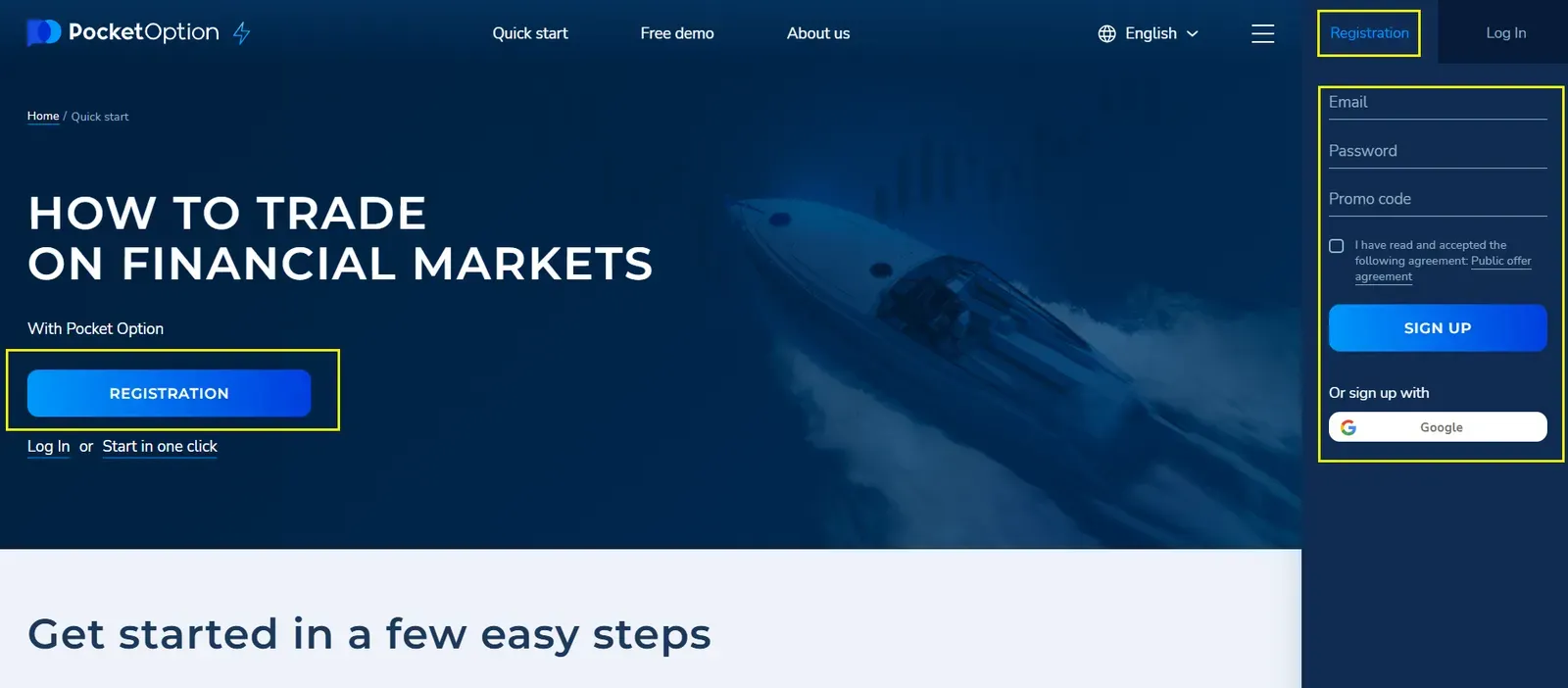

- Visit Pocket Option

- Click “Sign Up” and choose email, Google, or Facebook login

- Verify your identity via email or profile to activate features

Pocket Option A Guide Live Trading: Strategic Approach for Success

Pocket Option provides fast live trading with one-click trades, customizable charts, and hundreds of assets, plus strategies to enhance performance.

Article navigation

- How to Register a Live Trading Account on Pocket Option

- Pocket Option Live Trading: Features and Key Advantages

- Example of a Live Trade

- Pocket Option Live Trading Strategy Breakdown

- Earning Strategy on Pocket Option: Risk-Controlled Growth

- Why Traders Prefer Pocket Option: A Competitive Overview

- User Testimonials from Active Traders

- Final Thoughts: Expert Takeaways for Earning with Pocket Option

“Platforms like Pocket Option are reshaping access to financial markets by eliminating traditional barriers. Fast execution and educational tools make it ideal for retail traders looking to grow.” — Dr. Marcus Weller, Financial Systems Researcher

How to Register a Live Trading Account on Pocket Option

Step-by-Step Registration

Identity Verification

To withdraw and unlock all features, submit ID and proof of address in the Profile > Verification section. Review usually takes 24–48 hours.

