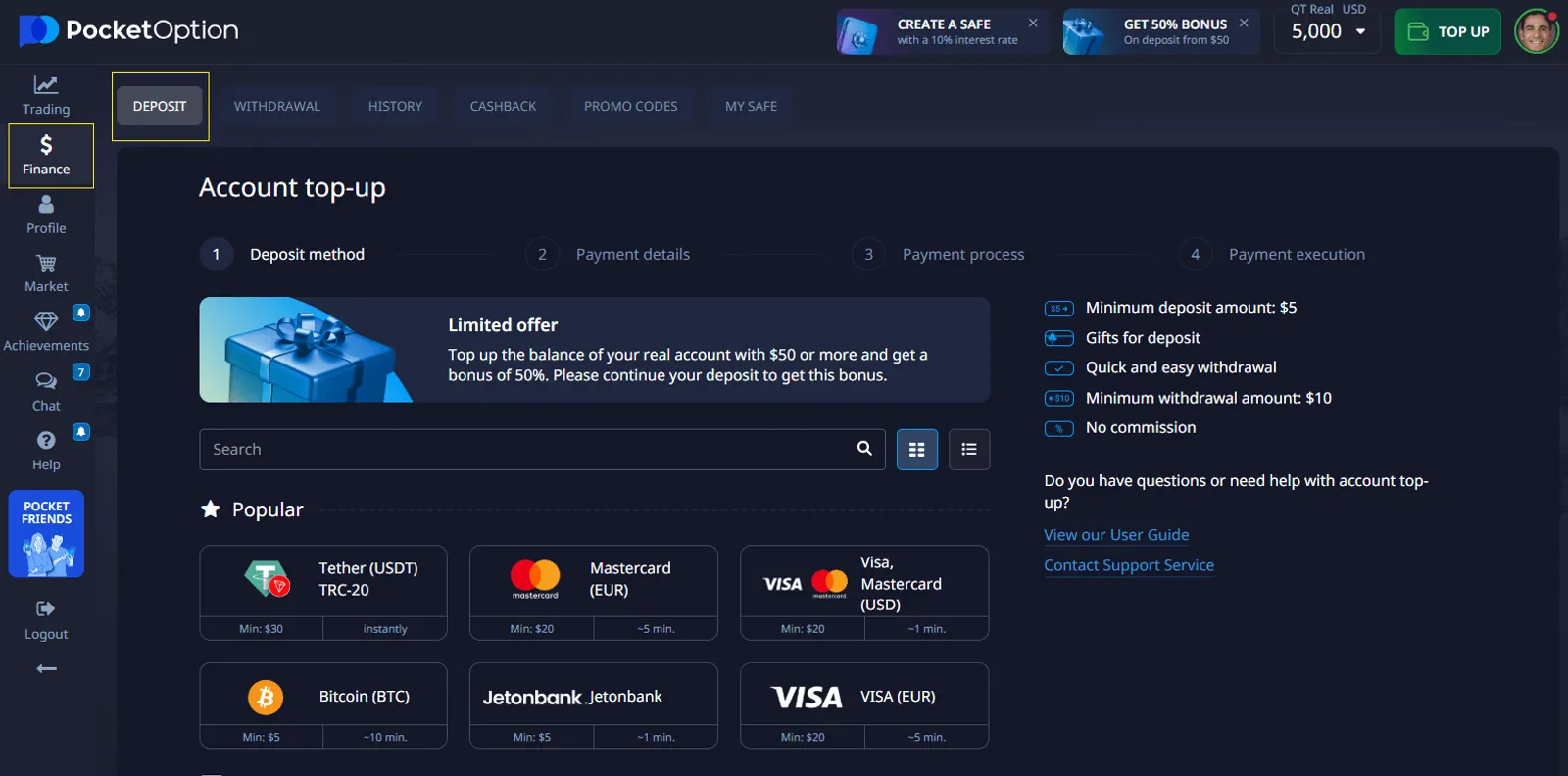

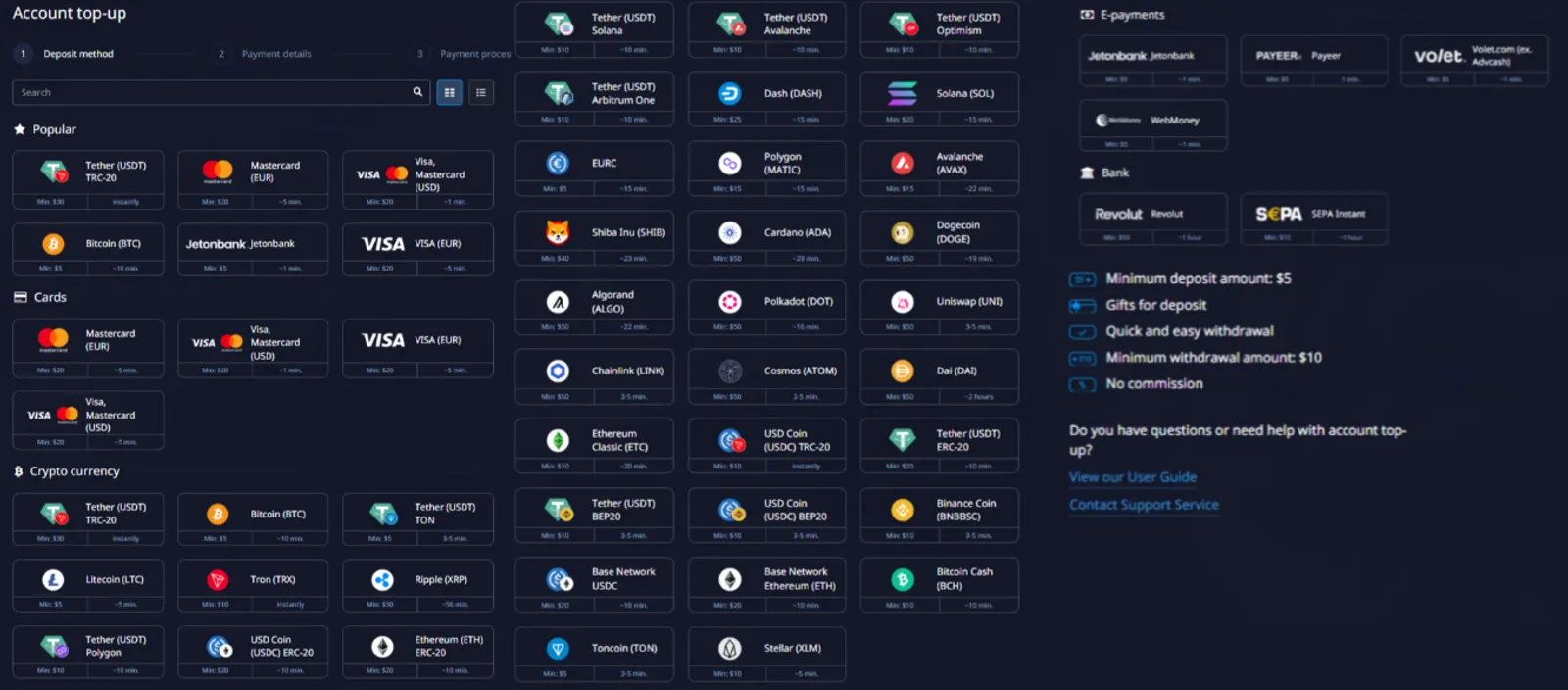

Trading with minimum deposit allows individuals to enter financial markets without committing large sums of money upfront. For instance, with platforms like Pocket Option, traders can start their journey with just $5, making it accessible to a wide range of people, from beginners to those with limited funds.

Why wait for big capital to start? Begin your trading adventure with just $5. Unlock your potential today with Pocket Option!

