- Simple Forecasting Mechanics: You don’t need to purchase or hold physical gold. Instead, you simply forecast whether the price will rise or fall over a chosen time period.

- Up to 92% Profit Potential: If your forecast is correct, you can earn profits up to 92%. This percentage is clearly visible before you open your trade.

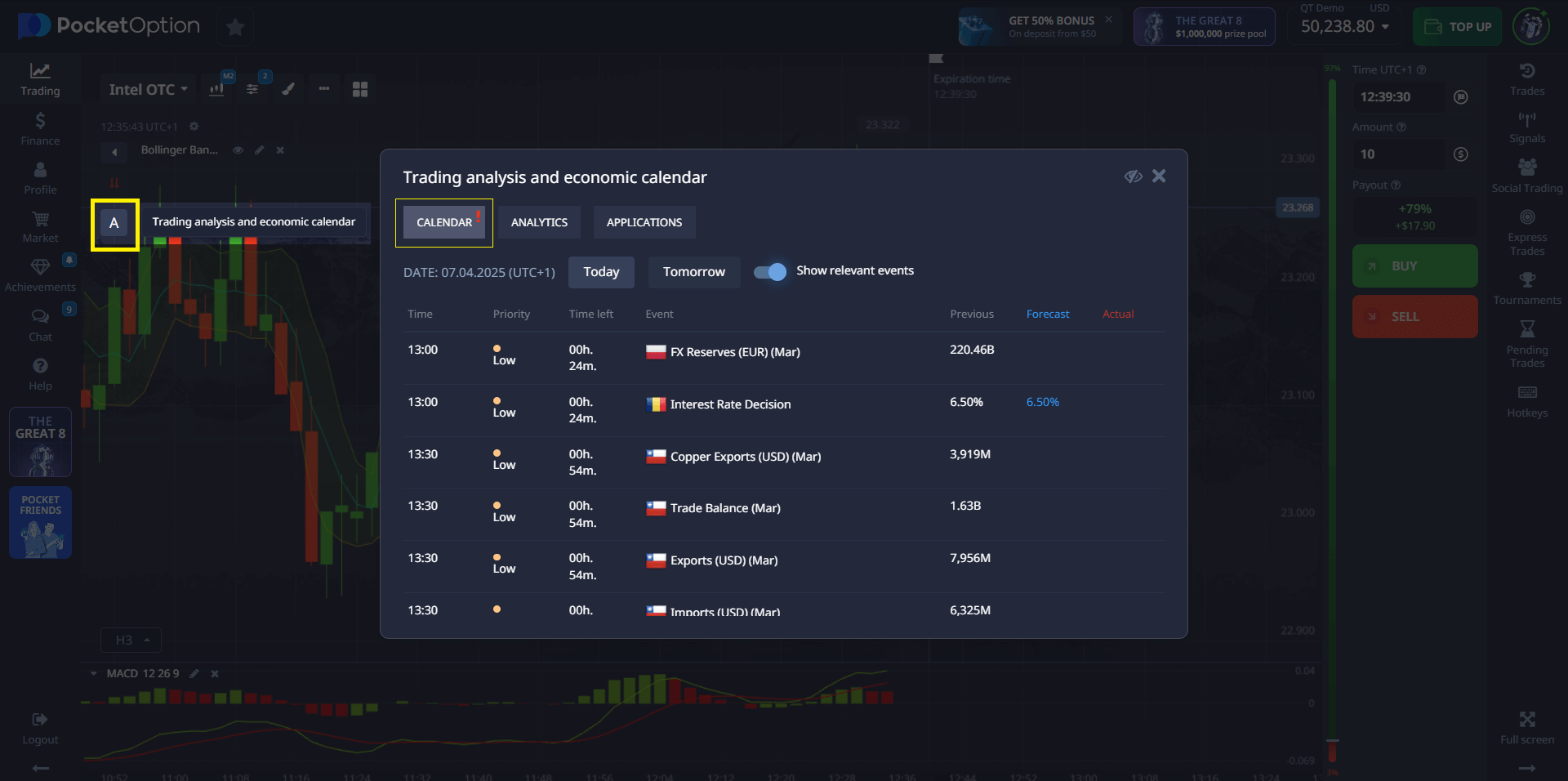

- Access to Advanced Tools: Use the built-in Economic Calendar on the platform to stay informed about key market-moving events, such as Federal Reserve statements or employment data.

