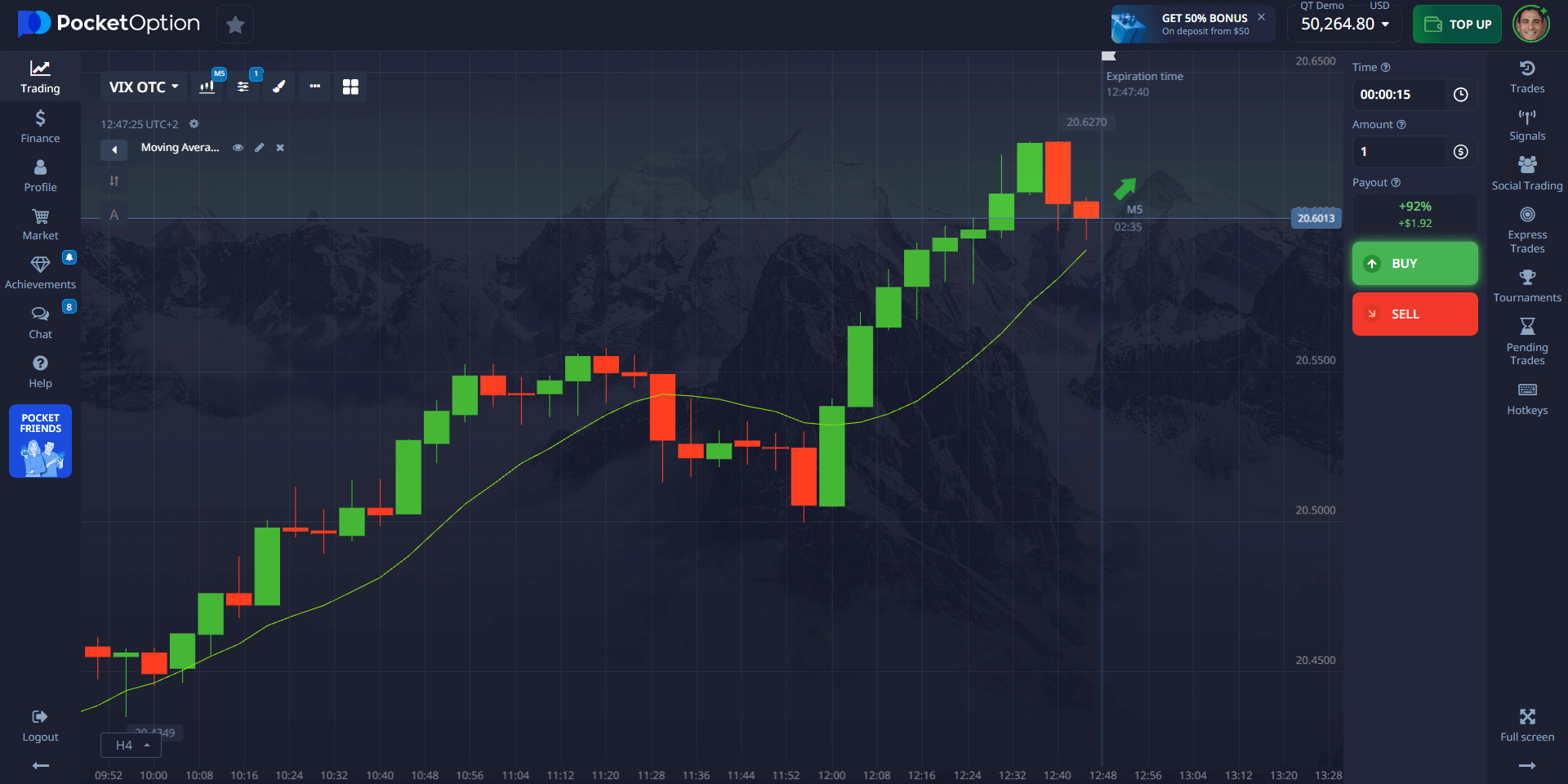

- High sensitivity to market sentiment shifts

- Ideal for contrarian strategies

- Great weekend trading asset

New OTC Assets on Pocket Option: Explore 10 Fresh Trading Opportunities

Pocket Option has expanded its trading universe with 10 new OTC assets that offer users more diversity, flexibility, and potential profit. These additions cover top stocks, volatile indices, and regional currency pairs, making them ideal for short-term and weekend trading.

