- Spoofed emails mimicking PayPal’s branding.

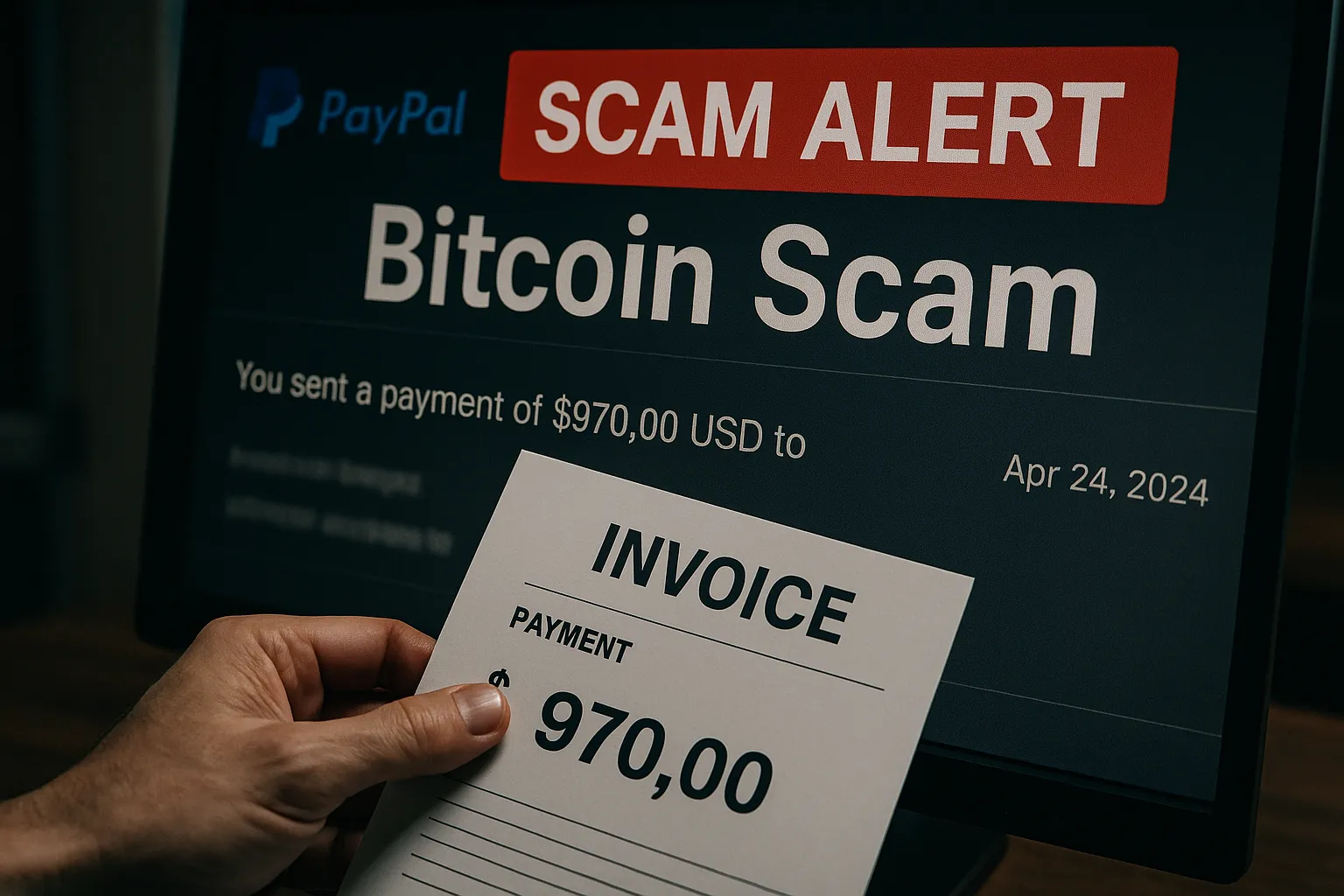

- Fake invoices or unauthorized charge alerts.

