- Strategic Partnerships: Archer’s collaboration with United Airlines strengthens its market credibility.

- Regulatory Milestones: Progress toward FAA certification by 2025 is critical for scaling operations.

- Market Potential: The global eVTOL market is expected to grow to $30 billion by 2030, giving Archer a significant growth runway.

Archer Aviation Inc. (NYSE: ACHR) is revolutionizing urban air mobility with its eVTOL technology. This article covers Archer Aviation stock predictions for 2030 and shows how to start trading its stock today from just $1 using Pocket Option.

Archer Aviation: A Brief Overview

Founded in 2018, Archer Aviation specializes in developing eVTOL aircraft for short-distance urban travel. Its flagship aircraft, Midnight, promises to deliver safe, quiet, and sustainable transportation. Archer’s partnership with United Airlines, which includes a pre-order of up to 200 aircraft, underscores the company’s potential to dominate the urban air mobility (UAM) market.

Key Growth Drivers

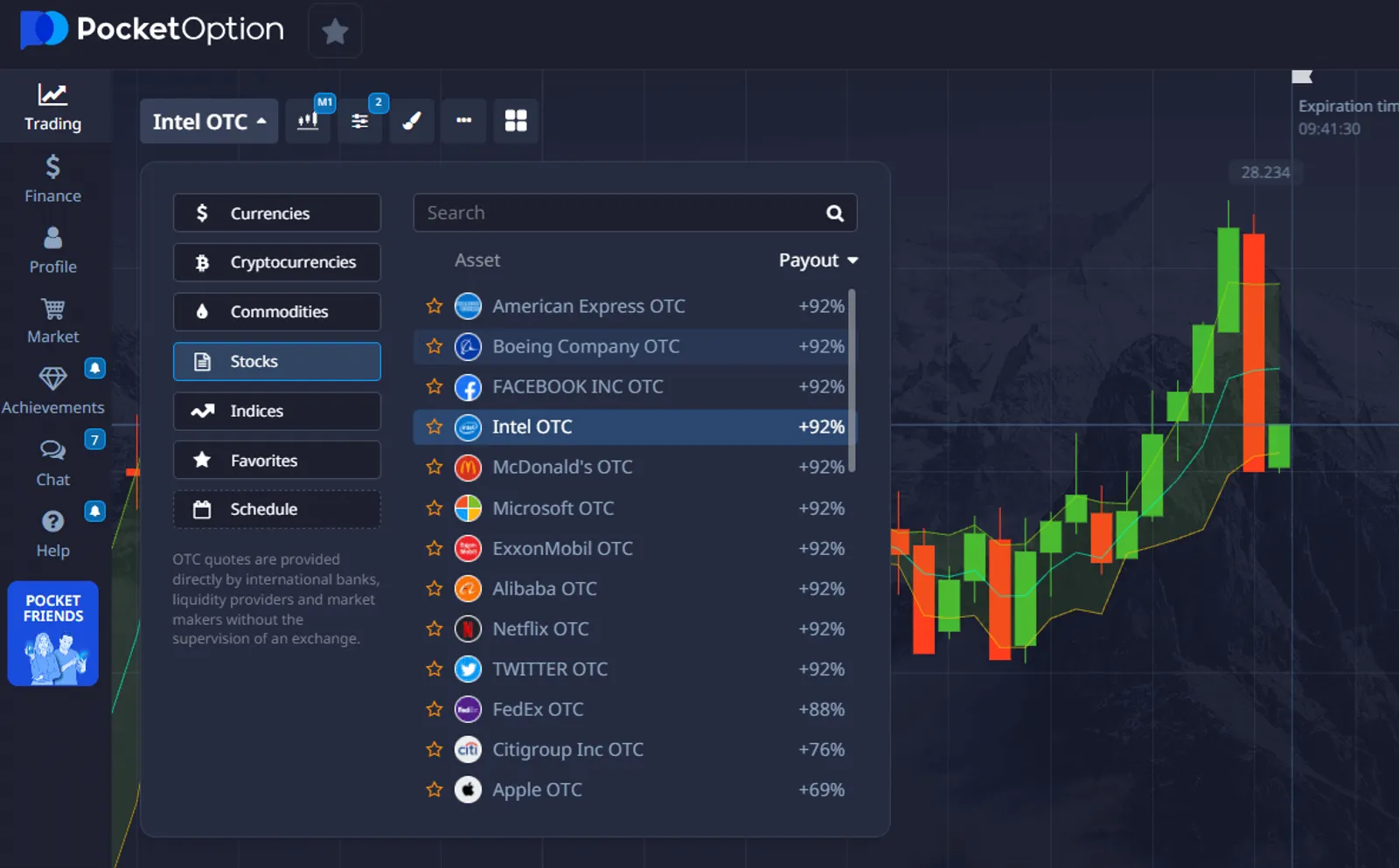

Pocket Option constantly updates the list of available assets! Choose from more than 100 different instruments! Register and follow the updates in the Chat-Notifications section!

