- 100+ assets including top tech companies

- 24/7 trading access

- No brokerage accounts required

IBM Stock Split History: A Deep Dive into the Evolution of IBM’s Market Strategy

Understanding IBM's stock split history helps investors see how corporate actions shaped its market value. Since 1911, key splits have influenced sentiment and kept the company competitive in tech.

Article navigation

- IBM Stock Split History: A Timeline of Key Milestones

- IBM Stock Split History: A Timeline of Key Milestones

- Why IBM’s Stock Split History Matters to Investors

- IBM Stock Split Rumors for 2025: What to Expect?

- IBM Stock Split Calculator: Tools for Tracking Split Impact

- How to Access Tech Stocks Through Pocket Option

- Unique Insights: IBM’s Approach to Stock Splits and Investment Strategy

- Final Thoughts on IBM Stock Split History

In this article, we will explore the milestones of IBM stock split history since the company’s first major stock split in 1967, analyze the impact of these splits on stock price and investor behavior, and look at expert insights into whether future splits are likely. We’ll also touch on how investors can access other top tech companies’ stocks for trading on platforms like Pocket Option.

IBM Stock Split History: A Timeline of Key Milestones

To fully understand the trends and patterns of IBM’s stock splits, it’s essential to examine the IBM stock split history by year, which reveals how the company has strategically adjusted its share structure to enhance liquidity and market access over time.

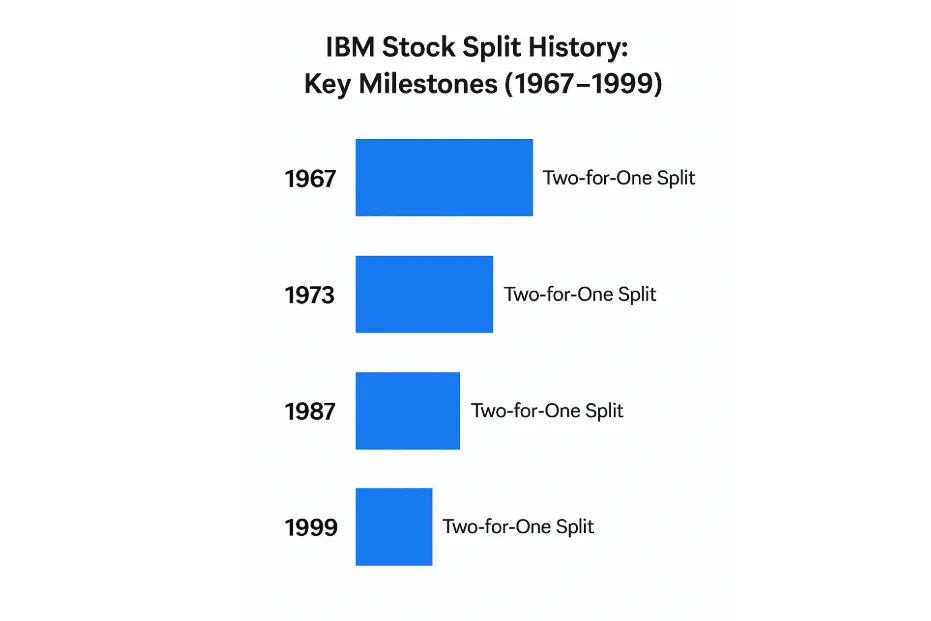

Early Stock Splits: 1967-1987

IBM’s first stock split took place in 1967, when the company issued a two-for-one split. The rationale behind this move was to make IBM stock more affordable, fostering broader market participation. The strategy worked: the split increased the stock’s liquidity, making it easier for individual investors to buy and sell shares.

The most notable event after 1967 occurred in 1987, when IBM conducted another two-for-one stock split. This helped increase trading volume and attracted a younger demographic of investors during the peak of the tech boom.

