- 🖥️ Desktop CPUs: AMD reached a record 28% market share in Q1 2025, driven by the popularity of the Ryzen 9800X3D among gamers and content creators.

- 🗄️ Server CPUs: The company secured 39.4% of the server market, thanks to wide adoption of EPYC Genoa chips across enterprise cloud and data infrastructure.

- 🎮 Graphics Cards: In March 2025, AMD held 16.87% GPU market share, reflecting strong Radeon RX performance amid ongoing competition with Nvidia.

- 🕹️ Gaming Consoles: AMD continues to dominate the console space, supplying custom processors for Sony’s PlayStation 5 and Microsoft’s Xbox Series X/S, with an estimated ~45% market share in this niche.

AMD Stock Forecast 2030: Analysis of Long-Term Growth Potential and Market Position

If you're considering long-term investments in the tech space, you've probably searched for the amd stock forecast 2030. You're not alone—many traders on platforms like Pocket Option want to understand if AMD is a good bet for the next decade. This guide offers in-depth analysis, expert predictions, price scenarios, and strategic insights—all grounded in current trends and long-term outlooks.

Where AMD Stands Today

As of May 28, 2025, AMD (Advanced Micro Devices) stock is trading at $114.56, up 3.85% over the previous day. This surge reflects investor optimism fueled by the company’s consistent innovation in CPUs, GPUs, and custom silicon across key tech sectors.

📊 Market Position Breakdown

| Segment | Market Share | Key Products |

|---|---|---|

| Desktop CPUs | 28% | Ryzen 7000 & 9000 Series, incl. Ryzen 7 9800X3D |

| Server CPUs | 39.4% | EPYC Genoa line for data centers and cloud |

| GPUs | 16.87% | Radeon RX 7000 & 9000 Series |

| Gaming Consoles | ~45% | Custom SoCs for PlayStation 5, Xbox Series X/S |

🔍 Segment Highlights

💰 Financial Snapshot

In Q1 2025, AMD posted record revenue of $7.438 billion, a 36% YoY increase. Net income stood at $709 million, with a 50% gross margin—demonstrating robust operational efficiency.

