- Real-time market data and quotes

- Technical analysis tools and indicators

- Portfolio tracking capabilities

- Risk management features

- Demo accounts for practice

Understanding Online Trading Software and Its Benefits

In today's digital economy, online trading software has become an essential tool for anyone looking to participate in financial markets. These platforms offer various features that help traders analyze market conditions, execute trades, and manage their portfolios efficiently.

Article navigation

- What Is Online Trading Software?

- Key Features of Effective Trading Platforms

- Popular Trading Software Options

- Why do thousands of traders choose Pocket Option?

- Key Features of Pocket Option

- How to Open a Trade on Pocket Option?

- Advantages of Pocket Option

- Choosing the Right Platform for Your Trading Style

- Security Considerations

- Cost Structure Analysis

- Getting Started with Online Trading Software

- Conclusion

What Is Online Trading Software?

Online trading software refers to digital platforms that enable users to buy and sell financial instruments via the internet. These tools have transformed how people interact with financial markets, making trading more accessible than ever before. Modern platforms combine technical analysis capabilities, real-time data, and user-friendly interfaces to support trading activities.

Different types of trading software cater to various investment strategies and experience levels. From simple mobile apps for beginners to sophisticated desktop solutions for professionals, there’s an option for everyone in the market.

Key Features of Effective Trading Platforms

When selecting online trading software, certain features stand out as particularly valuable. The right combination of tools can significantly impact your trading outcomes.

These core features create the foundation for any reliable trading platform. Advanced users might also look for API access, algorithmic trading capabilities, and extensive customization options.

| Feature | Benefit |

|---|---|

| Real-time data | Make decisions based on current market conditions |

| Technical indicators | Identify potential entry and exit points |

| Demo accounts | Practice without financial risk |

| Mobile access | Trade from anywhere at any time |

Popular Trading Software Options

The market offers numerous trading platforms, each with distinct advantages. Understanding what makes each option unique can help you choose the right software for your needs.

| Platform | Best For | Notable Features |

|---|---|---|

| Pocket Option | Quick options traders | User-friendly interface, social trading |

| MetaTrader 4/5 | Forex and CFD traders | Advanced charting, automated trading |

| ThinkorSwim | Stock and options traders | Extensive educational resources |

| Interactive Brokers | Professional traders | Global market access, low fees |

Pocket Option has gained popularity for its straightforward approach to trading. The platform offers numerous assets across different markets, making it suitable for traders with diverse interests.

Why do thousands of traders choose Pocket Option?

Pocket Option is a web-based quick trading platform that provides access to over 100+ assets, including stocks, indices, cryptocurrencies, commodities, and currency pairs. Here, you don’t need to buy or sell assets — you simply predict whether the price will go up or down, and if your forecast is correct, you can earn up to 92% profit.

The platform is available online through your PC browser, and there’s no need to download anything. Mobile apps for Android and iOS are also available.

