- XP Investimentos: One of the leaders in digital investment, with a wide variety of products and complete support in Portuguese.

- BTG Pactual Digital: Robust platform, with a strong presence in the variable income and international segment.

- Avenue: Specialized in access to the American market, allowing investors from any Portuguese-speaking country to operate directly on the US stock exchange with a dollar account.

- Inter Invest: Easy access option for those seeking simplicity, low cost, and integration with digital banking services.

Best broker to invest in stocks

Finding the best broker to invest in stocks requires more than just comparing fees; it's necessary to understand how the platform works and if it adapts to your investor profile. This article will help you identify the main criteria for choosing the ideal broker and how to avoid mistakes that can impact your investments.

Article navigation

- Updated list of the best brokers in 2025

- Why does broker choice impact your results?

- Practical criteria for choosing the best broker to invest in stocks

- Foolproof checklist for choosing the best broker to invest in stocks

- Common mistakes when choosing the best broker to buy stocks

- Which is the best broker to buy stocks according to investor profile

- Best broker to invest in stocks: what really matters

Did you know that the first stock traded in Brazil was in 1854, with the creation of the Dom Pedro II Railroad Company? Since then, the Brazilian capital market has gone through revolutions — and today, buying stocks is as simple as ordering food through an app. But with so many brokers competing for your attention, the question that can define your financial success arises: which is the best broker to invest in stocks?

And don’t think all brokers are the same. A classic mistake beginners make is choosing the first broker that appears on Google, without considering essential factors such as hidden fees, analysis tools, Portuguese customer service, or access to the American market.

To help you avoid this trap, we’ve prepared a quick and straightforward checklist with objective criteria, including average costs practiced in Brazil in 2025:

| Criterion | Acceptable standard in Brazil 2025 |

|---|---|

| Brokerage fee per order | Between R$0 and R$5, depending on the asset |

| Custody costs | Preferably zero |

| Access to B3 | Mandatory |

| Access to US stocks | Highly recommended |

| Mobile platform | Intuitive and in Portuguese |

In addition, we will reveal the 3 most praised brokers by Brazilian investors in 2025 — and one of them has surprisingly low fees for international stocks!

Get ready to discover which is the best broker to buy stocks and avoid traps that can compromise your returns.

Updated list of the best brokers in 2025

In 2025, the financial market has modern and competitive brokers that offer intuitive platforms, low fees, and global access. Among the most recommended by experienced and beginner investors, the following stand out:

These brokers are recognized for offering a complete experience, both for those who want to invest in local stocks, BDRs, or directly in foreign stocks.

How to trade stocks simply and immediately? On Pocket Option, stocks are available for trading 24 hours a day, 7 days a week, with transactions starting from $1. Learn more or try it now on a demo account!

Why does broker choice impact your results?

Investing in stocks without choosing the right broker is like trying to trade with an inadequate tool: you don’t know where you’re going. Unexpected fees, platform limitations, and ineffective support can silently erode your profits.

Impact of operational fees

- Brokerage fee on individual operations

- Account maintenance and custody costs

- Hidden spread and exchange fees in global brokers

Practical criteria for choosing the best broker to invest in stocks

In addition to fees, factors such as platform user experience, information security, access to international markets, and analysis tools are essential for success in the stock market.

Practical evaluation of criteria

| Criterion | Why it’s important |

|---|---|

| Intuitive platform | Reduces operational errors |

| Execution speed | Avoids slippage in fast operations |

| Analytical tools | Facilitate strategic decisions |

| Quick service | Fast problem resolution |

Foolproof checklist for choosing the best broker to invest in stocks

Before opening an account with any broker, it’s worth following this checklist that helps avoid traps and choose the platform most aligned with your investor profile:

- Transparent fees: Prefer brokers that clearly show all fees, without fine print.

- 100% Portuguese support: Essential for quickly resolving doubts and avoiding confusion with technical terms.

- Modern platform with advanced charts and tools: A good platform makes all the difference when analyzing assets and making decisions.

- Easy access to BDRs, ETFs, and international markets: Invest beyond borders and have the flexibility to diversify your portfolio.

This checklist is universal and applies both to those who invest in B3 and those who want to explore markets like the US, Europe, or Asia.

Common mistakes when choosing the best broker to buy stocks

Many beginner investors make the mistake of choosing a broker based on generic recommendations, without analyzing their profile. This can result in unnecessary costs or a platform that doesn’t meet their needs.