Archer Aviation Stock Forecast 2030: Expert Analysis

To determine the ACHR stock price prediction for 2030, we examined insights from 20 authoritative sources, including financial analysts, investment firms, and industry reports. Below is a summary of key projections:

Optimistic Scenarios

Bullish analysts predict that Archer Aviation will capture a significant share of the eVTOL market, driven by early adoption of its technology and strong partnerships.

| Source | Price Prediction (2030) | Reasoning |

|---|---|---|

| ARK Investment Research | $65 | Growing urban air mobility demand and technological leadership. |

| Morgan Stanley | $55–$70 | Scaling production and market dominance by 2028–2030. |

| Cathie Wood (ARK Invest) | $75 | Strong partnerships like United Airlines and innovative eVTOL technology. |

Moderate Scenarios

Some analysts adopt a cautious stance, citing competition and potential regulatory delays.

| Source | Price Prediction (2030) | Reasoning |

|---|---|---|

| Goldman Sachs | $40 | Regulatory challenges may slow adoption, but the long-term outlook remains positive. |

| JP Morgan | $35–$50 | Market growth depends on infrastructure readiness and public acceptance. |

Pessimistic Scenarios

Bearish analysts highlight potential risks such as increased competition, high capital requirements, and slower-than-expected market growth.

| Source | Price Prediction (2030) | Reasoning |

|---|---|---|

| Bank of America | $20–$25 | High costs and competition could limit profitability. |

| Citibank | $15 | Regulatory hurdles and market saturation risks. |

Consolidated Table of ACHR Stock Forecast 2030

| Scenario | Price Range (2030) | Probability | Comment |

|---|---|---|---|

| Optimistic | $60–$75 | 25% | Rapid market adoption and strong production scaling. |

| Moderate | $35–$50 | 50% | Steady growth but with potential delays and competition risks. |

| Pessimistic | $15–$25 | 25% | Regulatory and competitive challenges slow growth. |

Factors Influencing ACHR Stock Forecast 2030

- Market Growth: The eVTOL market’s projected CAGR of 25% presents significant opportunities for Archer.

- Regulatory Approvals: Successful FAA certification will be a key milestone for scaling operations.

- Competition: Rival companies like Joby Aviation and Lilium present significant competition in the eVTOL space.

- Strategic Partnerships: Archer’s relationship with United Airlines could pave the way for more commercial contracts and investments.

Pocket Option: A Unique Platform for Stock Price Trading

Beyond investing directly in Archer Aviation stock, traders can profit from its price movements through platforms like Pocket Option. This platform allows users to forecast stock price movements and earn up to 92% profit without actually buying or selling the asset.

Key Features of Pocket Option

- User-Friendly Interface: Easy to navigate for both beginners and experienced traders.

- Access to Over 100 Assets: Includes stocks, indices, cryptocurrencies, commodities, and currency pairs.

- $50,000 Demo Account: Practice trading strategies without any risk.

- 50% Deposit Bonus: Use the promo code 50START to receive a 50% bonus on your first deposit.

- Instant Trading: Forecast price movements in as little as one minute and earn profits instantly.