Article navigation

- 1. VIX Index

- 2. Palantir Technologies (PLTR)

- 3. GameStop Corp. (GME)

- 4. Advanced Micro Devices (AMD)

- 5. Coinbase Global (COIN)

- 6. Marathon Digital Holdings (MARA)

- 7. NGN/USD (Nigerian Naira / US Dollar)

- 8. KES/USD (Kenyan Shilling / US Dollar)

- 9. ZAR/USD (South African Rand / US Dollar)

- 10. UAH/USD (Ukrainian Hryvnia / US Dollar)

Whether you’re into tech stocks, crypto exposure, or exotic forex, there’s something for every trader in this lineup. Trade the movement of popular stocks, indices, and currencies around the clock with returns of up to 92%. Read more in our article on how to start trading.

1. VIX Index

Often referred to as the “fear index,” the VIX measures expected market volatility. Traders use it to speculate on market uncertainty — a rising VIX often signals market stress. It’s a powerful asset during global events or earnings seasons.

Key points:

2. Palantir Technologies (PLTR)

Palantir is a major player in big data analytics and government contracts. Its volatility and popularity among retail investors make it a favorite for speculative trades.

Why trade PLTR?

- Strong momentum stock

- Tied to AI, data, and defense sectors

- Popular among short-term traders

3. GameStop Corp. (GME)

GameStop became a meme stock phenomenon. Still volatile, it offers frequent price swings and is driven by retail sentiment and news catalysts.

- High retail investor attention

- Good for rapid intraday movements

- Watch earnings and social media buzz

4. Advanced Micro Devices (AMD)

AMD is a key semiconductor company competing with Nvidia and Intel. It moves with the tech sector and reacts strongly to chip demand trends.