Gold Prices Climb Following Fed's Economic Warning and Trade Focus

Gold markets experienced notable gains after the Federal Reserve issued statements expressing concern about economic conditions, driving investors toward safe-haven assets. Market attention has simultaneously shifted to upcoming US trade negotiations that could further influence commodity prices.

Article navigation

- Markets React to Federal Reserve’s Cautionary Tone

- Economic Concerns Drive Safe-Haven Demand

- Trade Negotiations Under Market Spotlight

- Broader Implications for Commodity Markets

- Outlook and Technical Considerations

- How to Trade Gold During Volatile Periods?

- Advantages of Trading Gold on Pocket Option

- Example: How to Open a Gold Trade on Pocket Option

- Exclusive Benefits on a Real Account

Markets React to Federal Reserve’s Cautionary Tone

Gold prices advanced on Wednesday following cautionary economic commentary from the Federal Reserve. The precious metal, traditionally considered a safe-haven during periods of uncertainty, gained traction as investors processed the Fed’s concerned outlook regarding economic stability.

Spot gold climbed approximately 0.8% to $2,373.49 per ounce while gold futures for June delivery rose 0.9% to $2,394.20. This upward movement reflects growing investor anxiety about potential economic headwinds and monetary policy directions.

Economic Concerns Drive Safe-Haven Demand

The Federal Reserve’s latest communications highlighted several challenges facing the economy, prompting investors to reassess risk exposures. Economic growth concerns combined with persistent inflation pressures have created an environment typically favorable for precious metals.

“The overall economic data remains mixed, with ongoing concerns about inflation persistence despite some moderating signals,” noted a senior market analyst. “This uncertainty creates a supportive environment for gold as investors seek portfolio protection.”

Technical Analysis on Pocket Option

Trade Negotiations Under Market Spotlight

Beyond monetary policy considerations, market participants have increasingly focused on developments in US trade negotiations. Forthcoming discussions with major trading partners could substantially impact various commodity markets, with precious metals particularly sensitive to such developments.

These negotiations occur amid delicate global trade relations, with ongoing debates about tariffs, market access, and trade balances creating additional uncertainty for commodity investors.

Broader Implications for Commodity Markets

The current gold price movement coincides with fluctuations across other commodity sectors. Energy markets have displayed significant volatility, while industrial metals remain reactive to manufacturing outlook revisions and supply chain considerations.

“We’re witnessing typical risk-hedging behavior across multiple asset classes,” observed one market strategist. “The precious metals sector is benefiting from the uncertainty premium currently being factored into financial markets.”

Outlook and Technical Considerations

Looking forward, several key economic indicators expected in the coming days may provide further direction for gold and related assets. Employment statistics, manufacturing data, and inflation metrics all have potential to significantly influence market sentiment.

Technical analysts have identified resistance levels around $2,400 that gold must surpass to confirm a sustained bullish trend. Meanwhile, central bank purchasing activities continue to represent an important fundamental factor supporting the gold market.

As economic conditions evolve and trade discussions advance, gold prices will likely remain sensitive to both macroeconomic indicators and geopolitical developments in the weeks ahead.

How to Trade Gold During Volatile Periods?

Periods of high market volatility, such as those triggered by cautious Federal Reserve communications or trade negotiations, often create lucrative opportunities in the gold market. However, these conditions also require careful risk management and strategic decision-making. On the Pocket Option platform, traders can take advantage of volatility without the need to directly buy or sell gold.

