- Advertising revenue

- User growth

- Competition from other platforms

- Regulatory and legal pressures

Is Meta a Good Stock to Buy? 2025 Financial Analysis and Investment Outlook

As investors navigate the ever-evolving landscape of tech stocks, a pressing question emerges: is meta a good stock to buy? With a focus on its financial performance, innovations, and market position, this article explores Meta Platforms' potential as a worthwhile investment through 2025. Another critical question many investors are asking is is meta stock a good buy, especially as market conditions evolve heading into 2025. Whether you're thinking about buy or sell decisions today, or looking at forecasts for tomorrow, next week, or 2030, we'll guide you through the key insights.

Overview of Meta Platforms

Meta Platforms, formerly known as Facebook, operates a diverse family of apps, including Instagram, WhatsApp, and Messenger. The company’s business model revolves around generating revenue primarily through advertising, which accounts for a significant portion of its earnings. This strategic focus on ad spending allows Meta to capitalize on the growing demand for digital advertising.

Company Background and Business Model

Founded in 2004, Meta has evolved into a powerhouse in the social media landscape. Its business model emphasizes user engagement, harnessing data to deliver targeted ads. This approach not only drives revenue growth but also positions Meta for sustained earnings, which is vital for future stock performance.

Recent Developments and Innovations

In recent months, Meta has introduced several innovations aimed at enhancing user experience and engagement, particularly in AI and Reality Labs. These advancements are designed to keep the company at the forefront of technology, potentially increasing its growth potential and attracting more advertisers to its platforms.

Position in the Market

Meta’s position in the market remains strong, despite facing challenges from competitors and regulatory scrutiny. Analysts have differing views on the stock, with some suggesting it may be undervalued. The ongoing antitrust discussions could impact Meta’s operations, and investors need to stay informed about these developments.

Understanding Meta Stock

To make an informed decision about whether Meta is a good stock to buy, it is essential to analyze its current market performance, historical price trends, and the factors influencing its stock prices. This comprehensive understanding will help investors navigate the potential risks and rewards associated with Meta stock.

Current Market Performance

Meta’s current market performance reflects a mix of optimism and caution among investors. As of now, the stock trades on the NASDAQ, and analysts provide a range of opinions about its price target. The fluctuations in the stock’s value indicate investor sentiment and expectations for Meta’s future earnings.

Historical Price Trends

Examining historical price trends for Meta stock reveals significant volatility, characteristic of tech shares. This volatility can be attributed to various factors, including earnings reports and market reactions. The average price target for Meta suggests that while there are risks, the potential for gains remains appealing to many investors.

Factors Influencing Meta Stock Prices

The forecast for Meta’s performance in the coming years will depend on how well the company adapts to these dynamics, as well as external events that could impact its growth trajectory and stock valuation.

Meta’s Earnings Analysis

Q1 Earnings Report Insights

Meta Platforms’ Q1 earnings report showcased a blend of strengths and challenges that are critical for investors to analyze. The earnings indicated a steady revenue stream driven largely by ad spending across its family of apps, including Instagram and WhatsApp. While the earnings met analyst expectations, there remains a cautious outlook due to competition and regulatory pressures that could affect future growth potential.

Analyst Estimates for Meta’s Future Earnings

Analysts have varied estimates for Meta’s future earnings, reflecting a spectrum of optimism and caution. The forecast for Meta suggests a potential rebound as the company invests in AI and Reality Labs, aiming to enhance user engagement and expand its advertising capabilities. As investors consider whether to buy Meta stock, understanding these forecasts is essential for making informed investment decisions.