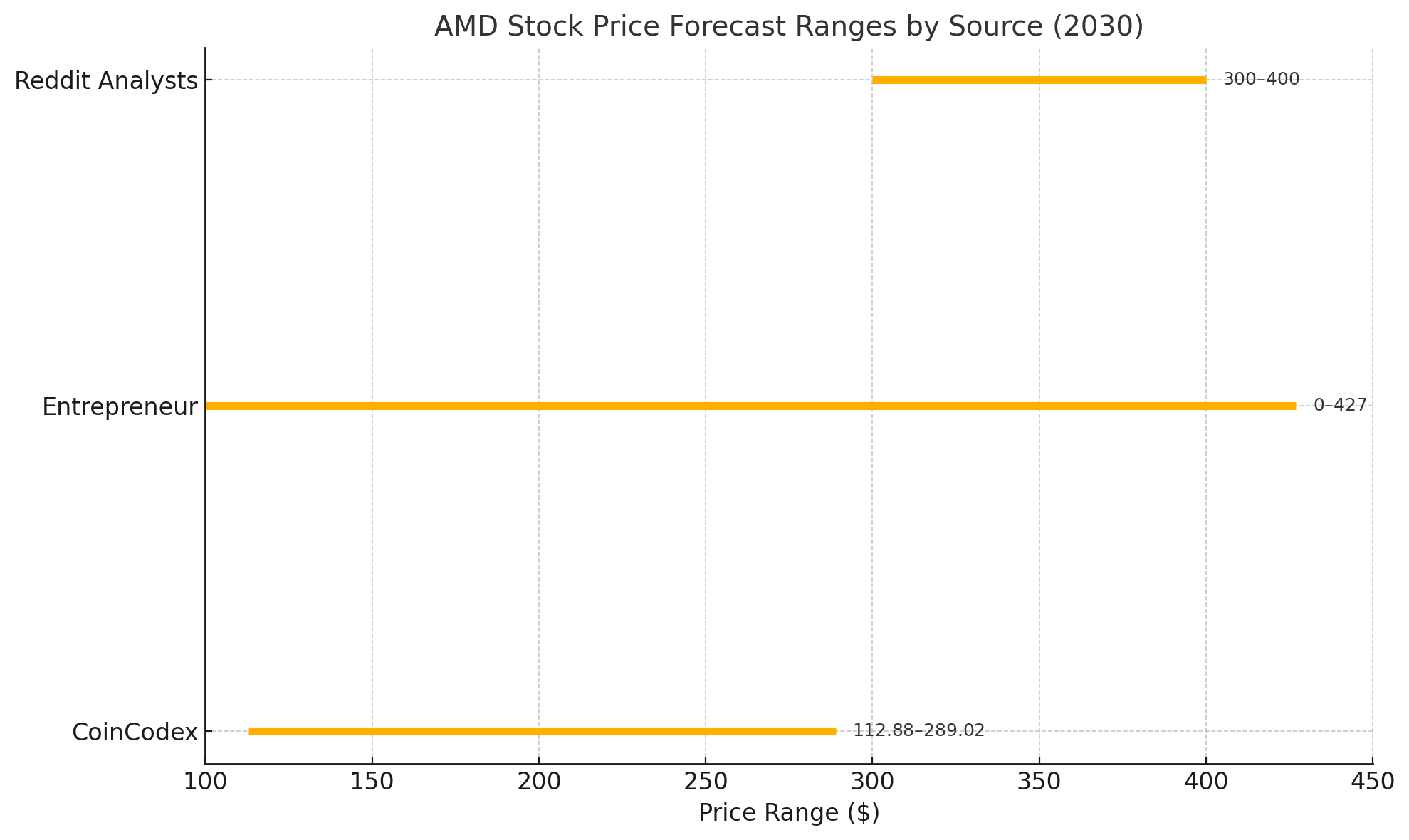

Analyst Insights and AMD Stock prediction to 2030

Industry experts and financial analysts expect AMD to continue its upward momentum through 2030, fueled by high-demand sectors like AI, cloud infrastructure, and high-performance computing. Analysts have set a price target 5 years from now for AMD ranging between $180 and $400, driven by expected growth in AI, gaming, and enterprise markets.

| Source | Price Range ($) | Notes |

|---|---|---|

| CoinCodex | 112.88 – 289.02 | Technical analysis-based forecast using historical price action and trend patterns |

| Entrepreneur | Up to 427 | Based on expected 25% annual profit growth and market cap expansion to $690 billion |

| Reddit Analysts | 300 – 400 | Based on EPS and P/E ratios projected from historical growth trends and AI market share |

Forecast Scenarios: Where Could AMD Stock Be in 2030?

| Scenario | Assumptions |

|---|---|

| Conservative | Tough competition, pricing pressure, slower AI adoption |

| Base Case | Gradual gains in data center & gaming, stable margins |

| Bullish | Dominant in AI/cloud, significant market share from Intel and Nvidia |

Based on analyst data and compound annual growth rate models, AMD stock price 2030 could trade between $180 and $400. Analysts have set a price target 5 years from now for AMD ranging between $150 and $300, driven by expected growth in AI, gaming, and enterprise markets.

What Is the Stock Price Prediction for AMD in 2040?

- Conservative outlook: ~$250

- Moderate outlook: ~$300

- Bullish projection: ~$350–400

These outcomes would reflect a CAGR of 8–12% from current prices.

What is the outlook for AMD in 2025?

- Launch next-generation Zen processors

- Expand AI presence via Xilinx and Nod.ai integrations

- Deepen its footprint in enterprise cloud and hyperscaler markets

What Is the Future Forecast for AMD Stock 2030?

- Sustained R&D investment

- Execution of strategic acquisitions

- Ability to navigate industry-wide shifts and global supply chain pressures

While volatility is expected, AMD remains well-positioned to capitalize on global AI and computing trends.

Is AMD a Good Long Term Investment?

