- Binance:

- Offers up to 125x leverage on Bitcoin futures.

- Known for a user-friendly interface, advanced tools, and high liquidity.

- Fees: 0.02% – 0.10%.

- BitMEX:

- Specializes in Bitcoin perpetual swap contracts with leverage up to 100x.

- Designed for experienced traders with advanced order types.

- Fees: 0.075% – 0.25%.

- Bybit:

- Provides up to 100x leverage on Bitcoin trades.

- Offers TradingView integration for advanced charting and analysis.

- Fees: 0.01% – 0.06%.

- Kraken:

- A more conservative platform with leverage up to 5x.

- Ideal for traders prioritizing security and stability.

- Fees: 0.02% – 0.05%

- Pocket Option:

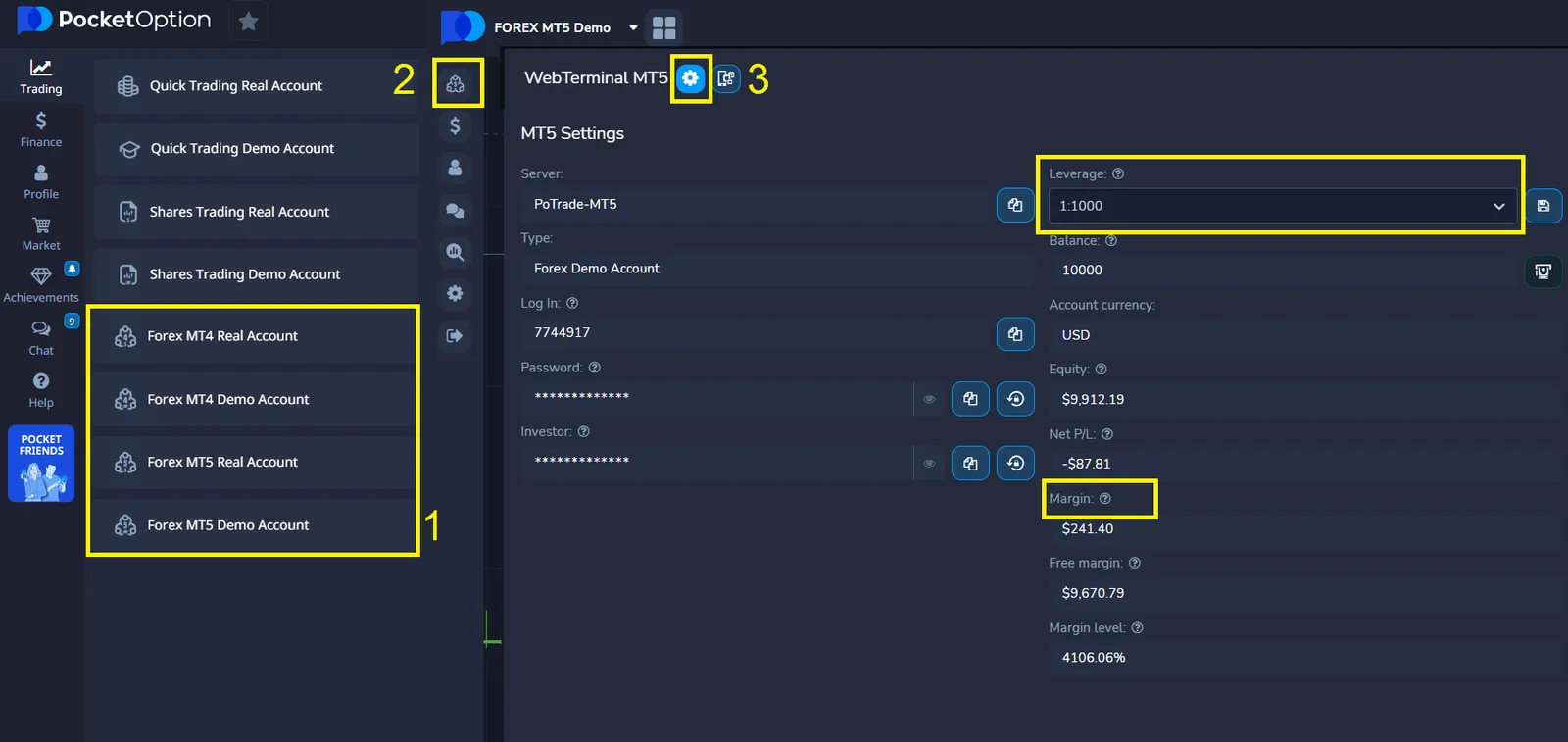

- For traders looking for high leverage, Pocket Option stands out with 1:1000 leverage via its MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

- Provides a wide range of trading tools and features for Bitcoin and other cryptocurrencies.

- Competitive spreads and additional bonuses for traders.