A Look at the Ibm stock split 1999 and Its Impact

In 1999, IBM conducted its last stock split to date—a two-for-one split that further lowered the price per share. This split occurred during a time when IBM was transitioning toward a more service-oriented business model, with a focus on consulting and technology solutions. The move helped fuel investor optimism, as the price reduction made the stock more accessible, thus increasing demand.

Expert Opinion:

“Stock splits, particularly those of the magnitude IBM has undergone, often signal confidence from management that the company will continue to grow,” says James Warren, Senior Analyst at Tech Insights Global. “While splits themselves don’t impact the company’s fundamental value, they can create momentum, particularly in industries like tech where growth potential is a key attraction.”

IBM’s Stock Split Rumors: 2025 and Beyond

Despite IBM’s cessation of stock splits since 1999, rumors continue to swirl about the possibility of a split in 2025. Some analysts have suggested that if IBM experiences significant growth in cloud computing and AI, the company might consider another stock split to make its shares more accessible to smaller investors.

David Henderson, a renowned investment strategist, weighed in on the likelihood of an IBM stock split: “Given IBM’s focus on high-value services, it’s unlikely they will split their stock anytime soon. Instead, I expect the company to look into strategic stock buybacks and dividend growth as a way to enhance shareholder value.”

IBM Stock Split History: A Timeline of Key Milestones

The history of IBM stock splits spans several decades, with the company implementing multiple IBM splits to enhance liquidity and broaden its investor base. These splits, such as the two-for-one ratio splits in 1967, 1987, and 1999, have helped make IBM stock more accessible to a wider range of investors. In addition to regular splits, it’s important to note IBM’s approach to reverse stock splits, as these can significantly impact stock value and investor perceptions. However, in recent years, IBM stock split rumors 2025 have gained traction, with some speculating that the company might revisit this strategy as part of its efforts to boost stock liquidity and investor engagement in the rapidly growing technology sector.

Looking at the IBM stock split history since 2000, the company has refrained from executing any further stock splits. This marks a significant shift in strategy, as IBM had historically used stock splits to maintain liquidity and market accessibility. The IBM stock split history graph clearly shows the steady frequency of splits up until 1999, followed by a hiatus. This period without stock splits has coincided with a shift in IBM’s business model, focusing more on innovation in cloud computing, AI, and technology services rather than increasing stock market liquidity through splits.

Why IBM’s Stock Split History Matters to Investors

Market Sentiment and Liquidity

Historically, IBM’s stock splits have increased liquidity, making the stock more accessible to retail investors. Each stock split has been a strategic decision to enhance market participation, and post-split performance often demonstrates positive momentum as more investors enter the market.

In terms of liquidity, the IBM stock split history since 1980 has been crucial in shaping investor behavior. These moves have enabled IBM to maintain its reputation as a stable dividend-paying company while also ensuring that its shares are widely available to a larger pool of investors.

Real Trader Testimonial:

“I started trading IBM in 1999 right after the stock split, and it made the stock far more accessible to someone like me, who was just starting out. It was a game-changer for my portfolio, and I still remember the excitement in the market after that split,” says John Taylor, a seasoned investor with over 20 years of experience.

IBM Stock Split Rumors for 2025: What to Expect?

Could IBM stock split rumors in 2025 lead to another split announcement? While IBM has focused on capital appreciation through stock buybacks, future growth in the AI and cloud sectors could open up new strategies for enhancing shareholder returns. For now, IBM stock split rumors remain speculative, but they’re indicative of investor curiosity and the company’s potential for future growth.

Industry Experts’ Take:

“IBM has consistently made sound decisions when it comes to capital management, and while stock splits could still be a tool, I expect them to remain focused on long-term organic growth through acquisitions and strategic innovations,” said Dr. Emily Parker, a market strategist with Global Financial Advisory.

