- Execute strategies without constant supervision.

- Monitor the market in real time.

- Optimize capital management.

- Eliminate emotional decision-making.

- Effectively utilize trading signals.

Best Crypto Trading Bot for Beginners

The modern cryptocurrency market is rapidly evolving, offering investors numerous profit opportunities. Automated trading solutions help optimize the trading process, minimize risks, and improve trade efficiency. Using trading bots has become a key tool for those looking to enhance their results.

Article navigation

Set up automated trading and simplify crypto asset management!

What is a Crypto Trading Bot?

A crypto trading bot is software that executes automated trades based on specific algorithms. It analyzes data, identifies trends, and opens positions without user intervention.

Main objectives of automated trading:

Using a trading bot significantly improves the speed and accuracy of trades.

Advantages of Automated Trading

Employing trading algorithms enhances trading outcomes.

Key benefits of automated systems:

- Round-the-clock operation – continuous monitoring of price changes.

- Instant order execution – eliminates delays in decision-making.

- Error reduction – minimizes human error.

- Flexible settings – choose strategies for different market conditions.

- Effective risk management – automatic stop-loss settings.

How to Choose the Best Crypto Trading Bot for Beginners?

Selecting an automated tool requires considering several factors.

| Criterion | Description |

|---|---|

| User-friendly interface | Intuitive design and easy setup. |

| Functionality | Ability to choose trading strategies. |

| Security | Two-factor authentication, API protection. |

| Flexibility | Adaptation to various market conditions. |

| Cost | Availability of free and premium plans. |

Before launching, it’s recommended to test the tool in demo mode to evaluate its performance.

Why Choose the Pocket Option Trading Bot?