Best Crypto Margin Trading Platform: Essential Tools and Strategies

Cryptocurrency margin trading has gained significant traction among traders seeking to maximize their potential profits. In this article, we’ll explore popular platforms, their features, and provide a comprehensive guide to help you navigate this dynamic market. Additionally, we’ll highlight the unique advantages of Pocket Option, particularly its integration with MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer unparalleled trading tools and leverage up to 1:1000.

Understanding Crypto Margin Trading

Margin trading in the cryptocurrency market allows traders to borrow funds to increase their trading position, potentially amplifying both profits and losses. Before diving into the features of different platforms, let’s review the basics of this trading method.

| Concept | Description |

|---|---|

| Leverage | The borrowed funds that increase trading position size |

| Margin | The collateral required to open a leveraged position |

| Liquidation | Forced closure of a position when losses approach the margin amount |

Top Crypto Margin Trading Platforms

When searching for the best crypto margin trading platform, several factors come into play, including leverage options, supported cryptocurrencies, fees, and tools. Here’s a list of the leading platforms:

| Platform | Max Leverage | Supported Cryptocurrencies | Fees |

|---|---|---|---|

| Binance | 125x | 100+ | 0.02% – 0.10% |

| BitMEX | 100x | 7 | 0.075% – 0.25% |

| Bybit | 100x | 16 | 0.01% – 0.06% |

| Kraken | 5x | 8 | 0.02% – 0.05% |

| Pocket Option | 1:1000 | Various (via MT4/MT5 integration) | Competitive spreads |

Best Margin Trading Bitcoin Exchanges

When it comes to margin trading Bitcoin, several exchanges stand out for their unique features and trading conditions. Here are the best margin trading bitcoin exchanges that you should consider:

By evaluating these platforms, you can find the best crypto margin trading platform to match your trading style and goals.

Why Choose Pocket Option?

While many platforms offer cryptocurrency margin trading, Pocket Option stands out by integrating MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most advanced trading platforms in the world. Here’s why Pocket Option is a superior choice:

Key Advantages of Pocket Option with MT4/MT5

High Leverage: With leverage up to 1:1000, Pocket Option allows traders to maximize their trading potential.

Advanced Trading Tools: MT4 and MT5 provide comprehensive charting tools, indicators, and automated trading features.

Wide Asset Range: Pocket Option supports margin trading across multiple asset classes, including cryptocurrencies, forex, and commodities.

Social Trading: Copy successful traders’ strategies to enhance your learning and results.

Capital Growth Tools: Track your performance with detailed statistics, equity curves, and trade history analysis.

Bonuses and Promotions: Take advantage of bonuses to boost your trading capital. Use “50START” for 50% bonus!

Competitive Spreads: Enjoy low trading costs, ensuring you retain more of your profits.

Educational Resources: Access a wealth of trading guides, tutorials, and analyses to refine your strategies.

To open a trade in MT5 (MetaTrader 5) on Pocket Option, follow these steps:

1. Log in to MT5

Use your Pocket Option MT5 credentials to log in to the platform.

