- Multi-exchange connectivity

- Real-time data monitoring

- Automated execution of trades

- Built-in risk management

- Customizable strategies

Arbitrage Trading Crypto Bot: Features, Strategies, and Benefits

In the fast-paced world of cryptocurrency trading, staying ahead of the curve is crucial for maximizing profits. One powerful tool that has gained significant attention in recent years is the crypto arbitrage trading bot. These automated systems are designed to capitalize on price discrepancies across different cryptocurrency exchanges, allowing traders to profit from market inefficiencies with minimal effort.

What Is a Crypto Arbitrage Trading Bot and How It Works

A crypto arbitrage trading bot is a sophisticated software that continuously monitors multiple exchanges for price differences. When it detects an opportunity, the bot executes trades automatically — often in a matter of seconds, much faster than any human could react.

The biggest advantage is that these bots operate 24/7. They track multiple assets, perform real-time calculations, and execute trades with speed and precision — without emotions or fatigue.

Key Features of Arbitrage Trading Bots

These features combine to create a powerful system that helps traders profit from even the smallest inefficiencies in the crypto markets.

Types of Arbitrage Strategies

| Strategy | Description |

|---|---|

| Spatial Arbitrage | Exploiting price gaps between two exchanges |

| Triangular Arbitrage | Using three crypto pairs to lock in profit from discrepancies |

| Statistical Arbitrage | Using algorithms and probability models |

| Latency Arbitrage | Taking advantage of data lag between platforms |

Each strategy has different risks and strengths. The bot’s performance often depends on its ability to execute these tactics effectively.

Implementing a Crypto Arbitrage Trading Bot

There are three main ways to start using an arbitrage trading bot:

- Build a custom bot from scratch

- Use an open-source bot framework

- Subscribe to a commercial trading bot service

An arbitrage crypto trading bot can serve as a reliable solution for fast-paced market execution, especially when configured correctly and monitored regularly.

Why You Should Consider a Crypto Arbitrage Bot Today

| Advantage | Description |

|---|---|

| 24/7 Trading | Bots never sleep — they trade around the clock |

| Speed & Efficiency | Bots act faster than humans in volatile markets |

| Emotion-Free Trading | No panic, no greed — just rules |

| Scalability | Manage dozens of trades at once |

| Data-Driven Decisions | Algorithms use historical and real-time data for decisions |

