- Infrastructure requirements and scalability options

- Data quality validation processes

- Integration with existing trading systems

- Compliance with regulatory standards

Advanced Real Time Market Data Solutions

The evolution of trading technology has made real-time market data an essential component for successful trading operations. Modern platforms offer sophisticated tools that transform raw data into actionable insights, enabling traders to make informed decisions quickly and efficiently. From realtime trading analytics to global data feeds, access to real time market data today is more critical than ever for both institutional and individual traders.

“The edge in modern trading isn’t just strategy—it’s timing. Access to accurate real-time market data can be the difference between a winning trade and a missed opportunity.” — Daniel K., Senior Market Analyst, EquityEdge Capital

Real-time market data encompasses a broad range of financial information across multiple asset classes—stocks, indices, currencies, commodities, and bonds. It includes live stock prices, quotes, trade volumes, and index values, all streamed with minimal delay. This real-time insight is vital for accurate analysis, timely investment decisions, and responsive trading strategies.

Top Real Time Market Data Platforms of 2025

| Platform | Key Features | Data Coverage | Integration Options |

|---|---|---|---|

| DataStream Pro | Low latency feeds, API access | Global markets | REST, WebSocket |

| MarketPulse Elite | Custom alerts, analytics | Stocks, forex, crypto | FIX protocol |

| QuantEdge Suite | Machine learning models | Multi-asset coverage | Python libraries |

“Pocket Option’s real-time interface gives me exactly what I need—speed, clarity, and global access.” — Louis T., active crypto and forex trader

Implementation Strategies

Implementing real-time trading data solutions requires careful consideration of several key factors:

| Infrastructure Type | Benefits | Considerations |

|---|---|---|

| Cloud-based | Flexible scaling, lower maintenance | Latency concerns |

| On-premises | Full control, minimal latency | Higher costs |

| Hybrid | Balanced approach | Complex setup |

“We always advise clients to prioritize real-time data quality. Inconsistent feeds can distort analysis and hurt long-term performance.” — Dr. Emily J., Quantitative Finance Advisor

Data Quality Metrics

- Timestamp accuracy and consistency

- Price feed reliability

- Data completeness checks

- Error detection mechanisms

| Metric | Importance | Monitoring Method |

|---|---|---|

| Latency | Critical | Automated testing |

| Accuracy | Essential | Cross-validation |

| Availability | High | System monitoring |

Integration Protocols

| Protocol | Use Case | Performance |

|---|---|---|

| WebSocket | Real-time updates | High |

| REST API | Historical data | Medium |

| FIX Protocol | Order execution | Very high |

Modern trading operations heavily rely on real-time market data for decision-making. The quality and reliability of data feeds directly impact trading performance and risk management capabilities. Many traders now access U.S. stock market live data through specialized real-time market data APIs or apps, enabling global coverage and minimal delays in execution.

Optimization Techniques

- Data compression methods

- Caching strategies

- Load balancing configurations

- Failover mechanisms

“I trust Pocket Option to deliver consistent data with no delays during market volatility—it’s key to my scalping strategy.” — Reema V., full-time day trader

Where can I get real-time market data?

You can obtain real time market data free or via premium subscriptions from providers such as Nasdaq, NYSE, or specialized platforms like TradingView and MarketTech Analytics. These sources often offer U.S. stock market today live charts, data from every major exchange, and comprehensive market data coverage for stocks, currencies, indices, and crypto.

How to see stock market in real-time?

To monitor the U.S. stock market live, you can use financial news websites, trading terminals, or install a real time market data app that streams stock prices, quotes, and analysis tools. These applications offer real-time trading analytics and help you visualize stock market movement through interactive charts, alerts, and custom dashboards.

What does real-time market data mean?

Real-time market data refers to the immediate delivery of financial information such as stock quotes, trade volumes, and index levels with near-zero delay. It empowers analysts and traders to react instantly to changes in the market, supports short-term trades, and is essential for advanced investment analysis and automation.

Does Googlefinance provide real-time data?

No, Googlefinance provides delayed data for most instruments. For genuine real time market data, traders should rely on verified, low-latency feeds via professional platforms and real-time market data APIs. These sources ensure high coverage and deliver real-time stock, crypto, and currency prices across global markets.

