- Middle Band (20-period SMA): This is the simple moving average that forms the center of the bands.

- Upper Band: The upper line is set two standard deviations above the middle band.

- Lower Band: The lower line is set two standard deviations below the middle band.

Best Bollinger Band Settings for Day Trading on Pocket Option

To succeed in trading, you need to use the right technical analysis tools and understand their best settings. This article covers the important aspects of using Bollinger Bands for day trading. We’ll discuss the optimal settings, their applications in various market conditions, and how Pocket Option can help you apply these strategies effectively.

Understanding Bollinger Bands Fundamentals

Bollinger Bands are one of the most popular indicators used by traders to understand market volatility and potential price reversals. Created by John Bollinger in the 1980s, they consist of a middle band (a moving average), and two outer bands (which are set two standard deviations away from the middle band). These bands help traders measure the volatility of the market and predict potential price movements.

Understanding the best Bollinger Band settings for day trading is crucial. The bands expand when the market is more volatile and contract during periods of low volatility, providing key signals for traders. The ideal settings depend on the market being traded and the timeframe used.

Optimal Parameters for Different Markets

When implementing a Bollinger Bands day trading strategy, understanding how volatility and price action affect the bands is crucial. The bands’ behavior can differ depending on the asset you are trading. Here’s a look at the recommended Bollinger Bands settings for various markets:

| Parameter | Standard Setting | Recommended Setting |

|---|---|---|

| Period Length | 20 | 20-21 |

| Standard Deviation | 2 | 2.1-2.3 |

For markets with higher volatility, such as cryptocurrencies, you may want to increase the standard deviation to 2.3 for more responsive signals.

Core Components of Bollinger Bands

Bollinger Bands consist of three parts:

Understanding the movement of these bands can provide key insights into market trends, reversals, and volatility shifts.

Time Frame Analysis

The best Bollinger Band settings for day trading depend heavily on the timeframe you’re using. Different timeframes give different levels of signal accuracy. Here’s how Bollinger Bands perform in different timeframes:

| Timeframe | Optimal Band Width | Signal Strength |

|---|---|---|

| 5-minute | 2.2 SD | Moderate |

| 15-minute | 2.1 SD | Strong |

| 1-hour | 2.0 SD | Very Strong |

Shorter timeframes like the 5-minute chart require a slightly wider band (2.2 SD) to account for faster price movements. Longer timeframes, like 1-hour, are usually more reliable, with stronger signals.

