- Extends expiration time without changing entry conditions.

- Allows adjusting the investment amount.

- Can only be applied to active trades that meet platform requirements.

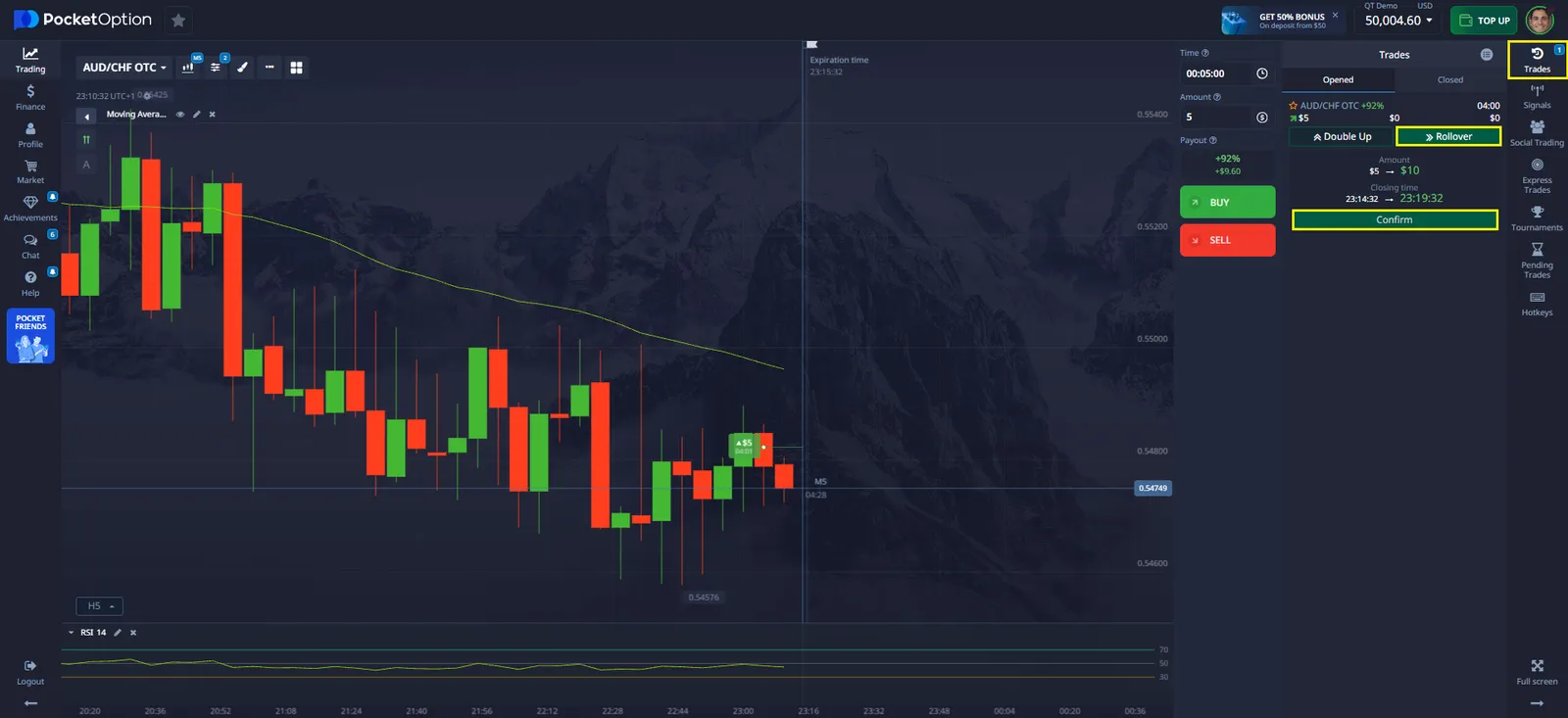

How to Rollover a Trade on Pocket Option: Mastering Extended Trading

In the fast-paced world of online trading, adaptability is key to success. One crucial skill that traders on platforms like Pocket Option need to master is the art of rolling over trades. This article delves into real-world cases and success stories related to trade rollovers, highlighting effective methods and impressive results achieved by both individual traders and companies. By understanding how to rollover a trade on Pocket Option, you can potentially turn challenging situations into profitable opportunities.

What is Trade Rollover and How Does It Work?

Rollover is a feature that allows extending the expiration time of an open trade if market conditions do not align with the trader’s expectations. Using this tool can help minimize risks and increase the chances of a successful trade closure.

Key Features of Rollover:

Practical Example of Trading with Rollover

Suppose a trader invests 100 USD in a trade with a prediction of an asset price increase. The expiration is set for 30 minutes, but after 15 minutes, the price moves in the opposite direction.

In this case, the trader can:

- Use rollover and increase the investment to 120 USD.

- Extend the expiration time by another 30 minutes.

- Wait for the market to shift in the predicted direction.

How to Use the Rollover Feature in Trading

To apply this feature, follow these steps:

- Open a trade on the trading platform.

- Monitor price movements and analyze the chart.