1. Go to the Pocket Option website via our link and register via email or social media.

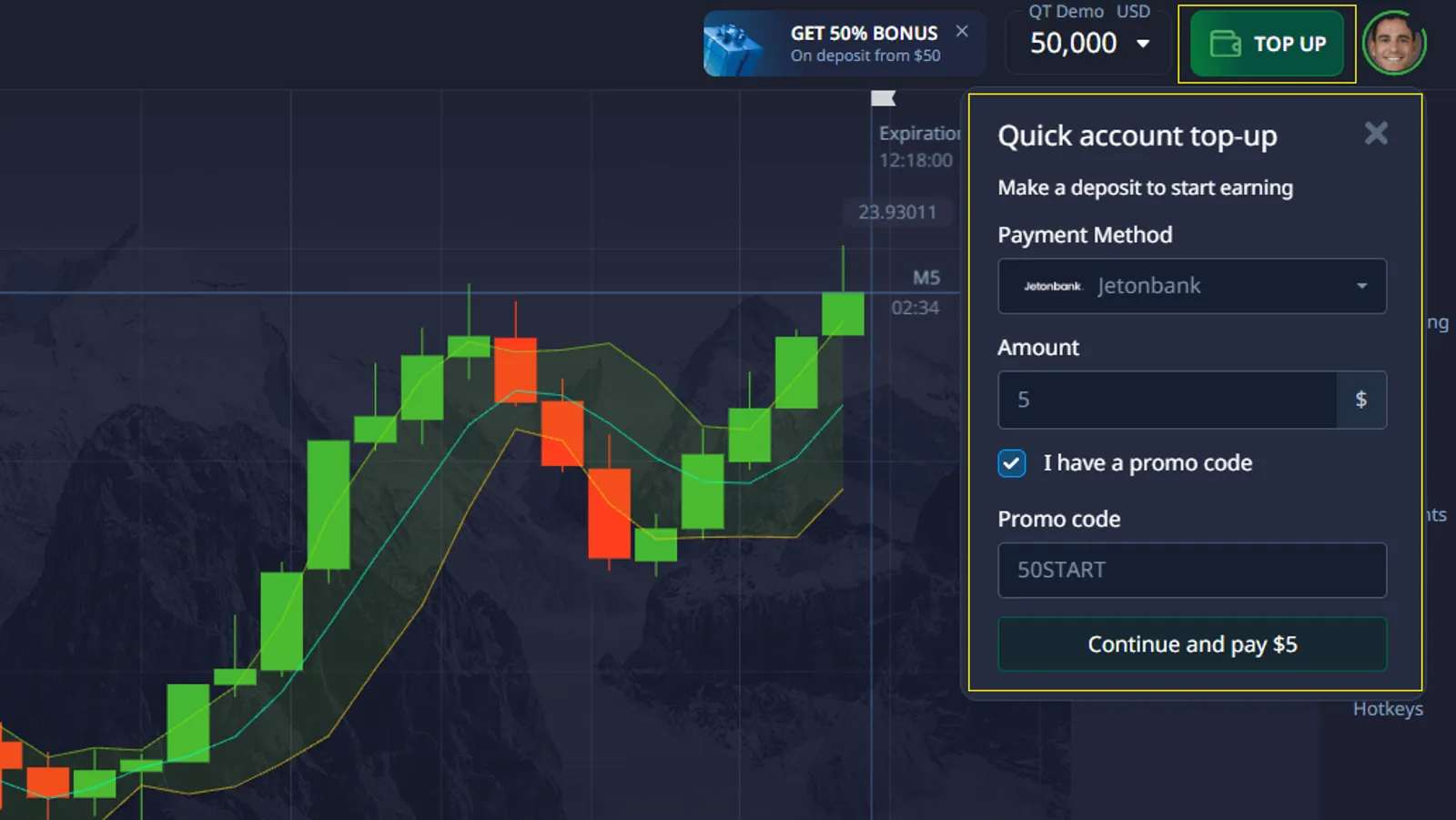

2. Get a demo account with a $50,000 balance to practice with no deposit required.

3. Move on to real trading by funding your account from $5.

4. Choose assets to trade and use copy-trading to replicate the trades of successful traders.

5. Open access to the loyalty system and get bonuses for activity, as well as use more than 50 deposit methods.

One report on the Finance Magnates website states that brokers with low minimum deposits, such as Pocket Option, have seen a 30% increase in new accounts in 2024 compared to the previous year. This confirms that more affordable trading conditions are attracting more people.

Key Insights on Trading with Minimum Deposit

Join the thousands of successful traders who started with just $5! Open your account on Pocket Option today and start trading with confidence.

Example of a Trade on Pocket Option with a $5 Minimum Deposit

Let’s walk through an example of how a trader might use a $5 minimum deposit on Pocket Option, along with a strategic approach to make the most out of their small account.

Step 1: Asset Selection

The first thing to consider when trading with a small account is choosing the right assets. The trader decides to trade a major currency pair like the EUR/USD. The trader selects this asset because it has:

- Sufficient volatility: The EUR/USD moves enough to generate profits without being overly unpredictable.

- High liquidity: This currency pair has a large volume of trades, making it easy to enter and exit positions quickly.

- Tight spreads: As the trader is working with a small account, low spread costs are essential to avoid eating into potential profits.

Step 2: Developing a Trading Plan

Before entering the trade, the trader develops a solid trading plan to guide their decisions. The plan for this $5 account is simple but clear.

Goals: The trader sets a target of 1-2% account growth per week. For a $5 deposit, this means aiming for a weekly profit of $0.05 to $0.10.

Risk Management: Since this is a small account, the trader decides to risk no more than 1% per trade. This means a maximum loss of $0.05 per trade.

Step 3: Analyzing the Market

The trader spends 30 minutes analyzing the market and notices that the EUR/USD pair has been trending upwards for the past hour, supported by positive news from the Eurozone. The trader uses a simple moving average (SMA) strategy to identify trends and confirms the upward momentum.

Entry Criteria: The trader decides to enter the trade when the price is above the 50-period SMA, signaling an upward trend. The trader waits for the price to dip slightly to 1.2005 before entering a call option (buy).