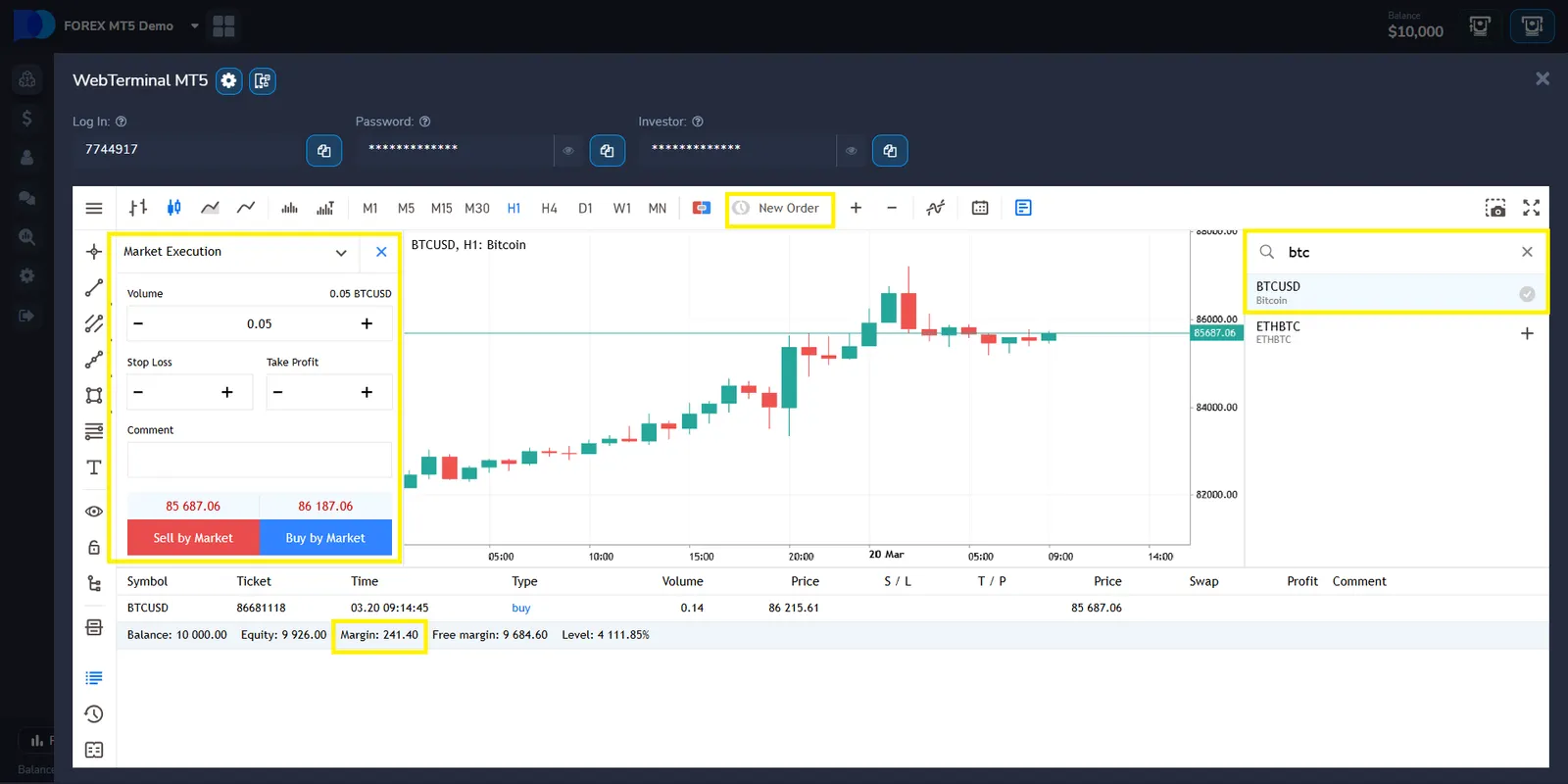

2. Select an Asset

Choose the financial instrument you want to trade in the Market Watch window.

3. Open the Order Window

- Right-click on the chosen asset in the Market Watch window and select New Order.

- Alternatively, press the F9 key or click the New Order button in the toolbar.

4. Set Order Parameters

- Volume: Specify the trade size (lot size).

- Stop Loss: Set a price level to limit your losses (optional).

- Take Profit: Set a price level to secure your profit (optional).

- Type: Choose between Market Execution (instant execution) or Pending Order (execute later at a specific price).

5. Execute the Trade

- For Market Execution, click Buy or Sell to open the trade immediately.

- For Pending Order, set your desired price and other parameters, then click Place.

6. Monitor Your Trade

Once the trade is open, you can monitor it in the Trade tab in the terminal window. Here, you can also modify or close the trade as needed.

Advanced Strategies for Crypto Margin Trading

As you gain experience, consider these advanced strategies:

| Strategy | Description | Risk Level |

|---|---|---|

| Scalping | Numerous small trades for minor price gains | Medium |

| Grid Trading | Multiple buy and sell orders at price levels | Low to Medium |

| Arbitrage | Exploiting price differences across exchanges | Low |

| Momentum Trading | Following strong market trends | Medium to High |

Conclusion

Choosing the best crypto margin trading platform requires careful consideration of leverage options, supported assets, fees, and tools. While platforms like Binance, BitMEX, and Bybit provide robust features, Pocket Option offers a unique edge with MT4/MT5 integration and leverage up to 1:1000, making it a powerful choice for traders seeking flexibility, advanced tools, and exceptional support.

With Pocket Option, you gain access to a diverse set of features, including social trading, tournaments, and detailed analytics, all designed to enhance your trading experience. Whether you’re a beginner or an experienced trader, Pocket Option empowers you to trade smarter and achieve your financial goals.

FAQ

What is the minimum deposit required to start margin trading on most platforms?

Minimum deposits vary by platform, but are typically between $50 and $200. Some platforms may have lower or higher requirements, so it's best to check the specific terms of your chosen exchange. On Pocket Option, you can start quick trading without buying an asset from $5!

How does liquidation work in crypto margin trading?

Liquidation occurs when your losses approach the value of your margin. The exchange automatically closes your position to prevent further losses. The exact liquidation price depends on the leverage used and the platform's policies.

Can I use margin trading for long-term cryptocurrency investments?

While possible, margin trading is generally more suitable for short to medium-term trades due to the associated fees and risks. Long-term investors typically prefer spot trading or holding cryptocurrencies directly.

Are there any tax implications specific to crypto margin trading?

Tax regulations for cryptocurrency trading, including margin trading, vary by country. Generally, profits from margin trading may be subject to capital gains tax. It's advisable to consult with a tax professional familiar with cryptocurrency regulations in your jurisdiction.

How do I choose between cross margin and isolated margin trading?

Cross margin uses your entire account balance as collateral, potentially offering more flexibility but higher overall risk. Isolated margin limits risk to the specific position but may require more active management. Your choice should depend on your risk tolerance and trading strategy.