- Low-latency network connections

- High-performance hardware

- Sophisticated algorithms

- Real-time market data feeds

- Risk management systems

High Frequency Trading Software: Powering Modern Financial Markets

In the fast-paced world of financial markets, high frequency trading software has emerged as a game-changing technology. This sophisticated tool enables traders to execute a large number of orders at incredibly high speeds, often in fractions of a second.

The Evolution of High Frequency Trading Software

High frequency trading (HFT) software has come a long way since its inception. Initially developed in the late 1990s, these programs have undergone significant improvements, adapting to the ever-changing market conditions and technological advancements. Today’s high frequency trading software is capable of analyzing multiple markets simultaneously, making split-second decisions based on complex algorithms.

| Era | Key Developments |

|---|---|

| Late 1990s | Introduction of basic automated trading systems |

| Early 2000s | Rise of algorithmic trading |

| 2010s | Integration of machine learning and AI |

| Present | Advanced HFT platforms with real-time data processing |

Key Components of High Frequency Trading Software

High-frequency trading software comprises several crucial components that work together to execute trades at lightning-fast speeds. Understanding these elements is essential for anyone looking to delve into the world of HFT.

Each of these components plays a vital role in the overall performance of high frequency trading software. For instance, low-latency network connections ensure that trade orders are transmitted as quickly as possible, while sophisticated algorithms analyze market conditions and make trading decisions in milliseconds.