How to Use Bollinger Bands on Pocket Option

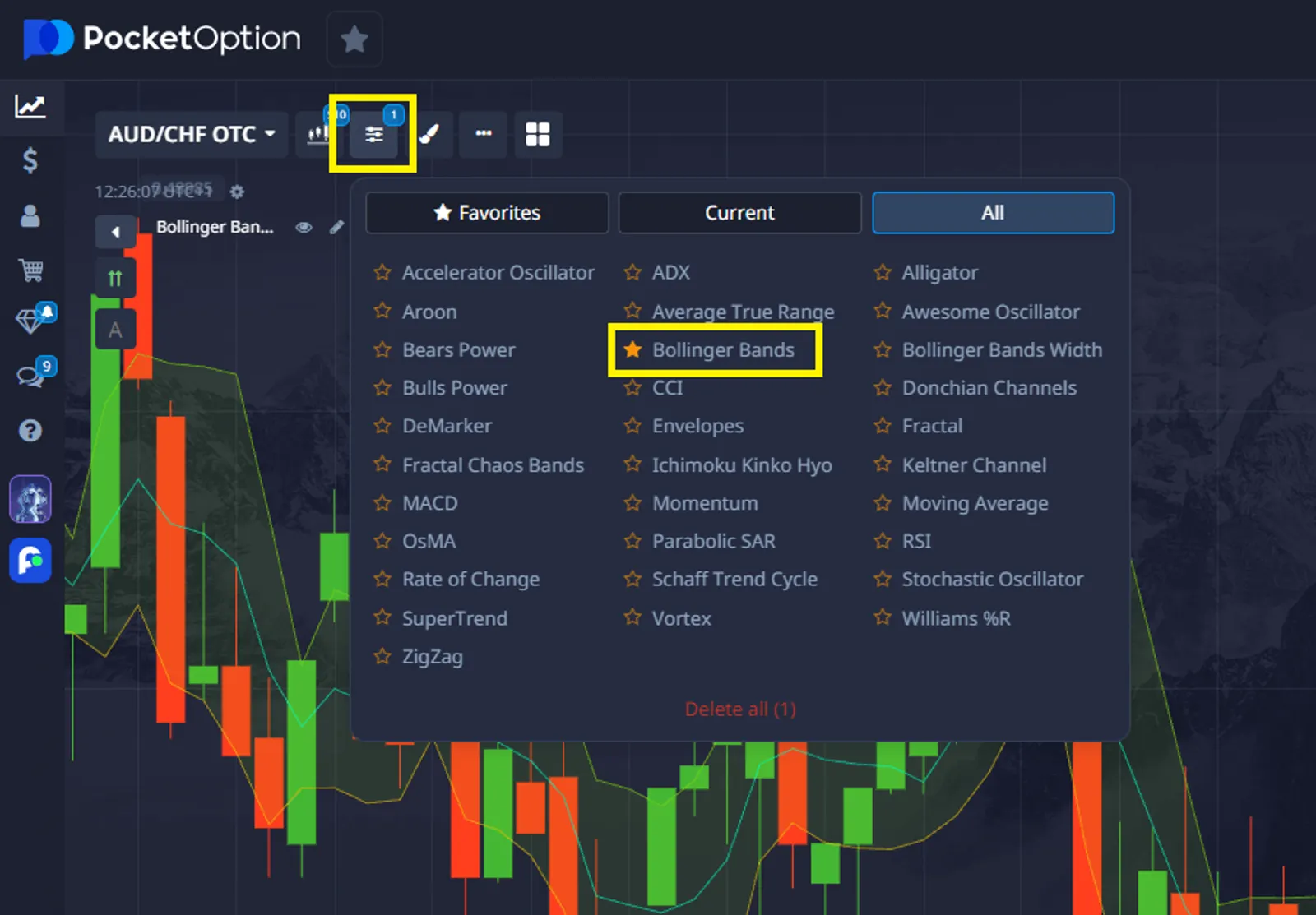

Pocket Option makes it easy to set up and use Bollinger Bands for day trading. Here’s how you can start:

- Open the Trading Interface and select Bollinger Bands from the list of available indicators.

- Adjust the Period Length to your preferred setting (usually 20-21 for day trading).

- Set the Standard Deviation to your desired level (you can experiment with 2.1 or 2.3 for more aggressive strategies).

- Choose Your Timeframe and start analyzing price volatility and trends.

- Apply the Settings to your chart, and start making more informed trading decisions.

Pocket Option gives you the flexibility to adjust Bollinger Bands for any market condition and easily track your performance with live signals.

Why Pocket Option is the Best Platform for Day Trading

When it comes to day trading, you need a platform that offers speed, precision, and reliability. Pocket Option is ideal for day traders because of its low latency and real-time execution.

Key features for day trading include:

- Real-time Signals: Get immediate market direction alerts to act quickly.

- Customizable Bollinger Bands: Easily adjust indicators to match your trading style.

- Risk Management: Use stop-loss, take-profit, and advanced charting tools to control your trades.

- $50,000 Demo Account: Test your strategies risk-free before going live.

- Mobile Access: Trade from anywhere with Pocket Option’s mobile app.

With these features, Pocket Option is perfect for traders who want to implement Bollinger Bands and other technical indicators effectively. Start practicing and fine-tuning your Bollinger Bands strategy risk-free.