What to Watch Out for When Using Trading Bots

- High volatility or thin liquidity

- API or technical issues

- Hidden fees or withdrawal limits

- Unstable regulation in some countries

- Bot saturation and competition

Best Practices for Arbitrage Bot Usage

| Practice | Description |

|---|---|

| Backtesting | Always test before deploying live |

| Risk Management | Use stop-loss and set trade limits |

| Monitoring | Watch the bot’s performance regularly |

| Diversification | Use multiple pairs or exchanges |

| Security | Protect your keys and use secure connections |

How Pocket Option Can Help With Arbitrage Strategy

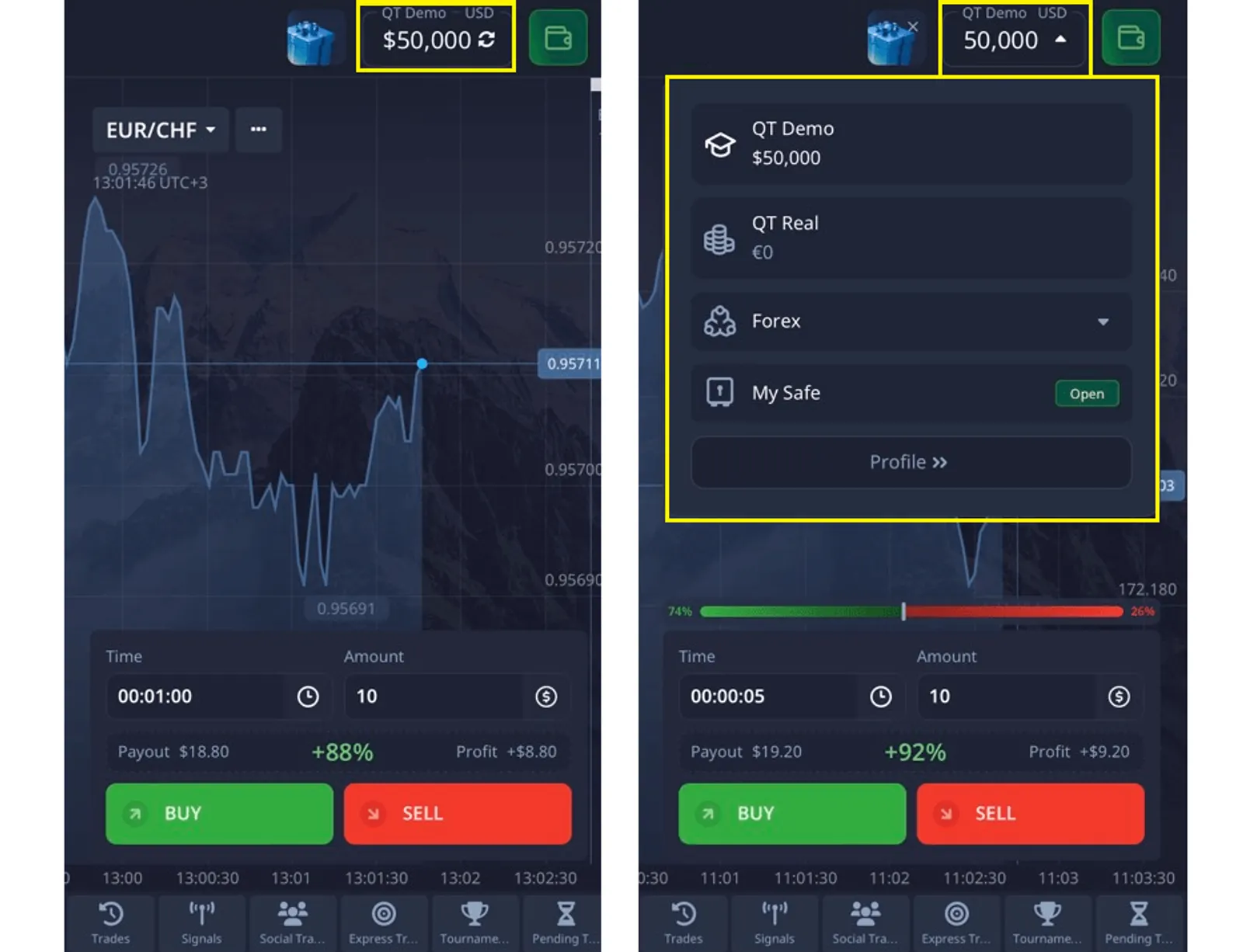

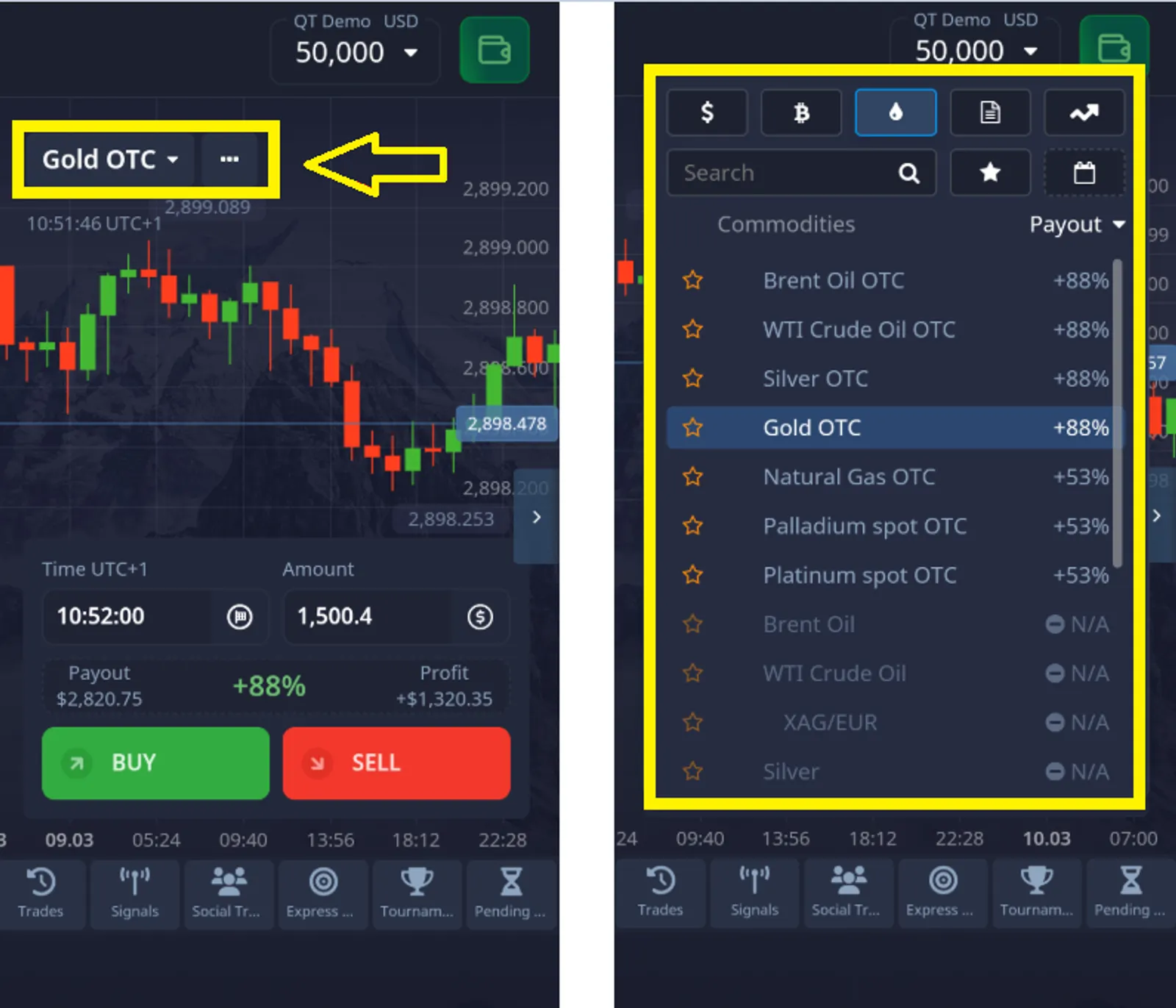

While Pocket Option doesn’t provide direct access to arbitrage bots, it offers useful tools for testing and strategy simulation. You can analyze real-time price movements, switch between trading pairs, and test volatility-based strategies on a $50,000 demo account.

Pocket Option’s features include:

- Fast execution and real-time price feeds

- Multiple assets for testing cross-pair behaviors

- Economic calendar, built-in indicators, and technical tools

- Web and mobile access for full flexibility

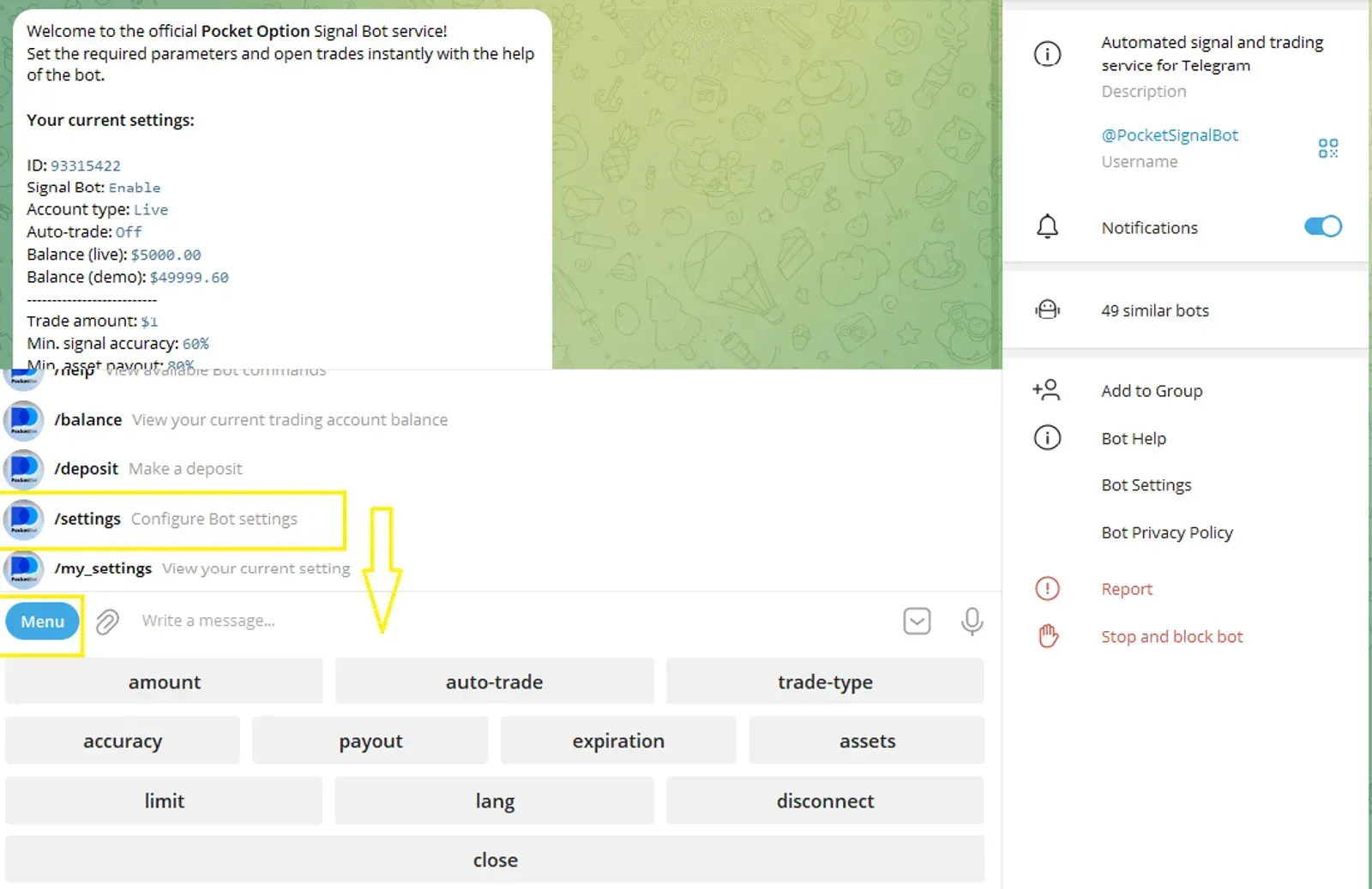

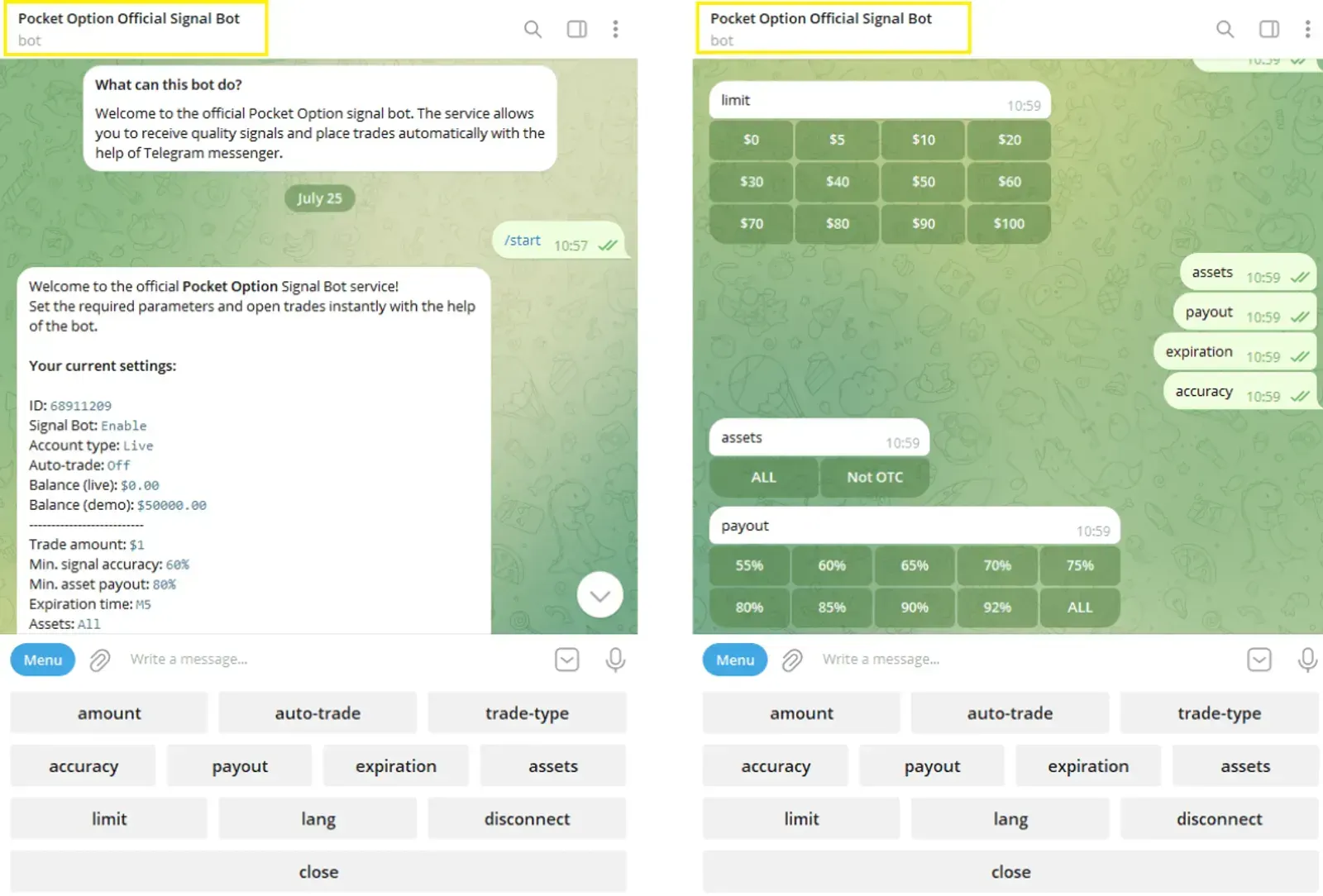

Telegram Signal Bot for Pocket Option

The Telegram Signal Bot (TG Bot) is an official Pocket Option tool for receiving trading signals directly in Telegram. You can trade automatically or manually with it.

How it works:

- Subscribe via the Signals menu in your account

- Use /SETTINGS to configure trade size, balance limits, and accuracy

- Click /START to begin receiving signals

- Enable or disable auto-trading anytime

- Use /STOP to pause all signals

This bot is especially useful if you want semi-automated trading without coding your own bot.

The Future of Crypto Arbitrage Trading Bots

The future is likely to include AI-powered bots, smarter algorithms, and better DEX integration. Traders will see more cross-chain opportunities, advanced automation, and tools that adapt to regulatory changes in real time.

Competition will grow — but so will the possibilities.

Conclusion

Crypto arbitrage bots offer traders a way to capitalize on market inefficiencies with speed, automation, and data. While they’re not a guaranteed path to profits, they can be a valuable part of a disciplined and well-tested strategy.

FAQ

What is a crypto arbitrage trading bot?

It’s an automated tool that tracks crypto exchanges and executes trades based on price differences between them.

How do arbitrage trading bots make money?

They buy crypto where it’s cheaper and sell it where it’s more expensive, locking in the profit from the difference.

Are crypto arbitrage trading bots legal?

Yes, in most regions. However, always check the regulations in your country.

What are the risks associated with using arbitrage trading bots?

Technical errors, market slippage, fee miscalculations, or competition can reduce profitability or cause losses.

Can beginners use crypto arbitrage trading bots?

Yes, but it’s best to start with paper trading, research, and demo accounts before going live.