- Improved Consistency: Reduces impulsive decisions.

- Enhanced Risk Management: Implements methodical position sizing.

- Reduced Stress: Promotes calm decision-making.

- Objective Analysis: Prioritizes data over emotion.

Emotionless Option Trading: Systems and Strategies for Consistent Results

In the world of finance, successful trading hinges on the ability to make decisions devoid of strong emotions. Emotionless option trading has emerged as a powerful approach, enabling traders to navigate the complexities of the market with clarity and purpose. By focusing on rational decision-making, traders can enhance their performance and achieve their financial goals.

Article navigation

Understanding Emotionless Trading

Emotionless trading refers to the practice of executing trades without being influenced by feelings like fear or greed. This approach is crucial in options trading, where emotional decisions can lead to poor outcomes. Traders who adopt an emotionless mindset utilize a trading system designed to prioritize rationality over emotional reactions, ensuring that their trading decisions remain consistent and informed.

What is Emotionless Option Trading?

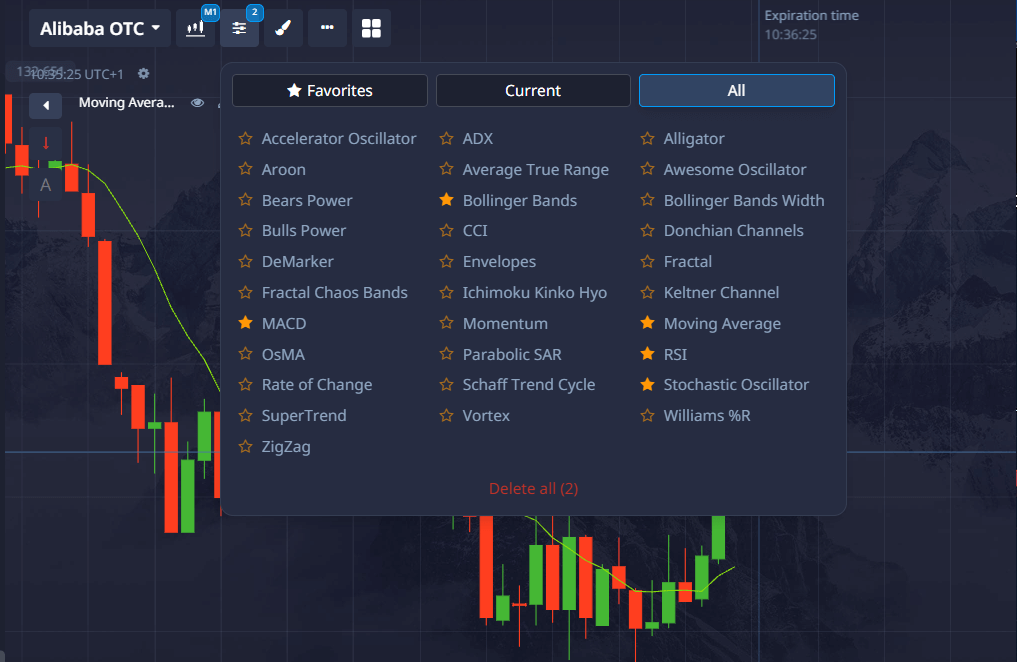

Emotion less option trading specifically pertains to executing trades in the options market with a focus on rational analysis rather than emotional impulses. By employing strategies that minimize emotional influence, traders can create a structured trading plan. This includes defining entry and exit points based on technical indicators, such as moving averages, and adhering to risk management principles that foster disciplined trading behavior.

Is Emotionless Option Trading Good?

Emotionless option trading—also known as emotion-less option trading—offers a disciplined approach that minimizes emotional interference in trading decisions.

Benefits of Emotionless Trading:

Implementing emotionless trading can lead to more disciplined and potentially profitable trading outcomes.

The Importance of Rational Decisions in Trading

Rational decisions are paramount in trading as they directly impact trading performance. Emotionless traders rely on data-driven insights and technical analysis to guide their trading strategies. This disciplined approach enables them to navigate market fluctuations without succumbing to emotional pressures. By focusing on long-term goals and utilizing tools like automated trading and algorithmic trading, traders can execute trades effectively while mitigating the risks that come with emotional trading.

Benefits of an Emotionless Mindset

Adopting an emotionless mindset offers numerous benefits for traders. It helps in avoiding emotional reactions that can cloud judgment and lead to impulsive decisions. By employing emotionless strategies, traders can enhance their trading performance and maintain a consistent approach to managing risk. This mindset not only fosters better trading outcomes but also instills a sense of confidence in their trading models and systems, ultimately paving the way for successful trading experiences.