Popular High Frequency Trading Platforms

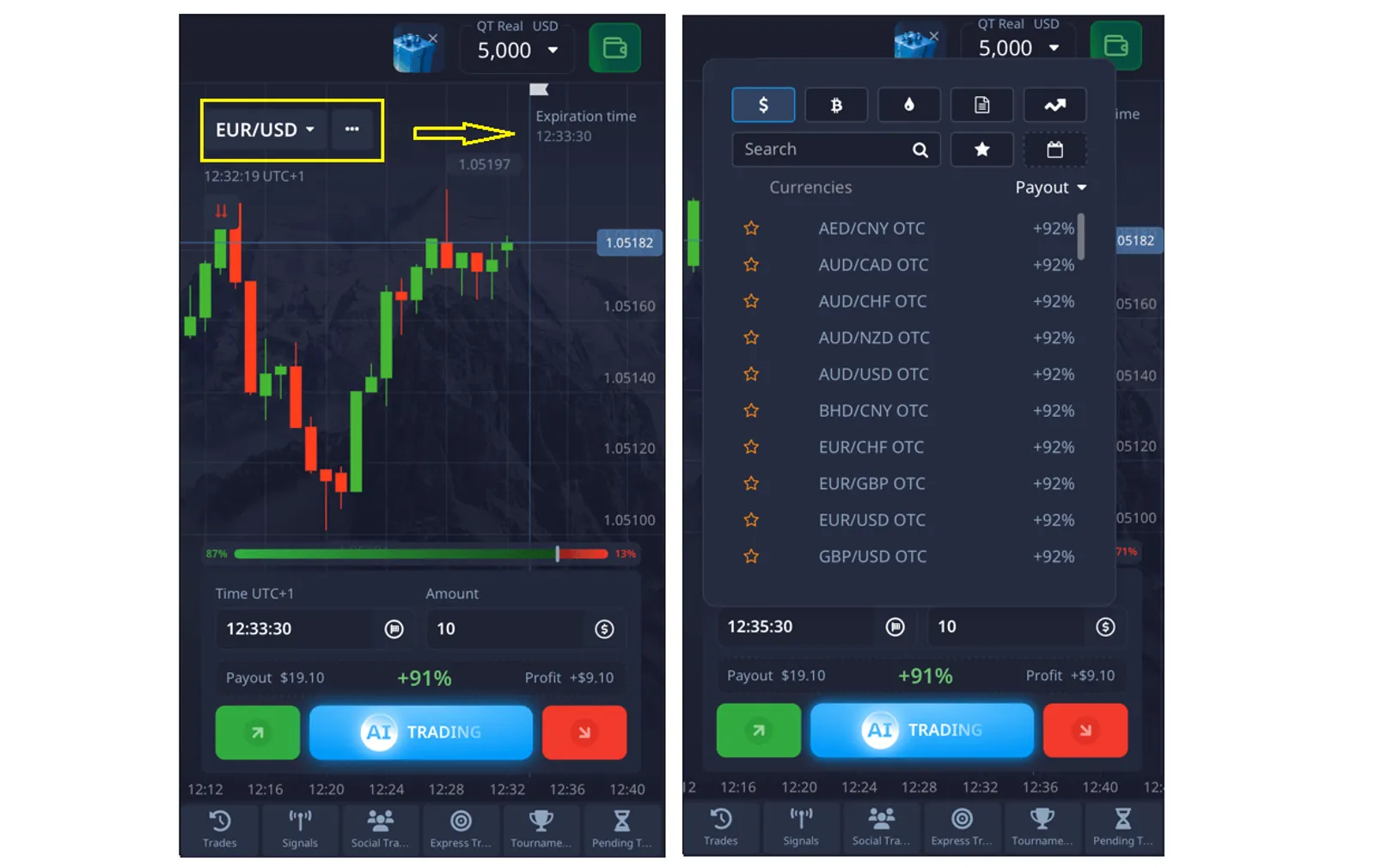

Several platforms have gained prominence in the high frequency trading arena. Among these, Pocket Option has emerged as a notable player, offering a user-friendly interface coupled with powerful trading capabilities. Let’s compare some of the leading hft trading platforms:

| Platform | Key Features | Target Users |

|---|---|---|

| Pocket Option | User-friendly interface, advanced charting tools | Both beginners and experienced traders |

| Quantopian | Open-source backtesting, community-driven | Quants and algo traders |

| MetaTrader 5 | Multi-asset trading, extensive API | Professional traders and institutions |

| Interactive Brokers TWS | Advanced order types, global market access | Experienced traders and fund managers |

Pocket Option: Your Choice for High-Frequency and Quick Trading

Pocket Option provides a unique opportunity not only for high-frequency trading (HFT) but also for a simplified trading approach suitable for both beginners and professionals. You do not need to buy or sell assets—just make a prediction about where the price will go: up or down. If your prediction is correct, you can earn up to 92% profit in just a few minutes!

Why Choose Pocket Option?

Pocket Option is a platform that combines convenience, powerful tools, and advanced technologies. Here’s what makes it unique:

- Over 100 trading assets: Stocks, indices, cryptocurrencies, commodities, and currency pairs—everything you need for successful trading.

- Express Trading: The ability to combine multiple trades to increase profits.

- Integration with MetaTrader: Access to a professional platform for in-depth analysis and strategies.

- Demo account with $50,000: The perfect way to test your skills and strategies without risk.

- Easy registration and promo code: Fund your account using any of over 50 payment methods and use the promo code “50START” to get a 50% bonus on your first deposit.