Accessing reliable real-time market data today enables competitive trading and robust financial strategies. Whether through REST APIs or WebSocket streams, seamless market data integration forms the backbone of efficient trading environments.

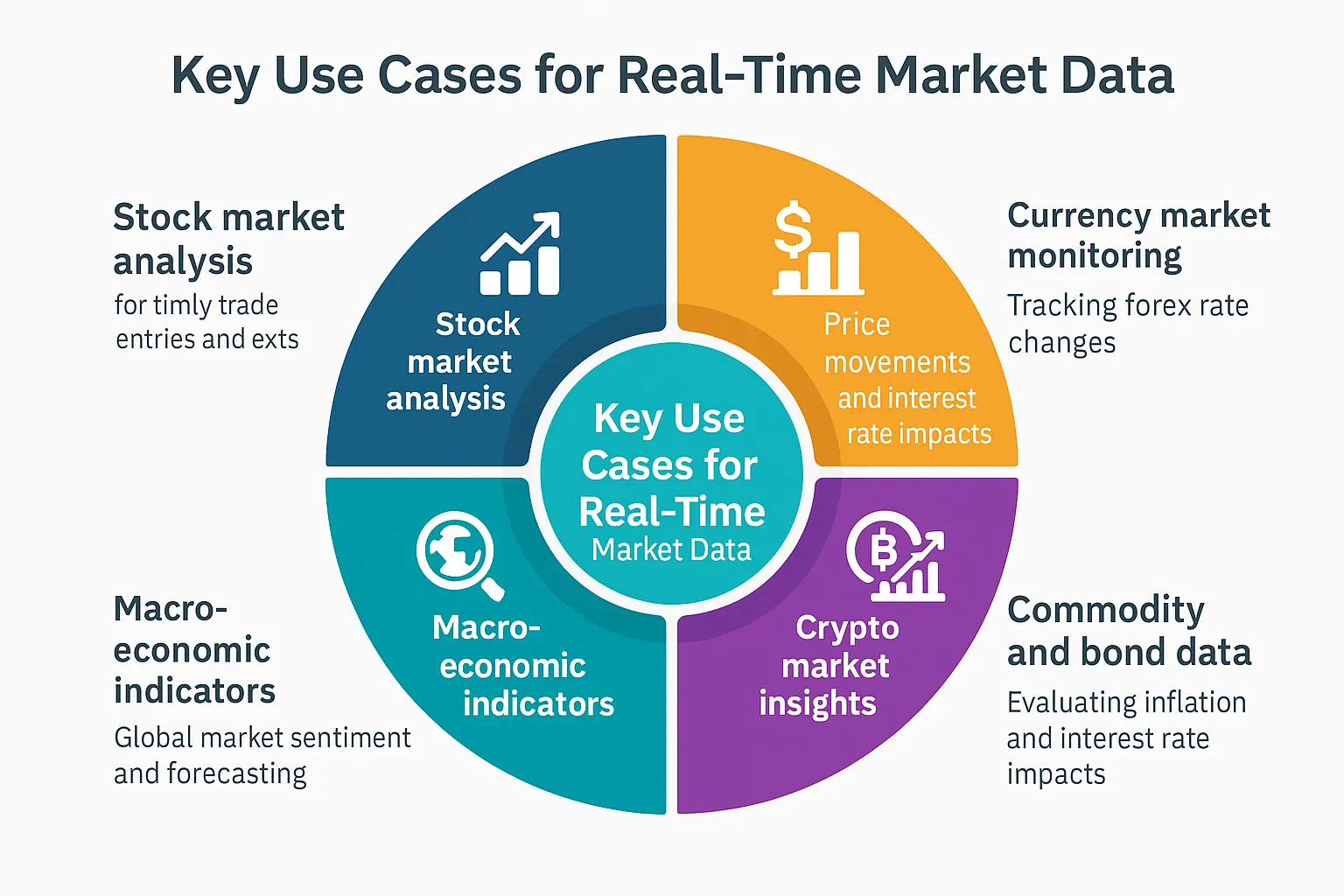

Key Use Cases for Real-Time Market Data

- Stock market analysis and trading decisions

- Currency markets and forex rate updates

- Crypto market tracking for prices and volumes