Step 4: Placing the Trade

The trader decides to invest $1 of their $5 balance in a 5-minute call option on the EUR/USD pair, expecting the price to rise further within the next few minutes.

The trader calculates their risk-reward ratio: Since they are risking $0.05 (1% of their balance), they aim to make a profit of $0.10, following a 1:2 risk-reward ratio. This ensures that the potential reward is twice the amount of the risk.

Step 5: Monitoring the Trade

The trader keeps an eye on the trade, using Pocket Option’s built-in tools for monitoring price movements and time remaining on the trade. As the price continues to move upward, the trader feels confident in their decision.

Step 6: Closing the Trade

After 4 minutes, the price hits 1.2020, the trader’s target, and the trade expires with a 10% profit. The trader made $0.10 on the $1 investment.

Exit Strategy: The trader decides to exit the trade once the 1:2 risk-reward ratio is met. They avoid staying in the trade too long, as it can be risky with a small account.

Step 7: Reviewing the Results

After the trade, the trader updates their trading journal. They note that they achieved their goal of 2% account growth for the week by sticking to their plan and using disciplined risk management. The trader also reviews the technical indicators used for the trade, considering how they could improve their strategy going forward.

Key Takeaways

- Risk Management: The trader risks no more than 1% of their account balance per trade to preserve capital.

- Asset Selection: By focusing on the EUR/USD currency pair, the trader ensures the trade has good volatility, liquidity, and tight spreads.

- Clear Strategy: The trader follows a simple strategy with clear entry and exit rules, ensuring disciplined decision-making.

- Consistency: By aiming for 1-2% account growth per week, the trader avoids trying to make quick profits and focuses on gradual, sustainable growth.

Small deposit, big opportunities! Take control of your financial future with just $5. Start trading now and see where it takes you.

Benefits of Starting With a Minimum Deposit

Starting your trading journey with a small initial investment can offer several advantages:

| Benefit | Description |

|---|---|

| Risk Management | Smaller deposits limit potential losses while learning |

| Psychological Comfort | Less stress when trading with a smaller amount |

| Learning Opportunity | Real-world experience without significant financial risk |

| Strategy Testing | Ability to test different approaches with minimal consequences |

| Gradual Progression | Opportunity to grow account slowly as skills improve |

| Low Entry Barrier | Accessible to those with limited initial capital |

| Motivation | Encourages disciplined trading to grow a small account |

Common Pitfalls to Avoid

While trading With minimum deposit can be a great starting point, there are several pitfalls to be aware of:

| Pitfall | Description | How to Avoid |

|---|---|---|

| Overtrading | Excessive trading to grow account quickly | Stick to a trading plan and predefined rules |

| Unrealistic Expectations | Expecting large profits from a small account | Set realistic goals and focus on percentage gains |

| Ignoring Risk Management | Taking oversized risks to make big gains | Always adhere to proper risk management techniques |

| Emotional Trading | Making decisions based on emotions | Develop and follow a systematic trading approach |

| Lack of Patience | Rushing to increase account size | Focus on consistent, small gains over time |

| Inadequate Education | Trading without proper knowledge | Invest time in learning before and during trading |

| Choosing Wrong Assets | Trading instruments unsuitable for small accounts | Research and select appropriate assets for your account size |

Conclusion

Starting your trading journey with a minimum deposit can be a smart approach. Trading with a minimum deposit of $5 on Pocket Option is possible even for beginners if you combine it with a solid trading plan and risk management. With the right choice of assets, using the right strategies and exercising discipline, small accounts can grow steadily over time even with minimal capital.

Don’t wait to invest in yourself—get started with a minimum deposit of just $5 and begin your trading journey now. Sign up and dive into the market!

FAQ

What is considered a minimum deposit in trading?

The definition of a minimum deposit varies by platform, but it typically ranges from $1 to $250. Pocket Option offers competitive minimum deposit options from $5. For Brazilian residents, the minimum deposit for Pocket Option is $10.

Can I make significant profits starting With minimum deposit?

While possible, it's important to have realistic expectations. Focus on percentage gains and consistent growth rather than large absolute profits.

What are the best assets to trade when starting with a small account?

Assets with low spreads and moderate volatility are often suitable. Many traders start with major currency pairs or popular stocks.

How can I manage risk effectively with a small trading account?

Limit your risk per trade to a small percentage of your account (e.g., 1-2%), use appropriate position sizing, and always use stop-loss orders.

Does Pocket Option offer educational resources for new traders starting with minimum deposits?

Yes, Pocket Option provides various educational materials, including tutorials, webinars, and strategy guides suitable for traders starting with small accounts.