If you’re aiming to build wealth through long-term exposure to innovation-heavy tech, AMD offers both promise and risk. It’s not without volatility, but with the right entry point and patience, AMD could deliver solid gains by 2030 and beyond.

- Why investors are optimistic:

- Leading innovation in chip architecture

- Penetration into AI and high-performance segments

- Historical consistency in executing product roadmap

- Risks to consider:

- Intense pressure from Nvidia and Intel

- Geopolitical tensions and supply chain dependencies

- Market cyclicality affecting earnings visibility

A Closer Look at the Competition

- Intel is ramping up investments in manufacturing and new architectures.

- Nvidia leads AI training workloads, with MI300 expected to challenge H100 in efficiency.

- Emerging rivals from China and Arm-based chip designers are rapidly innovating.

- AMD must not only compete on performance, but also deliver value and flexibility across data center, PC, and custom SoC markets.

Innovation Pipeline: Technology in Motion

- Advanced chiplet architectures

- Sub-2nm process adoption

- Integration of AI-optimized designs

- Expansion into custom hardware and automotive chips

These technologies will shape the company’s ability to lead in AI compute, edge devices, and specialized workloads.

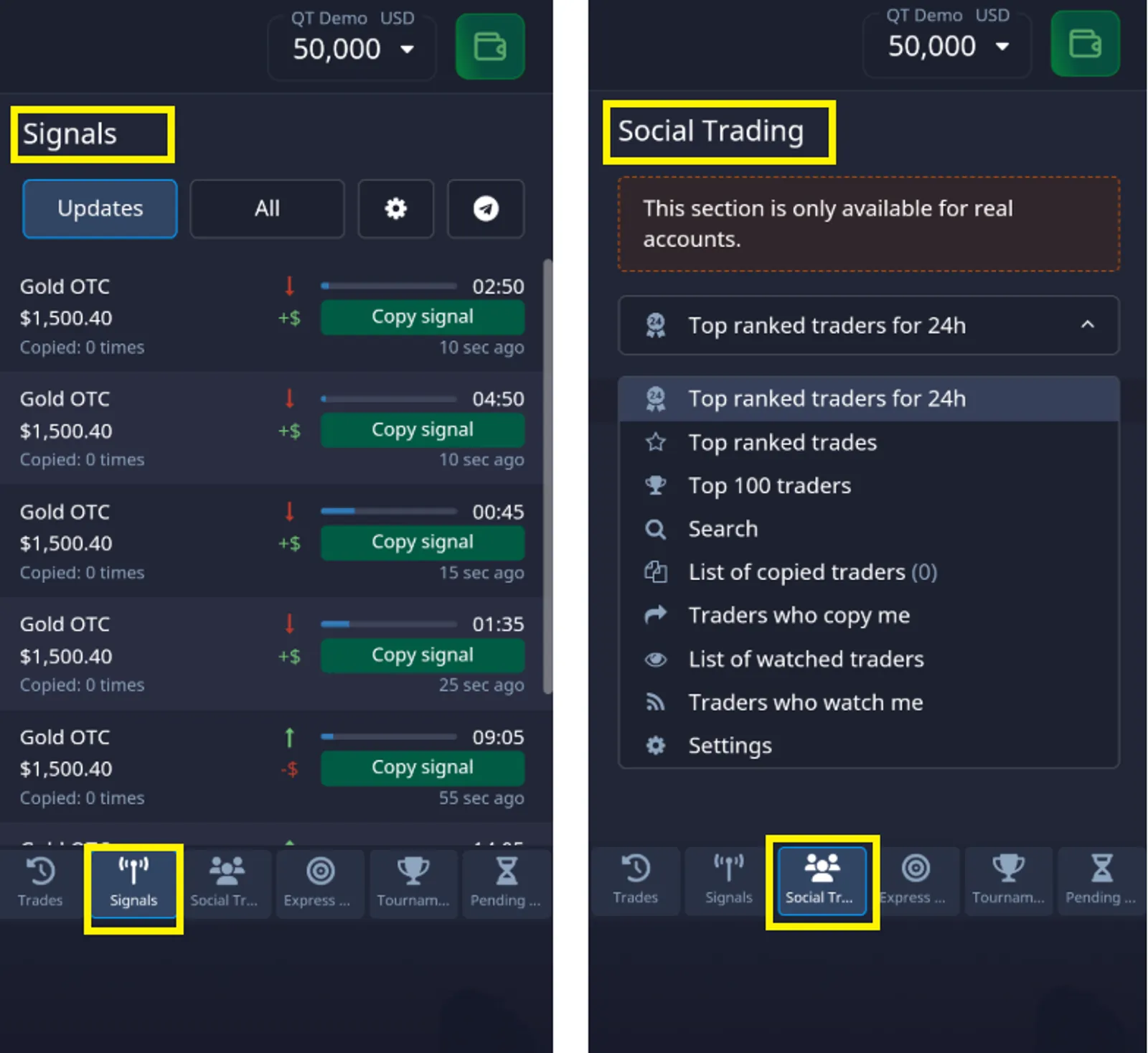

Pocket Option: Trade Stock With Precision

- Smart Trading Tools: Pocket Option offers AI bots and customizable strategies tailored for stock trading. Automate your decisions and stay ahead of market shifts.

- Social & Competitive Features: Follow top stock traders, copy their strategies, or compete in tournaments to sharpen your skills.

- Global Access & Bonuses: Deposit easily via 50+ payment methods. Benefit from trading bonuses and promo codes for extra value.

- Learning While Trading: Pocket Option provides tutorials, analytics, and round-the-clock support to help you trade stocks with confidence.

- Mobile-First Experience: Monitor stock trends and manage trades anytime, anywhere. Ideal for reacting to market news on the go.