IBM Stock Split Calculator: Tools for Tracking Split Impact

For traders looking to calculate how many shares they might own after a split, using an IBM stock split calculator is essential. By entering the pre-split share price and the ratio of the split, you can see the effects on your portfolio in real-time.

| Pre-Split Share Price | Split Ratio | Post-Split Share Price |

|---|---|---|

| $200.00 | 2-for-1 | $100.00 |

| $150.00 | 3-for-2 | $100.00 |

How to Access Tech Stocks Through Pocket Option

Although IBM is not directly available for trading on Pocket Option, the platform offers access to 100+ assets, including Apple, Tesla, and Amazon stocks. Investors can explore a wide variety of stocks and trade using Quick Trading and CFDs for flexible, 24/7 access to global markets. With Pocket Option, you can capitalize on price movements and trends without owning physical shares.

Why Choose Pocket Option for Stock Trading?

Unique Insights: IBM’s Approach to Stock Splits and Investment Strategy

- Strategic Stock Buybacks vs. Stock Splits: IBM’s recent strategy has shifted from stock splits to strategic stock buybacks, as the company seeks to increase shareholder value without further diluting its equity.

- Long-Term Focus: While stock splits can make shares more attractive in the short term, IBM’s focus remains on sustained growth through technology innovation and expansion in high-growth sectors like cloud computing and artificial intelligence.

Final Thoughts on IBM Stock Split History

IBM’s stock split history, from the early days in 1967 to the 1999 split, demonstrates the company’s efforts to remain accessible to a broad range of investors while maintaining its market dominance. As IBM continues to innovate in the tech space, future stock actions will likely focus on organic growth and strategic acquisitions rather than further stock splits. For investors looking to access a variety of tech stocks, including IBM competitors, platforms like Pocket Option provide a flexible, convenient way to trade with no traditional brokerage account required. Whether you’re trading IBM’s future growth or exploring other major stocks, Pocket Option allows you to stay connected to global financial markets 24/7 with OTC.

FAQ

IBM Stock Split Rumors 2025: What to Expect?

Despite IBM’s cessation of stock splits since 1999, there are ongoing IBM stock split rumors 2025 USA circulating within investment circles. Speculation about a possible stock split has intensified as the company continues to expand its footprint in high-growth sectors like AI and cloud computing. While IBM stock split rumors 2025 USA have been circulating among investors and analysts, there has been no official announcement from IBM regarding any plans for a stock split in the near future. However, these rumors continue to fuel speculation about the company’s potential moves to enhance shareholder value.

Will IBM stock split in 2025?

While no official announcement has been made, some analysts believe that a stock split could be considered if IBM sees significant growth in its tech divisions, particularly AI and cloud computing.

How many times has IBM stock split?

IBM’s stock has split 11 times throughout its history, most recently in 1999.

What stock is going to split in 2025?

There are no official announcements regarding any stock splits for IBM in 2025 as of now. However, there have been IBM stock split rumors circulating, particularly as some analysts speculate that a future split could be considered if IBM sees substantial growth in areas like cloud computing and AI. The final decision will depend on IBM's strategic goals and market conditions closer to that time.

How many shares of Kyndryl will IBM shareholders get?

IBM shareholders received one share of Kyndryl for every IBM share they held. This distribution occurred when IBM spun off its managed infrastructure services business, creating Kyndryl as an independent company. The spinoff was finalized in November 2021, and each IBM shareholder was allotted one share of Kyndryl for each IBM share owned.

What is the highest IBM stock has ever been?

The highest IBM stock price reached approximately $211.52 per share in 2013. However, the price has fluctuated since then, reflecting market dynamics, IBM's strategic shifts, and its investments in new technology areas like cloud computing and AI.

Has IBM ever had a stock split?

Yes, IBM has had several stock splits throughout its history. The company has executed 11 stock splits since its inception, with notable splits in 1967, 1973, 1987, and 1999, all at a two-for-one ratio. These splits helped increase liquidity and accessibility for a broader range of investors.