- Speed and Efficiency: Execute trades in milliseconds, reducing slippage

- Strategy Backtesting: Evaluate past performance and predefine entry/exit rules

- Risk Management Tools: Automate stop-losses and position sizing

- 24/7 Monitoring: Keep track of market dynamics even when you’re offline

Learn Gas Algorithmic Trading: How to Optimize Your Trading Strategy

In the ever-evolving landscape of the energy markets, one sector is becoming increasingly attractive to tech-savvy traders: gas algorithmic trading. By leveraging sophisticated algorithms, traders can automate decision-making, capitalize on market opportunities, and enhance efficiency in one of the most volatile markets in the financial sector.

“Algorithmic trading in natural gas is no longer a luxury–it’s a necessity to stay competitive,” says Ethan Sloane, energy strategist at J.P. Morgan Commodities Research.

Understanding Gas and Gas Markets

Overview of Gas Markets

The natural gas market is an essential part of the global energy trading ecosystem. This market includes contracts such as gas futures and swaps, traded primarily on platforms like NYMEX and ICE. Price fluctuations in gas markets are influenced by seasonal demand, supply shocks, geopolitical events, and infrastructure constraints.

Key factors affecting gas prices:

| Factor | Impact on Prices |

|---|---|

| Weather patterns | High volatility during winters |

| Storage capacity reports | Can cause short-term spikes |

| LNG exports | Influence global pricing |

📊 According to the International Energy Agency (IEA), LNG exports from the U.S. are expected to grow by 14% in 2025, contributing to increased market dynamism.

Importance of Natural Gas in Trading

Natural gas is a cornerstone of industrial energy consumption and electricity generation. Its volatility makes it ideal for algo trading–allowing traders to capitalize on short-term price movements using real-time market data and trading systems.

🔍 Insight: Expert traders often pair gas assets with oil-based derivatives to create hedged arbitrage portfolios during winter peaks, as confirmed by S&P Global’s energy trading outlook.

Gas Algorithmic Trading Fundamentals

What is Gas Algorithmic Trading?

Gas algorithmic trading involves using automated strategies powered by algorithms to execute trades in the gas sector. These strategies can analyze vast amounts of market data, identify trends, and respond faster than any human trader.

🧠 Expert Note: Dr. Lisa Martens, a quantitative analyst at Cambridge Energy Research, emphasizes, “Data latency and execution speed are crucial in gas trading. Even a 100ms delay can impact trade profitability.”

Benefits of Gas Algorithmic Trading Platforms

Key Algorithms for Gas Trading

Common algorithms in gas algo trading include:

- Mean Reversion: Capitalizes on the tendency of prices to revert to the mean. However, it may underperform during strong trends or unexpected market shocks.

- Momentum: Uses volume and trend indicators to follow price surges. It may generate false signals in sideways or low-volume markets.

- Arbitrage: Exploits price differences across exchanges. Requires low latency and high capital; opportunities can vanish within seconds.

- Machine Learning Models: Predict price movements using historical and live market data. They are powerful but require large datasets and may overfit past data if not validated properly.

📈 According to a 2024 Deloitte report, over 65% of energy-focused hedge funds deploy machine-learning-enhanced trading systems for gas and oil markets.

Effective Trading Strategies for Natural Gas

Natural Gas Futures Trading Strategies

Natural gas futures provide high liquidity and volatility, ideal for algorithmic trading. Strategies include:

- Breakout Trading: Automated detection of price range breakouts

- Statistical Arbitrage: Pair trading based on correlated assets

- Seasonal Patterns: Algorithms tuned to historical seasonal market conditions

Backtesting Algorithms for Gas

Backtesting is the simulation of your algorithm on past data. This process helps predefine rules and test risk metrics such as:

| Metric | Use Case |

|---|---|

| Sharpe Ratio | Evaluate risk-adjusted returns |

| Max Drawdown | Understand potential loss exposure |

| Win Rate | Fine-tune trading strategies |

Risk Management in Gas Trading

Implementing robust risk controls is critical. Best practices include:

- Position sizing formulas

- Adaptive stop-loss settings

- Volatility-adjusted exposure limits

📊 Example: An algorithm may reduce trade size automatically if market volatility exceeds a predefined threshold.

Automation in Gas Trading

Why Automate Your Gas Strategy?

Automation enables traders to remove emotion from trading and ensure consistent execution. In gas markets, where prices can change rapidly due to weather or political factors, automation provides a competitive edge.