Real stories of mistakes and successes when choosing a broker

Few investors know, but choosing the wrong broker can be costly — literally. A notable case happened in 2013, when an investor lost about 60% of the wealth accumulated over years. The reason? He only trusted a local broker without access to the American market, which prevented him from diversifying into global ETFs during an internal crisis in his country.

While American indices were rising, he was stuck with local assets in free fall. This episode illustrates the importance of choosing a broker that offers broad access to both the domestic market and the main international markets. After all, in today’s connected world, investing only in local stocks can limit — and greatly — your growth opportunities.

Which is the best broker to buy stocks according to investor profile

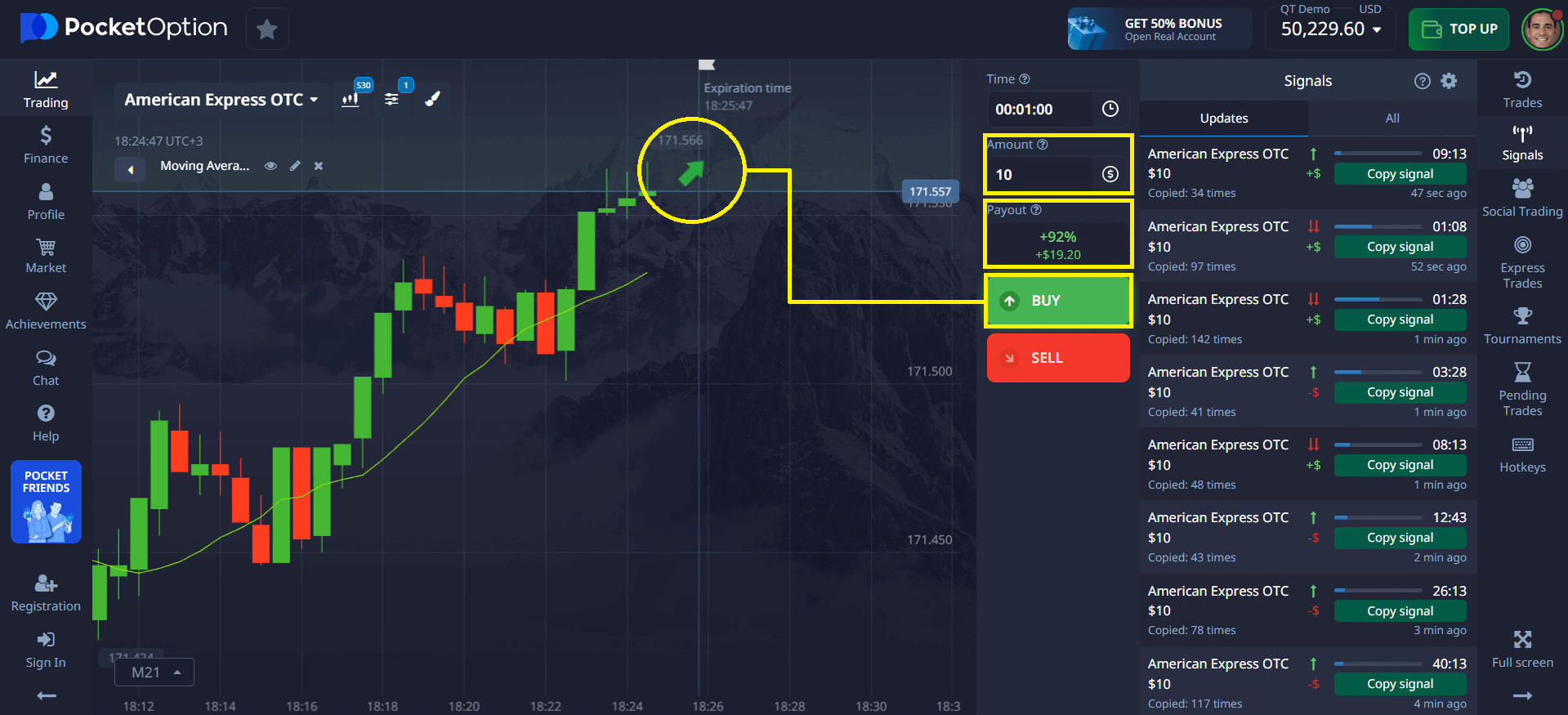

There is no single answer to the question of which is the best broker to buy stocks. For a conservative investor, a broker with strong regulation and low costs may be ideal, while more active investors may look for platforms with more flexibility and quick trading options, such as Pocket Option.

