- Pocket Option – Offers leverage up to 1:1200 with a user-friendly interface

- XM – Provides leverage ranging from 1:1 to 1:1000 depending on account type

- Exness – Known for leverage options up to 1:2000 on certain instruments

- FBS – Offers leverage up to 1:3000 for experienced traders

High Leverage Brokers: Complete Analysis of Top Trading Platforms

When entering the trading market with limited capital, high leverage brokers become a valuable option. These platforms allow traders to control larger positions with smaller deposits, potentially multiplying profits. However, understanding how leverage works and choosing reliable brokers is crucial for successful trading.

What Are High Leverage Brokers?

High leverage brokers are financial service providers that offer traders the ability to control positions larger than their account balance. Leverage is expressed as a ratio, such as 1:100, 1:500, or even 1:1000. This means a trader with $100 could potentially control positions worth $10,000, $50,000, or $100,000 respectively.

The primary benefit of using high leverage brokers is the potential to generate significant returns with a modest initial investment. However, this amplification works both ways – losses are equally magnified, making risk management essential.

| Leverage Ratio | Initial Investment | Position Size |

|---|---|---|

| 1:100 | $100 | $10,000 |

| 1:500 | $100 | $50,000 |

| 1:1000 | $100 | $100,000 |

Top High Leverage Brokers in 2025

The market offers numerous options for traders seeking high leverage opportunities. Below are some of the most notable platforms currently available:

Each of these brokers provides different features, trading instruments, and account requirements. Pocket Option stands out for beginners due to its intuitive platform and educational resources.

| Broker | Maximum Leverage | Minimum Deposit | Trading Platforms |

|---|---|---|---|

| Pocket Option | 1:1000 | $5 | MT4, MT5, Proprietary Platform |

| XM | 1:1000 | $5 | MT4, MT5 |

| Exness | 1:2000 | $1 | MT4, MT5 |

| FBS | 1:3000 | $1 | MT4, MT5 |

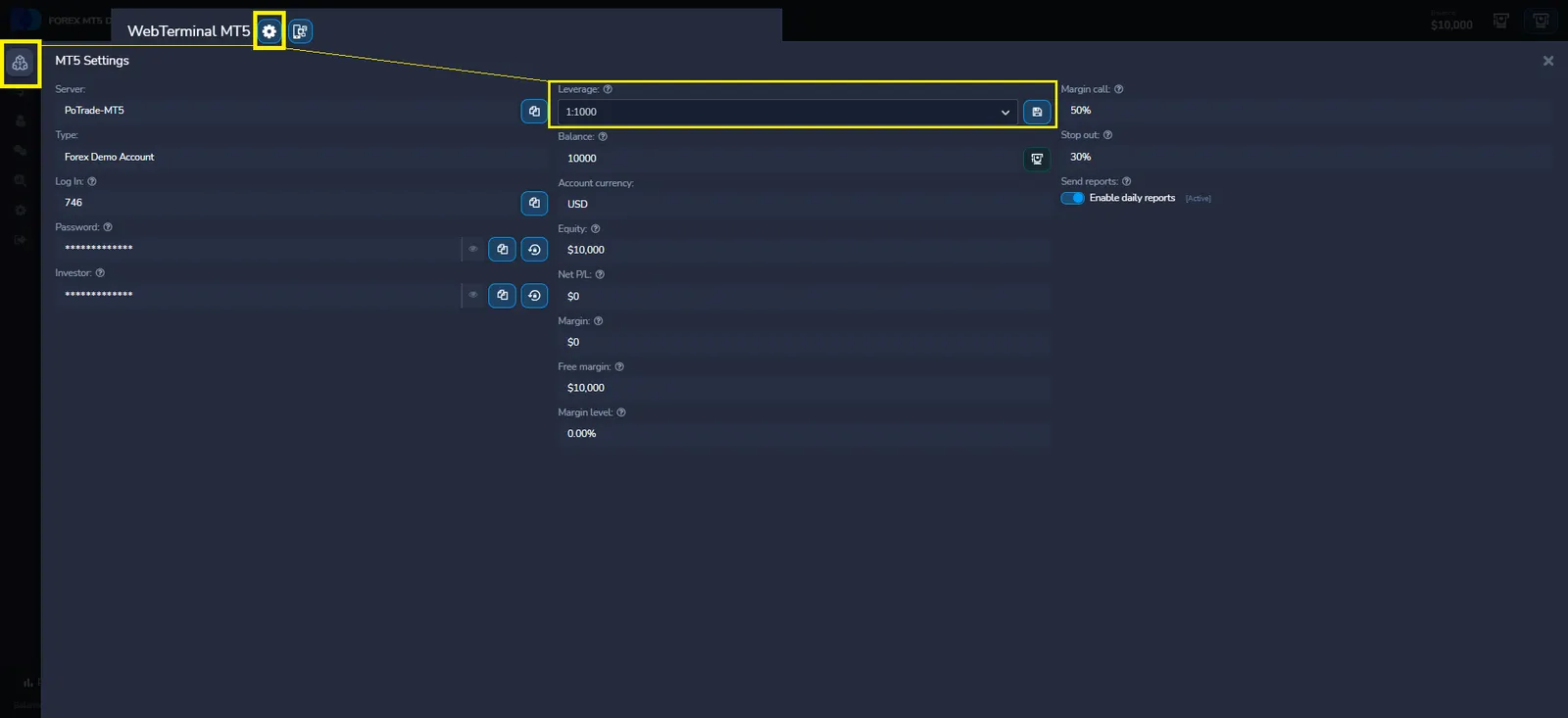

How to Set Up Leverage on Pocket Option

- Log in – Access your Pocket Option account.