- Tied to AI and gaming trends

- Earnings and chip sector news impact price

- Suitable for news-driven trades

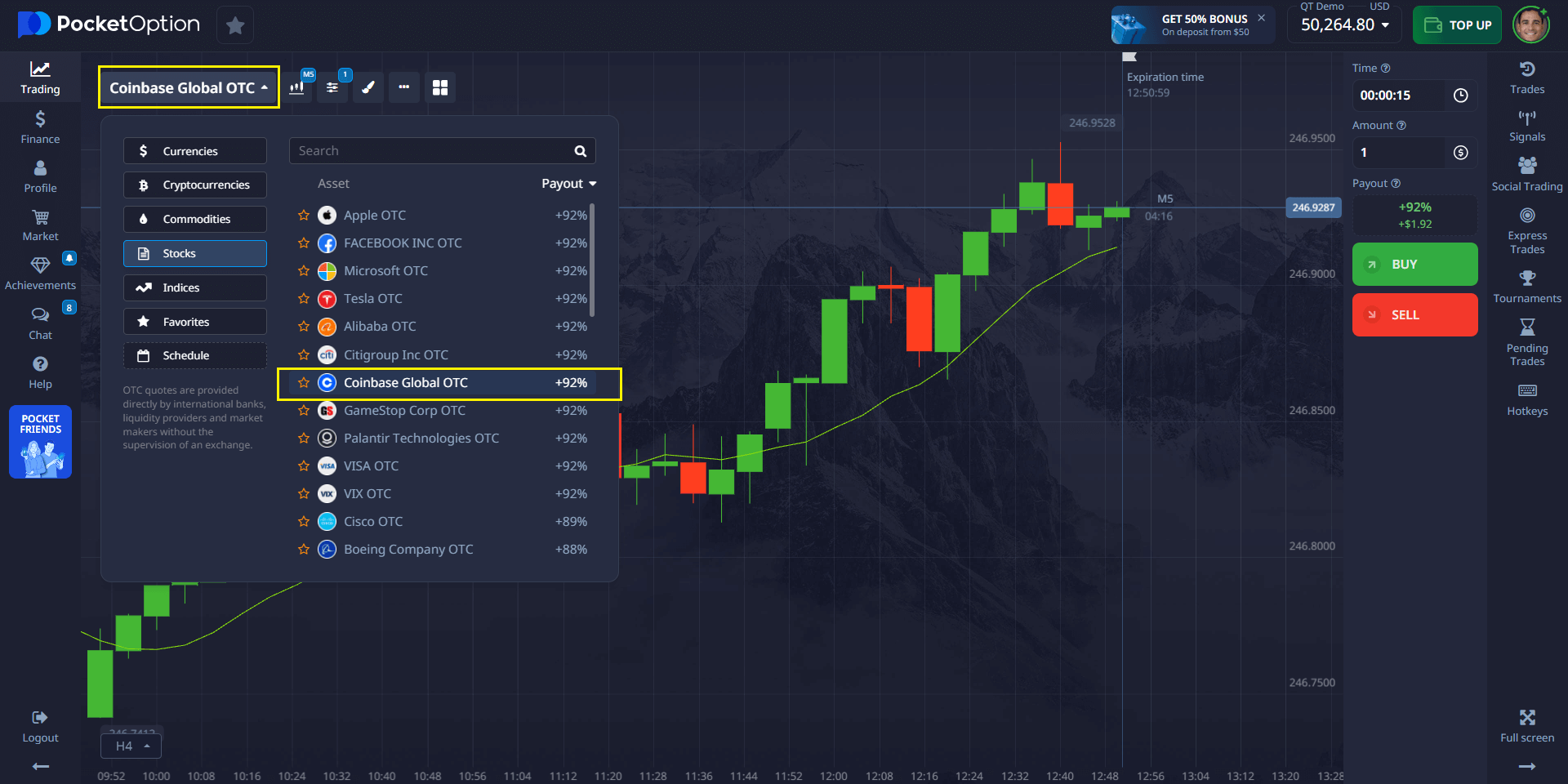

5. Coinbase Global (COIN)

Coinbase is a major cryptocurrency exchange. It moves in correlation with the crypto market, especially Bitcoin and Ethereum.

- Correlated with BTC/ETH movements

- Ideal for crypto-minded traders

- Reacts to regulation and adoption news

6. Marathon Digital Holdings (MARA)

Marathon is a major Bitcoin mining company. As with Coinbase, it offers leveraged exposure to crypto prices, but with more volatility.

- Strong BTC correlation

- Volatile miner stock, ideal for speculation

- Follow Bitcoin network difficulty and price

7. NGN/USD (Nigerian Naira / US Dollar)

Exotic currency pair, often affected by oil prices, political policy, and inflation in Nigeria.

- High spreads but good for macro plays

- Responds to OPEC news

- African market exposure

8. KES/USD (Kenyan Shilling / US Dollar)

Another regional currency reflecting East African economic conditions, including tourism, agriculture, and trade flows.

- Thin liquidity, high-risk/reward

- Good for regional insight

- Reacts to local monetary policy

9. ZAR/USD (South African Rand / US Dollar)

ZAR/USD is known for its volatility and connection to commodities like gold and platinum.

- High volatility

- Influenced by global risk sentiment

- Track commodity cycles

10. UAH/USD (Ukrainian Hryvnia / US Dollar)

Emerging market pair impacted by geopolitics, conflict, and IMF support.

- Political risk premium

- Sharp reactions to macro headlines

- Speculative asset