- Southwest saved $3.5 billion by using long-term fuel futures between 1999–2008.

- Delta acquired a refinery and used swaps to cut costs by $300 million in 2015.

Derivative Contracts in Action: How They Work and Where to Use Them

Derivative contracts are financial instruments whose value depends on an underlying asset like stocks, commodities, or currencies. While traditionally used by corporations to hedge risk, modern platforms like Pocket Option make these tools available to everyday traders — in a simple, efficient, and profitable way.

Real-World Success with Derivative Contracts

Airline Fuel Hedging: Airlines like Southwest and Delta have famously used derivative contracts to lock in fuel prices.

Agricultural Risk Management: Large farming businesses in the Midwest use futures and options to lock in selling prices and control input costs. This strategy helped them stay profitable even during poor weather seasons.

Modern Strategies for Individual Traders

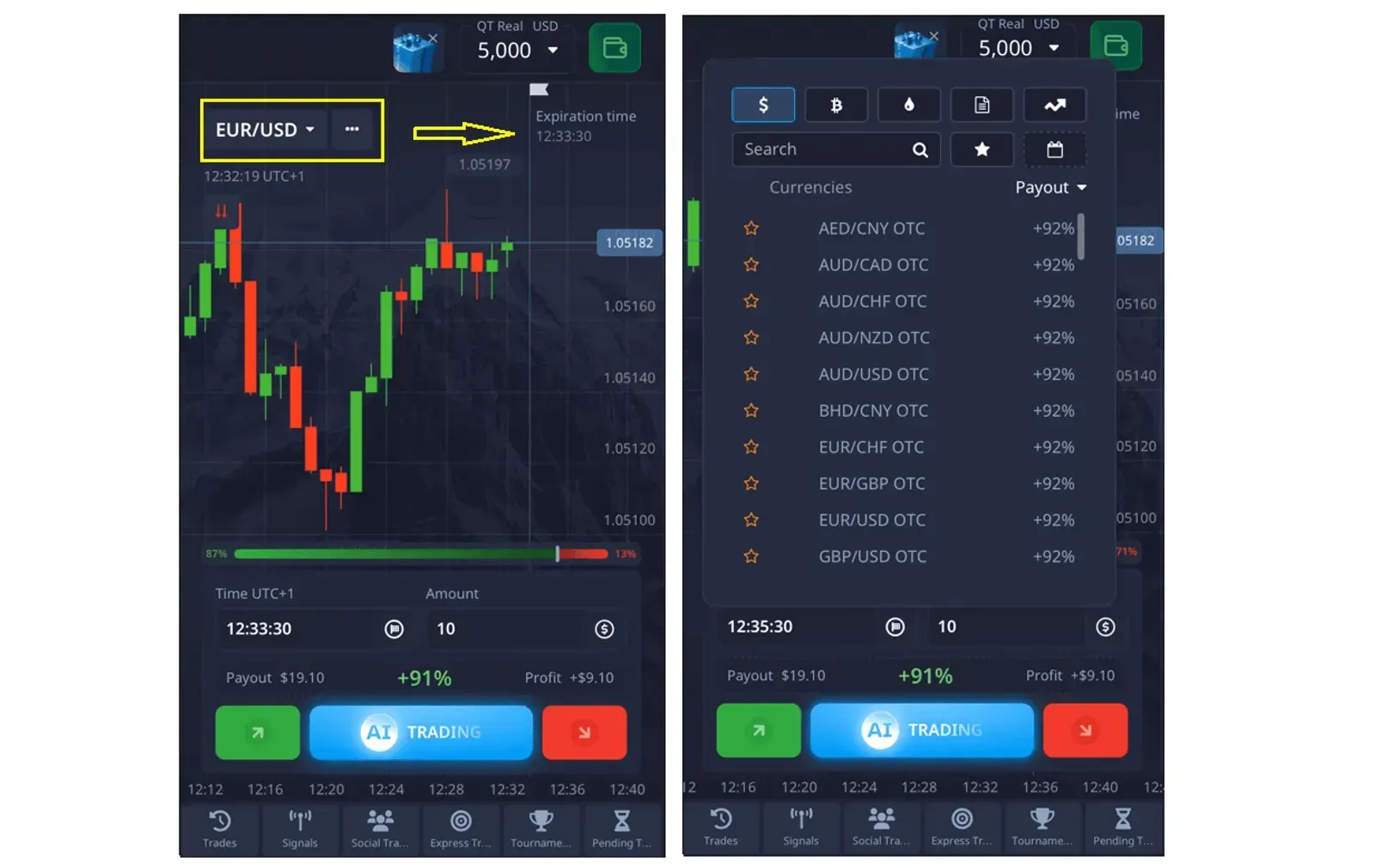

On Pocket Option, you don’t need to buy or sell assets — you simply forecast whether the price will rise or fall. If your prediction is correct, you can earn up to 92% profit. Trading is web-based and doesn’t require any downloads.

Main Types of Derivatives on Pocket Option:

- Quick Trades: Forecast price movement in as little as 5 seconds, especially on OTC assets.