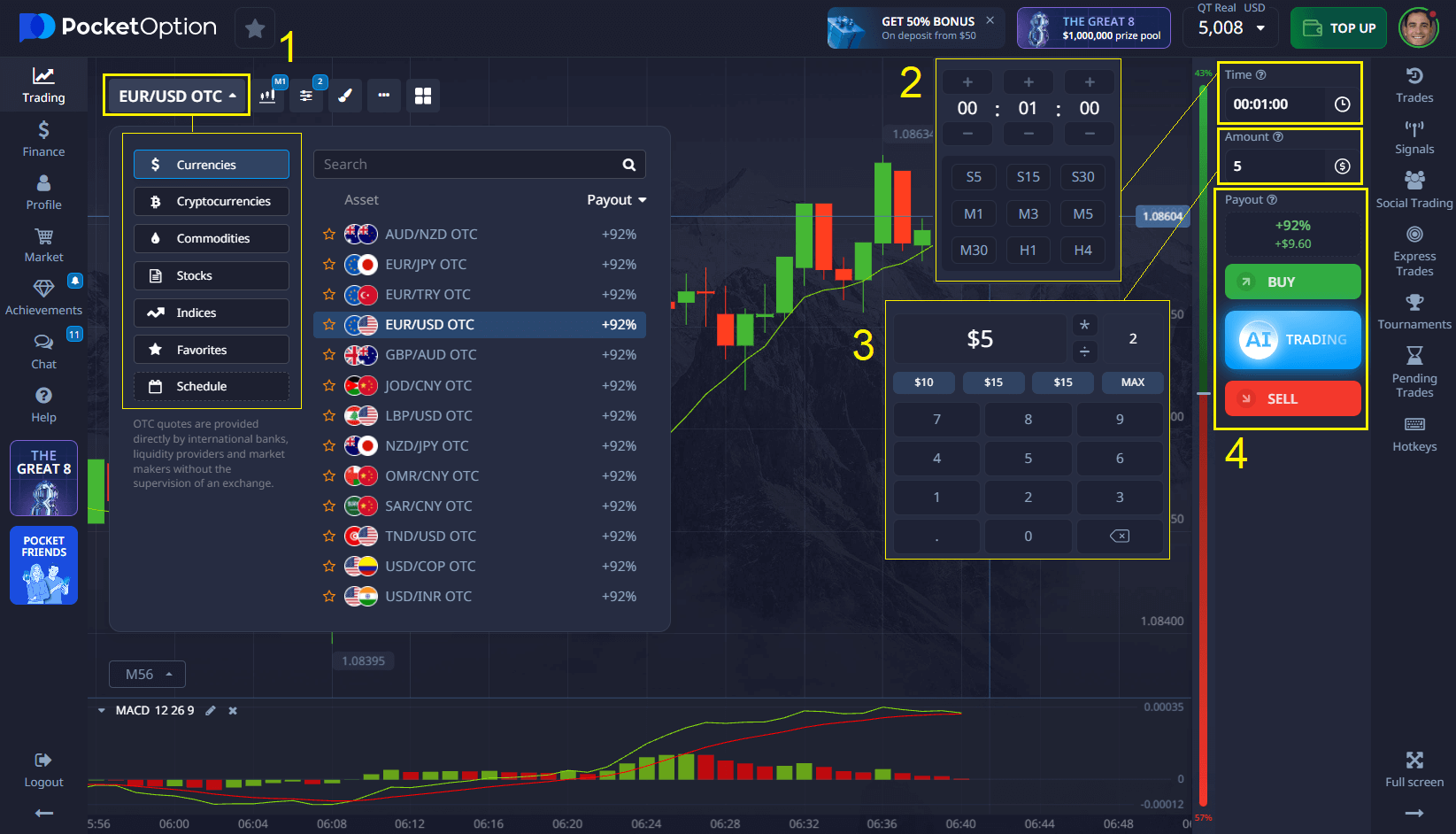

Pocket Option Live Trading: Features and Key Advantages

⚡Main Pocket Option feature: No need to buy or sell assets directly — simply forecast whether the price will go up or down. If correct, you can earn up to 92% profit per trade. The platform runs fully online in your browser, no downloads required.