Developing an Emotionless Trading System

Key Components of a Trading Plan

Creating a robust trading plan is essential for emotionless option trading. This plan should include clear guidelines for entry and exit points, which are determined using technical indicators such as moving averages. By establishing these parameters, traders can make decisions based on objective analysis rather than emotional reactions. A comprehensive trading plan also incorporates risk management strategies to protect capital and ensure long-term success.

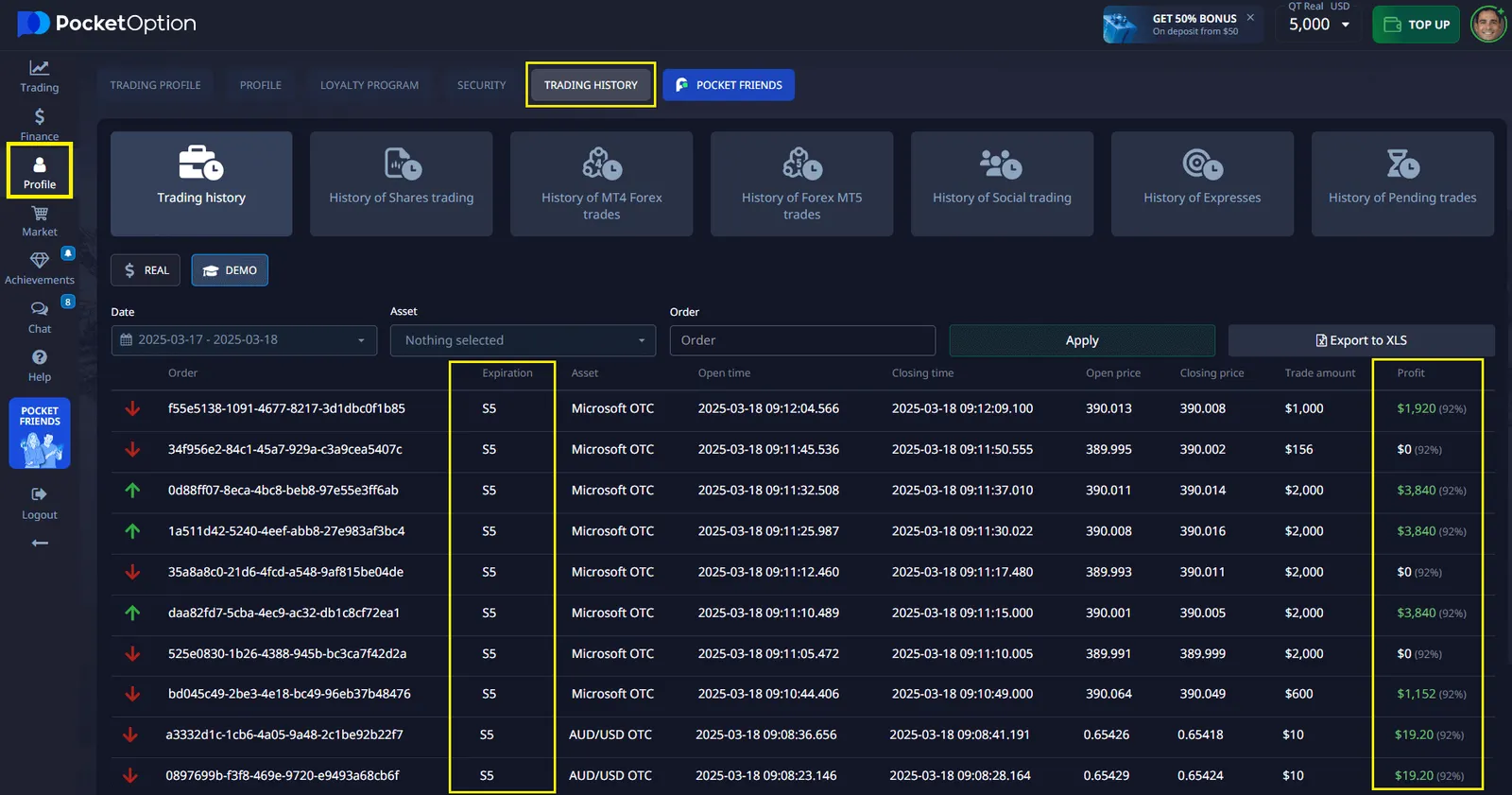

Creating a Trading Journal for Better Decision Making

A trading journal is a valuable tool that helps traders document their trades and the rationale behind each decision. By maintaining a detailed record, emotionless traders can analyze past performance and identify patterns in their trading behaviors. This practice enhances self-awareness, allowing traders to refine their strategies and eliminate emotional decisions that may lead to poor outcomes in the future. Regularly reviewing this journal fosters continuous improvement in trading performance.