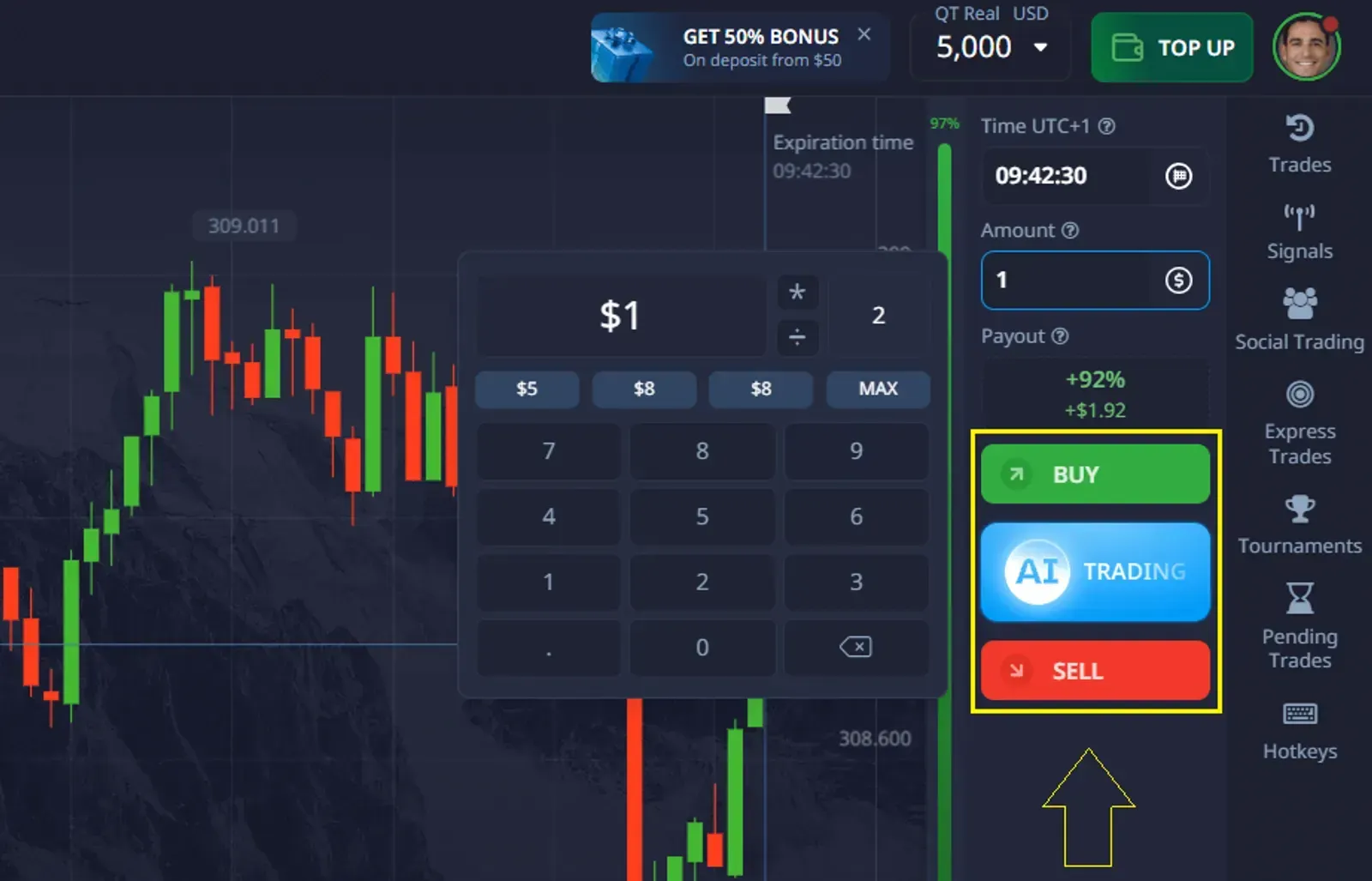

Quick trading doesn’t require direct stock purchase. You just need to make a prediction about whether the stock price will rise or fall. If your prediction is correct, you will receive up to 92% profit!