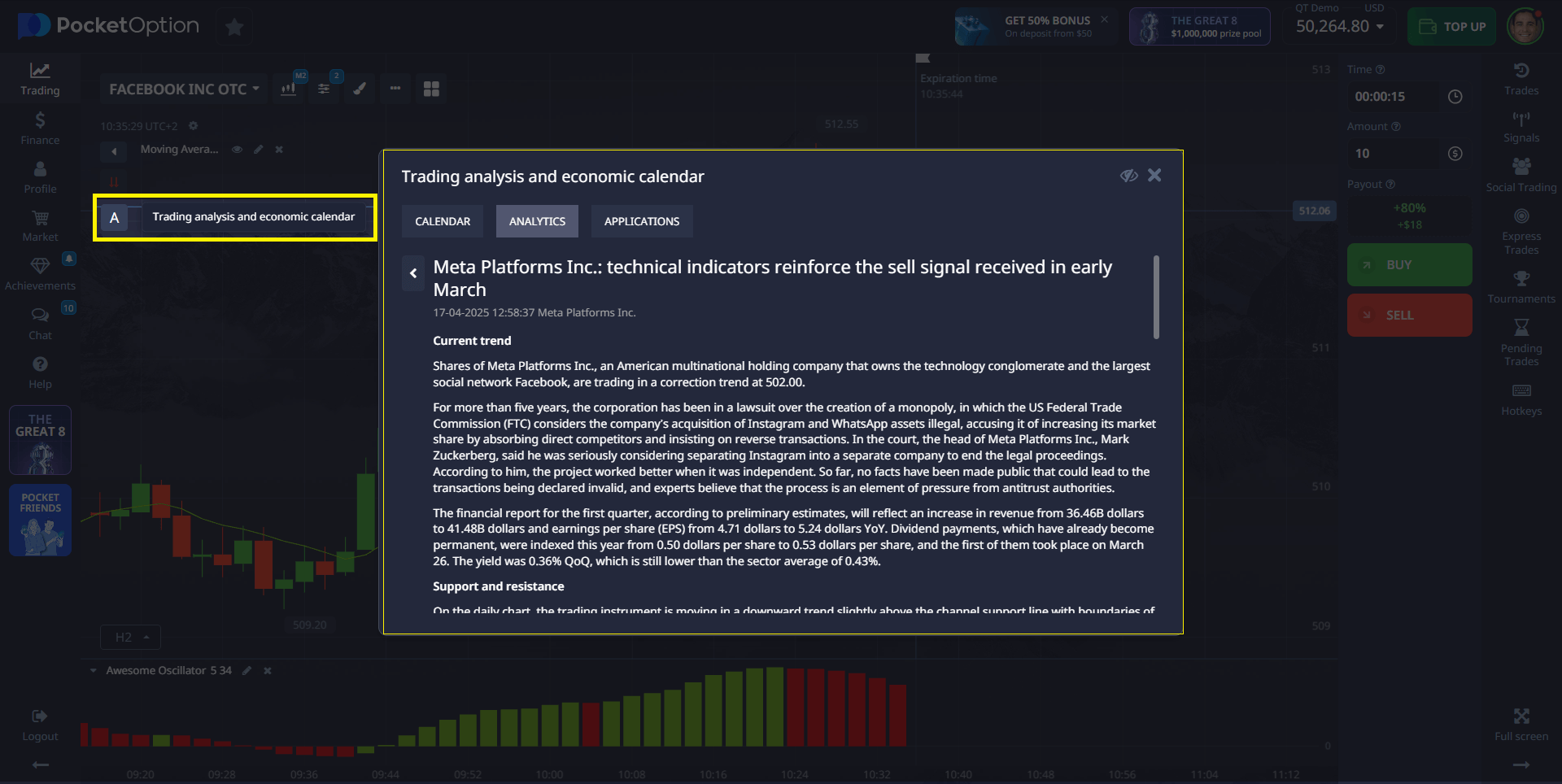

Read the latest news and trade on Pocket Option

Comparative Earnings Analysis with Competitors

When comparing Meta’s earnings to those of its competitors, it becomes evident that the company maintains a competitive edge in digital advertising. However, challenges from rival platforms and evolving market dynamics complicate this landscape. Analysts are closely monitoring how Meta’s earnings stack up against others in the so-called “magnificent seven” tech stocks to assess its relative valuation and growth trajectory.

Key Metrics for Evaluating Meta Stock

| Metric | Meta (2025E) | Industry Average | Comments |

|---|---|---|---|

| P/E Ratio | 21.5 | 24.0 | Slightly below average, potential upside |

| EPS Growth (YoY) | 17% | 12% | Above industry norm |

| Revenue Growth (YoY) | 14% | 10% | Strong ad-based revenue expansion |

| Dividend Yield | 0% | 1.2% | Reinvests earnings in innovation |

Analyst Opinions on Meta Stock

Meta Bulls Say: Positive Predictions

Meta bulls are optimistic about the stock’s future, citing its strong fundamentals and growth strategies. They argue that as Meta continues to innovate and expand its advertising reach, the stock could be a strong buy. The positive predictions are often supported by the company’s ability to leverage data and enhance user experiences, which could ultimately drive up earnings and stock prices.

