- Real-time market data access

- Order execution capabilities

- Historical data retrieval

- Account management functions

- Customizable parameters

In the fast-paced world of foreign exchange trading, staying ahead of the curve is crucial. One of the most powerful tools available to traders and developers is the forex trading API. This technology allows for seamless integration of trading platforms, real-time data feeds, and automated trading systems. In this comprehensive guide, we'll explore the ins and outs of forex trading API integration and how it can revolutionize your trading experience.

Understanding Forex Trading API

A forex trading API (Application Programming Interface) is a set of protocols and tools that enable different software applications to communicate with each other. In the context of forex trading, APIs allow traders and developers to access market data, execute trades, and manage accounts programmatically.

The forex trading API serves as a bridge between your trading application and the broker’s trading platform, facilitating the exchange of information and execution of commands. This integration opens up a world of possibilities for automated trading, real-time market analysis, and custom trading solutions.

Key Features of Forex Trading APIs

When exploring forex trading API options, it’s important to understand the key features that make them valuable for traders and developers. Here are some essential characteristics to look for:

These features form the foundation of a robust forex trading API, enabling users to create sophisticated trading systems and conduct in-depth market analysis.

Benefits of Using a Forex Trading API

Integrating a forex trading API into your trading strategy can provide numerous advantages. Let’s explore some of the key benefits:

| Benefit | Description |

|---|---|

| Automation | Implement algorithmic trading strategies without manual intervention |

| Speed | Execute trades and access data with minimal latency |

| Customization | Develop tailored trading solutions to fit specific needs |

| Scalability | Handle large volumes of trades and data efficiently |

| Integration | Connect multiple platforms and tools seamlessly |

By leveraging these benefits, traders can enhance their decision-making process and potentially improve their trading outcomes.

Types of Forex Trading APIs

There are several types of forex trading APIs available, each catering to different aspects of the trading process. Understanding these types can help you choose the right API for your specific needs:

- Market Data APIs

- Trading Execution APIs

- Account Management APIs

- Historical Data APIs

- News and Analytics APIs

Each type of API forex trading solution offers unique functionalities that can be combined to create a comprehensive trading ecosystem.

Implementing Forex Trading API Integration

Integrating a forex trading API into your trading system requires careful planning and execution. Here’s a step-by-step guide to help you get started:

- Choose a suitable forex trading API provider

- Register and obtain API credentials

- Study the API documentation thoroughly

- Set up a development environment

- Write and test API calls

- Implement error handling and security measures

- Develop your trading logic

- Deploy and monitor your live trading system

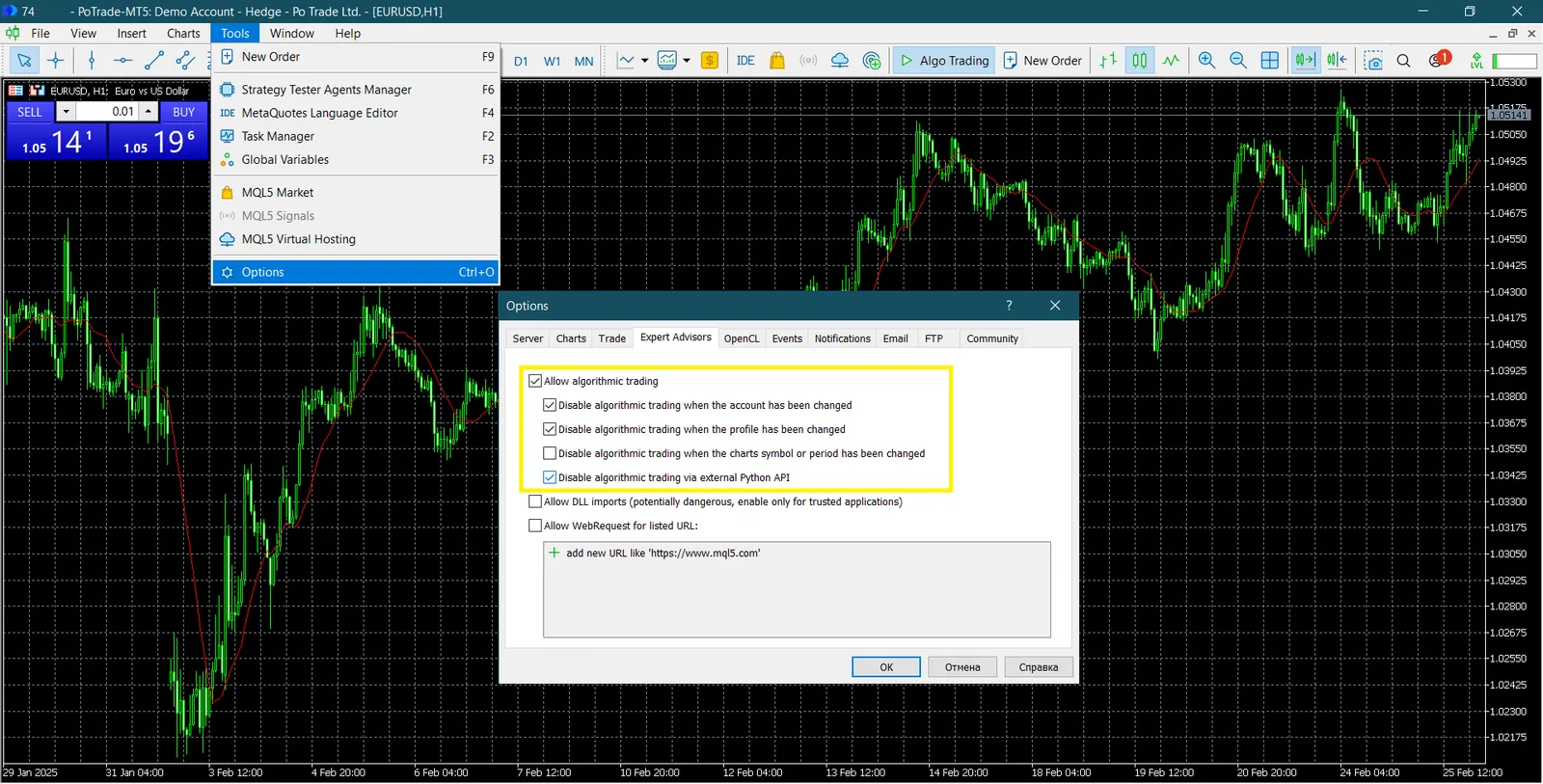

Following these steps will help ensure a smooth integration process and minimize potential issues when working with Forex trading API interfaces. See an example of connecting to an available API on MT5 below.

Best Practices for Forex API Trading

To make the most of your fx trading API integration, consider adopting these best practices:

| Practice | Description |

|---|---|

| Rate Limiting | Respect API rate limits to avoid service disruptions |

| Error Handling | Implement robust error handling to manage unexpected situations |

| Data Validation | Verify incoming data to ensure accuracy and consistency |

| Security Measures | Use encryption and secure authentication methods |

| Logging | Maintain detailed logs for troubleshooting and analysis |

By adhering to these practices, you can create a more reliable and efficient forex API trading system.

Challenges in Forex Trading API Implementation

While forex trading APIs offer numerous benefits, there are also challenges to consider:

- Latency issues in high-frequency trading scenarios

- Compatibility problems between different API versions

- Handling large volumes of real-time data

- Ensuring system stability during market volatility

- Keeping up with API updates and changes

Addressing these challenges requires ongoing monitoring, optimization, and adaptation of your forex trading API implementation.

Future Trends in Forex Trading API Technology

The landscape of forex trading API technology is constantly evolving. Here are some emerging trends to watch:

- AI-powered trading algorithms

- Blockchain integration for enhanced security

- Cloud-based API solutions for scalability

- Machine learning for predictive analytics

- IoT integration for real-time market insights

Staying informed about these trends can help you leverage cutting-edge technologies in your forex API trading strategies.

Conclusion

Forex trading API integration offers a powerful way to enhance your trading capabilities and automate your strategies. By understanding the key features, benefits, and best practices of forex trading APIs, you can create sophisticated trading systems that leverage real-time data and execute trades with precision. While challenges exist, the potential rewards of implementing a well-designed forex API trading solution are significant. As technology continues to advance, the future of forex trading APIs looks promising, with new innovations set to further revolutionize the world of foreign exchange trading.

FAQ

What is a forex trading API?

A forex trading API is a set of protocols and tools that allow different software applications to communicate with forex trading platforms, enabling automated trading, real-time data access, and custom trading solutions.

How can I start using a forex trading API?

To start using a forex trading API, you need to choose a provider, register for API access, study the documentation, set up a development environment, and begin implementing API calls in your trading application.

Are forex trading APIs suitable for beginners?

While forex trading APIs can be complex, some providers offer user-friendly interfaces and documentation suitable for beginners. However, a basic understanding of programming and forex trading concepts is recommended.

What are the costs associated with using a forex trading API?

Costs vary depending on the provider and the level of service. Some APIs offer free access with limited features, while others charge monthly fees or per-request pricing for more advanced functionalities.

How secure are forex trading APIs?

Reputable forex trading API providers implement strong security measures, including encryption and secure authentication. However, it's crucial for users to follow best practices in API key management and implement additional security measures in their applications.