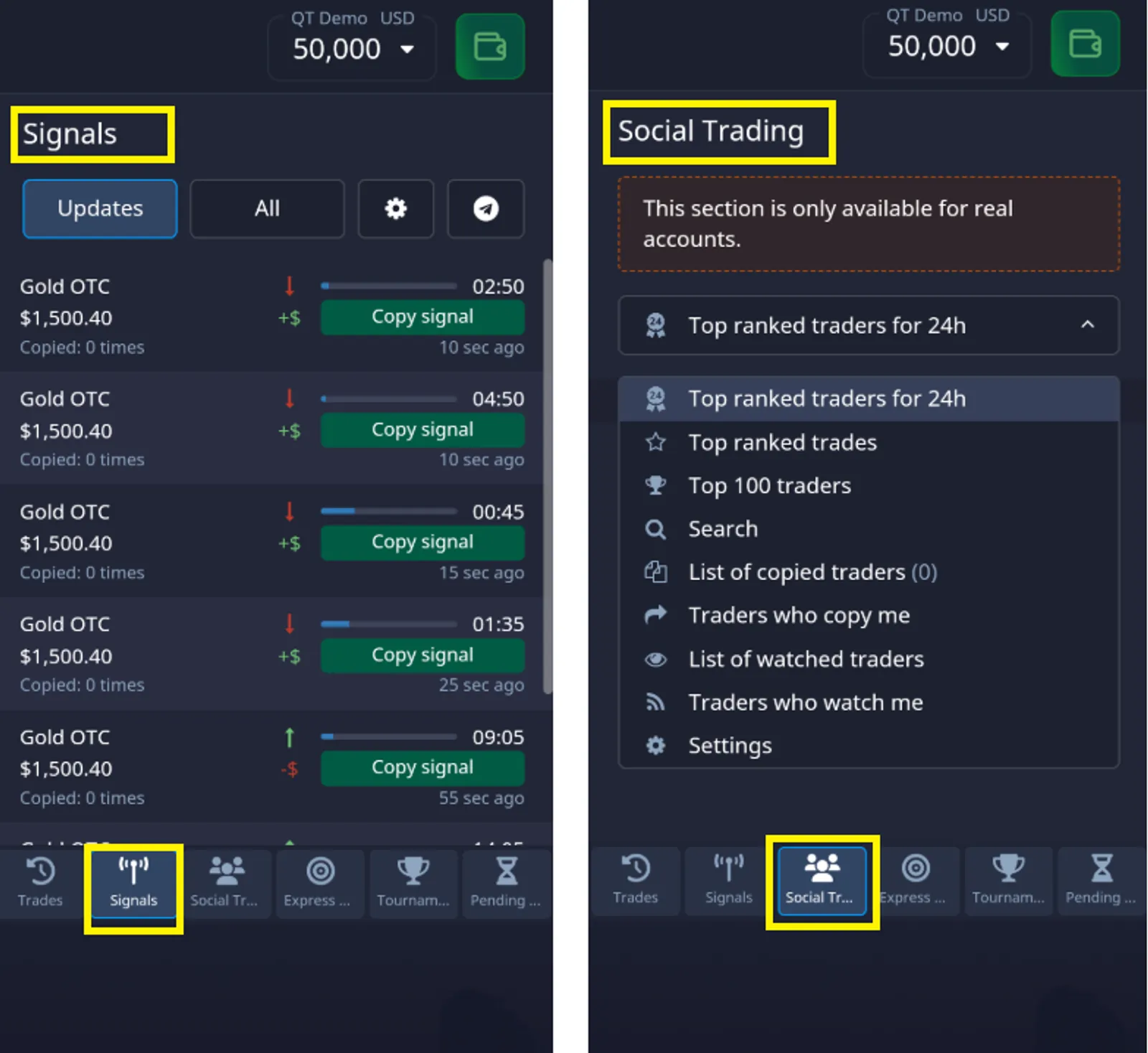

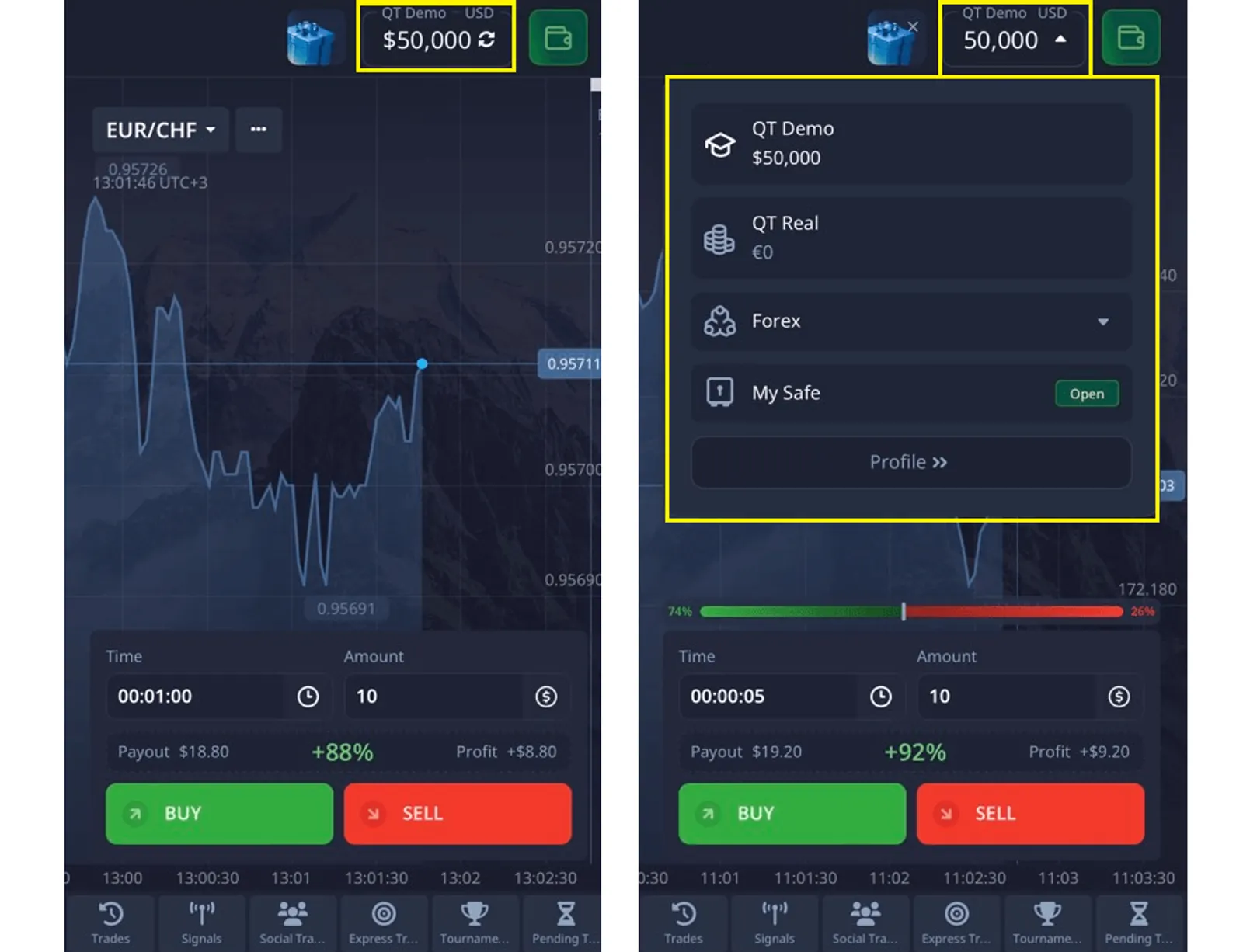

Key Features of Pocket Option

- Demo Account: Try trading with $50,000 in virtual funds to practice without financial risk.

- Social Trading: Copy trades of successful traders and learn from their strategies.

- Statistics and Analytics: Analyze your trading performance, including win rates, profits, and losses.

- Bonuses and Promotions: Use the promo code “50START” to get a +50% bonus on your first deposit.

- Tournaments: Participate in tournaments and compete for valuable prizes.

- Educational Resources: Learn strategies and market analysis using Pocket Option’s educational materials.

- Ease of Use: The platform features an intuitive interface, allowing you to start trading easily.