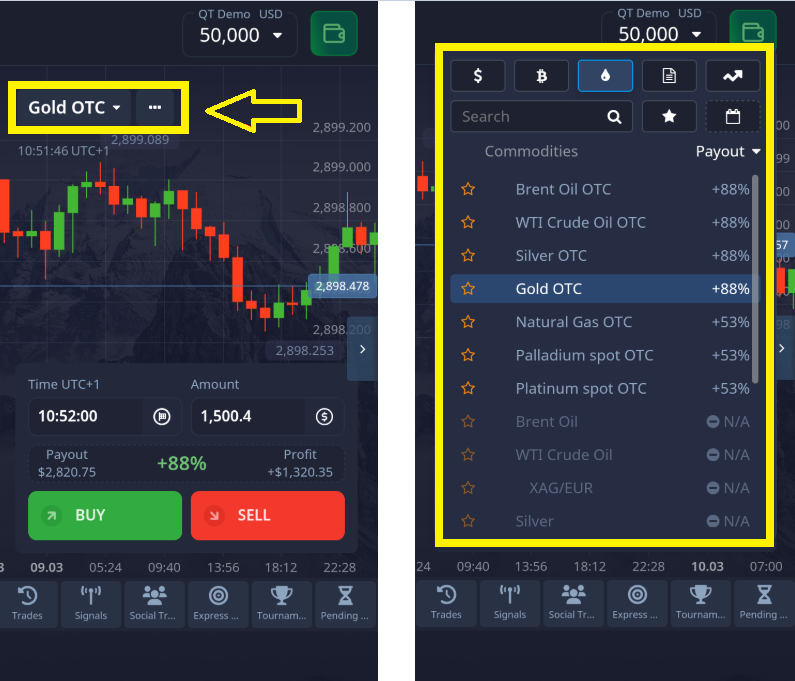

Supported Assets: Forex, Crypto, Stocks, Commodities, Indices

Minimum Deposit: $5 | Demo Access: $50,000 virtual funds

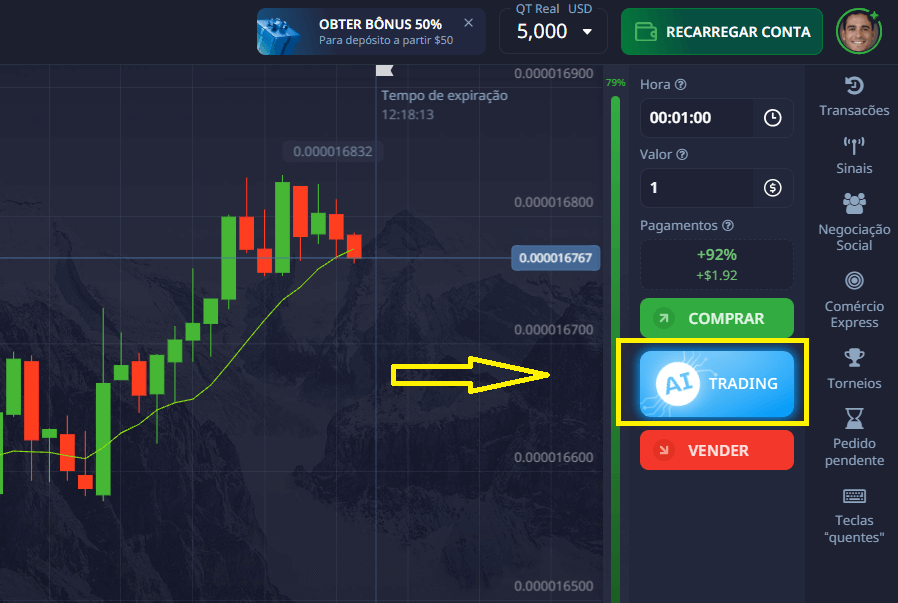

Example of a Live Trade

- Switch to “Live Account”

- Choose asset: EUR/USD

- Timeframe: 1-minute

- Trade amount: $10

- Direction: “UP” based on chart analysis

- If successful: Return = $19.20 (profit $9.20)

