- Quarterly earnings

- New product launches (e.g., Pegasus running shoes)

- Marketing campaigns

- Economic indicators (e.g., inflation, spending)

- Currency fluctuations and tariffs

Nike Stock for Beginners: Forecast, Analysis, and Investment Guide

Nike, the global leader in sportswear and footwear, remains a strong contender in the stock market. For those curious about Nike stock for beginners, this article provides a complete guide on whether to invest in NKE, Nike's ticker symbol on the NYSE. We'll walk through its company background, share price trends, dividend history, expert insights, and much more.

Nike Stock Overview

Nike, Inc., headquartered in Beaverton, Oregon, trades under the ticker NKE on the New York Stock Exchange. With iconic branding and innovative design, Nike dominates the global sportswear market. In addition to its flagship brand, Nike owns Converse, expanding its portfolio in the apparel and footwear industry.

Nike’s continued investment in marketing, sustainability, and product innovation positions it as a favorite among investors looking to buy Nike stock or diversify via ETFs.

Why Beginners Look to Nike

Nike stock for beginners is a popular choice due to its brand reliability, strong fundamentals, and history of rewarding shareholders. According to Morningstar, Nike enjoys a wide economic moat, which reflects its competitive advantage over time.

Current Share Price and Performance Metrics

Real-Time Nike Stock Quote

Investors tracking the NKE stock quote observe market sentiment and valuation. The current share price reflects both investor confidence and broader market conditions. As of July 2025, NKE is trading around $102 per share, rebounding from its April low.

Key Financial Metrics (Recent Quarter)

| Metric | Value (Q2 2025) |

|---|---|

| Net Income | $1.52 billion |

| Dividend Payout | $0.34 per share |

| Earnings Per Share | $1.03 |

| Dividend Yield | ~1.3% |

| Price/Earnings (P/E) | ~28 |

Nike stock often mirrors trends in the overall stock market. As CNBC’s Jim Cramer noted recently: “Nike’s margin resilience and DTC strategy make it a dependable blue-chip stock in turbulent times.”

Investment Analysis of NKE Stock

Is Nike Stock a Buy?

For investors wondering “Is Nike stock a buy right now?”–the answer lies in understanding both short-term volatility and long-term fundamentals. Nike’s innovation in digital retail and expansion in global markets make it attractive. For long-term portfolios, analysts often list NKE as a buy.

Expert Insight: According to Bank of America, “Nike’s strategic pricing power and growing online presence position it well for high-margin growth.”

Nike Stock Split History

Nike has a notable stock split history:

| Date | Split Ratio | Description |

|---|---|---|

| 1983-10-24 | 2-for-1 | First stock split |

| 1996-10-23 | 2-for-1 | Third major split |

| 2015-12-23 | 2-for-1 | Most recent split |

How many times has Nike stock split? The answer is 7 times as of 2025.

✨ These splits reflect management’s effort to keep the stock affordable, especially appealing for beginners.

What Affects Nike’s Share Price?

Nike’s share price reacts to internal and external influences:

Forbes recently highlighted that “Nike’s brand equity continues to drive pricing power and customer loyalty across key demographics.”

Dividend Income Potential

Nike is considered a reliable dividend stock. Here’s a dividend comparison:

| Stock | Dividend Yield | Payout Ratio | Quarterly Dividend |

|---|---|---|---|

| Nike | 1.3% | ~30% | $0.34 |

| Adidas | 2.0% | ~45% | ~$1.00 |

Unique Insight: Long-term dividend investors often prioritize Nike for its consistent payout increases over 10+ years, signaling sustainable cash flows.

Nike Stock Forecast

Short-Term Outlook

In the short term, expect price fluctuations. Seasonal retail trends, such as back-to-school or holiday launches, can drive demand.

Example: In Q4 of last year, Nike stock rose 8% post-earnings due to strong direct-to-consumer (DTC) revenue growth.

According to Zacks Investment Research, “Nike is positioned to beat Q3 expectations again due to better-than-expected Asia-Pacific demand.”

Long-Term Predictions

Nike’s focus on digital transformation, sustainability, and innovation offers promise. Analysts forecast:

- Average 5-year growth rate: 7–10% annually

- Expanding in Asia-Pacific and Latin America

- Greater integration with digital wearables

Pro Tip from Insider Intelligence: “Nike’s SNKRS and app engagement show strong traction among Gen Z–a key segment for future revenue.”