Choosing a Gas Algorithmic Trading Platform

Your platform must support:

- Access to real-time data

- Fast order execution

- Integration with Python or C++ for custom scripts

- Paper trading for simulations

📌 “Check for latency benchmarks and server proximity to exchanges,” recommends AlgoInsights Research (2024).

Top Tools for Automating Gas Trades

- API Integration: Enables algorithm connection to exchanges

- Data Feed Services: Supplies real-time and historical data

- Strategy Builder UI: Drag-and-drop interface for coding-free setup

- VPS Hosting: Ensures low-latency, 24/7 uptime

Example: Quick Trading Natural Gas on Pocket Option

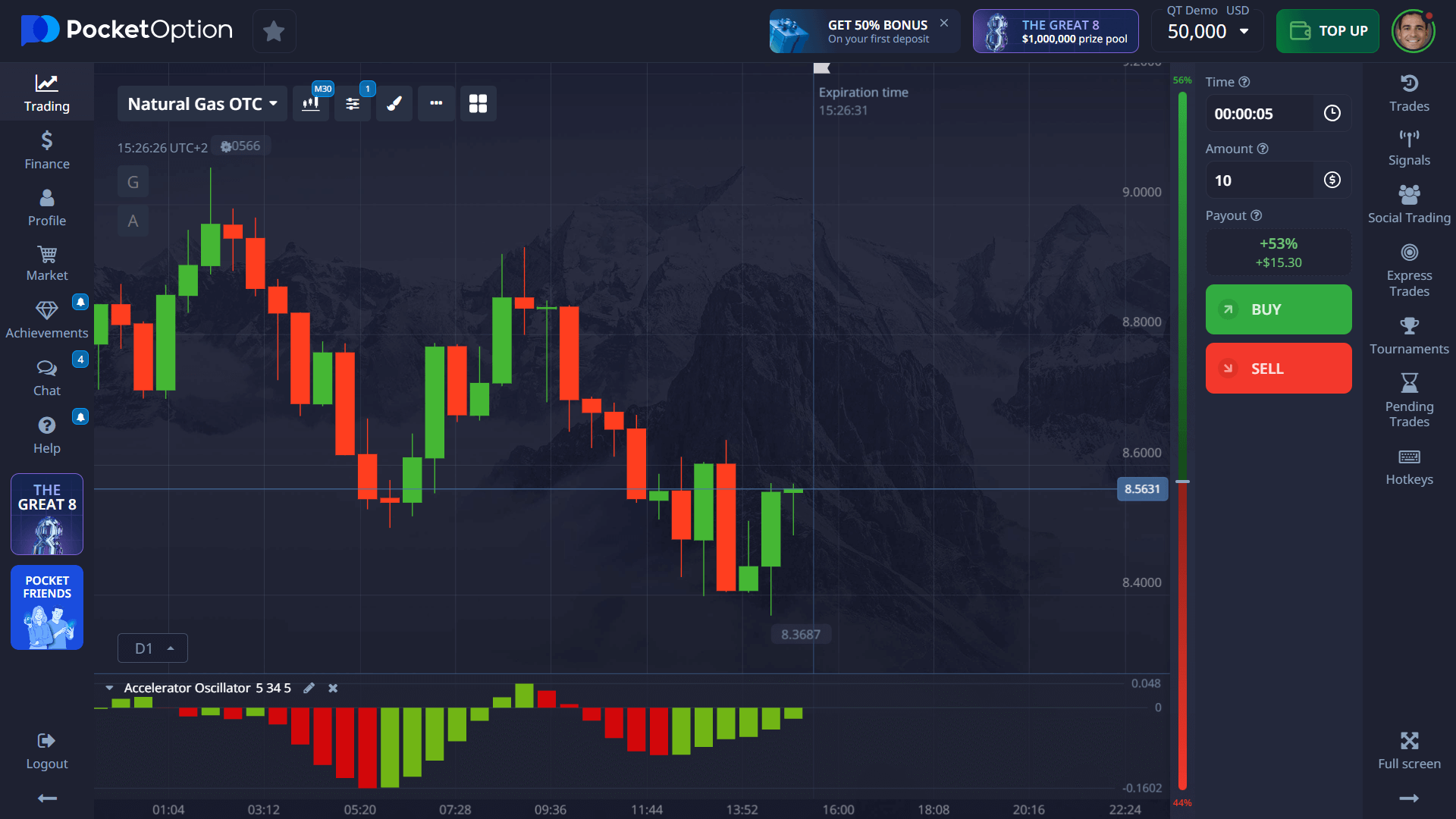

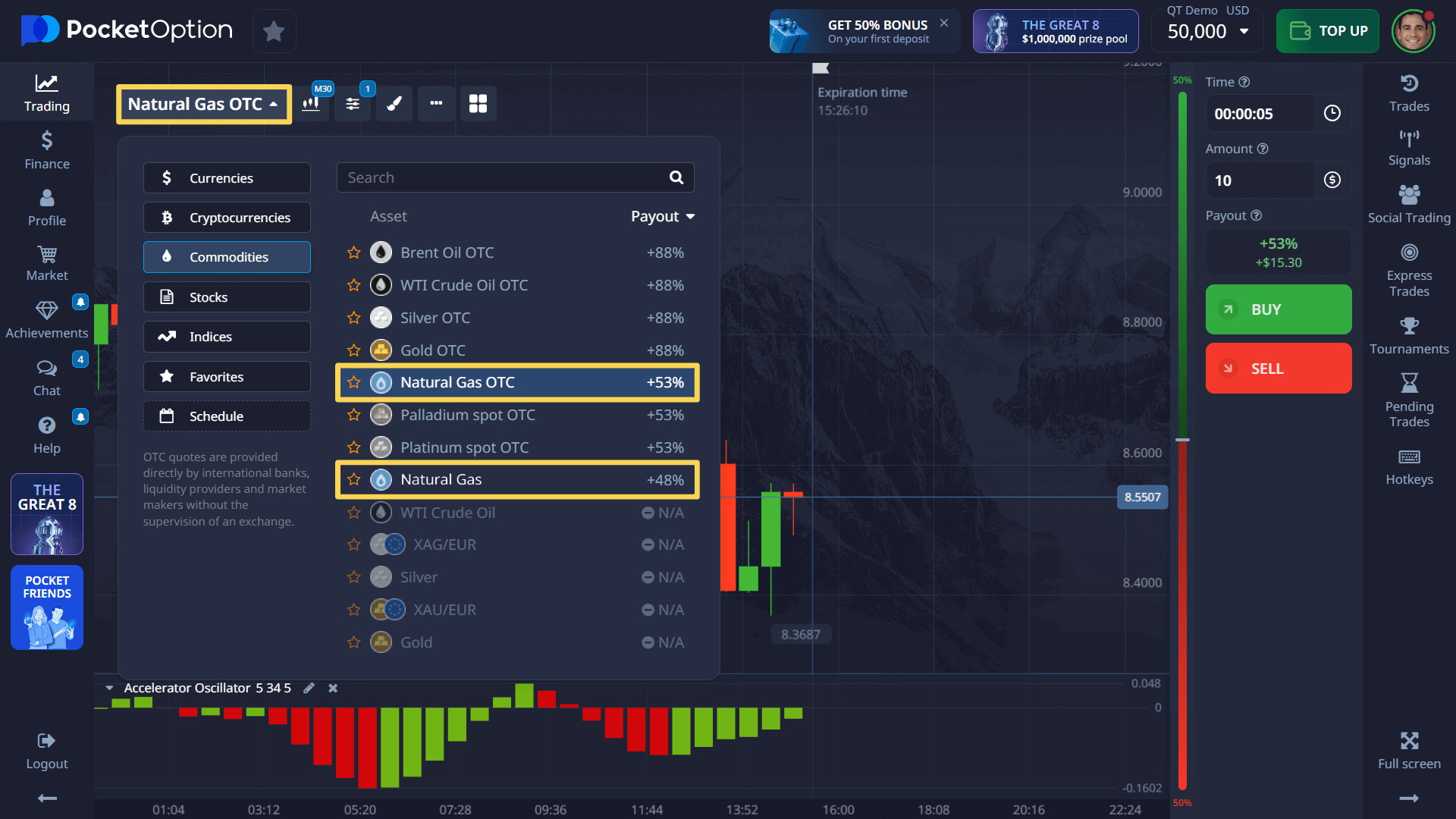

Pocket Option offers the ability to trade natural gas 24/7 using a user-friendly Quick Trading interface. Here’s a simple real-case scenario:

📌 Scenario: A trader analyzes the U.S. Energy Information Administration (EIA) inventory report, which indicates a larger-than-expected withdrawal from gas storage. This news typically suggests higher demand, which can push prices up.