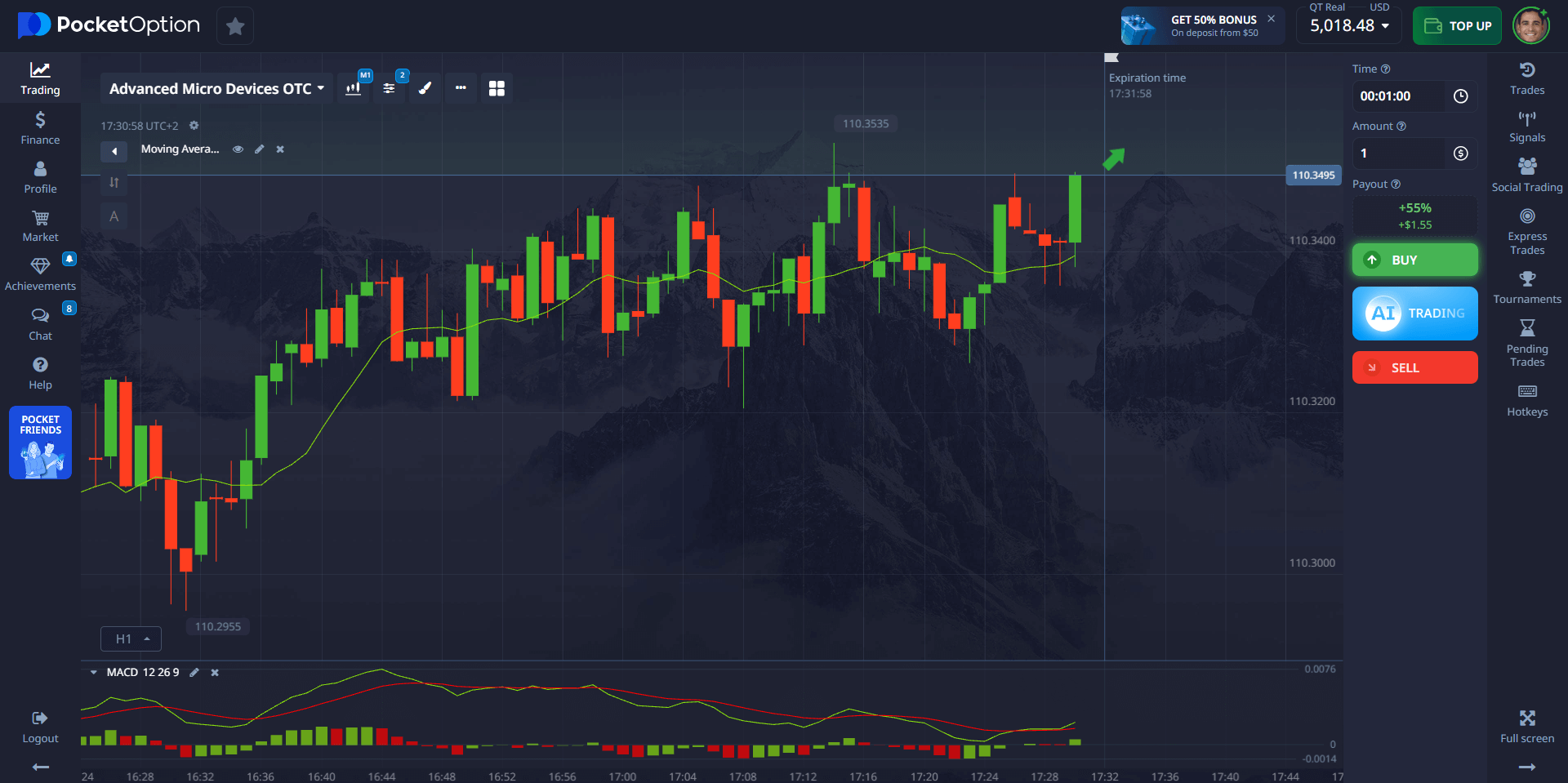

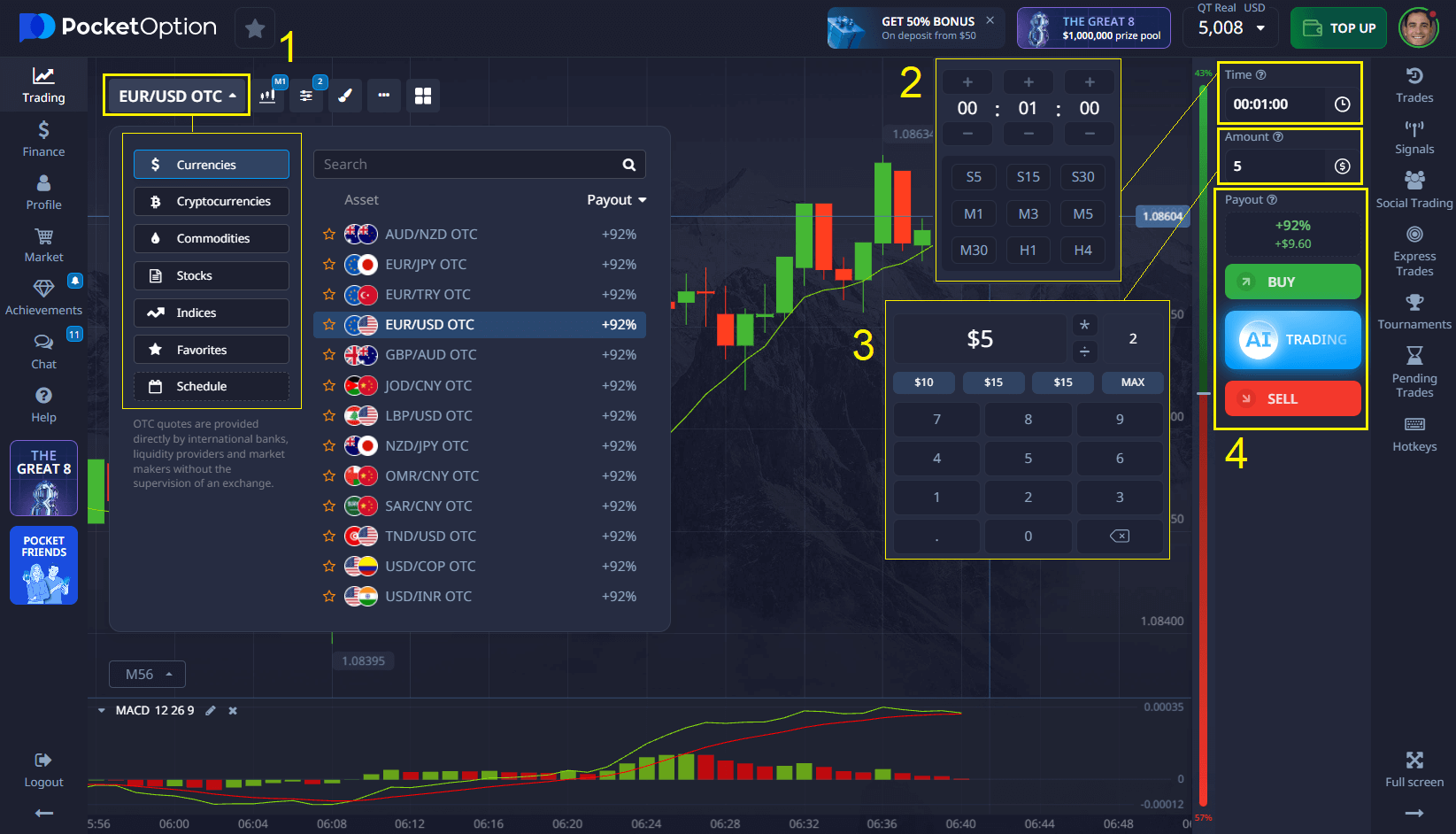

How to Open a Trade on AMD with Pocket Option

- Choose the Asset: Select “AMD” from the list of available stock assets.

- Analyze the Market: Use the sentiment indicator or apply technical analysis tools available directly on the trading screen. Look for support/resistance zones or momentum signals.

- Set Your Trade Amount: Decide how much to invest — starting from as little as $1.

- Pick an Expiry Time: Select the trade duration. For AMD, you can choose from short-term windows (as little as 5 seconds on OTC markets) or longer-term options.

- Make Your Forecast: If you believe AMD’s price will rise during the chosen time period, click Buy. If you expect it to drop, click Sell.

- Get Your Result: If your prediction is correct, you’ll earn a return of up to 92%, clearly shown before placing the trade.

💡 Tip: With a real account starting from just $5, you unlock features like copy trading, cashback on trades, and enhanced tools for stock market strategies.

Final Take: Where Will AMD Be in 2030?