Meta Bears Say: Concerns and Critiques

Conversely, Meta bears express concerns regarding the company’s long-term viability, highlighting issues such as regulatory scrutiny and potential market saturation. Critics argue that these factors could inhibit Meta’s growth potential and impact its earnings, leading to a more cautious outlook. Their critiques emphasize the risks associated with investing in Meta stock, particularly in light of the ongoing antitrust discussions.

Analyst Price Targets for 2025

Analyst price targets for Meta Platforms in 2025 reflect a range of expectations, with some suggesting the stock is fairly valued, while others see it as a strong buy or strong sell. The average price target for Meta indicates that, despite market fluctuations, there is potential for substantial gains if the company successfully navigates its challenges and capitalizes on emerging opportunities in the digital space.

Meta vs. Competitors: Performance at a Glance

- Advertising Dominance: Meta commands a sizable share of global digital advertising spend.

- Ecosystem Engagement: Cross-app integration drives higher time-on-platform metrics.

- AI Integration: Reality Labs and Meta AI tools position the firm for long-term tech leadership.

Stock Forecast and Investment Outlook

Notable 2025 Events Impacting Meta Stock

| Date | Event | Impact |

|---|---|---|

| Q1 2025 | Strong earnings: $6.43 EPS, $42.3B revenue | Stock rebounded 17% after a 3-month decline |

| Apr 2025 | Delay of AI model “Behemoth” launch | Minor investor concerns; CapEx forecast raised to $72B |

| May 2025 | Germany proposes 10% digital tax on companies like Meta | Potential revenue hit in EU region |

| Q1 2025 | CalPERS increases Meta stake by over 500K shares | Institutional confidence signal |

| Apr–May 2025 | FTC lawsuit over Instagram & WhatsApp acquisitions begins | Regulatory risk; Zuckerberg testifies in court |