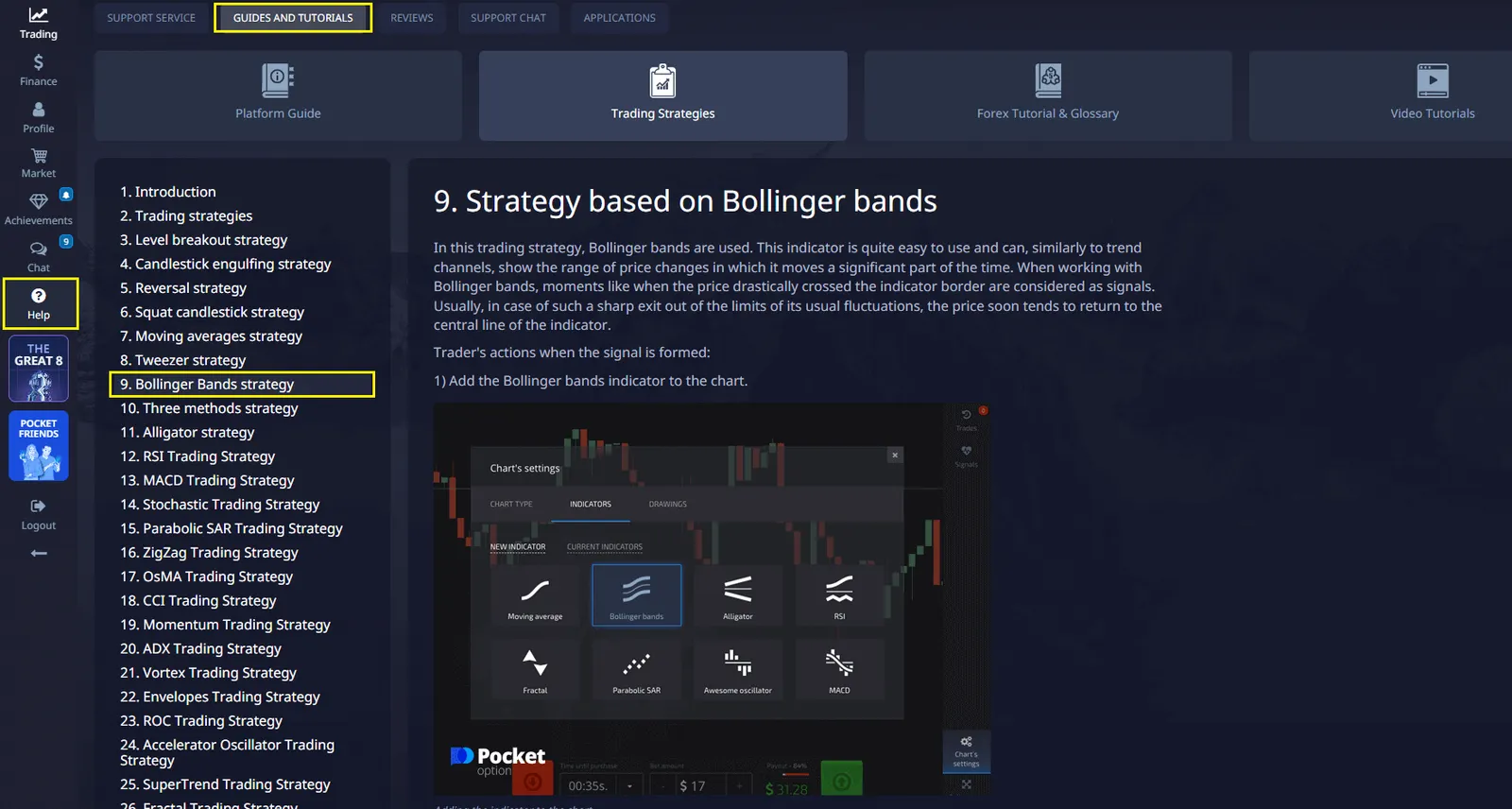

Want to learn even more about Bollinger Bands day trading? We provide basic training on various strategies within our platform. Just register and go to our Guides and Tutorials section to start learning!

Conclusion

Mastering Bollinger Bands requires a good understanding of both their technical parameters and their practical application. By using the right settings, you can enhance your day trading strategies and make more informed decisions. Pocket Option offers the tools you need to implement these strategies effectively, providing a flexible and fast trading environment.

FAQ

What are the optimal Bollinger Band settings for scalping?

For scalping, use 20-period SMA with 2.2 standard deviations on 5-minute charts. This configuration provides balanced sensitivity for short-term trades.

How do you adjust Bollinger Bands for different market conditions?

Adjust standard deviation values: use 2.1 for normal volatility, 2.3 for high volatility markets. The period setting can remain at 20 for consistency.

Can Bollinger Bands predict market reversals?

While not predictive alone, Bollinger Bands indicate potential reversals when price touches the bands and shows divergence with other technical indicators.

What is the relationship between volatility and band width?

Band width expands during high volatility periods and contracts during low volatility. This movement helps identify potential breakout opportunities.

How do you combine Bollinger Bands with other indicators?

Use RSI for momentum confirmation, volume indicators for breakout validation, and moving averages for trend direction verification.