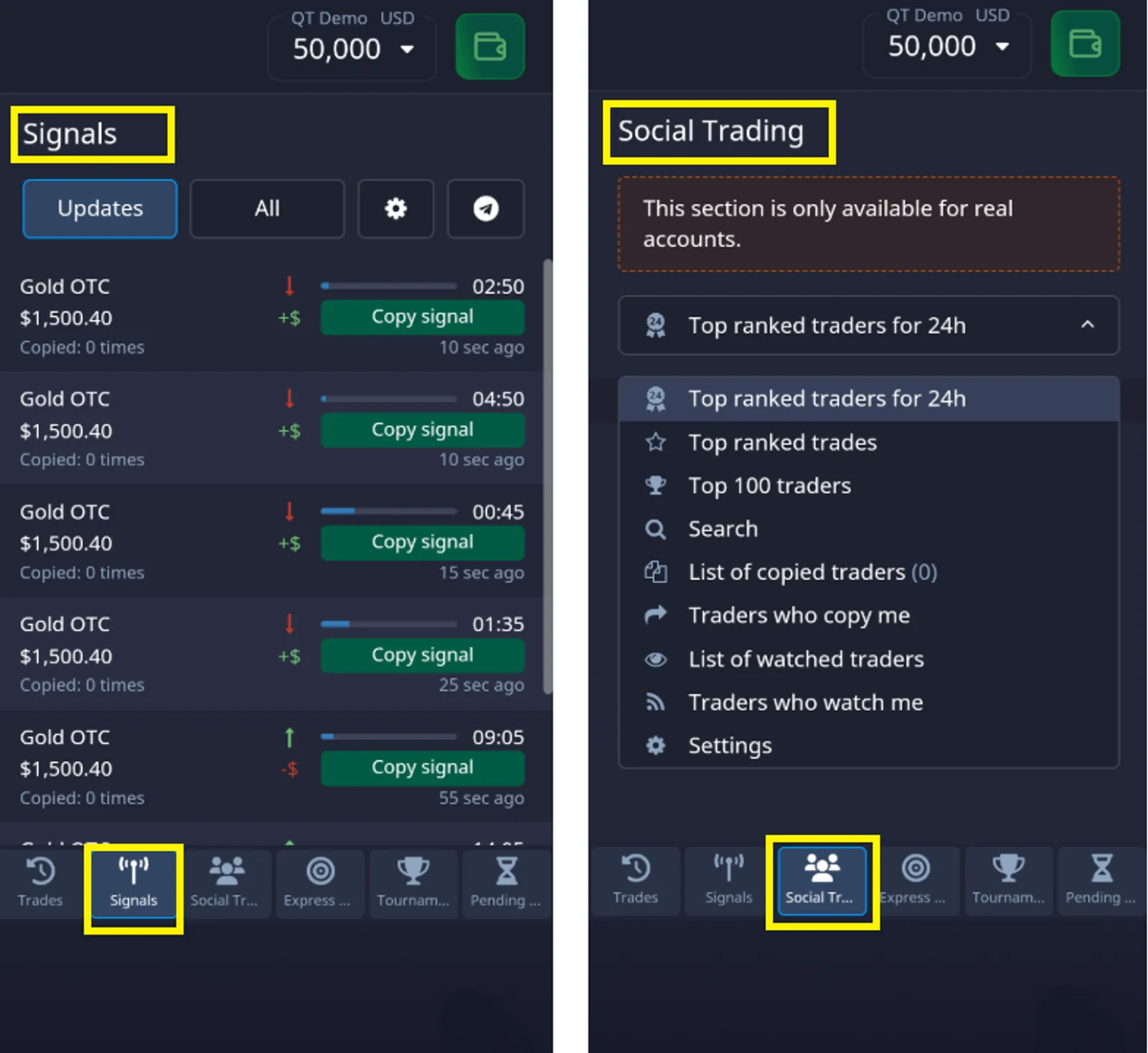

- Copy trading / social trading: Learn from successful traders and copy their trades with just one click.

- Educational resources, videos and analytics: From trade statistics to trader sentiment indicator charts—everything to help you improve your results.

Example of a Trade on Pocket Option

Trading with Pocket Option is simple and intuitive:

- Choose an asset from the list (for example, a currency pair, stock, or cryptocurrency).

- Analyze the chart using technical tools or the trader sentiment indicator, which shows what other market participants are choosing.

- Set the trade amount (minimum from $1) and select the trade duration (from 5 seconds and up).

- Make a forecast:

- If you believe the price will rise, click BUY.

- If you are confident the price will fall, click SELL.

- If your forecast is correct, you will receive a profit of up to 92%, with the profit amount visible in advance when selecting an asset.

Additional Benefits of Pocket Option

- Bonuses and promotions: Boost your trading capital with various offers.

- Tournaments: Compete with other traders for prizes.

- Cashback and rewards: Get a partial refund on your trades.

- 24/7 support: Professional assistance is available at any time.

Why Pocket Option?

Pocket Option is more than just a trading platform. It is your trusted partner in the financial world, offering unique tools and opportunities to increase your income. Try your skills on a demo account and then switch to real trading with a minimum deposit of just $5.