Pocket Option Live Trading Strategy Breakdown

Strategy 1: EMA + RSI Confirmation

- Setup: EMA 9 & 21, RSI 14

- Buy Signal: EMA 9 crosses 21 upward, RSI above 50

Strategy 2: Support & Resistance Reversals

- Mark levels from past price action

- Enter trade on bounce confirmations with short expiration

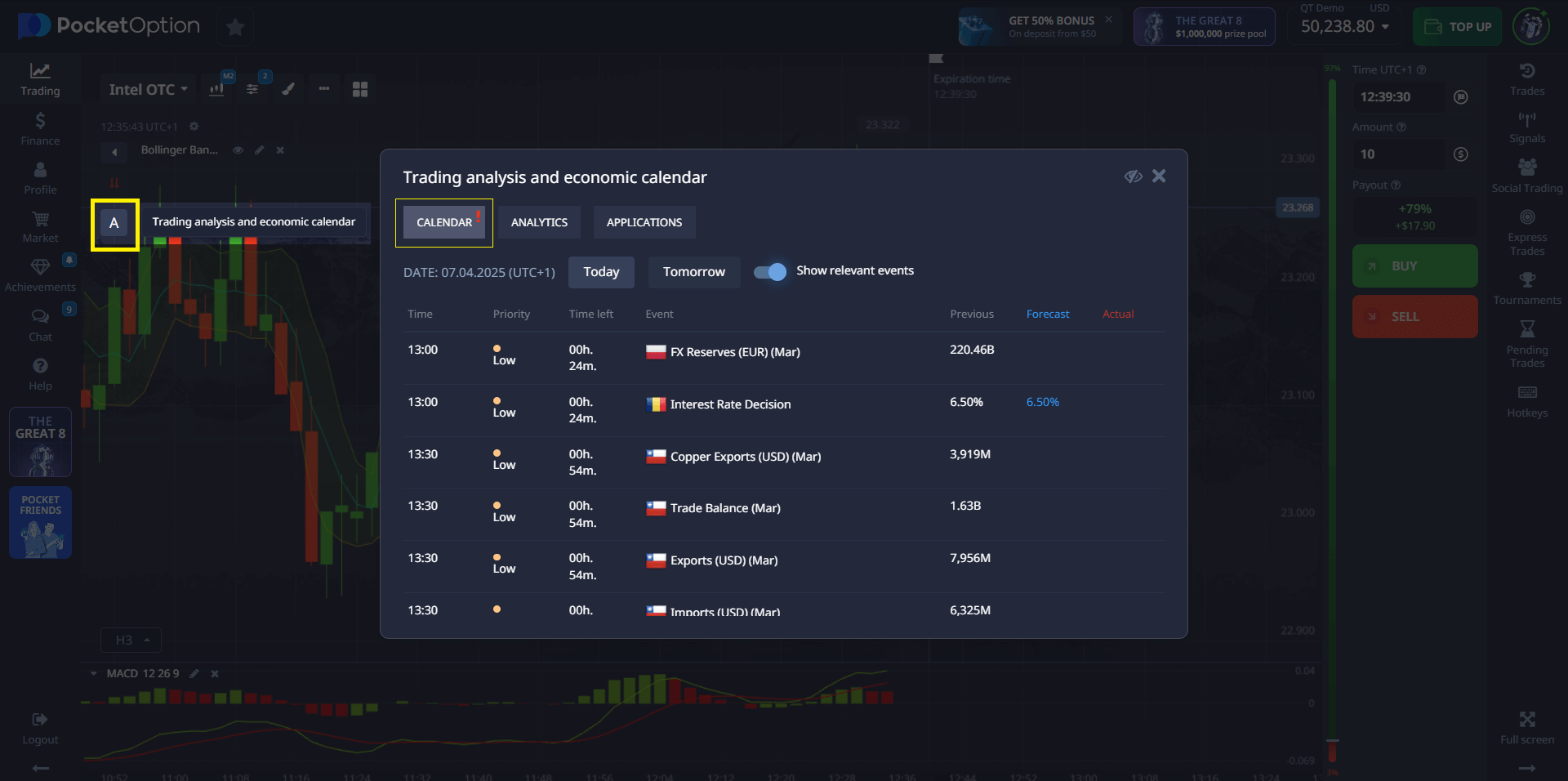

Strategy 3: Event-Based Volatility Surge

- Use the in-platform Economic Calendar or News Tab

- Trade volatile pairs 1–2 minutes post-announcement

“Momentum strategies like RSI/EMA setups are well-suited to Pocket Option’s turbo trading environment. But always test new tactics in demo first.” — Selina Grant, Quantitative Strategy Analyst

Earning Strategy on Pocket Option: Risk-Controlled Growth

An effective earning strategy Pocket Option should combine:

- Risk per trade capped at 1–3% of balance

- Diversified trades across different timeframes

- Weekly reviews of performance and psychology logs

Pro Tip: Stick to one strategy for 50–100 trades before tweaking variables. Avoid emotional shifts in live trading.

