- Q1 Free Cash Flow: -$417M

- Memorial Day revenue: All-time high

- Stock gained 9% after the holiday weekend

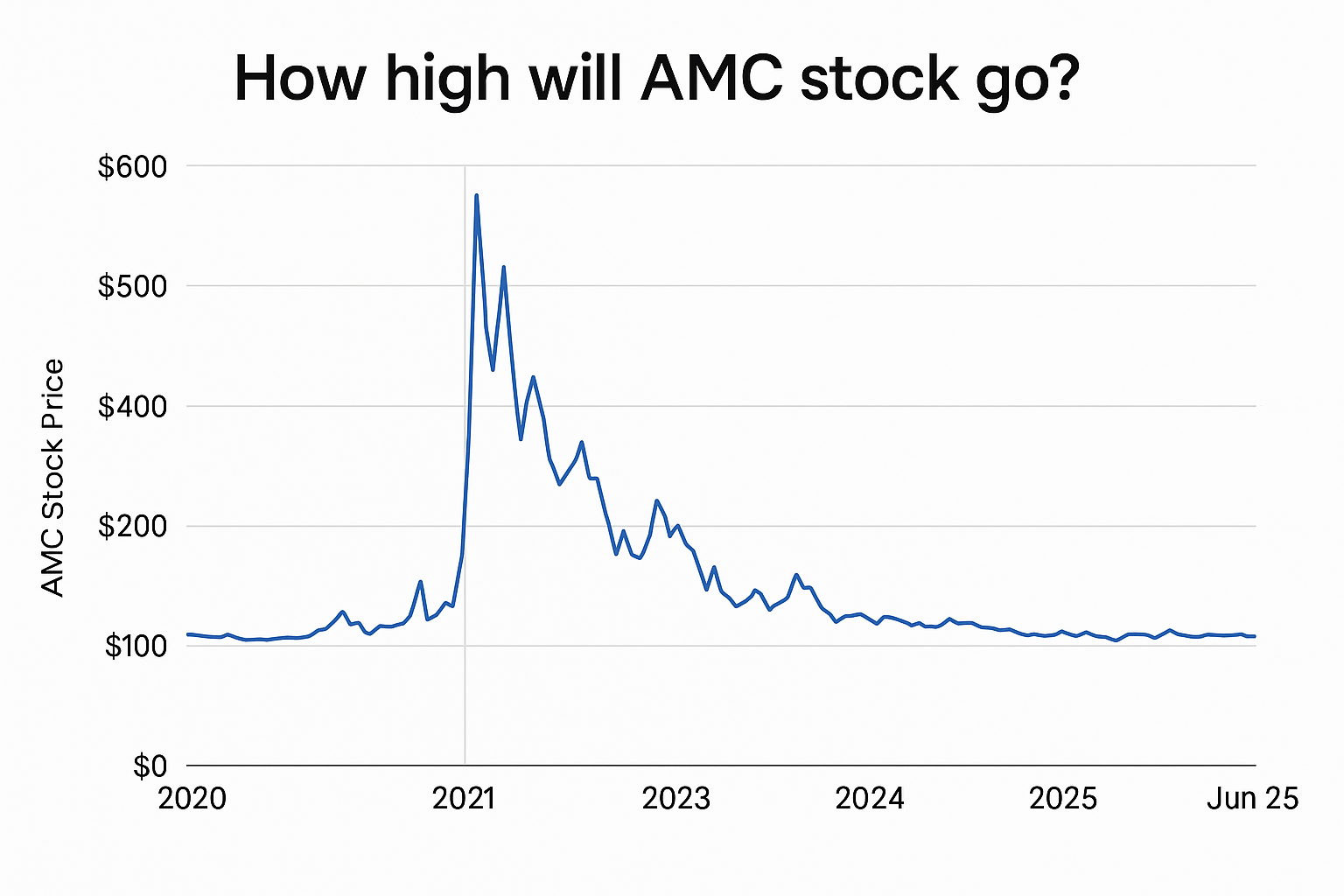

How High Will AMC Stock Go: Expert Analysis and Market Predictions

AMC Entertainment has become a focal point in the stock market, captivating both retail investors and analysts alike. This article explores the key factors influencing AMC stock's future, including historical performance, market sentiment, analyst projections, and trading opportunities.