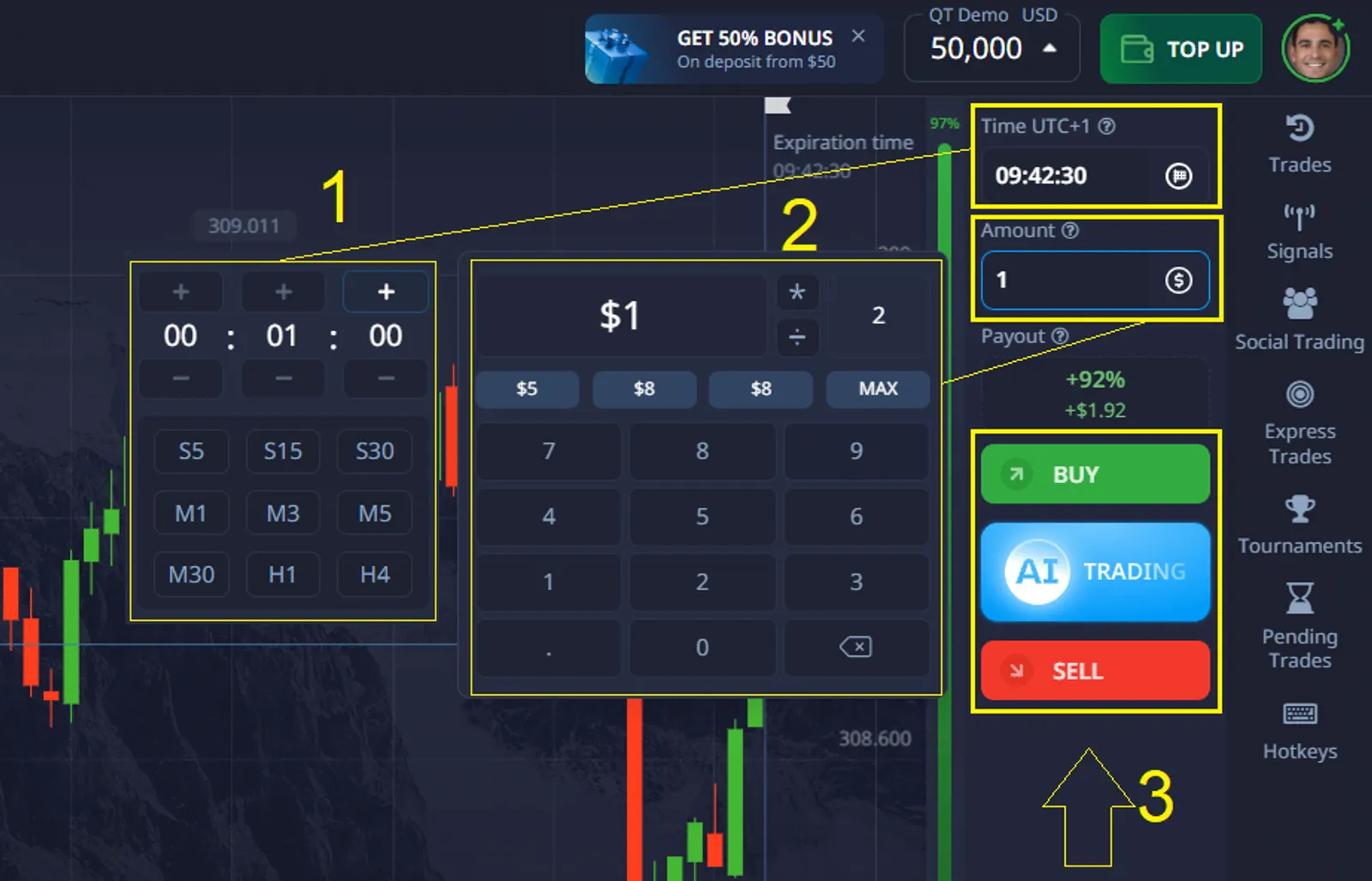

Example Trade on Pocket Option

Let’s say you want to trade on Pocket Option. At the moment, the stock is trading at $7.50 per share.

Step-by-Step Example:

- Select the Asset: Choose an instrument from the list of available assets.

- Make a Price forecast: For instance, you forecast that the price will increase in the next 1 minute.

- Set the Investment Amount: For example invest $20 in your forecast.

- Choose Trade Duration: Set the trade duration, for example 1 minute.

- Outcome: After 1 minute, the price rises from $7.50 to $7.55. Your forecast was correct.

Profit Calculation:

- Investment: $20.

- Profit: $20 × 92% = $18.4.

- Total Return: $20 + $18.4 = $38.4.

In this example, you earned $18.4 in just one minute by correctly forecasting the price movement of chosen stock!

Why Use Pocket Option?

- Flexibility: Trade without owning the asset, focusing only on price movements.

- Quick Profits: Short-term trades allow you to earn up to 92% profit in minutes.

- Low Entry Barrier: Open real account with a small investment from $5, making the platform accessible to all.

- Analytical Tools: Use charts and indicators to make informed forecasts.

Conclusion

The Archer Aviation stock prediction for 2030 highlights significant growth potential for the company, supported by its innovative technology, strong partnerships, and the expanding eVTOL market. While optimistic scenarios suggest a price range of $60–$75, moderate and cautious forecasts place the stock between $35 and $50, depending on market and regulatory developments.

For those interested in short-term profit opportunities, platforms like Pocket Option provide a unique way to trade Archer Aviation stock price movements without owning the asset. With features like a user-friendly interface, demo accounts, and high-profit potential, Pocket Option is an excellent choice for both novice and experienced traders.

Whether you’re investing directly in Archer Aviation or trading its stock price movements, the future of this innovative company offers exciting opportunities!

FAQ

What is Archer Aviation’s main focus as a company?

Archer Aviation specializes in developing electric vertical takeoff and landing (eVTOL) aircraft, aiming to revolutionize urban air mobility with sustainable, quiet, and efficient transportation solutions.

What are the key factors influencing Archer Aviation’s stock price prediction for 2030?

Key factors include regulatory approvals (such as FAA certification), market growth in the eVTOL sector, competition from companies like Joby and Lilium, and strategic partnerships like the one with United Airlines.

How can I trade Archer Aviation stock without owning it?

Platforms like Pocket Option allow you to trade on Archer Aviation’s stock price movements without owning the shares. You can start with as little as $1 and earn up to 92% profit by correctly forecasting short-term price changes.

What is the projected price range for Archer Aviation stock by 2030?

Expert predictions vary: optimistic scenarios place the stock between $60–$75, moderate forecasts suggest $35–$50, while more cautious estimates forecast $15–$25.

Can I practice trading Archer Aviation stock before risking real money?

Yes, platforms like Pocket Option offer a free demo account with $50,000 in virtual funds, allowing you to practice and refine your trading strategies risk-free.