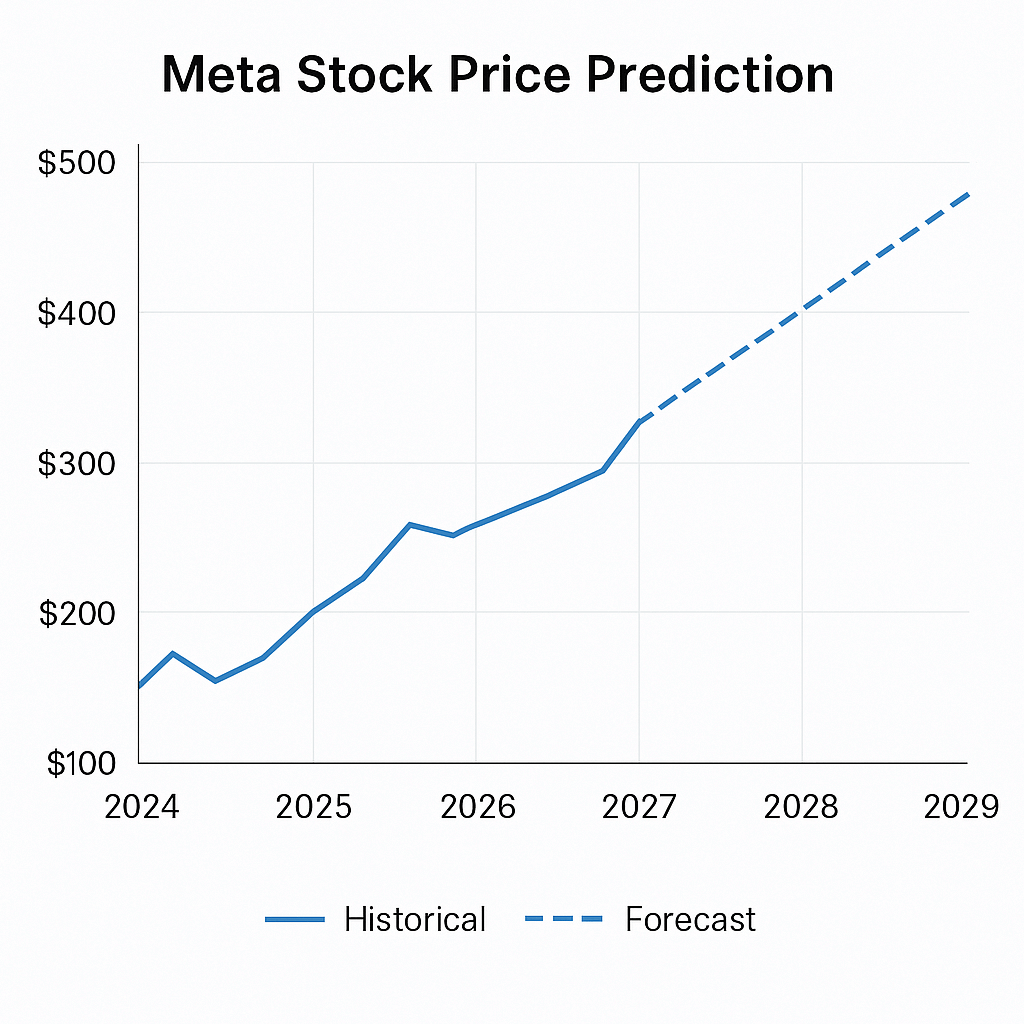

Meta Stock Forecast for 2025

The stock forecast for Meta in 2025 is shaped by various factors, including its growth potential in the digital advertising space and advancements in AI and Reality Labs. Analysts have differing views on where the stock price will land, with some estimating a considerable rebound driven by increased ad spending and user engagement across its family of apps. The outlook suggests that if Meta can effectively leverage its innovations and address regulatory concerns, it could see a significant appreciation in its stock value over the next few years.

Valuation Metrics: Fairly Valued or Overvalued?

When analyzing the valuation metrics for Meta Platforms, it becomes crucial to determine if the stock is fairly valued or overvalued. The average price target for Meta is indicative of differing analyst sentiments, with some suggesting it is currently undervalued. Morningstar and other analysts argue that the stock’s current price does not fully reflect the company’s earnings potential, especially as it continues to invest in growth strategies. However, caution is advised as external factors like antitrust hearings could also impact these valuations, impacting investor perceptions.

Better Magnificent Seven Stock Comparisons

In the competitive landscape of tech stocks, comparisons with the “magnificent seven” can provide valuable insights for potential investors in Meta stock. While Meta has a robust advertising model and strong user base through platforms like WhatsApp and Instagram, its rivals are also making strides in AI and user engagement. These comparisons can help investors weigh the relative merits of investing in Meta against other tech giants, giving a clearer picture of its position within the stock market. An informed decision hinges on understanding how Meta’s earnings and stock performance align with its competitors’ forecasts.