- Commodity and bond price monitoring

- Macro-level economic indicators for global outlook

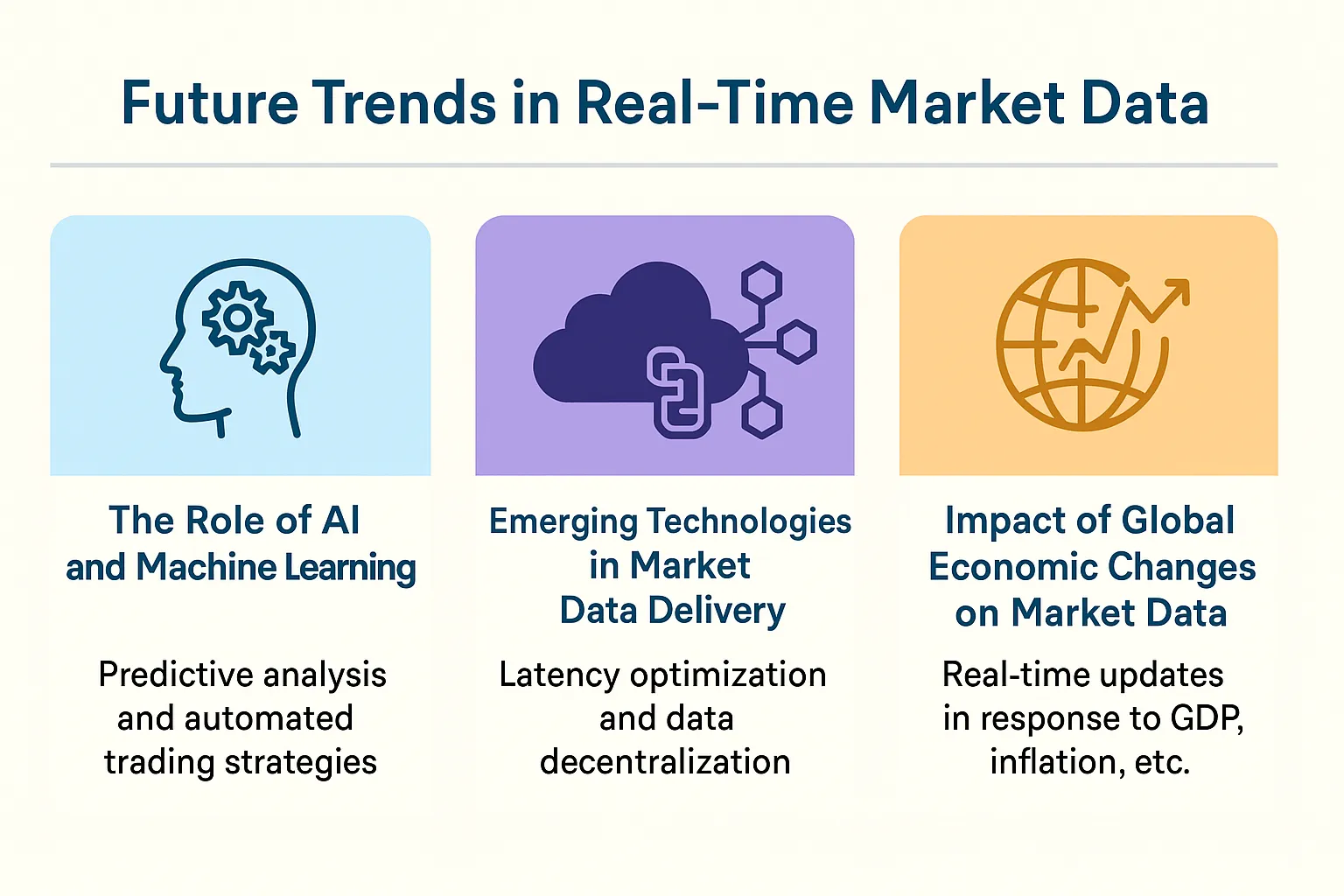

Future Trends in Real-Time Market Data

The Role of AI and Machine Learning

The future of real time market data is shaped by AI and machine learning. These technologies enable predictive analysis, pattern detection, and automated trading strategies. AI models adapt to market behavior, improving accuracy and performance.