Article navigation

- Overview of AMC Entertainment and Its Stock

- Will AMC Be Profitable in 2025?

- Market Sentiment and Meme Stock Status

- What Is the Record High for AMC Stock?

- Analyst Forecasts and Recovery Outlook

- Will AMC Stock Rebound?

- Technical Overview

- Is AMC Stock Worth Investing in Right Now?

- Trading AMC Stock on Pocket Option

- Final Takeaways

Overview of AMC Entertainment and Its Stock

AMC Entertainment Holdings is a major player in the global cinema industry. Founded in 1920, the company faced significant challenges during the pandemic but gained renewed attention in 2021 amid the meme stock surge.

In June 2021, AMC stock reached a record high of $625.50, driven by retail investor momentum. However, the stock has since declined significantly, closing at $3.56 as of May 30, 2025.

Will AMC Be Profitable in 2025?

AMC reported a negative free cash flow of $417 million in Q1 2025, largely due to seasonal factors. However, a record-breaking Memorial Day weekend provided a positive signal. Blockbusters like “Lilo & Stitch” and “Mission: Impossible – The Final Reckoning” boosted attendance and revenue, suggesting potential profitability by year-end.

Key Indicators:

Market Sentiment and Meme Stock Status

As a meme stock, AMC remains subject to social media influence and retail sentiment. While some investors anticipate recovery and a possible short squeeze, volatility remains high. Shifts in consumer entertainment habits and competition from streaming also weigh on the outlook.

What Is the Record High for AMC Stock?

| Date | Price | Notes |

|---|---|---|

| Jun 2, 2021 | $625.50 | All-time high |

| May 30, 2025 | $3.56 | Recent close |

| 52W High | $5.96 | June 6, 2024 |

| 52W Low | $2.45 | April 2025 |

Analyst Forecasts and Recovery Outlook

2025 Forecasts: Analysts predict moderate growth if attendance continues to improve and debt is reduced.

Long-Term (2030): Mixed views persist. Optimists point to strategic shifts and diversified revenue streams, while skeptics note continued meme-stock volatility.

Will AMC Stock Rebound?

Many investors ask: Will AMC stock ever go up again? Will AMC stock recover in the long term? The recent momentum hints at possible recovery, but much depends on sustained box office success and debt management. While analysts remain cautiously optimistic, the trading community is still debating how high can AMC stock go in the short and long term.

Supportive Factors:

- Strong 2025 film lineup

- Over $375M in debt reduced

- Improved theater efficiency

Challenges:

- Volatile trading environment

- Ongoing pressure from digital platforms

If retail sentiment strengthens again, some believe AMC could regain previous levels. The question remains: Will AMC stock go back up, or is this a temporary bounce?

Technical Overview

Key Signals: Moving averages and RSI show potential momentum.

Patterns: Volatile spikes, especially during meme-driven periods.

Levels to Watch: Support near $3.00; resistance around $5.00.

Is AMC Stock Worth Investing in Right Now?

Pros:

- Technical buy signals

- High trading volume and community engagement

Cons:

- Price swings remain unpredictable

- Debt concerns linger

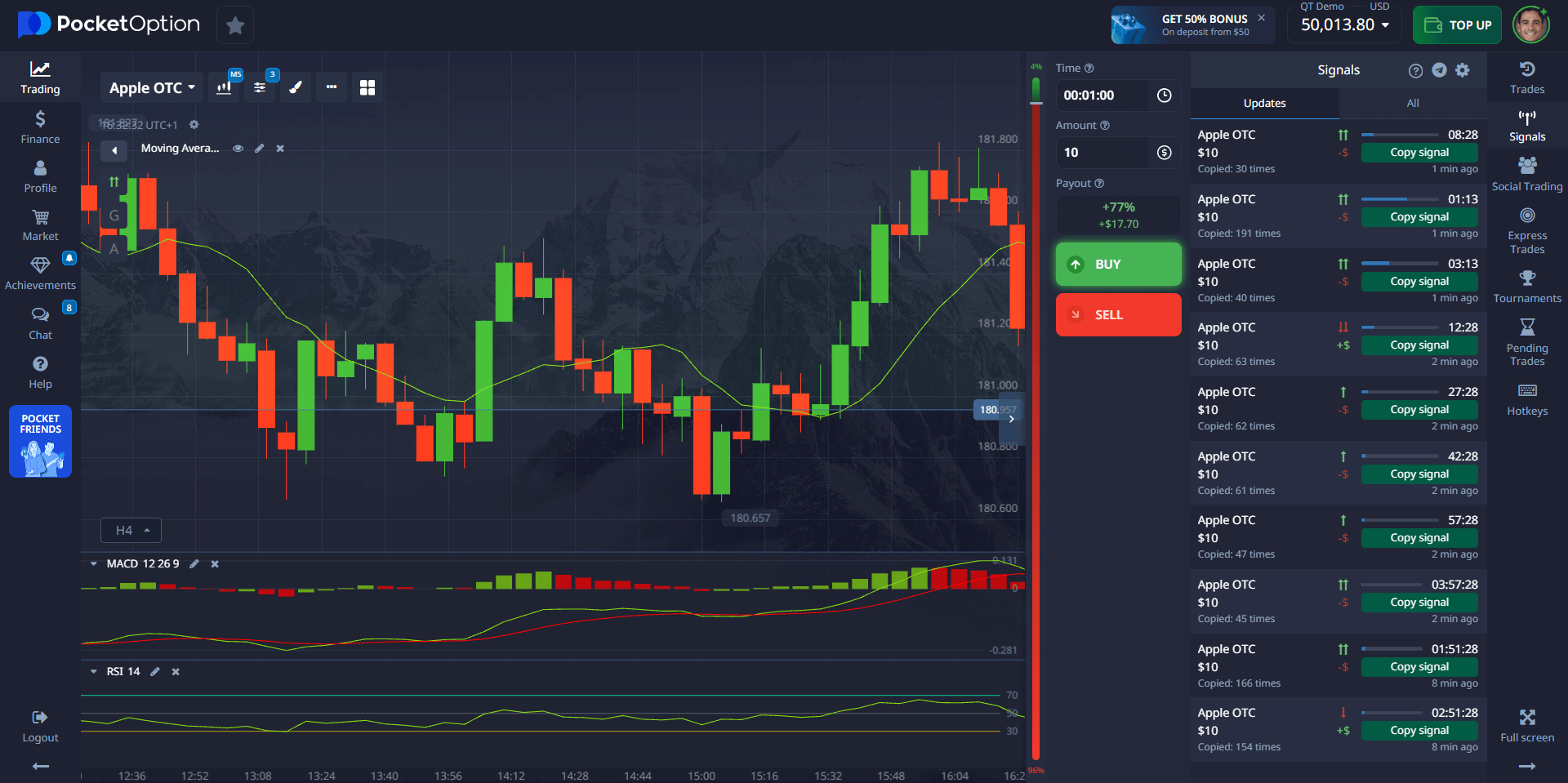

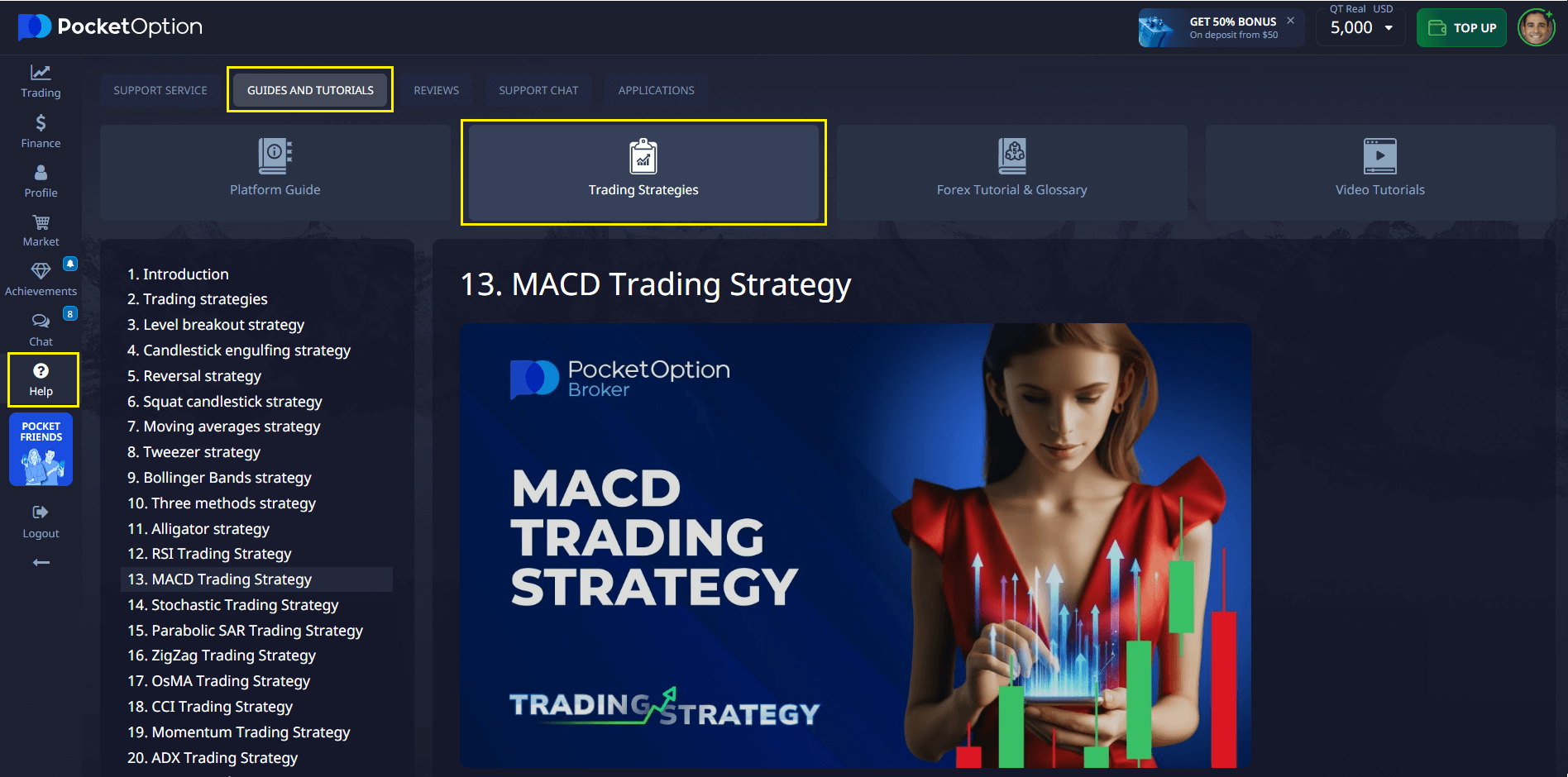

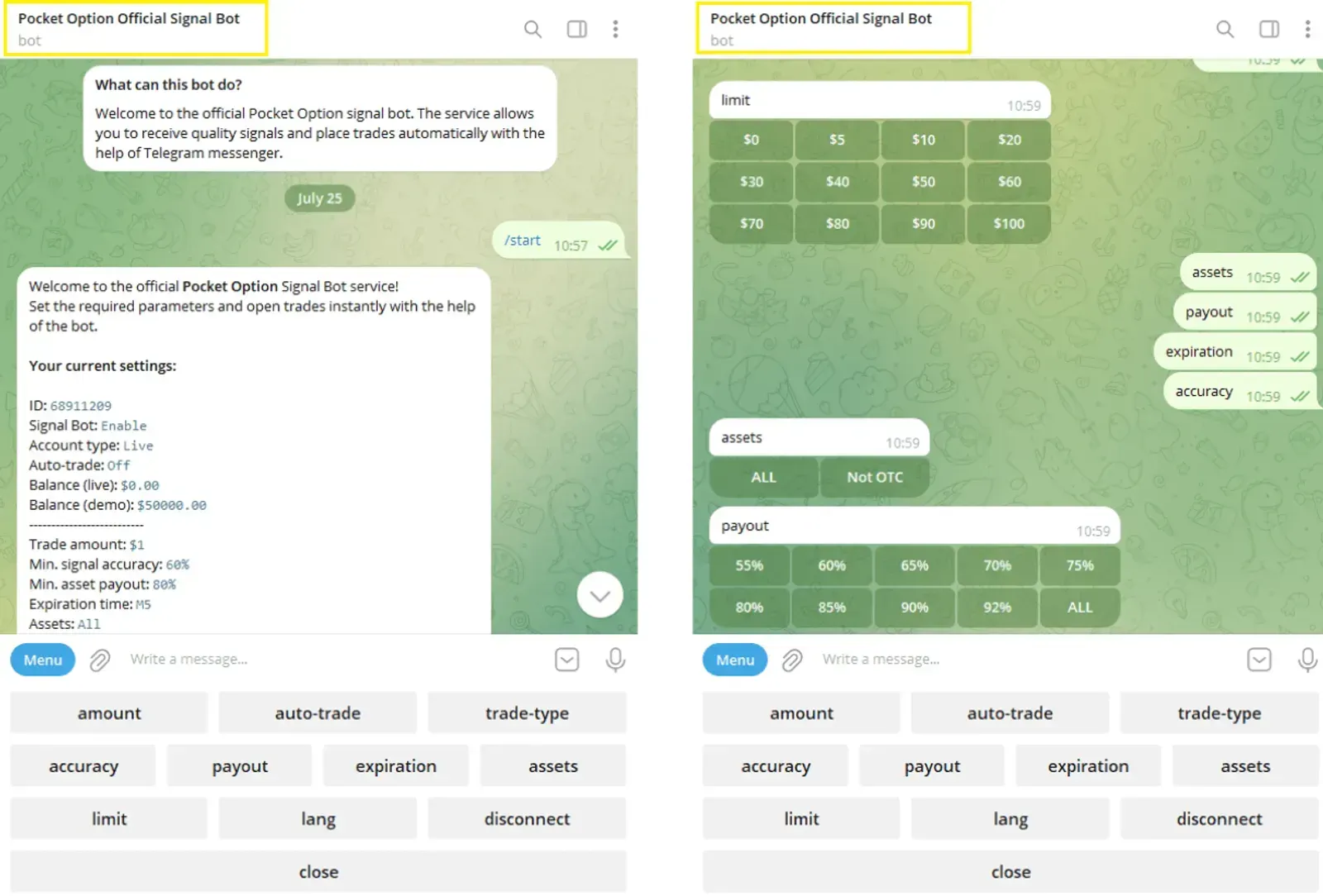

Trading AMC Stock on Pocket Option

Although AMC stock is not directly available on Pocket Option, the platform provides access to correlated assets such as major stock indices and leading tech companies. These instruments often reflect sentiment linked to meme stocks like AMC, offering opportunities for trend-based strategies.

Why Pocket Option appeals to trend traders:

- Correlation with tech-heavy indices affected by meme-stock volatility

- Real-time market analytics and news alerts

- User-friendly tools for short-term speculative strategies

- Educational content and trading insights

“Pocket Option helps me respond to sudden market shifts triggered by news around popular stocks.” — Brian M., trader since 2023