- Select a Platform – Open MetaTrader 4 or 5 for forex and CFD trading.

- Navigate to Account Settings – Locate the leverage settings and choose your preferred ratio (1:1 – 1:1000).

- Confirm Changes – Save your settings to apply the selected leverage to your trades.

Important: Adjusting leverage influences margin requirements and potential risks. Evaluate your strategy and risk tolerance before making changes.

How is Margin Calculated with Leverage Max?

Margin is the required amount to open and maintain a trading position. Higher leverage reduces the margin requirement.

Calculation Formulas:

- Required Margin = Position Size / Leverage Ratio

- Available Margin = Account Balance – Used Margin

- Free Margin = Equity – Used Margin

Example:

A trader with a $600 deposit opens a $60,000 position using 1:100 leverage.

- Required Margin = 60,000 / 100 = $600

- Free Margin remains at $0, making the position vulnerable to market fluctuations.

Market Analysis Tools for Leveraged Trading

Pocket Option offers a variety of analytical tools to help traders manage risk effectively.

Key Analysis Tools:

- 95+ Technical Indicators – Assist in predicting price movements.

- Market Depth – Shows supply and demand levels.

- Volatility Scanners – Analyze market conditions.

- Chart Analysis – Includes candlestick patterns, Fibonacci retracement, and trendlines.

These tools help traders make informed decisions when using high leverage.

Risks Associated with High Leverage Trading

While high leverage brokers provide opportunities for substantial profits, traders must understand the inherent risks:

- Accelerated capital loss – Small market movements can quickly deplete your account

- Margin calls – Insufficient funds to maintain positions can result in automatic closure

- Psychological pressure – Higher stakes can lead to emotional trading decisions

- Overtrading – The illusion of having more capital can encourage excessive trading

Successful traders using high leverage brokers typically employ strict risk management strategies, limiting exposure to a small percentage of their account balance per trade.

| Risk Factor | Mitigation Strategy |

|---|---|

| Rapid losses | Use stop-loss orders on every trade |

| Margin calls | Maintain adequate free margin (30%+) |

| Emotional trading | Follow a pre-defined trading plan |

| Overtrading | Limit daily trade volume and frequency |

Choosing the Right High Leverage Broker

When selecting among high leverage brokers, consider these critical factors:

1. Regulatory Compliance: Verify the broker is regulated by a reputable authority, even if that means accepting lower leverage limits.

2. Trading Costs: High leverage means little if spreads, commissions, and overnight fees are excessive.

3. Platform Reliability: Ensure the platform offers stable execution, particularly during volatile market conditions.

4. Customer Support: Responsive support is essential when trading with high leverage.

Pocket Option performs well across these categories, offering reliable execution with reasonable trading costs while maintaining high leverage options.

| Selection Criteria | Why It Matters |

|---|---|

| Regulation | Ensures fund safety and fair trading practices |

| Trading Costs | Impacts overall profitability, especially with frequent trading |

| Platform Stability | Critical for executing precise entries and exits |

| Customer Support | Important for resolving issues quickly |

How to Choose the Right Leverage Level

Selecting the right leverage depends on various factors:

- Trading Experience – Beginners should start with lower leverage (1:20 – 1:100).

- Trading Strategy – Scalpers often use high leverage, while long-term investors prefer lower ratios.

- Acceptable Risk Level – Define how much you are willing to risk per trade.

- Market Conditions – High volatility requires careful leverage selection.

Examples of Using Leverage Max

Example 1:

A trader with a $1,500 deposit uses 1:600 leverage to open a $900,000 trade. A 0.7% price movement could result in a $6,300 gain or loss.

Example 2:

A trader with the same deposit uses 1:100 leverage, opening a $150,000 position. The same 0.7% price movement results in a $1,050 gain or loss.

Conclusion

High leverage brokers provide significant opportunities but come with substantial risks. Choosing a reputable platform like Pocket Option ensures a balance between leverage potential and responsible trading practices. Prioritize regulation, platform stability, and trading costs over the highest leverage ratios. Always use disciplined risk management strategies for long-term success.

FAQ

What is the maximum leverage typically offered by high leverage brokers?

High leverage brokers typically offer ratios ranging from 1:100 to 1:3000, depending on the regulatory environment they operate in.

Is trading with high leverage suitable for beginners?

Trading with high leverage is generally not recommended for beginners. The amplified risks can quickly deplete trading accounts when proper risk management isn't applied. Beginners should start with lower leverage (1:10 or 1:20) until they develop consistent trading strategies and risk management skills.

How does Pocket Option compare to other high leverage brokers?

Pocket Option offers leverage up to 1:1000, placing it in the mid-range of high leverage brokers. It stands out with a user-friendly platform, reasonable minimum deposit requirements ($5), and good customer support. While some competitors offer higher leverage, Pocket Option provides a balanced approach for traders seeking amplified opportunities with manageable risk.

What risk management strategies should I use with high leverage brokers?

When using high leverage brokers, essential risk management strategies include: limiting risk per trade to 1-2% of your account, always using stop-loss orders, avoiding overleveraging by using only a portion of available leverage, maintaining adequate free margin (at least 30%), and having a clear exit strategy for every position.