Emerging Technologies in Market Data Delivery

Cloud computing and blockchain technology are transforming market data infrastructure. Innovations in latency optimization and data decentralization support better global coverage, higher reliability, and cost-efficient access to market data.

Impact of Global Economic Changes on Market Data

Real-time updates are critical in the context of global economic changes. Shifts in GDP, inflation, employment, or political risks impact every exchange and index. Reliable real-time data allows investors to adjust strategies quickly and stay informed.

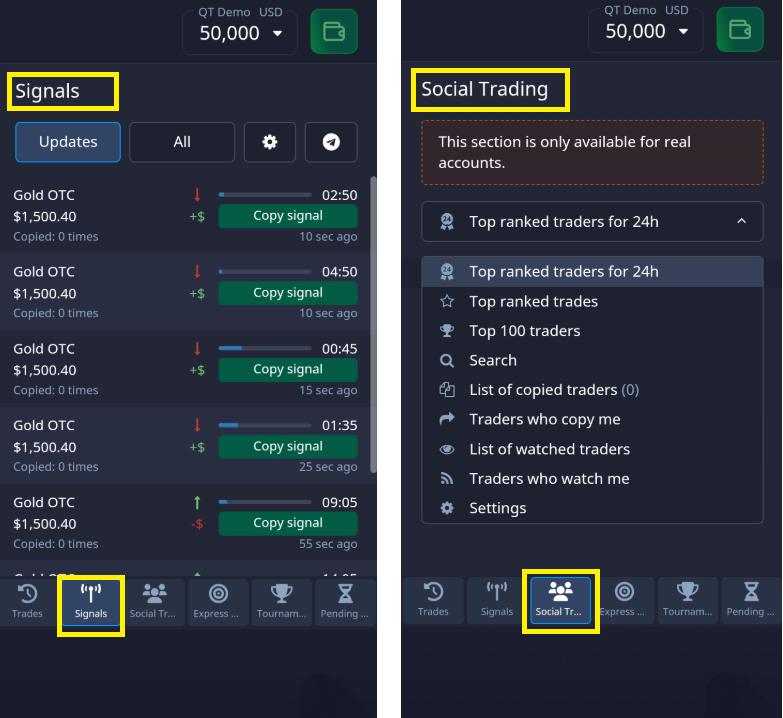

Pocket Option: Real-Time Trading with Seamless Market Data Access

Pocket Option exemplifies the power of real-time market data by offering a high-speed, intuitive platform designed for precision and performance. With access to global financial markets including stocks, currencies, indices, commodities, and crypto, Pocket Option supports informed trading decisions backed by data.

- 🔄 Live market charts with over 30 technical indicators ensure you stay on top of every market move.

- 🌐 WebSocket-powered updates mean minimal delay—crucial for active traders and analysts.

- 📱 Available on desktop and mobile, Pocket Option is built for traders who demand flexibility and speed.

Whether you’re conducting real time market analysis or executing trades in Quick Trading mode, Pocket Option delivers the tools to act instantly and with confidence.

“Platforms like Pocket Option are reshaping access to financial markets by eliminating traditional barriers. Fast execution and educational tools make it ideal for retail traders looking to grow.” — Dr. Marcus Weller, Financial Systems Researcher

Just One More Thought Before You Go

Real-time market data continues to revolutionize how traders and investors interact with the financial world. As technologies evolve and access to information becomes faster and more democratized, the edge will belong to those who are prepared, connected, and adaptive. Whether you’re trading currencies, equities, or crypto, real-time insights are your key to timely decisions and lasting success.

Discuss this and other topics in our community!

FAQ

What is the optimal infrastructure for real-time market data systems?

The optimal infrastructure depends on specific needs, but typically involves a combination of cloud and on-premises solutions, prioritizing low latency and high availability.

How can data quality be ensured in real-time systems?

Through implementation of automated validation checks, cross-reference verification, and continuous monitoring of data feeds.

What are the key considerations for selecting a market data provider?

Consider factors such as data coverage, latency specifications, reliability track record, and technical support quality.

How does real-time market data integration affect trading strategies?

It enables immediate response to market changes, improves risk management, and allows for more sophisticated algorithmic trading approaches.

What are the common challenges in maintaining real-time data systems?

Key challenges include managing latency, ensuring data accuracy, handling high volumes, and maintaining system stability during market volatility.