- MNQ stands for Micro E-mini Nasdaq-100 Futures.

Mastering MNQ trading hours is essential for traders capitalizing on micro Nasdaq futures movements. This article explores optimal trading windows, market patterns, and strategy adjustments across different sessions to maximize your profitability with proper risk management.

MNQ is the ticker symbol for the Micro E-mini Nasdaq-100 futures contract traded on the CME (Chicago Mercantile Exchange).

- This is a smaller version of the standard E-mini Nasdaq-100 (NQ) contract.

- One MNQ contract is 1/10 the size of the standard E-mini.

- It tracks the Nasdaq-100 Index, which includes the 100 largest non-financial companies traded on NASDAQ.

The Complete MNQ Trading Hours Schedule

| Session Type | Trading Hours (ET) | Characteristics |

|---|---|---|

| Regular Trading Hours (RTH) | 9:30 AM – 4:15 PM (Mon-Fri) | Highest liquidity, smallest spreads |

| Extended Trading Hours (ETH) | 6:00 PM – 5:00 PM next day (Sun-Fri) | 23 hours/day, includes overnight trading |

| Daily Maintenance | 5:00 PM – 6:00 PM (Mon-Thu) | Market closure for settlement |

| Weekend Closure | 5:00 PM Fri – 6:00 PM Sun | Complete market closure |

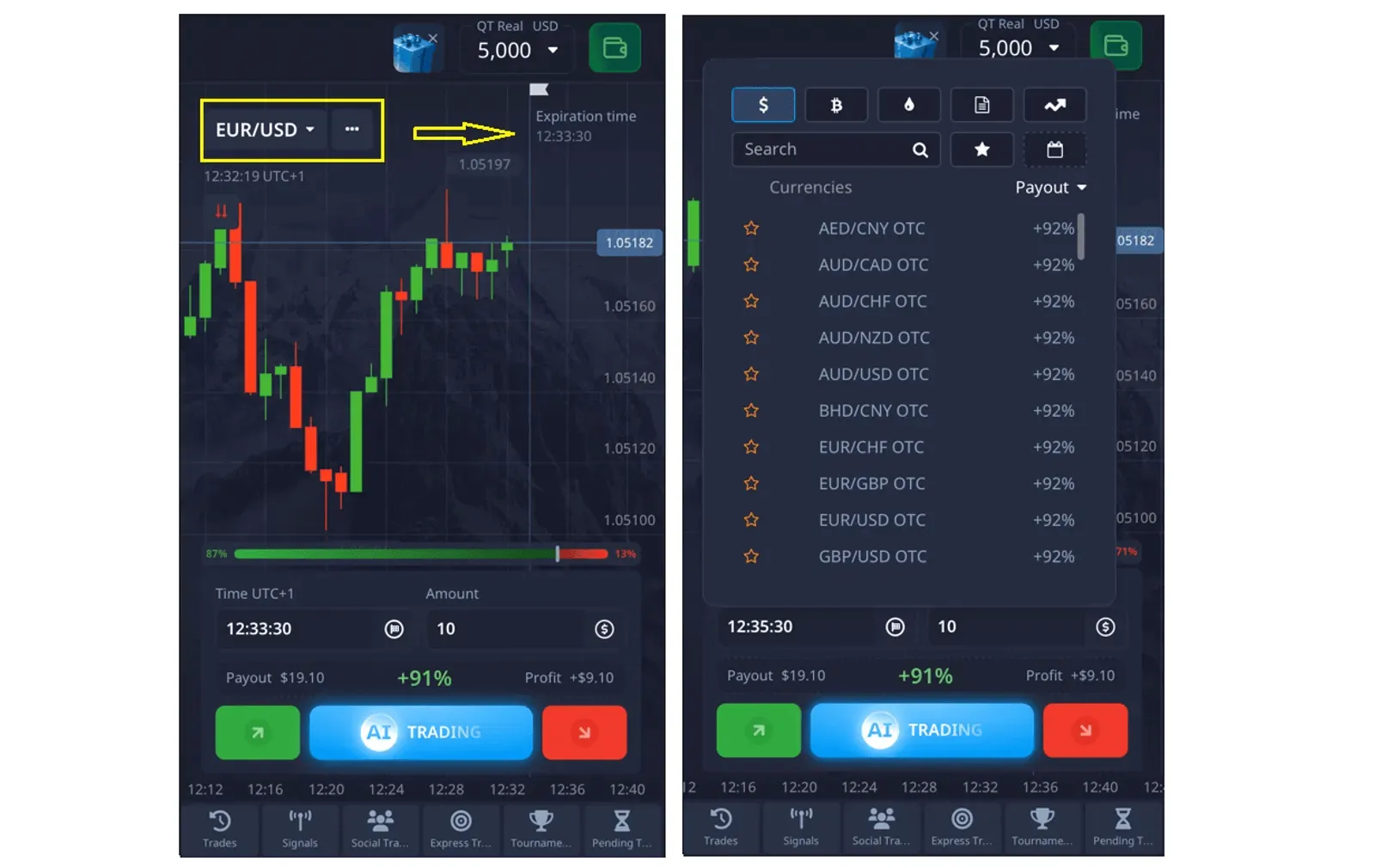

Platforms like Pocket Option offer 24/7 access to popular trading instruments, allowing traders to operate without depending on traditional exchange hours. This flexibility is ideal for those who want to trade on their own schedule.

The platform’s user-friendly interface displays real-time market status, helping users avoid common mistakes like time zone confusion or attempting to trade during market closures.

Simply go to the “Trading” tab, choose your preferred instrument, and open a trade whenever it suits you.