Advantages of Trading Gold on Pocket Option

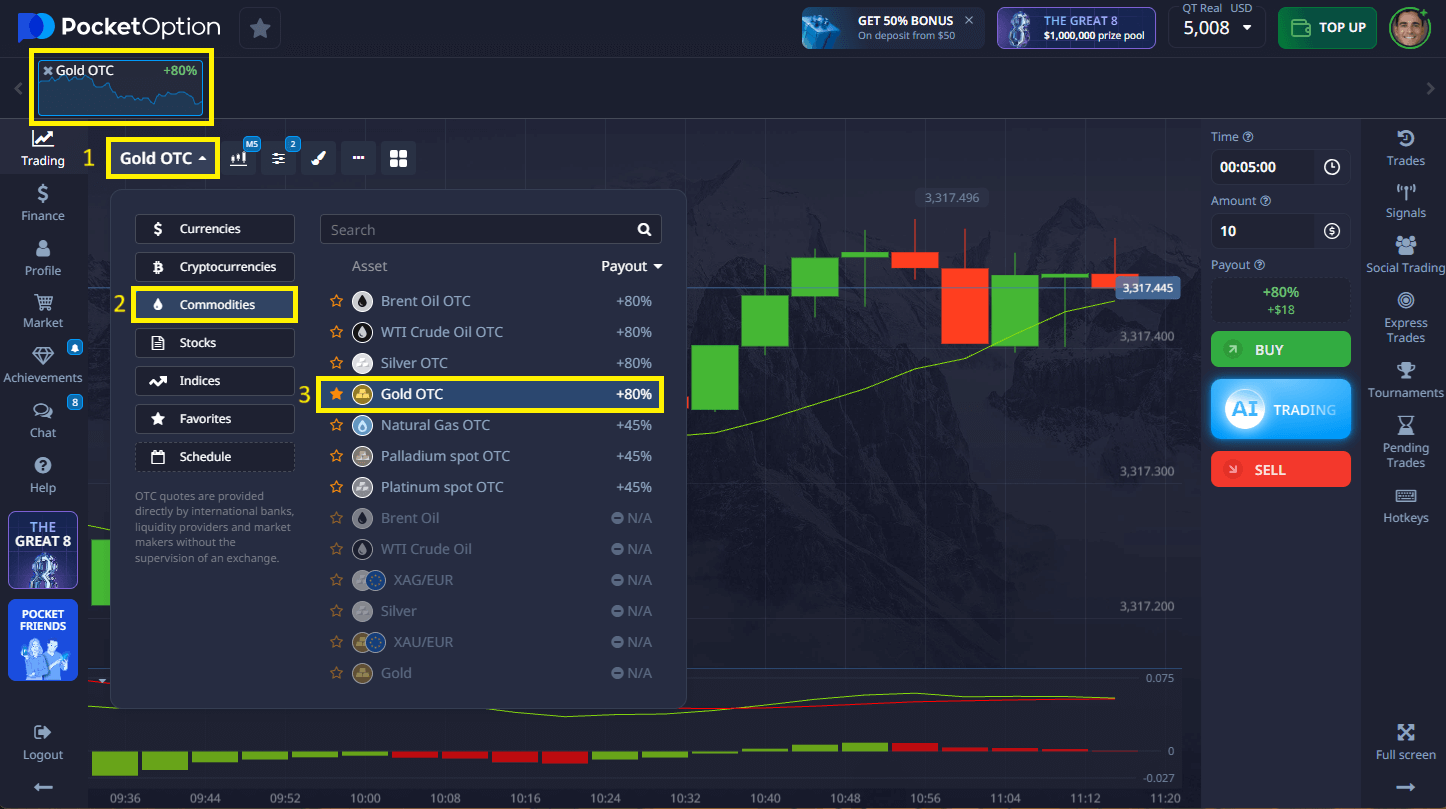

Example: How to Open a Gold Trade on Pocket Option

- Select the Asset: On the main screen, choose gold from the asset list.

- Analyze the Chart: Use tools like the Trader Sentiment Indicator or apply technical analysis indicators (RSI, Bollinger Bands, etc.) to gauge the market direction.

- Set the Trade Amount: Choose your trade size starting from as little as $1.

- Set the Timeframe: Pick your desired trade duration, from 5 seconds on OTC assets to longer periods during active market hours.

- Make Your Forecast: Click BUY if you think the price will rise, or SELL if you expect it to fall.

- Profit Opportunity: If your forecast is correct when the time expires, you receive the profit—up to 92% as displayed for the selected asset.

Exclusive Benefits on a Real Account

When you upgrade to a real account (available from just $5 deposit), you unlock additional benefits:

- Access to Copy Trading and follow top-performing traders.

- Earn cashback on your trades.

- Participate in tournaments and promotions.

- Full access to all trading tools and features.

Gold remains a preferred choice during volatile markets, and with Pocket Option, you can navigate these conditions efficiently using built-in tools and real-time insights.