- If an extension is needed, click the “Rollover” button.

- Confirm the increased investment and trade extension.

- Wait for the updated expiration time to conclude.

When to Use Rollover

| Situation | Use Rollover | Do NOT Use Rollover |

|---|---|---|

| Market Movement | Temporary movement against your position. | Clear and sustained trend in the opposite direction. |

| Trend Reversal Probability | High chance of price reversal in your favor. | Market continues moving against your position. |

| Market News Impact | Upcoming news that may shift the price. | Low asset volatility or market closure. |

| Account Balance | Sufficient funds to increase investment. | Insufficient funds to extend the trade. |

How Traders Successfully Use the Rollover Feature on Pocket Option

Real Success Stories

Case 1: The Patient Trader

A part-time trader was confident in their analysis of a currency pair. They opened a position on Pocket Option, but as the expiration time approached, the market hadn’t moved as expected. Instead of closing the trade at a loss, the trader decided to use the rollover feature.

| Initial Trade | Rollover Action | Result |

|---|---|---|

| $100 investment | Extended by 1 hour | $180 profit |

By using the rollover feature, the trade was given more time to develop, ultimately leading to a profitable outcome. This case demonstrates how understanding how to use rollover on Pocket Option can help turn potential losses into gains.

Case 2: Corporate Strategy

A small trading firm implemented a strategy of using rollovers on Pocket Option. They trained their traders to identify situations where extending a trade’s duration could be beneficial. Over six months, they compared their trading results with and without the rollover strategy:

| Period | Without Rollovers | With Rollovers |

|---|---|---|

| Months 1-3 | 12% profit | – |

| Months 4-6 | – | 18% profit |

This case highlights the importance of incorporating rollover as part of a comprehensive trading strategy.

Key Strategies for Successful Trade Rollovers

Based on the experiences of successful traders, here are some key strategies for effectively using the rollover feature:

- Always have a clear reason for rolling over a trade

- Set a limit on the number of rollovers per trade

- Consider market volatility before deciding to use rollover

- Use rollovers only in conjunction with thorough market analysis

Common Pitfalls to Avoid

While learning how to use rollover on Pocket Option can be beneficial, it’s also important to be aware of potential pitfalls:

- Overusing rollovers and increasing potential losses

- Rolling over without a clear strategy or analysis

- Ignoring additional costs associated with rollovers

- Making emotional decisions when considering a rollover

Case 3: Learning from Mistakes

A group of novice traders decided to experiment with rollovers on Pocket Option. Initially, they used the feature indiscriminately, leading to poor results:

| Week | Rollover Usage | Profit/Loss |

|---|---|---|

| 1 | Frequent, unplanned | -15% |

| 2 | Moderate, some planning | -5% |

| 3 | Selective, well-planned | +10% |

This experience taught them the importance of using rollovers judiciously and having a clear strategy for implementing them on Pocket Option.

Advantages and Disadvantages of Rollover

Advantages:

- Provides more time for price movement.

- Can improve the chances of a successful trade closure.

- An alternative to closing the trade at a loss.

Disadvantages:

- Increases the investment amount.

- Can only be used once per trade.

- Does not guarantee a positive outcome.

Comparison of Rollover with Alternative Strategies

| Strategy | Description | Suitable For |

|---|---|---|

| Rollover | Extending a trade with increased investment | Risk management and trade preservation |

| Martingale | Doubling the stake after losses | Loss recovery |

| Hedging | Opening an opposite trade | Risk minimization |

Conclusion

Understanding how to rollover a trade on Pocket Option can be a valuable tool in a trader’s arsenal. The success stories and case studies presented here demonstrate that when used wisely, rollovers can help extend profitable trades and manage potential losses. However, it’s crucial to approach rollovers with a well-thought-out strategy, clear rules, and an understanding of the associated risks and costs.

By learning from both the successes and mistakes of others, traders can develop their own effective approaches to using the rollover feature on Pocket Option. Remember, the key to successful trading lies not just in knowing the tools available but in using them judiciously as part of a comprehensive trading plan.

FAQ

What is a trade rollover on Pocket Option?

A trade rollover on Pocket Option is a feature that allows traders to extend the expiration time of their current position, giving them more time for the market to move in their favor.

How often can you rollover a trade on Pocket Option?

The number of times you can rollover a trade on Pocket Option may vary depending on the specific asset and market conditions. It's best to check the platform's current rules and use rollovers judiciously.

Are there additional costs associated with rolling over a trade on Pocket Option?

Yes, there are usually additional costs associated with rolling over a trade. These costs can vary, so it's important to understand the fee structure before using the rollover feature.

Can you rollover on Pocket Option for all types of trades?

While Pocket Option offers rollover features for many types of trades, it's essential to check the specific rules for each asset and trade type, as there may be limitations or exceptions.

Is it always beneficial to rollover a trade on Pocket Option?

No, it's not always beneficial to rollover a trade. The decision to rollover should be based on careful analysis, market conditions, and a clear strategy. Overusing rollovers can potentially increase losses.