- Fraudulent customer service lines asking for access or remote control.

Unmasking the PayPal Bitcoin Scam: How to Stay Protected

As opportunities grow, so do threats. One such danger is the growing wave of Bitcoin scams via PayPal. These scams target not only your funds, but also your trust in secure payment systems.

Article navigation

- What is a PayPal Bitcoin Scam?

- How Phishing Tactics Are Used

- Spotting & Handling Scam Emails

- What to Do If You’ve Been Targeted

- Tips to Stay Safe from PayPal Fraud Bitcoin Schemes

- The Role of Chargeback in PayPal Dispute Crypto Scams

- Staying Informed and Educating Others

- Why Platforms Like Pocket Option Are Safer

- Final Thoughts

Let’s break down how these scams work, how to spot them, and most importantly–how to protect yourself while navigating digital payments, including when trading crypto or using platforms like PayPal or Pocket Option.

What is a PayPal Bitcoin Scam?

The PayPal Bitcoin scam typically involves fraudsters impersonating legitimate entities. The scam often begins with a convincing email or invoice, seemingly from PayPal, notifying the recipient of an urgent issue. To resolve it, the user is asked to confirm or cancel a suspicious transaction — but here’s the trick: the attacker requests payment in Bitcoin, capitalizing on the untraceable and irreversible nature of crypto transactions.

🔍 Example: One victim reported receiving an invoice for $499 from “PayPal Support” asking for confirmation of a Bitcoin purchase. The email contained a fake customer service number, where a fraudster guided the user through a phony refund process that drained their wallet.

“These scams exploit two key things: user urgency and crypto’s lack of reversibility. Once the Bitcoin leaves your wallet, there’s virtually no way to get it back.”

— Mike Dore, former PayPal Security Analyst

According to a 2024 report by Cybersecurity Ventures, crypto-related fraud involving PayPal increased by 64% year-over-year, underscoring the growing relevance of crypto scams PayPal users encounter.

Common Red Flags in Scam Emails

| Feature | Description |

|---|---|

| Urgency & Pressure | Warnings of account suspension, fraudulent transactions, etc. |

| Fake Email Addresses | Slight misspellings like “paypall” or unusual domains. |

| Bitcoin Requests | No legit PayPal service ever asks for Bitcoin payments.] |

| Links to Phishing Sites | Redirects to fake login pages capturing credentials. |

Expert Tip: “Even seasoned traders fall for these scams when they don’t pause to verify. Always take a breath before reacting to urgent financial emails.” — Natalie Chow, Cybercrime Researcher at MIT

How Phishing Tactics Are Used

These scams rely heavily on classic phishing tactics:

A 2025 analysis by The Verge highlighted that over 32% of reported PayPal fraud bitcoin complaints started from mobile devices, where users are more likely to click before evaluating an email’s legitimacy.

These messages aim to create urgency and fear, pushing users to act without verifying the source. Once personal data is submitted or payments are made, recovery is often impossible due to the nature of Bitcoin.

Spotting & Handling Scam Emails

Key Indicators of a Scam:

- Unusual sender address (e.g., “service@paypai.com”).

- Grammatical errors or strange formatting.

- Attachments with .exe or .zip extensions.

- Bitcoin payment requests.

Tips for Identifying PayPal Dispute Crypto Scams:

- Hover over links before clicking.

- Never call numbers in suspicious emails.

- Log in directly at paypal.com to check your account.

If you have any suspicions, write to the support chat.

What to Do If You’ve Been Targeted

- Do not interact with the email.

- Change your passwords immediately for PayPal and any linked emails.

- Enable two-factor authentication (2FA) for extra security.

- Report the incident to PayPal, your local authority, and the FTC (in the U.S.).

- Monitor your financial activity and watch for unauthorized payments.

“The first 24 hours after discovering a scam are crucial. The faster you report, the better your chances of damage control,”

says Dana Brook, fraud recovery specialist at BitSafe.