- MT4 and MT5: Trade Pocket Option on integrated MetaTrader platforms

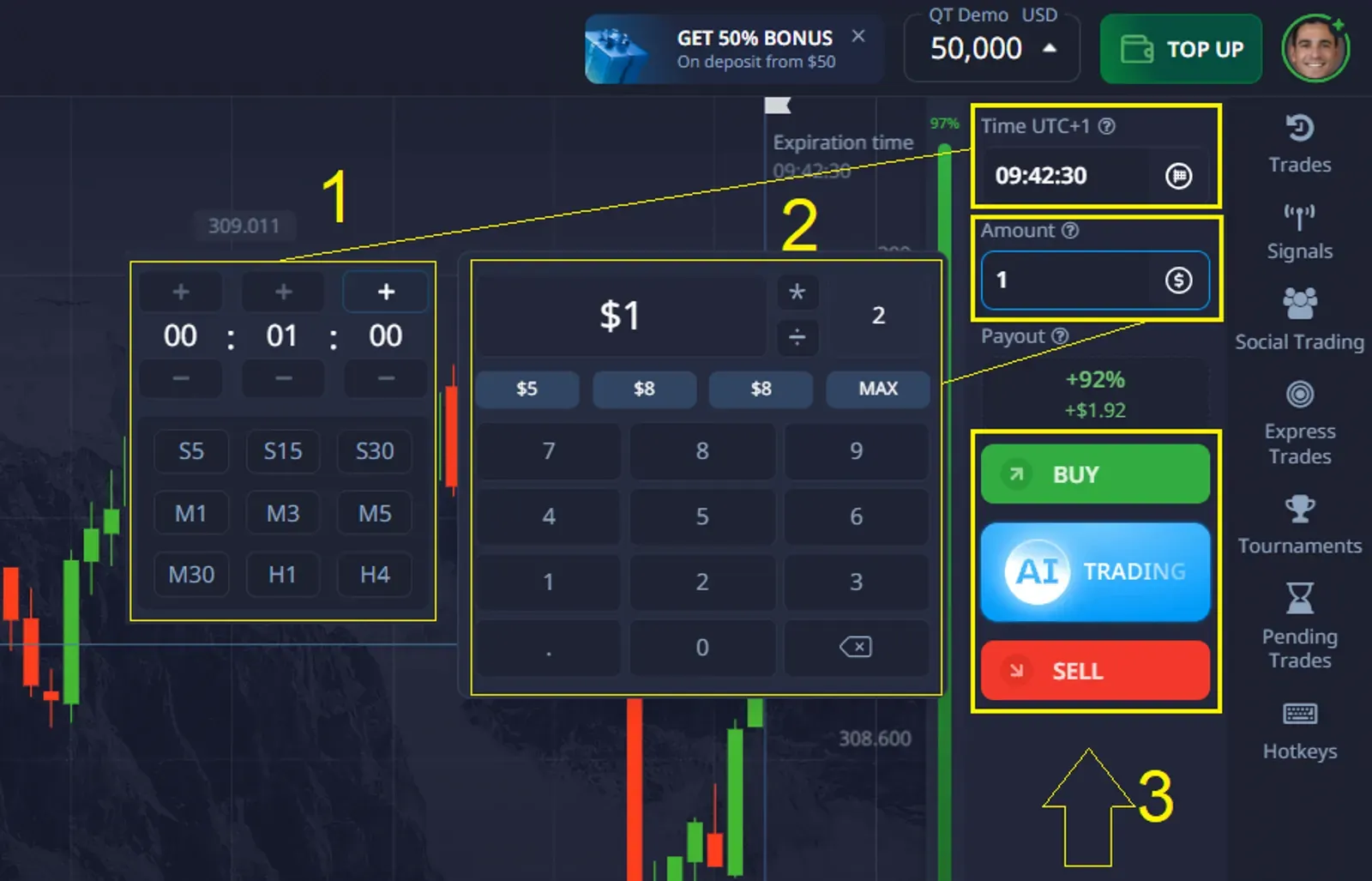

How to Open a Trade on Pocket Option?

- Select the asset you want to trade.

- Analyze the chart using the trader sentiment indicator or technical tools.

- Choose the trade amount (starting from $1).

- Set the trade duration (starting from 5 seconds).

- Make a prediction: if you think the price will go up, click BUY. If you think it will go down, click SELL.

If your forecast is correct, you can earn up to 92% profit. This percentage is displayed in advance when selecting an asset for trading. The minimum deposit starts at just $5, and features like copy trading, cashback, and other benefits are also available.

Advantages of Pocket Option

- More than 50 methods for deposits and withdrawals.

- Simple and user-friendly trading interface.

- Accessible on all devices: web version, Android, and iOS apps.

- Instant access to 100+ financial assets.