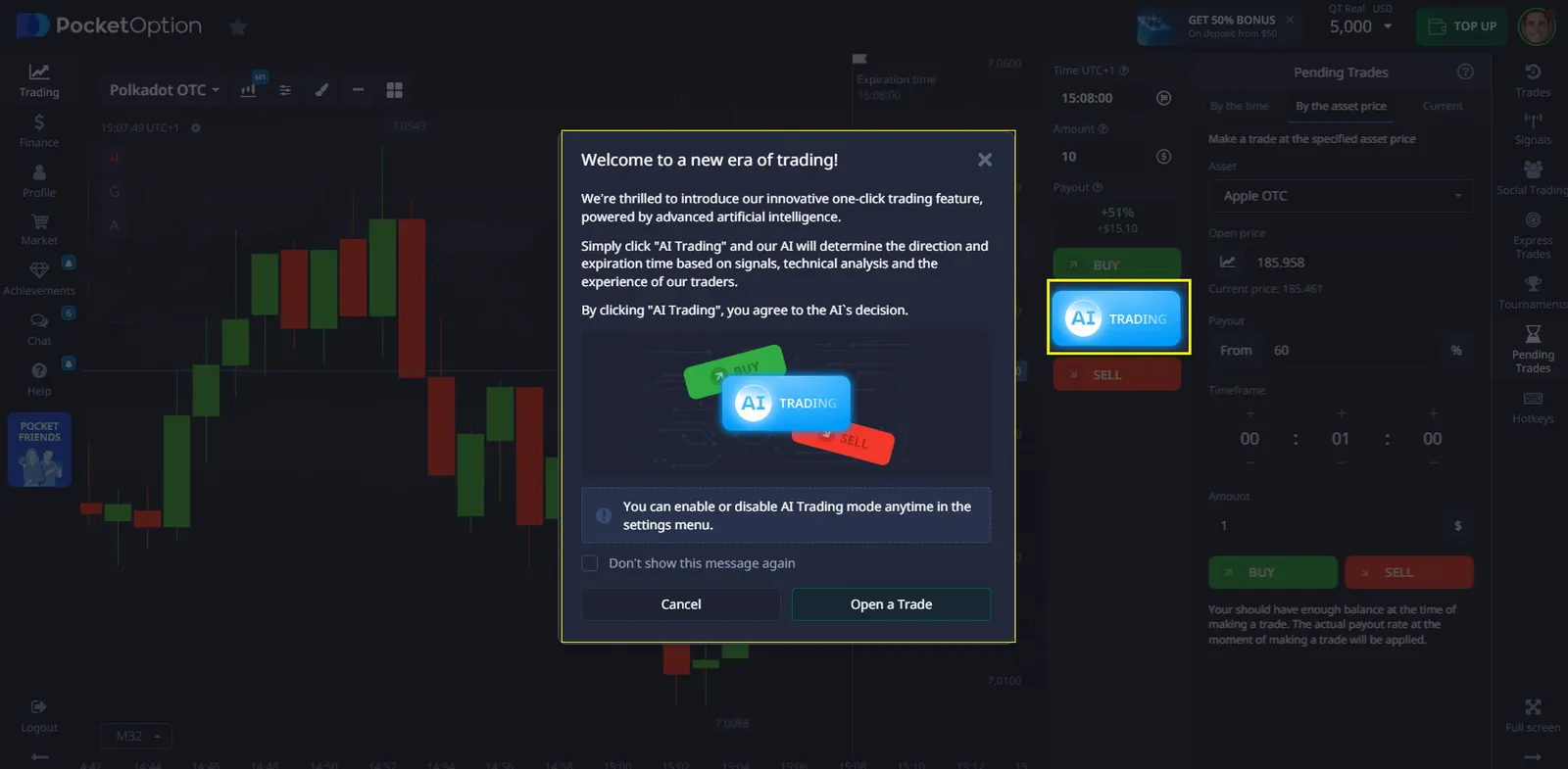

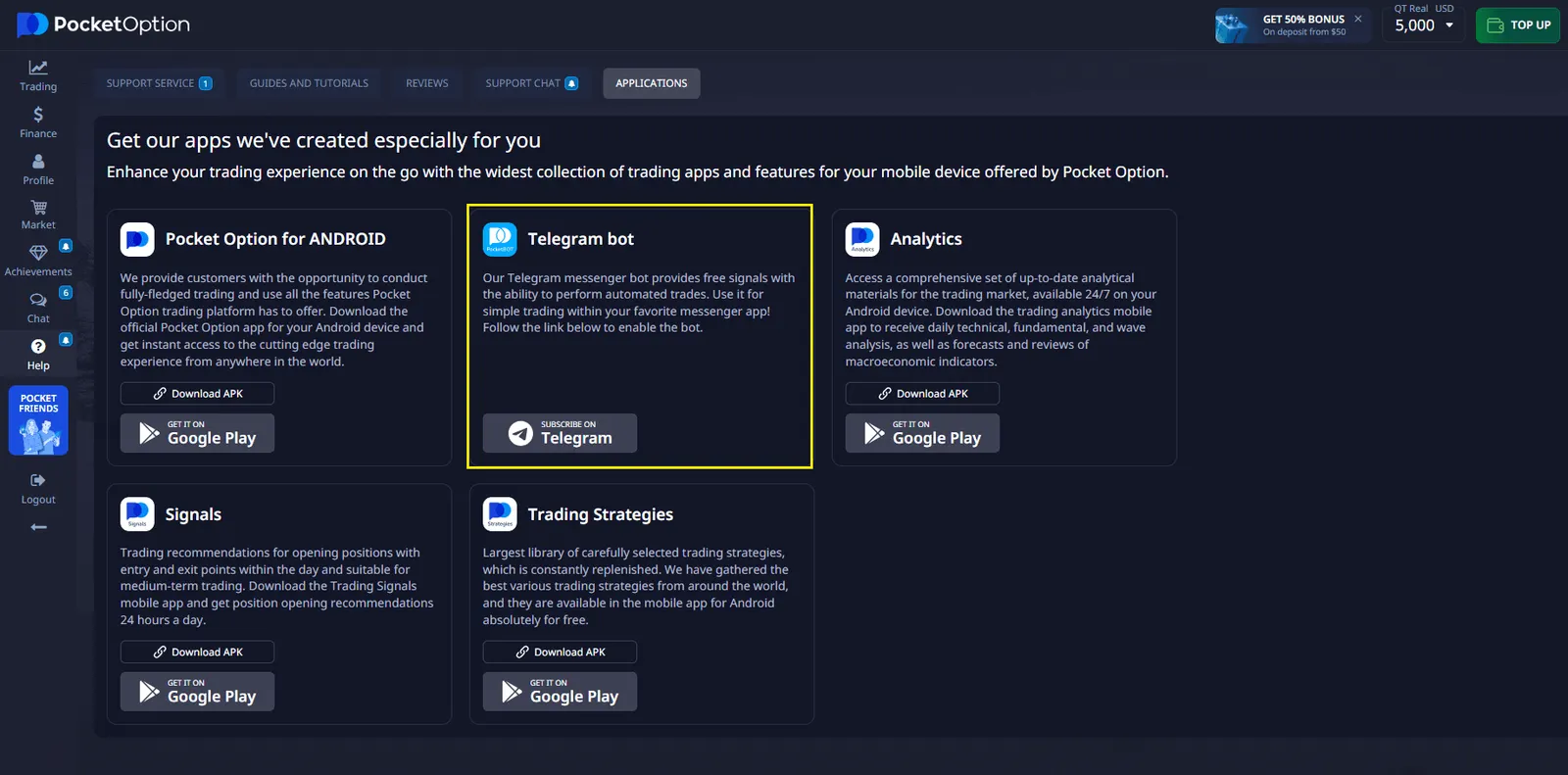

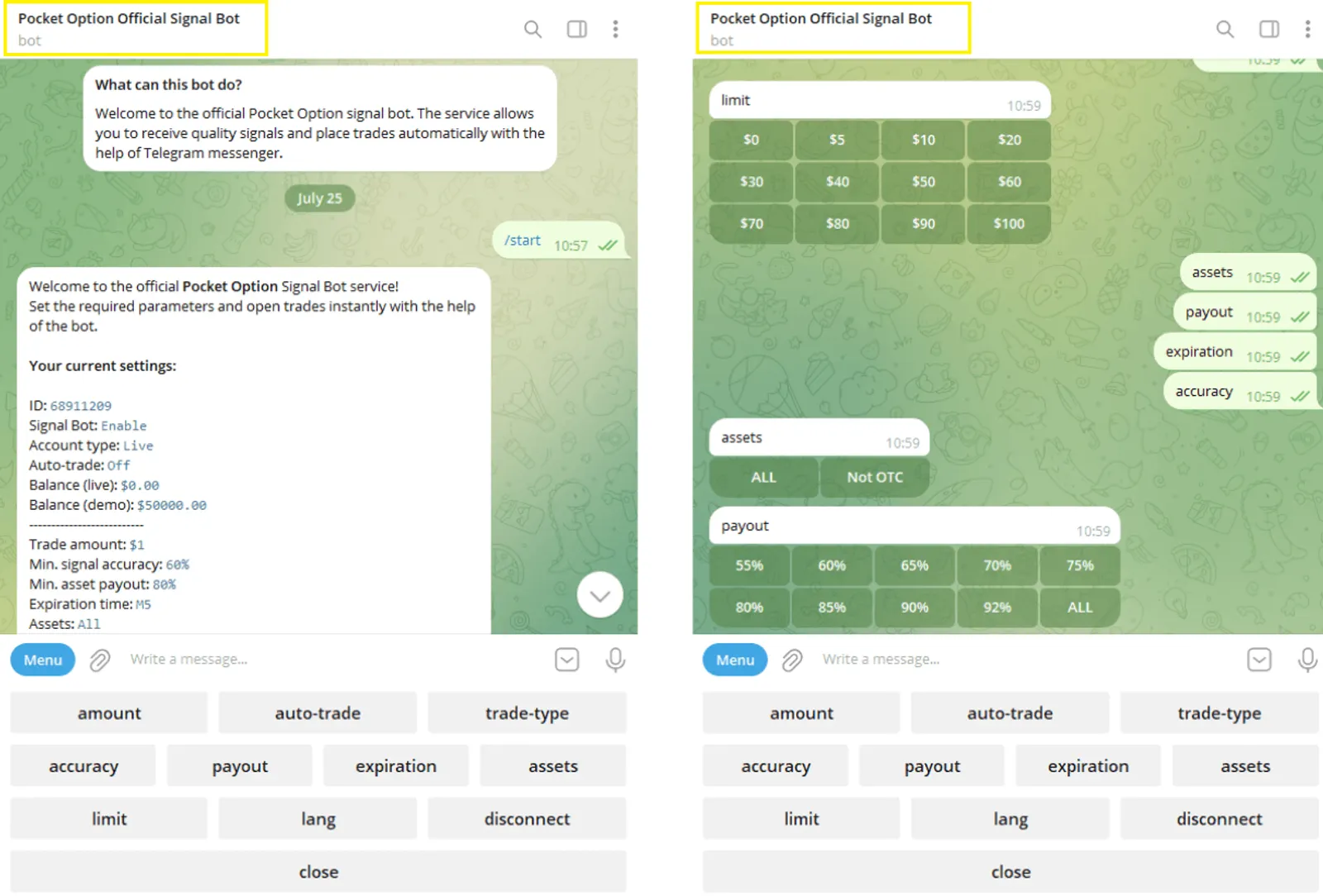

When selecting an automated trading tool, it is essential to consider functionality, reliability, and ease of setup. The Pocket Option trading bot combines a wide range of strategies, flexible settings, and high-speed trade execution.

Key Benefits of Using the Pocket Option Bot:

- Full automation – The bot independently analyzes the market and executes trades based on predefined parameters.

- Adaptability to market conditions – Supports various strategies for stable performance.

- Use of technical indicators – The bot analyzes data based on signals received from the platform.

- Effective risk management – Allows setting limits on the maximum number of trades and profit levels.

- Demo account trading – Enables strategy testing without risking funds.

The Pocket Option Bot automates trading without complex configurations, offering users an intuitive interface. This makes it an excellent choice for beginner traders who need to quickly adapt and minimize errors.

| Feature | Description |

|---|---|

| Automatic chart analysis | Assesses market conditions based on indicators |

| Trade execution | Opens and closes positions according to the set strategy |

| Profit limit setting | Ability to stop trading upon reaching a defined profit level |

| High-speed performance | Instant execution of trades without delays |

Key Features of Crypto Trading Bots

Modern solutions offer a wide range of tools for automated trading.