Final Takeaways

AMC’s future combines risk and potential. Analysts continue to speculate how high will AMC stock go as the company adapts its strategy. While some believe it may take years, others expect a faster rebound driven by retail momentum.

Discuss this and other topics in our community!

FAQ

Will AMC stock go back up to its all-time highs?

While possible, a return to previous all-time highs would require significant improvements in AMC's business fundamentals and/or another period of extraordinary market conditions similar to 2021. Most analysts consider this scenario unlikely in the near term.

How high can AMC stock go if a short squeeze occurs again?

If another short squeeze occurs, AMC could see significant upward movement. However, the current short interest is lower than during the 2021 event, suggesting any squeeze might have less dramatic effects than previously experienced.

Will AMC stock ever go up again after recent declines?

Stock markets are cyclical, and AMC shares could certainly rise again. The extent and timing of any recovery depends on the company's financial performance, industry trends, and broader market sentiment.

How does Pocket Option relate to AMC stock trading?

Pocket Option and similar trading platforms have made stock and options trading more accessible, including for meme stocks like AMC. These platforms have contributed to increased retail participation in stocks with high social media interest.

What factors will determine if AMC stock recovers in value?

Key factors include box office performance, debt management success, streaming competition impacts, operating cost control, and continued retail investor interest. The company's ability to adapt to changing entertainment consumption patterns will be crucial.