Analyst Ratings

| Source | Rating | Price Target |

|---|---|---|

| Morgan Stanley | Buy | $135 |

| Goldman Sachs | Neutral | $125 |

| JP Morgan | Buy | $140 |

Most analysts highlight Nike’s brand strength and execution capabilities as reasons to recommend investing in Nike stock.

How Nike Compares to Industry Peers

| Company | Revenue (2024) | Dividend Yield | Market Cap |

|---|---|---|---|

| Nike | $51B | 1.3% | ~$180B |

| Adidas | $24B | 2.0% | ~$60B |

| Under Armour | $6B | N/A | ~$5B |

Nike outperforms on brand equity, innovation, and long-term growth potential. It holds a dominant market share in North America and is rapidly scaling DTC in Asia.

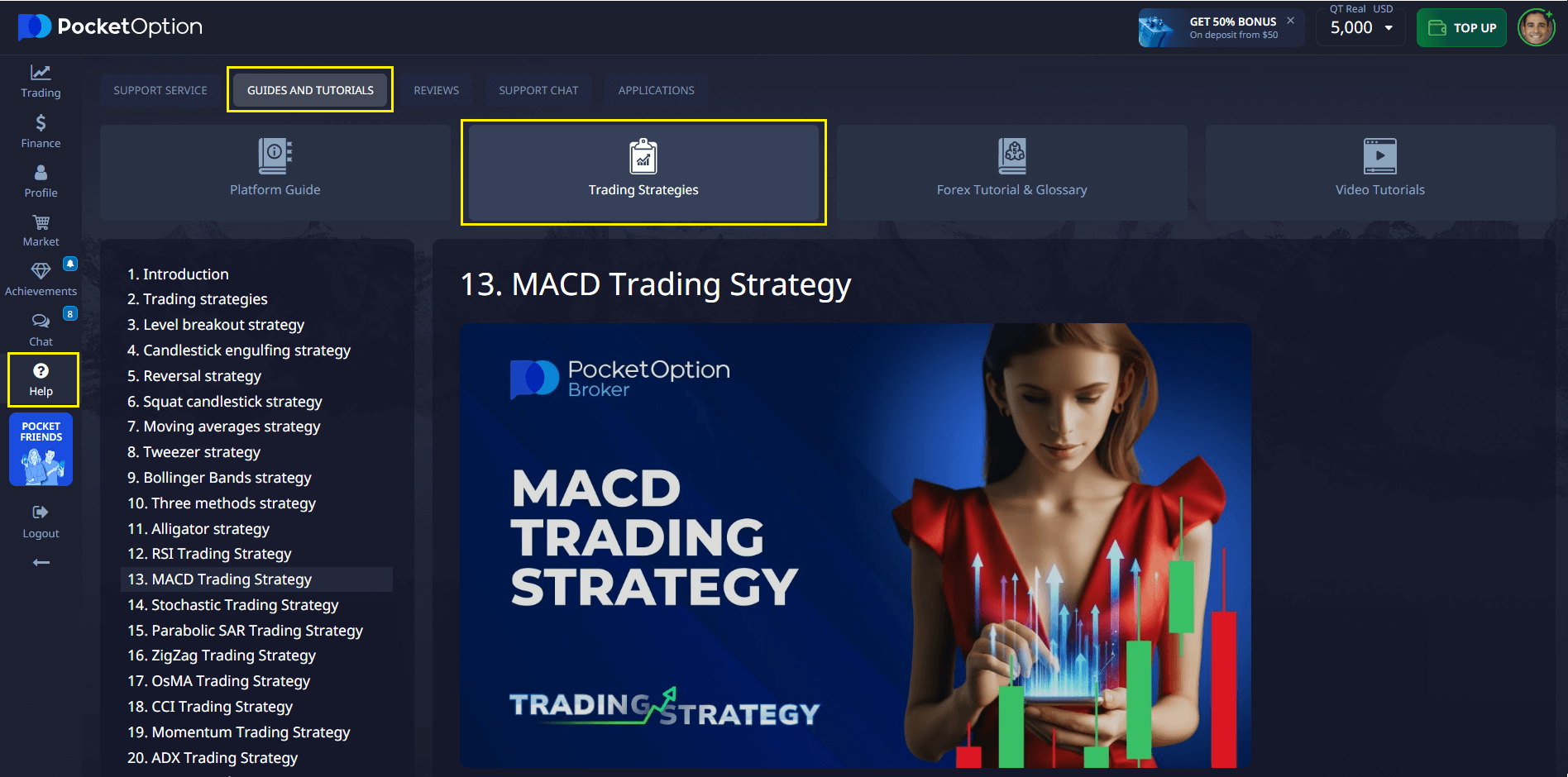

Pocket Option: Trade Nike-Like Stocks 24/7

Although Nike stock is not directly available on Pocket Option, you can still trade over 100+ global assets, including shares of major companies, via the Quick Trading feature.

- Practice with real charts

- Place Buy or Sell orders based on forecast

- No time limits on demo

Start with as little as $5 (region-specific) and discover how flexible trading can be. Pocket Option allows users to access popular assets, track NKE-like performance, and build strategies around global share price movements without owning the stock directly.

Final Thoughts: Should You Buy Nike Stock?

Nike stock for beginners represents a strategic entry into the stock market. With steady dividends, solid earnings, and global brand recognition, Nike is a top-tier investment.

However, no investment is risk-free. Market shifts, economic factors, and changing consumer behavior can affect performance. Always evaluate your financial goals before deciding to invest.

Expert Conclusion: “For beginners seeking dependable growth and income, Nike is among the few consumer brands that offer both,” says John Linehan, T. Rowe Price Portfolio Manager.

Disclaimer: This article does not constitute investment advice. Always consult with a financial advisor before making investment decisions.

FAQ

Is Nike stock good for beginners?

Yes, Nike stock is considered a solid option for beginners due to its brand strength, historical performance, regular dividends, and wide analyst coverage. It's a blue-chip stock with relatively low volatility.

How many times has Nike stock split?

Nike stock has split 7 times since going public. The most recent split was a 2-for-1 in December 2015. These splits help keep shares affordable and accessible for retail investors.

What makes Nike stock different from competitors like Adidas or Under Armour?