Start now and use the promo code “50START” to get a bonus on your first deposit!

Advantages of Using High Frequency Trading Software

The adoption of high frequency trading software offers numerous benefits to traders and financial institutions. These advantages have contributed to the rapid growth and widespread use of HFT in modern financial markets.

- Improved market liquidity

- Enhanced price discovery

- Reduced transaction costs

- Increased market efficiency

- Ability to capitalize on small price movements

By leveraging high frequency trading software, traders can execute a large number of trades quickly, taking advantage of even the smallest price discrepancies across different markets. This not only benefits the traders themselves but also contributes to overall market efficiency and liquidity.

Challenges and Considerations in High Frequency Trading

While high frequency trading software offers numerous advantages, it also comes with its own set of challenges and considerations. Traders and institutions must be aware of these factors when implementing HFT strategies.

| Challenge | Description | Mitigation Strategy |

|---|---|---|

| Technological arms race | Constant need for faster hardware and lower latency | Regular infrastructure upgrades, co-location services |

| Regulatory scrutiny | Increased oversight and potential restrictions | Compliance with regulations, transparent operations |

| Market volatility | Rapid price fluctuations can lead to losses | Robust risk management systems, circuit breakers |

| Algorithmic errors | Potential for costly mistakes due to faulty algorithms | Thorough testing, fail-safe mechanisms |

The Future of High Frequency Trading Software

As technology continues to advance, the future of high frequency trading software looks promising. We can expect to see further innovations in this field, driven by advancements in artificial intelligence, machine learning, and quantum computing.

- Integration of AI for more sophisticated decision-making

- Exploration of quantum computing for faster processing

- Enhanced natural language processing for news-based trading

- Improved cybersecurity measures to protect trading systems

These developments are likely to shape the next generation of high frequency trading platforms, including offerings from established players like Pocket Option and new entrants to the market.

Implementing High Frequency Trading Strategies

For traders and institutions looking to implement high frequency trading strategies, careful planning and execution are essential. Here are some key steps to consider:

| Step | Description |

|---|---|

| Strategy Development | Create and backtest trading algorithms |

| Infrastructure Setup | Invest in high-performance hardware and low-latency connections |

| Software Selection | Choose a suitable HFT platform (e.g., Pocket Option) |

| Risk Management | Implement robust risk controls and monitoring systems |

| Compliance | Ensure adherence to regulatory requirements |

By following these steps and leveraging the power of high frequency

trading software, traders can position themselves to compete effectively in today’s fast-paced financial markets.

Conclusion

High frequency trading software has undeniably transformed the landscape of financial markets. From its humble beginnings to the sophisticated platforms we see today, such as Pocket Option and other leading hft trading platforms, this technology continues to evolve and shape trading practices worldwide. As we look to the future, it’s clear that high-frequency trading software will remain a critical tool for traders and institutions seeking to gain a competitive edge in the ever-changing world of finance.

FAQ

What is high frequency trading software?

High frequency trading software is a sophisticated tool that enables traders to execute a large number of orders at incredibly high speeds, often in fractions of a second. It uses complex algorithms to analyze market data and make trading decisions.

How does high frequency trading software differ from regular trading platforms?

High frequency trading software operates at much faster speeds, executing trades in milliseconds. It also uses more advanced algorithms and requires specialized hardware to achieve low latency.

Is Pocket Option suitable for high frequency trading?

Yes, Pocket Option offers features that can support high frequency trading strategies, including advanced charting tools and a user-friendly interface suitable for both beginners and experienced traders.

What are the main risks associated with using high frequency trading software?

The main risks include technological failures, market volatility, regulatory challenges, and the potential for algorithmic errors that could lead to significant losses.

How can I get started with high frequency trading?

To get started with high frequency trading, you'll need to develop a solid understanding of financial markets, learn programming skills, invest in appropriate hardware and software, and thoroughly test your strategies before live trading.

How to get high frequency trading software in Brazil for fast trades?

Look for licensed tools compatible with Brazilian brokers and check latency optimization features.