- Trading algorithms: Define trade entry and exit logic

- Data analysis tools: Analyze price movements and indicators

- Risk management modules: Set limits and stop losses

- Execution engines: Place trades in real-time

- Performance monitors: Track and adjust trading behavior

Automated Option Trading Solutions

In today’s fast-evolving financial markets, automated option trading stands out as a strategic tool for investors aiming to boost precision, remove emotional bias, and increase trading efficiency. Powered by algorithms and artificial intelligence, it enables consistent execution of trades—often faster and more accurately than any human.

Understanding Automate options trading

Options auto trading, also called algorithmic trading or algo-trading, refers to the use of computer programs and mathematical models to analyze market conditions and execute options trades automatically. It removes emotional interference and enables faster, rule-based decision-making across a variety of market scenarios.

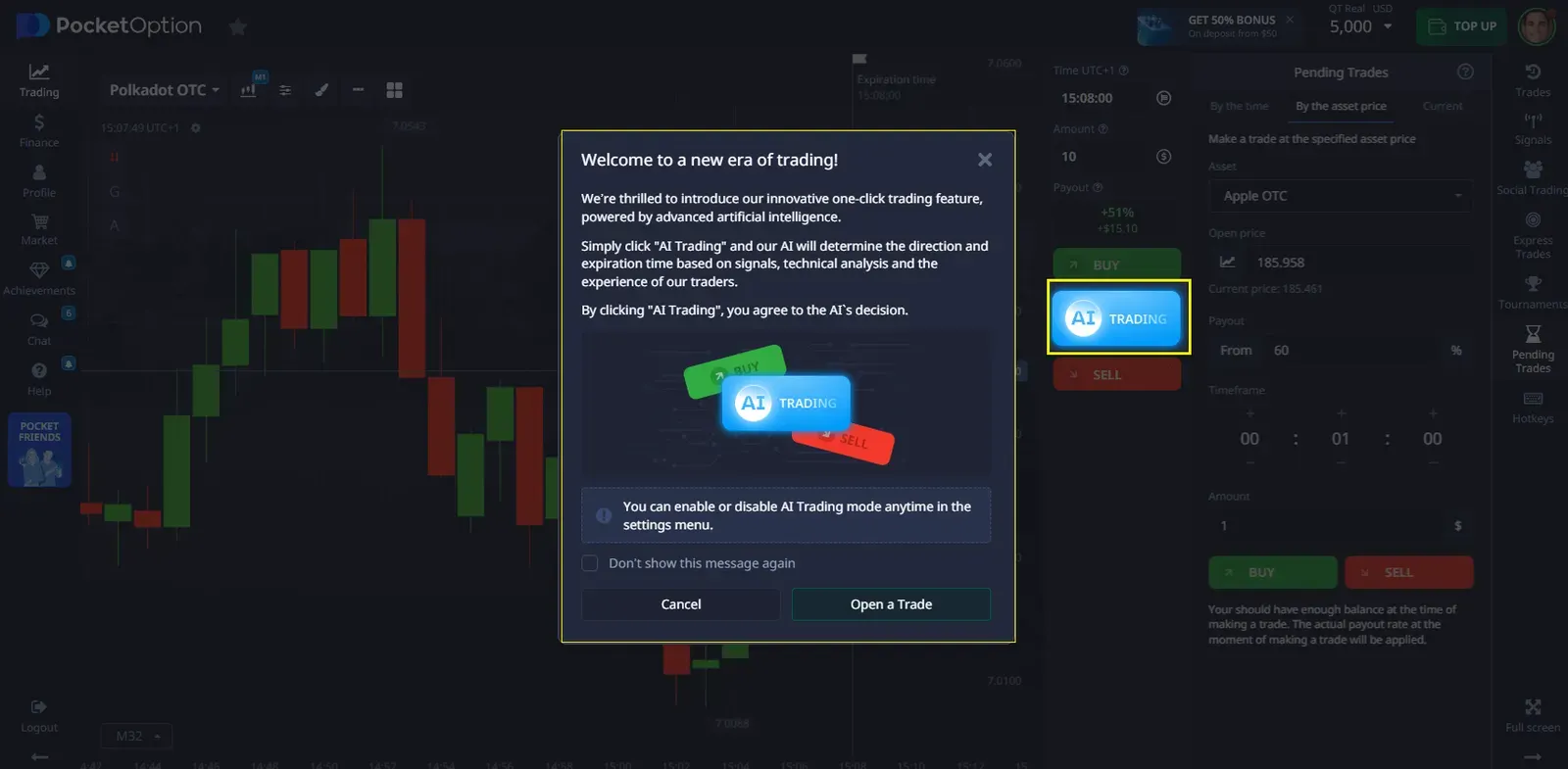

Ready to automate your trades? Dive into Pocket Option’s AI Trading Mode and see how smart strategies perform in real time.