📈 Action: The trader logs into Pocket Option and opens the gas asset chart. Observing an upward trend, they decide to place a Quick Trade by pressing Buy (green button), predicting the price will rise in the next 5 minutes.

💡 Outcome: The gas price increases, and the position closes in profit based on the time selected. The trader earns a percentage return on the amount invested in this short-term position.

With Pocket Option, users can trade 100+ assets–including natural gas, major stocks, and indices–any time using just two buttons: Buy or Sell, depending on their forecast.

Real-Time Data in Gas Trading

Having access to real-time data is non-negotiable in gas algo trading. Market reactions can occur within milliseconds of data releases. Examples of critical data include:

- EIA inventory reports

- Weather model updates

- Spot price changes

- Pipeline outage notifications

📈 A trader leveraging a gas algorithmic trading platform that instantly responds to these inputs can capitalize on fleeting market inefficiencies.

Becoming a Successful Gas Algo Trader

Must-Have Skills

To learn gas algorithmic trading effectively, you’ll need:

- Solid knowledge of gas markets and natural gas fundamentals

- Basic programming (Python, R)

- Quantitative analysis capabilities

- Familiarity with trading platforms and APIs

Staying Ahead of Market Trends

📉 Keep up with developments by:

- Subscribing to EIA and IEA bulletins

- Following weather intelligence platforms

- Joining energy trader communities on Discord/Reddit

The Future of Gas Algorithmic Trading

With AI and quantum computing on the horizon, gas algorithmic trading will continue evolving. Traders who invest in learning, adapting, and using the best tools will stay ahead.

Conclusion

To learn gas algorithmic trading is to invest in one of the most dynamic corners of the financial markets. Combining real-time insights, automation, and robust trading strategies, you can navigate the complex natural gas market with confidence.

Whether you’re a seasoned trader or just exploring algo opportunities, platforms like Pocket Option offer user-friendly tools to build, test, and launch your own algorithmic systems — across 100+ assets available 24/7 🌍.🚀 Ready to step into the future of gas trading?

FAQ

What initial capital is typically needed for gas algorithmic trading?

Initial capital requirements vary widely, but most serious traders start with at least $5,000-$10,000. This provides sufficient capital to withstand normal market fluctuations while still generating meaningful returns. Some platforms allow starting with smaller amounts, but this significantly limits strategy options.

How much programming knowledge is needed for gas algo trading?

While basic strategies can be implemented using template-based systems requiring minimal programming, more sophisticated and customized approaches typically require proficiency in languages like Python, R, or C++. Many traders start with simpler systems and gradually develop programming skills.

What timeframes work best for gas algorithmic trading?

Natural gas markets exhibit patterns across multiple timeframes, from intraday to seasonal. Many successful algorithms focus on short to medium-term opportunities (hours to days) to capitalize on weather forecast changes and inventory reports, though some specialized strategies target longer seasonal patterns.

How do gas trading algorithms handle unexpected events?

Robust algorithms incorporate risk management features like automatic stop-losses, position size limits, and volatility-based adjustments. Some systems include news-detection capabilities that reduce exposure during potential high-impact events. However, no system can perfectly protect against all unexpected developments.

Can gas algorithmic trading work for part-time traders?

Yes, algorithmic trading is particularly well-suited for part-time traders since the automated systems can monitor markets and execute trades according to predefined rules without constant human supervision. However, regular monitoring and periodic strategy adjustments are still important for long-term success.

What are the best tools for learn gas algorithmic trading?

The best tools include algorithmic trading platforms with real-time data, backtesting engines, API support for automation, and strategy builders. Pocket Option offers user-friendly tools to get started.

Can beginners succeed with learn gas algorithmic trading?

Yes, beginners can succeed by starting with demo accounts, focusing on a few well-tested strategies, and gradually increasing their knowledge of gas markets and trading algorithms.

How to avoid losses in learn gas algorithmic trading?

To reduce risk, use backtesting, position sizing, stop-loss mechanisms, and diversify your strategies. Monitoring market conditions and volatility also helps protect your capital.

What is the best gas algorithmic trading strategy?

There's no single "best" strategy. However, momentum-based and mean-reversion algorithms have shown consistent performance in volatile gas markets.

How to start trading gas algorithmic for beginners?

Start with a demo account, choose a simple trading platform like Pocket Option, focus on one strategy, and learn how to automate trades using basic scripts or UI-based strategy builders.