- 24/7 market monitoring and trade execution: Automated systems can operate 24/7, reacting to market changes without interruption.

- Elimination of emotional trading decisions: Algorithms follow predetermined rules, preventing impulsive actions from the trader.

- Ability to backtest strategies using historical data: The backtesting feature allows evaluating a strategy’s effectiveness before applying it in the real market.

- Simultaneous management of multiple trading accounts: Automation makes it easier to control and manage multiple accounts simultaneously.

- Improved trade entry and exit precision: Algorithms can precisely determine optimal points for opening and closing positions.

MetaTrader 4 Automated Trading: Strategies, Benefits, and Success Stories

Explore how automated trading on MetaTrader 4 boosts efficiency and stability for traders.

Developed by MetaQuotes Software, the MetaTrader 4 platform has become the industry standard for Forex and CFD trading. Its popularity is due to its user-friendly interface and powerful features, including the ability to implement automated trading strategies. Auto trading MT4 allows traders to execute trades based on predefined rules and algorithms, eliminating emotional decision-making from the trading process.

Key Benefits of MT4 Automated trading

The Role of Pocket Option in MT4 Automated Trading

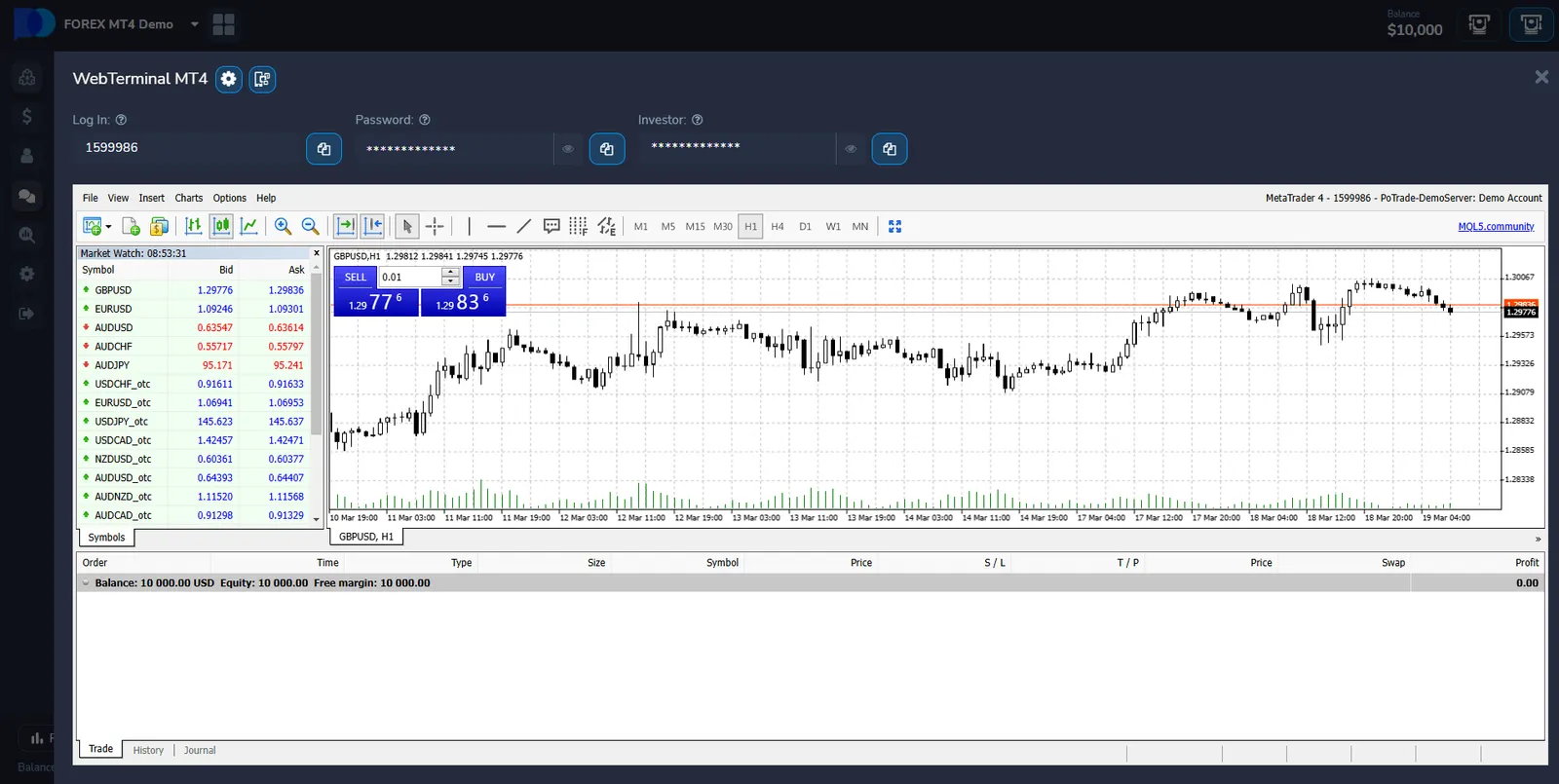

Pocket Option has integrated MetaTrader 4 (MT4) into its platform, offering traders a seamless experience when using automated trading systems. After registering on Pocket Option, you can easily start trading with MT4, accessing all the benefits of algorithm-based strategies and expert advisors.

✔️ Try Metatrader on Demo Pocket Option!

How to Start Trading on MT4 via Pocket Option:

- Register on Pocket Option Create an account on Pocket Option, and you’ll gain access to both the web platform and MT4 integration.

- Deposit to Start You can start trading with MT4 after making a real deposit from as low as $5. This ensures you can test your strategies in real market conditions without significant financial commitment.

- Open MT4 After logging into Pocket Option, you can openMT4 directly from your account dashboard. Then, link it to your account, and you’ll be ready to begin automated trading.