With strategic bets in AI, cloud, and chip design innovation, AMD is poised to ride structural tech trends. It faces strong competition—but also presents one of the most compelling long-term stories in semiconductors.

According to leading analysts, the amd stock price prediction 2030 ranges between $180 and $400, depending on market conditions and AMD’s continued success in AI and data center growth. Whether you’re a long-term investor or an active trader, keeping AMD on your radar makes sense for the next decade. Discuss this and other topics in our community!

FAQ

What is the future forecast for AMD stocks?

While specific numbers vary among analysts, most projections suggest AMD could see significant growth from current levels, contingent on successful execution in AI and data center markets, alongside maintaining competitiveness in consumer segments.

How does AMD's AI strategy impact its long-term outlook?

AMD's AI strategy is crucial for its growth potential, as this represents one of the fastest-growing semiconductor segments. Their development of specialized AI accelerators and integration of AI capabilities across product lines will significantly influence their market position by 2030.

What risks could negatively affect AMD's stock performance by 2030?

Key risks include intensified competition from Intel and NVIDIA, potential market saturation, manufacturing challenges with advanced nodes, and macroeconomic factors affecting the broader technology sector.

How does AMD's acquisition strategy influence its growth prospects?

AMD's strategic acquisitions, like Xilinx, have expanded its technological capabilities and market reach. Future smart acquisitions could enhance AMD's competitive position in specialized markets and contribute to diversified revenue streams.

Should investors consider AMD for long-term portfolio inclusion based on 2030 projections?

AMD represents a potential long-term growth opportunity in the semiconductor sector, but investors should consider their risk tolerance and maintain a diversified portfolio. Regular reassessment of AMD's competitive position and execution of growth strategies is advisable.