Choosing the Right Platform for Your Trading Style

Your trading objectives and experience level should heavily influence your choice of online trading software. Different platforms excel in specific areas.

- Day traders require platforms with minimal lag and advanced charting

- Long-term investors benefit from research tools and portfolio analysis

- Beginners should prioritize educational resources and intuitive interfaces

- Advanced traders need customization options and algorithmic capabilities

| Trading Style | Recommended Features |

|---|---|

| Day Trading | Low latency, hotkeys, level 2 data |

| Swing Trading | Strong charting, scanning tools |

| Algorithmic Trading | Coding interface, backtesting capabilities |

| Options Trading | Options analysis, strategy builders |

For those interested in options trading specifically, Pocket Option provides a streamlined experience with tools designed for this market segment. Their platform balances functionality with accessibility.

Security Considerations

When using online trading software, security should be a top priority. Your financial information and investment capital deserve robust protection.

- Two-factor authentication implementation

- Data encryption standards

- Regulatory compliance and oversight

- Insurance protections for accounts

Reputable platforms invest heavily in security measures to protect their users. Before creating an account, research the security protocols in place and verify regulatory credentials.

| Security Feature | Why It Matters |

|---|---|

| Two-Factor Authentication | Prevents unauthorized account access |

| Encryption | Protects data transmission |

| Regulatory Oversight | Ensures platform accountability |

| Fraud Monitoring | Identifies suspicious activities |

Cost Structure Analysis

Understanding the cost structure of online trading software is essential for maintaining profitability. Different platforms employ various fee models that can significantly impact your returns.

| Fee Type | Description | Impact on Trading |

|---|---|---|

| Commission | Per-trade fee | Affects frequent traders most |

| Spread | Difference between buy/sell prices | Hidden cost on every trade |

| Subscription | Regular payment for platform access | Fixed cost regardless of activity |

| Inactivity | Fee for not trading | Penalizes occasional traders |

Some platforms like Pocket Option focus on transparent pricing structures to help traders understand exactly what they’re paying for. This clarity allows for better planning and cost management.

Getting Started with Online Trading Software

Beginning your journey with online trading software involves several key steps. A methodical approach can help you avoid common pitfalls and set yourself up for success.

- Research different platforms based on your trading goals

- Create a demo account to test the interface and tools

- Learn the basic functions through tutorials and practice

- Start with small investments when transitioning to real trading

- Regularly review and adjust your approach as you gain experience

Most quality platforms offer extensive educational resources to help new users become familiar with their systems. Take advantage of these materials to accelerate your learning curve.

Conclusion

Online trading software has revolutionized how individuals participate in financial markets. The right platform can provide the tools and information needed to make informed decisions while managing risk effectively. Whether you’re considering established options like Pocket Option or exploring other alternatives, focus on finding software that aligns with your specific trading goals, technical requirements, and budget constraints. As markets continue to evolve, the quality of your trading software will remain a crucial factor in your overall experience and results.

FAQ

What is the minimum deposit required for most online trading software?

Minimum deposits vary widely across platforms. Some online trading software requires as little as $5-10 to start, while others might require $500 or more. Pocket Option, for example, has a relatively low minimum deposit requirement compared to many traditional brokers.

Can I use online trading software on my mobile device?

Yes, most modern online trading software offers mobile applications for iOS and Android devices. These apps typically provide core functionality for monitoring markets and executing trades while on the go, though they may have fewer features than desktop versions.

How do I know if an online trading software is secure?

Look for platforms that use encryption, offer two-factor authentication, and are regulated by recognized financial authorities. Secure trading software will also be transparent about their security measures and have clear privacy policies.

Is it possible to test online trading software before investing real money?

Yes, most reputable online trading software provides demo accounts that allow users to practice with virtual funds. This is an excellent way to familiarize yourself with the platform's features and test trading strategies without financial risk.

How much technical knowledge do I need to use online trading software?

The required technical knowledge varies by platform. Some online trading software is designed specifically for beginners with intuitive interfaces and educational resources, while others cater to experienced traders with advanced technical analysis tools and customization options.