- Customize Your Trading Once MT4 is set up, you can either use the pre-installed expert advisors (EAs) or upload your own. Pocket Option’s integration allows you to automate trades on MT4 with precision.

- Start Trading on MT4 With MT4 connected, you can now execute trades using custom-built bots or any automated strategy, benefiting from Pocket Option’s fast execution times and secure platform.

Real-World Success Stories

Let’s look at some examples of traders and companies that have achieved outstanding results using automated trading systems on MT4.

Case Study 1: The Trend Follower

Mark, a retail trader, developed a trend-following algorithm for the EUR/USD pair. His strategy involved identifying strong trends using multiple timeframe analysis and entering trades with clear risk management rules.

| Metric | Result |

|---|---|

| Annual Return | 32% |

| Maximum Drawdown | 15% |

| Win Rate | 58% |

| Profit Factor | 1.85 |

Mark’s success demonstrates the power of consistent execution and reliable risk management in automated trading MT4.

Case Study 2: The Scalping Specialist

Joan, a professional trader, created a scalping bot that takes advantage of small price movements in highly liquid currency pairs. Her strategy involves entering and exiting trades within minutes, sometimes seconds.

| Metric | Result |

|---|---|

| Monthly Return | 8-12% |

| Average Trade Duration | 3 minutes |

| Trades per Day | 50-100 |

| Risk-Reward Ratio | 1:1.2 |

Joan’s example highlights the potential of high-frequency trading strategies when implemented through metatrader 4 automated trading.

Strategies for Successful MT4 Automated Trading

While individual results may vary, certain principles contribute to successful automated trading on the MT4 platform:

- Thorough backtesting and optimization: Conducting backtests on historical data helps identify the strengths and weaknesses of a strategy.

- Implementing robust risk management rules: Defining the maximum risk per trade and setting stop-loss orders protects capital.

- Regular monitoring and adjustment of strategies: Markets are constantly changing, so strategies require periodic adjustments.

- Diversification across multiple currency pairs or assets: Expanding the range of traded instruments reduces overall portfolio risk.

- Continuous learning and adaptation to market conditions: Following new trends and technologies increases a trader’s competitiveness.