Incorporating Trading Models into Your Strategy

Incorporating established trading models into an emotionless trading strategy can significantly enhance decision-making processes. These models, often based on algorithmic trading and technical analysis, provide structured frameworks for executing trades without emotional influences. By relying on proven trading algorithms, traders can automate entry and exit points, ensuring that their trading actions are based on data rather than feelings of fear or greed. This systematic approach minimizes the impact of emotional reactions and maximizes trading efficiency.

Implementing Emotionless Trading Techniques

Strategies for Entry and Exit Points

Effective strategies for entry and exit points are crucial in an emotionless trading system. Traders can utilize technical analysis to identify optimal times to enter or exit trades based on specific criteria. By focusing on metrics such as moving averages and market trends, traders can execute trades without being swayed by emotions like fear or greed. This disciplined approach not only enhances trading performance but also increases confidence in the chosen strategies.

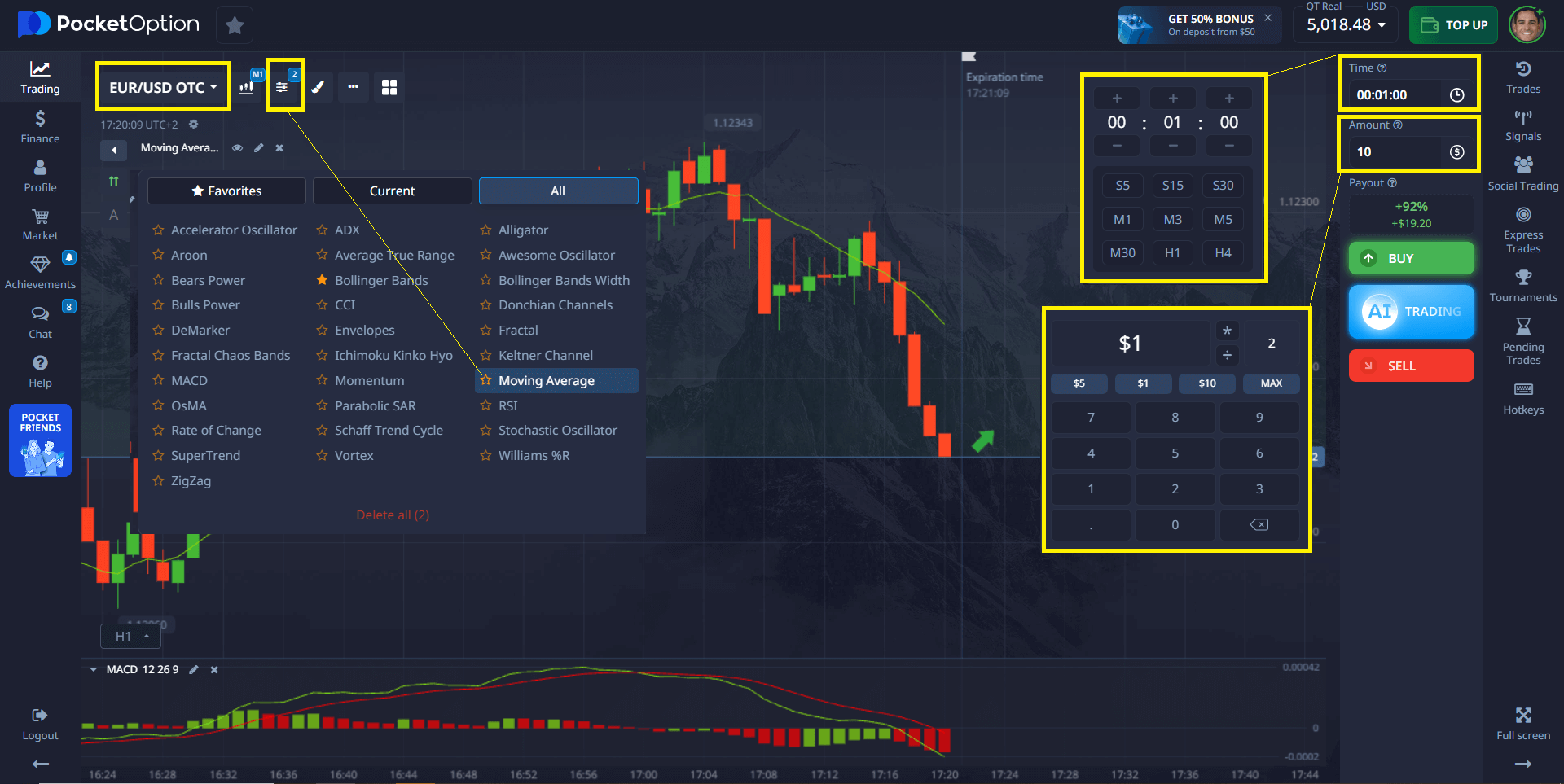

Utilizing a Trading Platform Effectively

A well-chosen trading platform can greatly assist traders in executing emotionless option trading. Many platforms offer tools that facilitate automated trading and allow for the integration of trading algorithms. By leveraging these capabilities, traders can minimize manual trading errors and ensure that their strategies are executed precisely as intended. Furthermore, effective use of a trading platform can streamline the monitoring of market conditions, enabling traders to make informed decisions without emotional distractions.

Managing Exit Points for Maximum Profit

Managing exit points is vital for maximizing profit in an emotionless trading approach. Traders must establish clear criteria for when to exit a trade, using technical indicators to inform their decisions. By setting predefined exit points, traders can avoid emotional reactions that may lead to holding onto losing positions longer than necessary. This practice not only protects profits but also reinforces the importance of a disciplined approach to trading, aligning with the overall goal of successful trading outcomes.

How to Be Emotionless When Trading?

- Create a Detailed Plan: Define entry, exit, and risk parameters.

- Use Trading Bots: Automate decisions with emotion-less option trading tools.

- Journal Every Trade: Analyze emotional triggers.

- Practice Mindfulness: Stay calm under pressure.

- Set Realistic Goals: Focus on process, not outcome.