Key Components of Automated Option Trading Systems

Benefits of Automated Option Trading

- Speed and efficiency: Trades are executed within milliseconds

- Emotion-free trading: Eliminates psychological biases

- Backtesting: Allows testing strategies on historical data

- Diversification: Enables trading multiple assets at once

- Consistency: Follows predefined rules without deviation

Challenges in Implementing Automated Option Trading

- Requires technical skills or pre-built tools

- Upfront setup and maintenance can be resource-intensive

- Over-optimization may reduce real-world performance

- Compliance with regulatory rules is essential

- Risk of technical failures and connectivity issues

Pocket Option: A Leading Platform for Automated Trading

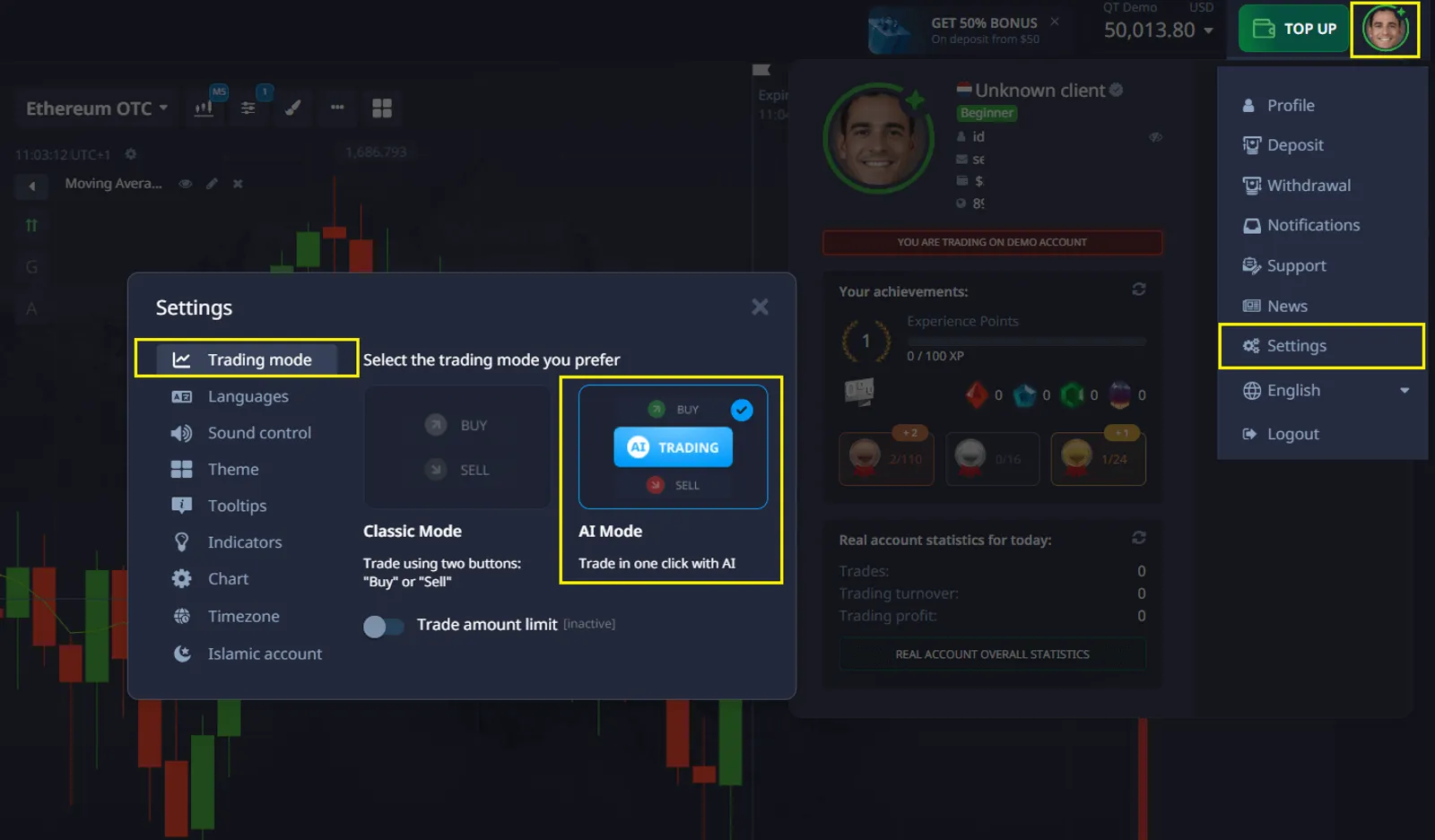

Pocket Option offers a range of automated trading tools tailored for both beginners and experienced users. The platform’s intuitive interface and advanced AI features make it ideal for those looking to streamline their trading process.

Key features include:

- AI Trading Mode: Uses artificial intelligence to determine trade direction and expiry

- Signal Integration: AI relies on built-in trading signals and technical analysis

- Market vs OTC: Expiration time is adjusted based on asset type

- Custom Algorithms: Ability to create or follow automated strategies

- Mobile Automation: Trade on-the-go with full automation support

Steps to Start Automated trading options

- Create a clear trading plan based on market behavior

- Choose a platform that supports automation (e.g., Pocket Option)

- Use built-in AI tools or integrate your own trading logic

- Test strategies using historical data and demo accounts

- Start small and scale with experience

The Future of Automated Option Trading Automation in trading is evolving rapidly. New trends are shaping the future:

- AI and machine learning for predictive analytics

- Greater access to data and real-time analysis

- More retail-friendly platforms with drag-and-drop automation

- Enhanced regulation to ensure fair market practices

Platforms like Pocket Option are already embracing many of these innovations, especially through their AI Trading Mode and intuitive mobile integration.

Use the Pocket Option demo account to fine-tune your strategy — no deposit, no pressure, just practice.

Conclusion

Auto trading options open the door to strategic, consistent, and emotion-free investing. With the right tools and mindset, it can become a key pillar in any trader’s portfolio. Pocket Option, with its AI-powered trading features, mobile flexibility, and accessible interface, provides an ideal entry point for those ready to automate their trading approach.

Still, automation is not a silver bullet. Success requires solid planning, responsible risk management, and a willingness to learn. As the landscape continues to evolve, staying informed and adaptable remains essential.

FAQ

What is automated option trading?

It is the use of computer algorithms to execute options trades based on predefined rules and market data.

Yes, Pocket Option provides a $50000 demo account for testing strategies risk-free.

Are there risks in automated option trading?

Yes, including technical errors, overfitting of strategies, and potential market anomalies. Proper risk controls are vital.

Is automated trading better than manual trading?

It can be faster and more consistent but still requires monitoring and risk management.

Does Pocket Option support automated trading?

Yes, Pocket Option offers AI Trading Mode, technical indicators, and the ability to automate trades using signals and strategies.