Popular Automated Trading Strategies on MT4

| Strategy | Description | Typical Performance |

|---|---|---|

| Trend Following | Identifies and rides strong market trends | 15-25% annual return |

| Mean Reversion | Takes advantage of price oscillations around a mean | 10-20% annual return |

| Breakout Trading | Enters trades when price breaks key levels | 20-30% annual return |

| Grid Trading | Places buy and sell orders at preset intervals | 5-15% monthly return |

MT4 Automated Trading: Key Considerations

While the potential benefits of MT4 automated trading are significant, it is important to approach this method with caution and awareness of potential risks:

- Over-optimization leading to poor real-world performance: Excessive optimization of a strategy on historical data can make it ineffective in the future.

- Technological risks such as internet outages or platform glitches: Unexpected technical issues can lead to missed trades or losses.

- Market conditions that may render strategies temporarily ineffective: Changes in volatility or liquidity can affect trading results.

FAQ

How to use MetaTrader 4 on Android?

To use MetaTrader 4 on Android, download the app from Google Play Store, install it, and log in with your trading account credentials. On Pocket Option, you can link your account by logging into your Pocket Option account first, then opening MT4 through their platform. The mobile version offers most desktop features including chart analysis, placing trades, and managing automated strategies.

How to withdraw money from MetaTrader 4?

You cannot withdraw directly through MT4 itself. To withdraw funds, log into your broker's main platform (like Pocket Option) and use their withdrawal system. For Pocket Option users, go to your main account dashboard, select the withdrawal option, choose your preferred payment method, and follow the prompts to complete the withdrawal request.

What is the difference between MetaTrader 4 and 5?

MetaTrader 4 focuses primarily on forex and CFD trading with a simpler interface, while MetaTrader 5 offers more markets (including stocks and commodities), additional timeframes, more technical indicators, and an improved backtesting environment. MT4 remains popular for automated trading due to its established ecosystem of Expert Advisors, while MT5 provides more advanced features for professional traders.

How to add money to MetaTrader 4?

You cannot deposit directly through MT4. To fund your trading account, log into your broker's main platform (such as Pocket Option), navigate to the deposit section, select your preferred payment method, and complete the transaction. Once processed, the funds will be available in your linked MT4 account. With Pocket Option, you can start with as little as $5.

How to install MetaTrader 4 on Mac?

To install MT4 on Mac, you can either use a Windows emulator like Wine or Boot Camp, or use the web-based version through your broker. With Pocket Option, you can access MT4 directly through their platform after logging in. Alternatively, some brokers offer a dedicated Mac-compatible version of MT4 you can download from their website.

What broker to use for MetaTrader 4?

Pocket Option is a recommended broker for MT4 as they offer seamless integration with the platform, low minimum deposits (starting at $5), and support for automated trading strategies. When choosing a broker for MT4, consider factors like regulation, spreads, execution speed, available markets, and customer support quality to ensure a positive trading experience.

Is MetaTrader 4 legit?

Yes, MetaTrader 4 is a legitimate and widely-used trading platform developed by MetaQuotes Software. It's the industry standard for forex and CFD trading, used by millions of traders worldwide and supported by hundreds of reputable brokers. The platform's longevity (since 2005) and widespread adoption by regulated brokers like Pocket Option confirm its legitimacy in the trading world.

How to download MetaTrader 4 on PC?

To download MT4 on PC, visit your broker's website (like Pocket Option) and find their MT4 download link. Alternatively, you can go to the official MetaTrader website. Run the installer, follow the setup instructions, and once installed, launch the platform and log in with your broker account credentials. With Pocket Option, you can also access MT4 directly through their web platform.

How to open a demo account in MetaTrader 4?

To open a demo account in MT4, first register with a broker like Pocket Option that offers MT4 integration. Then select the "Open a Demo Account" option either within the MT4 platform or through your broker's website. With Pocket Option, you can easily switch to a demo account from your dashboard and practice with $50,000 in virtual funds before committing real capital.

How to download MetaTrader 4 on Windows?

To download MT4 on Windows, go to your broker's website (such as Pocket Option) and locate their MT4 download section. Click the download button for the Windows version, run the .exe file once downloaded, and follow the installation wizard. After installation, open the platform and enter your login credentials provided by your broker to start trading.