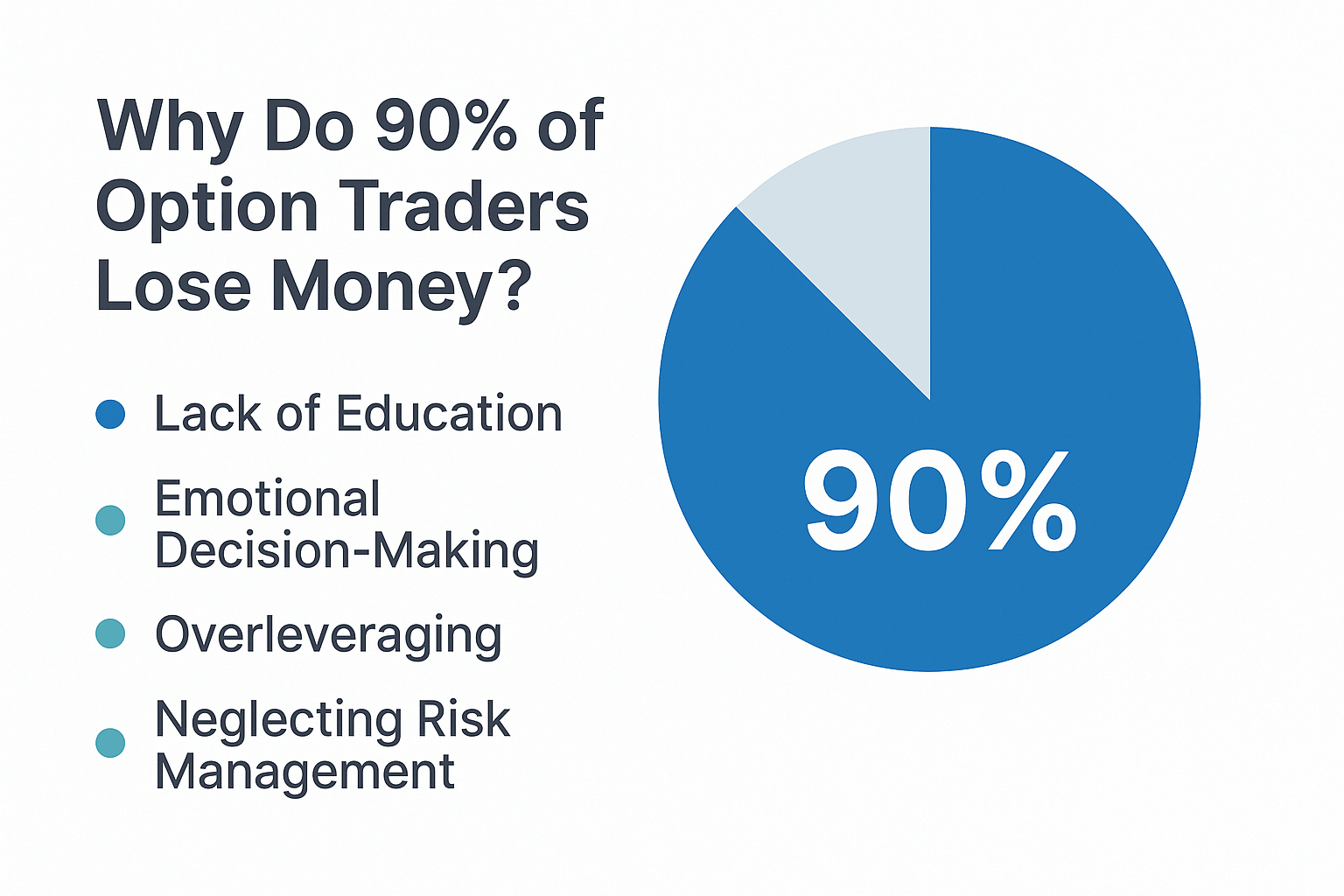

Why Do 90% Option Traders Lose Money?

Reasons include:

- Lack of strategy.

- Overtrading.

- Emotional decision-making.

- Ignoring risk management.

| Reason | Impact |

|---|---|

| No Plan | Random outcomes |

| Emotional Bias | Inconsistent results |

| Overleverage | Large, rapid losses |

| Poor Risk Control | Account depletion |

Do People Live Off Options Trading?

Yes, but it requires:

- Mastery of strategies.

- Discipline and resilience.

- Capital and consistency.

“My income from trading became stable after I committed to emotionless option trading.” — Liam T., trader

Emotionless Trading with Pocket Option

Pocket Option empowers emotionless traders with:

- Advanced Charting Tools

- Position Size Calculator and Multiplier Control

- Demo and Real Accounts

Example of an Emotionless Trade on Pocket Option

A trader named Eliza M. used Pocket Option’s Quick Trading mode to monitor EUR/USD volatility. She applied a 50-period moving average and RSI to identify overbought conditions. Rather than reacting to a temporary spike, she waited for confirmation with two bearish candles. When the price crossed below the moving average and RSI confirmed divergence, she clicked “Sell” with a fixed trade duration.

Instead of closing the position early due to temporary reversals, Eliza stayed committed to her preselected timeframe. Her discipline paid off with a 78% ROI on that trade—demonstrating the power of combining emotionless strategies with Pocket Option’s streamlined Quick Trading environment.

Expert Insight on Emotionless Trading

“The most consistent traders I mentor are those who treat every trade like a business decision. They don’t chase losses or celebrate wins—they just follow the system.” — Dr. Henry Brooks, financial psychologist and trading behavior expert

User Feedback on Pocket Option

“Pocket Option gave me the structure I needed. The clean interface and focus on clarity helped me finally stick to my trading plan.” — Ava N., full-time trader