Why try trading with Pocket Option?

✔️ Quick trading provides 24/7 access to 100+ OTC assets, so you can trade anytime without waiting for the market to open.

✔️ AI trading and bots take over routine actions, allowing you to trade faster and stay focused on strategy.

✔️ Social trading lets you copy experienced traders and learn from real market behavior. Tournaments give you a chance to compete, improve, and win.

✔️ Bonuses and promo codes help grow your balance, while 50+ global payment methods make deposits and withdrawals simple.

✔️ Tutorials, trading tips, and expert insights are always available, and support is ready to help when needed.

✔️ The mobile app gives you full control over your trading — from quick deals to full analysis, wherever you are.

Pocket Option Mobile: Complete Trading Experience

With the Pocket Option app, you can trade from anywhere. You can literally open trades on the go:

- While waiting for your friends at a sports game

- On a beach vacation when relaxing under an umbrella

- In between sets at the gym during your workout routine

The Pocket Option app delivers comprehensive trading functionality wherever you go. Everything operates seamlessly – from quick trade execution and chart analysis to financial insights and trading controls. It provides all the capabilities of the desktop version but with enhanced convenience and mobility in your pocket!

Key Market Conditions During Different MNQ Trading Hours

Market conditions fluctuate significantly throughout the trading day, creating distinct opportunities and challenges:

- Market opening (9:30 AM – 10:30 AM ET): Highest volatility and volume, ideal for momentum strategies

- Midday (11:30 AM – 2:00 PM ET): Often range-bound conditions with lower volatility

- Market closing (3:00 PM – 4:15 PM ET): Increasing volume as positions are squared away

- Evening session (4:15 PM – 8:00 PM ET): Moderate liquidity with reactions to after-hours news

- Overnight (8:00 PM – 3:00 AM ET): Lowest liquidity, influenced by Asian markets

Strategic Approaches for Different MNQ Trading Hours

| Time Period | Recommended Strategy | Risk Management |

|---|---|---|

| Market Open (9:30-10:30 AM) | Momentum trading, breakouts | Wider stops, smaller positions |

| Midday (11:00-2:00 PM) | Range trading, mean reversion | Tighter stops, normal sizing |

| Market Close (3:00-4:15 PM) | Trend continuation, closing momentum | Adaptive stops, standard sizing |

| Extended Hours | News reaction, overnight positioning | Wider stops, reduced sizing |

Many successful traders on Pocket Option specialize in specific MNQ trading hours rather than attempting to trade all sessions, allowing deeper pattern recognition and consistent execution.

Critical Economic Releases and Their Impact

Major economic announcements can significantly disrupt normal Emini Nasdaq trading hours patterns:

| Economic Release | Release Time (ET) | Trading Approach |

|---|---|---|

| FOMC Interest Rate Decision | 2:00 PM | Consider closing positions before release |

| Non-Farm Payrolls | 8:30 AM | Wait for post-release pattern |

| CPI/Inflation Data | 8:30 AM | Prepare for pre-market volatility |

Economic events often influence the market, and Pocket Option traders use economic calendars on the embedded metatrader platform. Pocket Option also provides news and trading signals to make more informed trading decisions.

Global Market Influences on Extended MNQ Trading Hours

International markets significantly impact MNQ price action during extended hours:

- European markets (3:00 AM – 11:30 AM ET): Strong correlation, especially tech sectors

- Asian markets (8:00 PM – 4:00 AM ET): Moderate influence, particularly following US tech news

- Currency markets: USD strength/weakness affects tech export valuations

Pocket Option traders can leverage these correlations during extended MNQ trading hours by monitoring related markets for early signals of potential movements.

Practical Considerations for Retail Traders

Retail traders can optimize their approach to MNQ trading hours by:

- Focusing on specific time windows that match their analytical strengths

- Adjusting position sizing based on session liquidity profiles

- Using appropriate timeframes for different sessions (shorter during RTH, longer during ETH)

- Maintaining awareness of overnight developments that might impact opening prices

- Leveraging Pocket Option’s tools for monitoring global market correlations

Conclusion

Success comes not from attempting to trade every available hour, but from identifying the specific MNQ trading hours that best match your skills, risk tolerance, and personal schedule, allowing you to develop specialized expertise that leads to consistent results. Optimizing your Emini Nasdaq trading hours allows you to focus your energy on the most productive market periods, increasing your efficiency and potential returns.

FAQ

What exactly are MNQ trading hours?

MNQ (Micro E-mini Nasdaq-100) futures trade nearly 24 hours daily on weekdays. Regular trading hours run 9:30 AM to 4:15 PM ET, while extended hours continue from 6:00 PM to 5:00 PM ET the following day.

How do MNQ trading hours differ from regular stock market hours?

While stocks trade from 9:30 AM to 4:00 PM ET, MNQ futures provide nearly 23 hours of daily trading. This extended availability allows traders to react to overnight news and global market movements.

When is liquidity highest during MNQ trading hours?

Highest liquidity occurs during regular trading hours (9:30 AM - 4:15 PM ET), especially in the first 90 minutes after open and the last hour before close. These periods feature the tightest spreads and highest trading volumes.

Can I trade MNQ futures on weekends?

No, MNQ futures trading is unavailable on weekends. The market closes at 5:00 PM ET Friday and reopens at 6:00 PM ET Sunday, providing a break for settlement and system maintenance.

How should I adjust my trading strategy for overnight MNQ trading hours?

For overnight sessions, use wider stops, reduce position sizes, and focus on longer timeframes. Overnight markets have lower liquidity and can experience sudden movements in response to international events.