Best broker to invest in stocks: what really matters

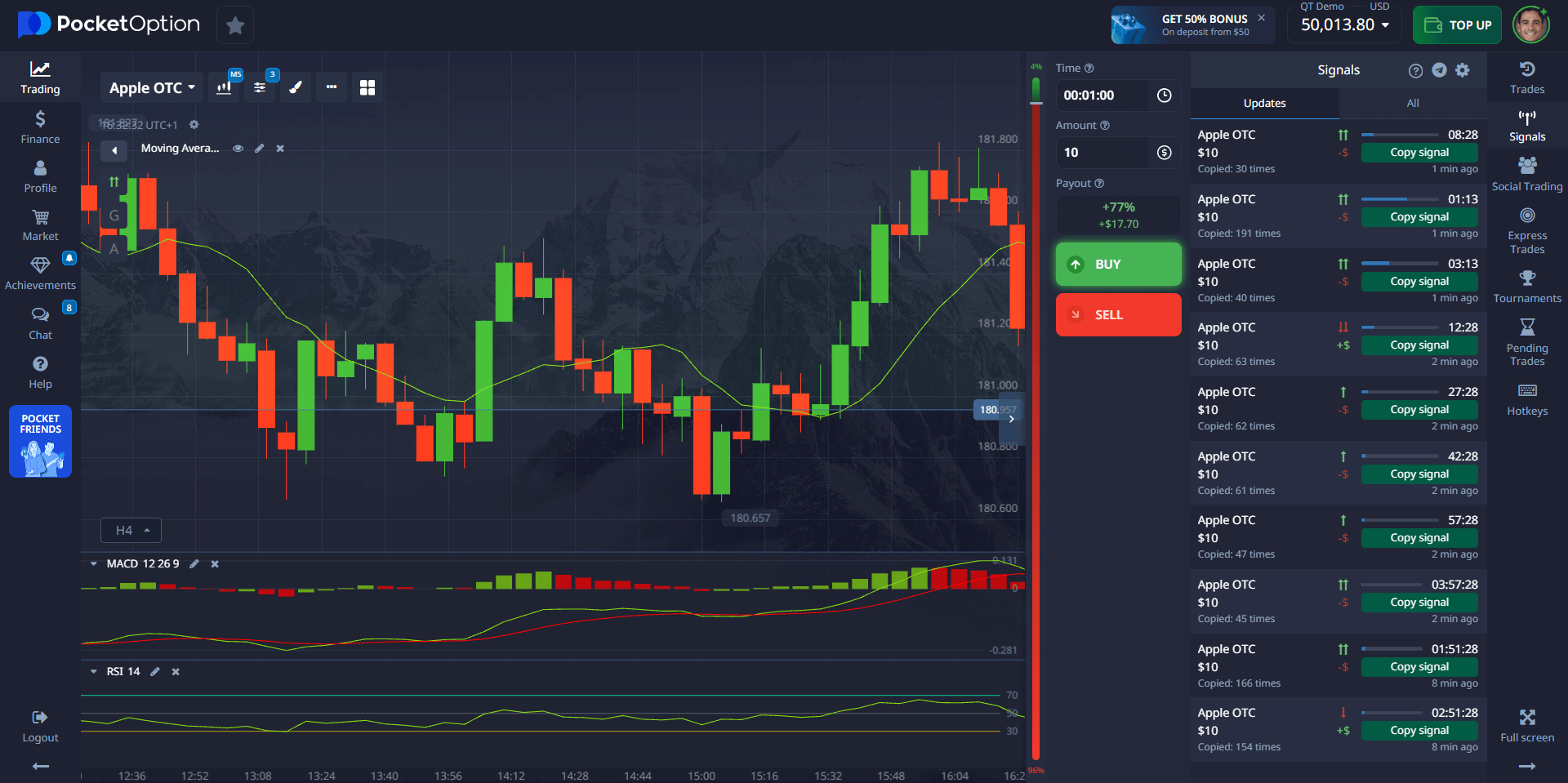

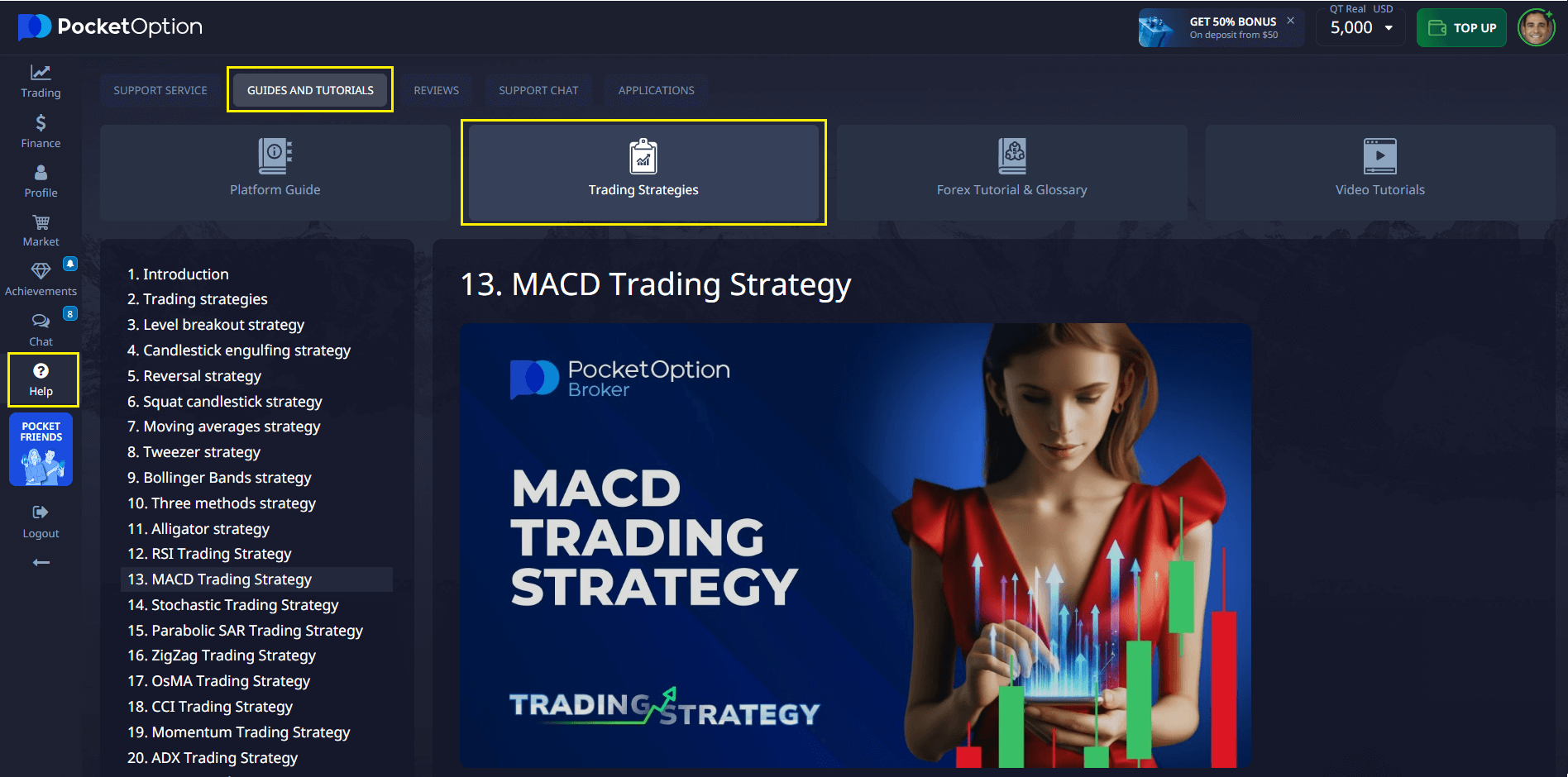

Beyond commissions, broker reliability and information transparency are fundamental. Pocket Option, for example, offers a simple yet complete platform, with 24/7 support and access to professional tools, as well as an extensive library of trading training materials, which will be made available to you for free as soon as you register:

FAQ

Which is the best broker to buy stocks for beginners?

Brokers with a friendly interface and active support are more suitable. Pocket Option is an alternative to start with low amounts.

What is the best broker to invest in stocks with a short-term focus?

Platforms like Pocket Option, which offer quick operations and integrated analysis tools, are recommended.

How to know if a broker is reliable?

Check licenses, market history, and opinions from other investors. Avoid brokers without registration with regulatory bodies.

Can I test before investing?

Yes, use demo accounts offered by brokers like Pocket Option to test your strategies without risking capital.

What is the best broker to buy stocks with a focus on diversification?

Brokers that offer access to multiple markets, including stocks, forex, and commodities, ensure greater flexibility.