Why Traders Prefer Pocket Option: A Competitive Overview

| Platform | Minimum Deposit | Demo Available | Copy Trading | Max Payout |

|---|---|---|---|---|

| Pocket Option | $5 | Yes ($50,000) | Yes | 92% |

| IQ Option | $10 | Yes | No | 90% |

| Olymp Trade | $10 | Yes | No | 82% |

| Quotex | $10 | Yes | Limited | 90% |

| Binarium | $10 | No | No | 85% |

User Testimonials from Active Traders

“I was skeptical, but Pocket Option’s UI and fast payouts really changed my perspective. I’m now using RSI/EMA strategies and journaling every trade.” — Lucas B.

“The copy trading and demo account helped me build confidence before switching to live. Definitely one of the most intuitive platforms I’ve used.” — Anna R.

“Having real-time news and strong community feedback made a huge difference for my learning curve. Even when I lose, I know why.” — David M.

Final Thoughts: Expert Takeaways for Earning with Pocket Option

- Backtest your strategy on at least 200 trades before going live

- Avoid emotional chasing — use timers and trade caps per session

- Engage with the community — share setups, analyze losses together

“A disciplined trader with a tested plan and a tool like Pocket Option has every chance to beat the market short term. It’s about structured decision-making, not luck.” — Julian Ito, Risk Manager, APT Global

FAQ

What is Pocket Option a guide live trading?

Pocket Option a guide live trading refers to executing real-time trades with actual capital on the Pocket Option platform. It involves analyzing market conditions, implementing strategic entry and exit points, and managing risk while trading with real money rather than in demo mode.

How much capital should I start with for live trading on Pocket Option?

Start with only what you can afford to lose, typically keeping initial investments between $200-$500. This allows you to implement proper risk management while gaining experience without risking financial hardship.

What technical indicators work best for Pocket Option live trading strategy?

Moving averages, RSI, MACD, and Bollinger Bands are particularly effective for Pocket Option trading. Combine trend-following indicators with momentum oscillators to create a comprehensive analysis framework that reduces false signals.

Can beginners succeed with Pocket Option live trading earning strategy Pocket Option?

Yes, beginners can succeed by starting with thorough education, practicing extensively on demo accounts, and transitioning to very small position sizes when beginning live trading. Focus on consistent application of a simple strategy rather than complex approaches requiring advanced skills.

Can I test before risking money?

Yes, use the $50,000 demo mode anytime.

How do I withdraw?

Use the “Finance – Withdrawal” tab. Most methods process within 1–3 days.

What’s the minimum deposit?

From $5 to start live trading. May vary depending on payment method and country

Can I trade without installing anything?

Yes, the platform is 100% browser-based.

Do people really make money on Pocket Option?

Yes, users on Pocket Option do make money, but it’s important to understand that successful trading requires knowledge, skills, and a strategic approach. Many traders report having a positive experience using the platform to earn profits. However, as with any form of investing, there are risks involved. We recommend exploring available tools and strategies before trading with real funds and always approaching trading with caution and responsibility.

What is the best time to trade on Pocket Option?

The best time to trade depends on your preferences and strategy. However, generally, the best moments to trade are when major financial markets are open. For example, trading during the London and New York sessions is often characterized by higher liquidity and volatility, which creates more trading opportunities. It’s important to note that on Pocket Option, you can trade 24/7, so it’s essential to choose a time when you feel most confident and focused on analyzing the markets.

Can you trade options for a living?

Yes, trading options can be a source of consistent income if you approach it with the right mindset and knowledge. Many traders make a living by using effective strategies, managing risks, and following a disciplined plan. However, it’s important to remember that trading in financial markets always involves risks. We recommend starting with a demo account to familiarize yourself with the market and strategies before transitioning to a real trading account.