Core functionalities of the best trading bots:

- In-depth data analysis – evaluates historical and current trends.

- Flexible settings – choose trading modes and algorithms.

- Risk control – automated loss management.

- Notification setup – monitors price changes in real time.

- Automated strategy testing – checks effectiveness before execution.

Utilizing automated solutions significantly reduces trader workload and increases trade execution accuracy.

Types of Trading Strategies for Crypto Bots

Automated trading supports various strategies, allowing adaptation to market changes.

Popular automated trading strategies:

- Grid strategy – placing trades at different price levels.

- Arbitrage trading – profiting from price differences in assets.

- Trend following – opening positions based on price movement direction.

- Momentum trading – analyzing sudden price spikes.

- Scalping – profiting from small price fluctuations.

How to Start a Trading Bot?

Setting up automated trading involves several steps.

- Choose a platform for automated trading.

- Configure trading parameters and strategies.

- Determine risk levels and set stop-loss orders.

- Test the algorithm with a small capital.

- Monitor results and adjust parameters.

Before launching, it’s advisable to test in demo mode to adapt the strategy to the market.

Security in Crypto Bot Usage

When selecting a system, it’s essential to consider data protection levels and asset security.

Key security measures:

- Account protection – two-factor authentication.

- API key encryption – prevents information leaks.

- Withdrawal limits – additional capital protection layers.

- Activity monitoring – detects suspicious actions.

Conclusion

Selecting and implementing automated trading solutions requires careful consideration of multiple factors. Focus on platforms offering strong security features, clear user interfaces, and comprehensive educational resources. Start with basic strategies and smaller investments, gradually increasing complexity as you gain experience and confidence in automated trading systems.

FAQ

What makes a crypto trading bot suitable for beginners?

A suitable bot features an intuitive interface, basic strategy templates, comprehensive security measures, and reliable customer support.

How much initial investment is recommended?

Start with a small amount you can afford to lose, typically between $100-500, while learning the system.

Are automated trading systems reliable?

While they can be effective tools, success depends on proper configuration, market conditions, and risk management strategies.

What security features are essential?

Look for two-factor authentication, API key encryption, and withdrawal limits as minimum security requirements.

How long does it take to become proficient with trading bots?

Most users need 3-6 months to understand basic operations and develop effective strategies.

Can a crypto bot be used without prior experience?

Yes, but it’s recommended to start with demo mode and conservative strategies.