Tips to Stay Safe from PayPal Fraud Bitcoin Schemes

Essential actions to protect your PayPal and crypto activity from fraud.

| Action | Description |

|---|---|

| Use 2FA | Adds an extra layer of account security. |

| Avoid Public Wi-Fi | Don’t check sensitive accounts on untrusted networks. |

| Regularly Check Transactions | Look for unfamiliar charges or logins. |

| Educate Yourself | Stay updated on cryptocurrency safety trends. |

| Use Legit Platforms Only | Trade crypto on trusted platforms like Pocket Option. |

Expert Insight: “If you’re investing in crypto, stick with platforms that publish their security protocols and update them regularly. Transparency matters.”

The Role of Chargeback in PayPal Dispute Crypto Scams

Unfortunately, chargebacks aren’t possible with Bitcoin. Once a transaction is confirmed on the blockchain, it’s final. That’s why scammers push for crypto payments–it offers them a safety net against PayPal’s usual buyer protections.

However, if the initial payment was made via PayPal (not BTC), you might still initiate a dispute depending on the context. Always report suspicious behavior early.

Staying Informed and Educating Others

📢 Awareness is your first defense.

| Source | Usefulness |

|---|---|

| PayPal Security Hub | Official updates and phishing education. [14] |

| FTC Complaint Assistant | Report U.S.-based frauds. |

| IC3.gov | For U.S. internet crime reporting. |

| Pocket Option Blog | Tips on secure crypto trading and platform safety. |

Don’t keep it to yourself. Share scam warnings with friends and colleagues. The more people are aware of crypto scams PayPal fraudsters use, the harder it becomes for attackers to succeed.

“Security is a shared responsibility. One educated trader can prevent dozens of scams.”

— Alex Merkov, cybersecurity lecturer at NYU

Why Platforms Like Pocket Option Are Safer

Pocket Option implements multiple fraud protection measures and doesn’t request crypto payments via email or unsolicited messages. [1, 4] On our platform, you can trade Bitcoin and even fund your account using this cryptocurrency. [3] Plus, you get:

- ✅ Free unlimited demo account

- ✅ Minimum deposit from just $5

- ✅ 100+ assets available 24/7

- ✅ AI Trading and Signal Telegram Bot

- ✅ Social Trading for quick learning

- ✅ Bonuses, Promo Codes, and Tournaments

- ✅ 50+ global payment methods

- ✅ Reliable support and mobile app access

“With Pocket Option, you’re not just trading. You’re trading smart and secure,”

says Emily Ho, financial safety advisor at CryptoGuard.io

Final Thoughts

The rise of the PayPal Bitcoin scam is a serious issue, blending classic phishing with modern crypto exploitation. [10, 24] While platforms like PayPal work hard to combat fraud, users must stay vigilant. Remember: PayPal will never ask for Bitcoin. [10, 18] Use only secure platforms, verify every request, and when in doubt–don’t click.

💡 Stay alert, protect your assets, and explore safer ways to grow your crypto journey with trusted platforms like Pocket Option.

FAQ

Is there a Bitcoin scam on PayPal?

Yes, scammers frequently use fake PayPal emails and invoices to trick users into paying in Bitcoin. These scams exploit urgency and the irreversible nature of crypto to defraud victims.

How to avoid PayPal crypto scams?

Always verify sender email addresses, avoid clicking suspicious links, enable two-factor authentication, and never send Bitcoin in response to unsolicited messages

Can I recover money from PayPal scam?

If you sent money via PayPal (not crypto), you can file a dispute or chargeback. However, if you transferred Bitcoin directly, recovery is nearly impossible. Reporting the scam promptly is essential.

Does PayPal offer fraud protection for crypto?

PayPal does not cover cryptocurrency transactions under its Buyer Protection policy. That’s why scammers often request Bitcoin instead of fiat currencies.

Is it safe to use PayPal for cryptocurrency?

It’s safe if you use official platforms and avoid responding to unsolicited emails or messages. Always verify sources and never share your login data.

Comments 1