“What I appreciate about Pocket Option is how it encourages discipline. It’s the perfect environment for practicing emotionless trading.” — Jared L., swing trader

Emotionless trading focuses on consistency and logic, which are key to long-term success in trading. Integrate these practices with robust tools like Pocket Option for best results.

Share your strategies and get feedback — join our vibrant trading community today!

FAQ

What makes Pocket Option suitable for emotionless trading?

Pocket Option offers simple technical analysis tools and quick execution capabilities that help traders stick to predetermined strategies. Its straightforward interface reduces decision fatigue, making it easier to follow rules-based trading approaches without emotional interference.

How do I start implementing emotionless option trading?

Begin by developing clear trading rules covering entry/exit conditions, position sizing, and risk management. Document these rules in writing, then practice following them strictly using paper trading. Once comfortable, gradually transition to live trading with small position sizes while maintaining strict adherence to your system.

Can emotionless trading be completely automated?

While full automation is possible using platforms with programming capabilities like TradeStation, most traders benefit from a semi-automated approach. This involves using technology to identify opportunities based on predetermined criteria but maintaining human oversight for execution and risk management.

How often should I review my trading system?

Conduct regular reviews of your system's performance, ideally monthly or quarterly. Focus on whether the system is producing expected results and your level of adherence to the rules. Make adjustments based on statistically significant data, not recent wins or losses.

Is emotion-less option trading suitable for beginners?

Yes, emotionless trading principles are especially valuable for beginners who haven't yet developed bad habits. However, new traders should first understand basic option mechanics and market dynamics before implementing complex rule-based systems.