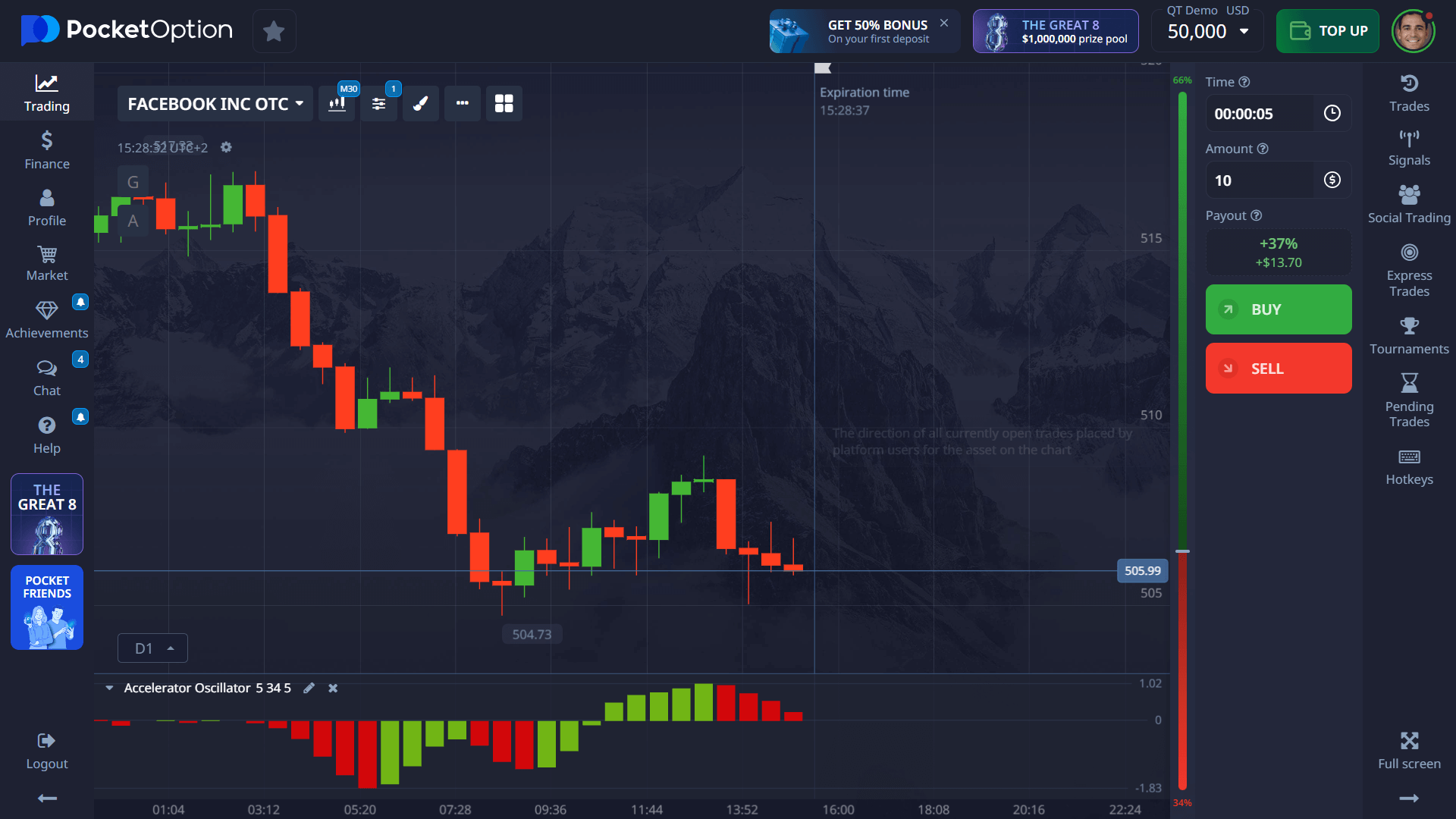

Pocket Option and Meta: An Unlikely but Valuable Comparison

Although Meta and Pocket Option serve very different markets—technology and online trading respectively—they share a common theme: adaptability and growth. Pocket Option, a leading trading platform, provides access to fast-paced financial markets with tools tailored for both beginners and professionals. Just as Meta evolves in response to digital ad trends, Pocket Option continuously updates its interface and tools to reflect current market demands.

Benefits of Pocket Option for Investors:

- Forecast-based trading with clear risk-reward ratio

- Real-time market signals and copy trading tools

- Web-based access with no installation required

⚡ Key functionality of Pocket Option: Instead of traditional asset buying or selling, you make a prediction on the asset’s price movement — whether it will rise or fall within a specific timeframe. If the direction is correct, you can receive a return of up to 92%. The service operates entirely in your browser, so there’s no installation needed.

How to Open a Trade on Pocket Option

- Choose an Asset – Select from currencies, commodities, or stocks.

- Analyze the Chart – Use tools such as the Trader Sentiment Indicator or technical indicators.

- Set Your Investment Amount – Start from just $1.

- Choose Trade Duration – From 5 seconds (on OTC assets) to several minutes.

- Make Your Forecast – Press “Buy” if you expect the price to rise, or “Sell” if you think it will drop.

If your forecast is correct, your return can be up to 92% — this percentage is displayed when choosing the asset.

On a live account (starting from just $5), you can access advanced features like copy trading, receive cashbacks on trades, and benefit from other premium tools.