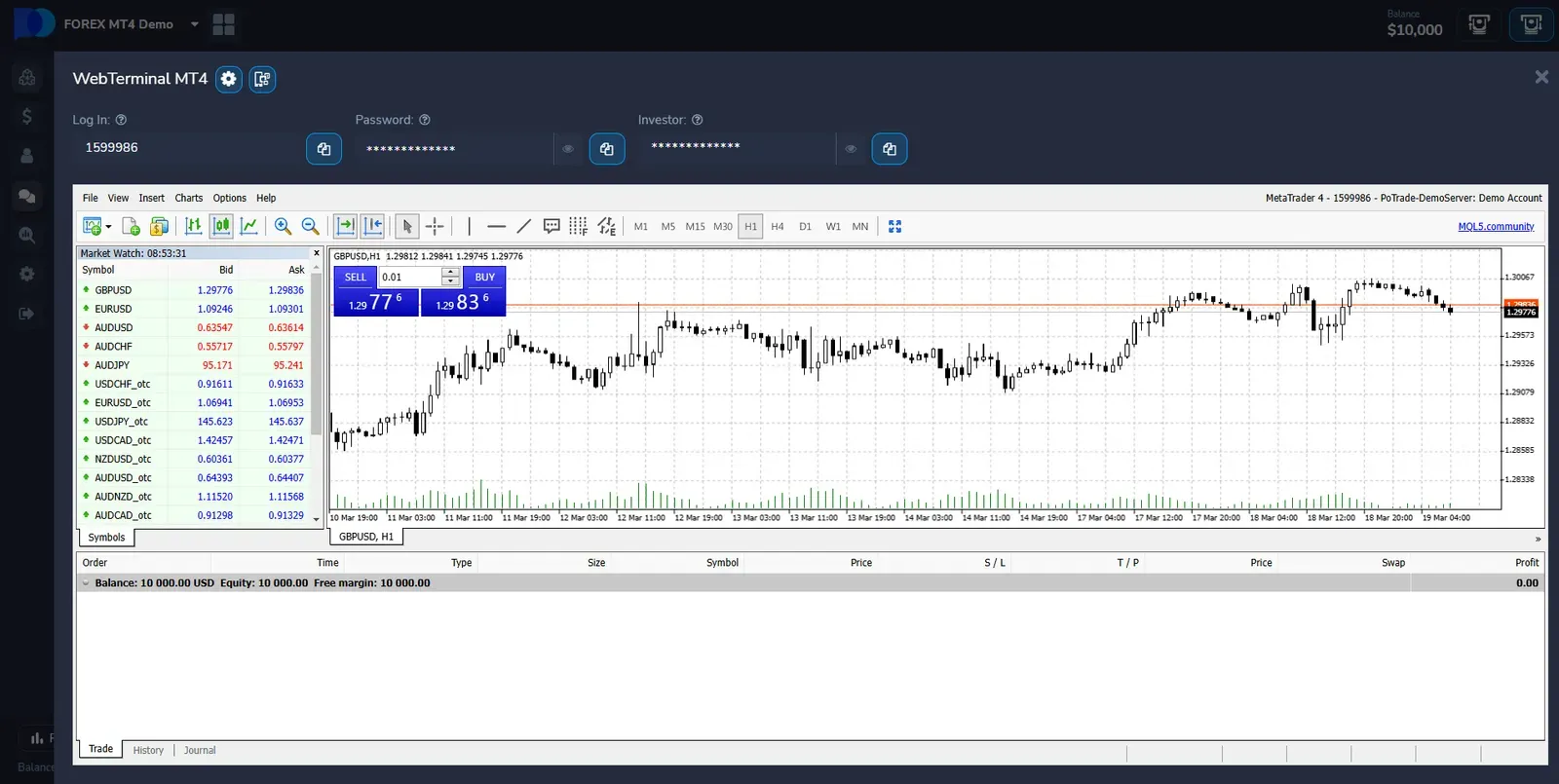

- CFDs on MetaTrader: Pocket Option’s integrated MT5 terminal offers CFD trading — allowing for long and short positions with leverage on forex, stocks, and commodities.

Why Use Derivative Contracts on Pocket Option?

- AI Trading Bots – Automate decisions with smart algorithms

- Technical Indicators – Dozens available directly in the trading interface

2. Community Engagement

- Social Trading – Copy trades of top performers

- Tournaments – Compete, win prizes, and build skills

3. Financial Benefits

- Bonuses and Promo Codes – Boost deposits instantly

- Flexible Payments – 50+ methods, global coverage

4. Education & Support

- Video Tutorials – Learn how to trade

- 24/7 Customer Support – Get help when needed

5. Mobile Trading

- Pocket Option App – Trade from anywhere, even on a break or commute

How to Place a Trade on Pocket Option

Here’s a simple example to open a trade:

- Choose an asset

- Analyze the chart using trader sentiment or technical indicators

- Enter trade amount – starting from just $1

- Set trade time– from 5 seconds (on OTC assets)

- Make a forecast:

- Press Buy if you believe the price will rise

- Press Sell if you think it will fall.

⚡ Profit up to 92% if your forecast is correct — the payout is shown in advance

Conclusion

Derivative contracts are no longer limited to corporations. With platforms like Pocket Option, anyone can use derivatives for risk management and short-term profit. Whether you prefer high-speed trading or want to explore CFD strategies through MetaTrader, you have the tools to act confidently.

From real-world cases to your own screen, derivative contracts can help you capitalize on market movements — anytime, anywhere.

FAQ

What are derivative contracts?

Derivative contracts are financial instruments whose value is derived from an underlying asset, such as stocks, commodities, currencies, or interest rates. They include futures, options, swaps, and forwards, among others.

Are derivative contracts suitable for all investors?

Derivative contracts can be complex and carry significant risks. They are generally more suitable for experienced investors who understand the products and can manage the associated risks. Novice investors should approach derivatives with caution and seek professional advice.

How do companies typically use derivative contracts?

Companies often use derivative contracts to manage various risks, such as currency fluctuations, interest rate changes, or commodity price volatility. They can also use derivatives for financial engineering purposes or to optimize their capital structure.

What is a derivative contract on Pocket Option?

It’s a financial instrument that lets you predict price direction of an asset without owning it — and earn up to 92% if your forecast is correct.

How fast can I trade on Pocket Option?

You can open trades starting from just 5 seconds, especially on OTC assets.