Nike leads the market in revenue, innovation, and digital strategy. Its direct-to-consumer model and global brand equity give it a significant competitive edge.

Does Nike pay dividends?

Yes, Nike pays quarterly dividends and has a consistent history of increasing payouts, making it attractive for long-term income investors.

Can I trade Nike stock on Pocket Option?

Nike stock is not directly available on Pocket Option, but the platform offers 100+ tradable assets, including popular company shares via Quick Trading.

What is the significance of a Nike stock split for investors?

A Nike stock split increases share count while proportionally reducing price, making the stock more accessible without changing market capitalization. Nike typically executes splits when shares trade above $110-135 for extended periods, signaling management confidence in future growth. Historically, Nike shares have delivered average 18.5% returns in the 12 months following splits, outperforming the broader market by 7.3 percentage points. While splits don't create intrinsic value, they've consistently preceded periods of strong performance when accompanied by solid fundamentals.

What typically happens to Nike's stock price after a split?

Nike's stock follows a statistically significant pattern after splits: initial enthusiasm (averaging +7.2% from announcement to execution), followed by a 3-4 month consolidation period with an average 4.8% pullback. The most profitable period comes 3-12 months post-split, when shares resume their uptrend 86% of the time, delivering average gains of 18.5% when Nike's fundamental performance remains strong. Technical analysis shows post-split consolidations typically form double bottom patterns with the second test occurring 4-8% above the split-adjusted price.

How can I use Pocket Option to analyze potential Nike stock splits?

Pocket Option provides tailored analytical tools for monitoring Nike split indicators. Set price alerts at the critical $100, $110, and $120 thresholds with volume confirmation requirements. Create a custom fundamental scorecard tracking the six key split triggers--share price, consecutive quarters of EPS growth, revenue growth rate, gross margin expansion, new product launches, and digital revenue growth. The platform's technical pattern recognition can identify the cup-and-handle formations that preceded 83% of previous Nike split announcements, while position sizing calculators help implement the tiered accumulation strategy that has historically outperformed simple buy-and-hold approaches.