Common Pitfalls When Evaluating Meta

- Relying solely on past performance: Tech stocks evolve rapidly.

- Ignoring regulatory risks: Antitrust rulings could materially impact operations.

- Overlooking global user trends: Meta’s user base is growing fastest outside the U.S.

Real Trader Voices on Meta and Pocket Option

“Meta remains on my watchlist—not just for its ad revenue but for the AI angle. It’s a strategic hold in my tech portfolio.” — Sophia W., Independent Investor

“I use Pocket Option for short-term trades and track stocks like Meta for long-term growth. The platform helps me balance both strategies.” — Liam J., Retail Trader

What’s Next for Investors

For those considering whether Meta is a strong stock to add in 2025, the evidence suggests potential, especially when paired with vigilant market tracking. Evaluate the risk-reward ratio based on financial metrics, growth prospects, and innovation pipelines.

Engage with other traders and deepen your market insights—Join the conversation and explore more topics in our community!

FAQ

What are the biggest risks of investing in Meta stock?

The most significant risks include the FTC's antitrust case seeking Instagram/WhatsApp divestiture ($185-230B potential market cap impact), continued Reality Labs losses ($12.4B in 2024), increasing competition from TikTok (37% Gen Z screen time vs Meta's 23%), and potential technological disruption from specialized AI competitors. Meta's dual-class share structure, giving Mark Zuckerberg 58% voting control despite owning 14% of economic shares, also creates governance concerns for institutional investors.

How does Meta's investment in the metaverse affect its stock value?

Meta's $12.4B annual metaverse investment directly reduced 2024 EPS by approximately $4.85, creating a significant earnings drag that contributes to its below-peer valuation multiples. While Meta has shipped 20 million Quest devices (63% market share), metaverse revenues remain modest at under $2B annually against these substantial investments. Long-term investors may view this as securing Meta's position in computing's next platform, while shorter-term investors often see it as an expensive strategic distraction from the highly profitable core business.

How does Meta compare to other tech stocks as an investment?

Meta trades at a 22% discount to average tech sector multiples (21.4x P/E vs. 27.3x sector average) while maintaining superior margins (28.6% operating margin vs. 19.2% peer average) and stronger free cash flow yield (4.2% vs. 2.8% sector average). Unlike pure growth tech stocks, Meta offers value characteristics with growth optionality, positioning it as a hybrid investment with both defensive qualities and significant upside potential depending on metaverse and AI execution.

What impact could regulatory changes have on Meta's stock performance?

Regulatory actions represent Meta's most significant risk factor, with potential outcomes ranging from manageable fines to business-altering structural remedies. The most severe scenario--forced divestiture of Instagram or WhatsApp--could reduce Meta's market cap by $185-230B based on sum-of-parts valuation models. More likely intermediate outcomes include operating restrictions under the EU's Digital Markets Act, potentially reducing revenue by 3-7% through reduced cross-platform data usage and mandatory interoperability requirements.

How important is Meta's core advertising business to its overall value?

Meta's advertising business generates 92% of total revenue and essentially all current profits, making it the fundamental driver of present valuation. Despite privacy headwinds, Meta maintained 14.3% YoY advertising growth in Q4 2024 through AI-enhanced targeting and measurement capabilities. This core business not only determines current stock performance but also funds Meta's $12B+ annual metaverse investments and $10B share repurchase program, making its continued resilience critical for both value and growth investors.

What could Meta be worth in 2040?

Long-term projections for Meta in 2040 are speculative, but continued leadership in digital platforms and successful AI integration could position the stock to exceed current valuation benchmarks.

What is the downside of Meta?

The key risks include heightened regulatory scrutiny (such as antitrust cases), digital ad market volatility, and competition from other tech giants innovating in AI and social media.

What will Meta stock be worth in 2030?

Forecasts vary, but projections suggest Meta's stock could range between $650 and $900 by 2030 depending on economic conditions, tech sector performance, and regulatory outcomes.

Can Meta reach $1000?

While no forecast guarantees exact outcomes, some analysts believe Meta's strong fundamentals and long-term AI investments could potentially push the stock toward $1000 by the early 2030s, especially if global ad revenue and platform engagement continue to grow.