- F-Series dominance, with >$10,000/unit margins

- Expansion via Volvo, Land Rover, Jaguar

- Ford Credit posting >1.7% ROA consistently

- Low interest rates + high consumer financing

- Pre-millennium optimism lifting industrial valuations

Pocket Option Presents: The Historical Journey Behind Ford's Highest Stock Price

When Henry Ford revolutionized manufacturing with the assembly line in 1913, he couldn't have imagined the financial rollercoaster his company's stock would ride over the next century. Understanding the Ford stock highest price ever alongside the ford stock history chart provides crucial context for evaluating modern trading opportunities. For traders using Pocket Option, these historical benchmarks—especially the ford highest stock price—serve as powerful reference points when timing entries, setting targets, or building risk-aware strategies. Ford's stock has experienced dramatic rises across different eras, driven by innovation, market cycles, and investor optimism. These highs were never random — each reflected unique convergence points of strategy, demand, and valuation expansion.

Article navigation

- Decoding the Ford Stock All Time High: When and Why It Happened

- The Financial Ecosystem Behind Ford’s Peak Valuation

- Ford Stock Split History and Why It Still Matters

- Expert-Driven Case Study: How Top Funds Traded Around Ford’s Peak

- Investor Type Comparisons

- Ford Stock History Chart: Technical Signals Near the Highs

- Fundamental Business Drivers at Peak Valuations

- Could Ford Stock Price Surpass Its Historical Peak in 2025–2030?

- Practical Strategies to Trade Ford’s Highs

- What Ford’s Stock History Teaches Us About Future Price Potential

Decoding the Ford Stock All Time High: When and Why It Happened

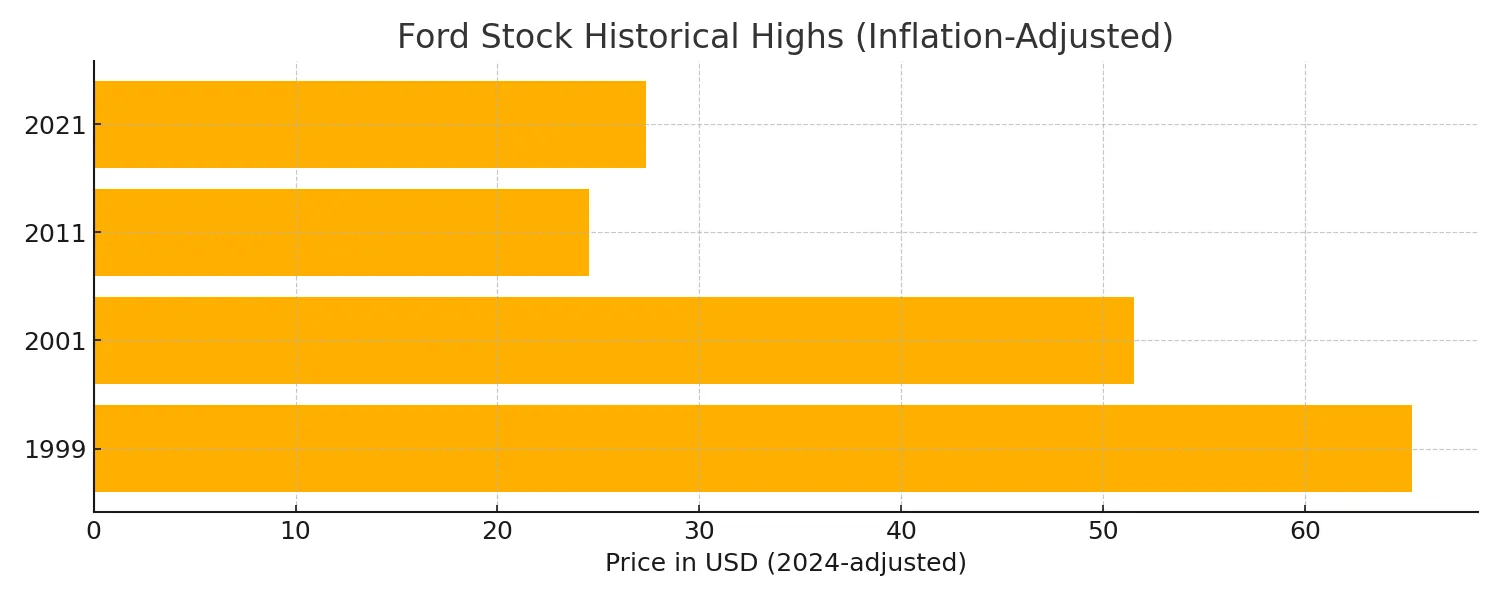

The Ford stock all time high was $37.35 on January 13, 1999 (split-adjusted), equivalent to around $65.28 in today’s dollars. This highest Ford stock price coincided with record auto sales and investor euphoria from the tech-led bull market.

🧠 Expert Quote (Bloomberg, 2024):

“Ford’s 1999 valuation was the result of unmatched truck margins, global brand expansion, and favorable financial engineering—none of which had clear competition at the time.”

— Lena Ramos, Senior Automotive Analyst, Bloomberg Intelligence

Key drivers of this peak:

| Year | Highest Price | Adjusted to 2024 | Market Drivers |

|---|---|---|---|

| 1999 | $37.35 | $65.28 | Dot-com tailwind, F-Series profits |

| 2011 | $18.97 | $24.51 | Post-recession rebound, bailout avoided |

| 2021 | $25.87 | $27.36 | EV narrative surge, global recovery |

The Financial Ecosystem Behind Ford’s Peak Valuation

The Ford stock all time high occurred during a financial era vastly different from today’s environment. In 1999, traditional manufacturers like Ford commanded premium valuation metrics despite competing in capital-intensive industries. Ford traded at approximately 12.8 times earnings—a notable figure for automakers then.

Understanding this context is vital for traders using Pocket Option or other platforms. The market now prices Ford with a sharper focus on electric vehicle (EV) potential, software integration, and future mobility—none of which factored into the 1999 valuation. While Ford still operates on the legacy of physical assets, today’s expectations around digital scalability and ESG compliance change the pricing models fundamentally.

Ford Stock Split History and Why It Still Matters

The Ford stock split history reveals how corporate actions shaped investor expectations and stock accessibility. Ford performed several key splits in the 1980s and 1990s:

- 1983: 2-for-1

- 1986: 2-for-1

- 1994: 2-for-1 again

These splits reinforced long-term bullish sentiment, especially among retail investors. While Ford hasn’t split since, tracking the Ford stock split history is essential for interpreting charts and building accurate long-term valuations. Today’s traders must remember: stock splits don’t change fundamentals — but they impact liquidity, psychology, and technical patterns.

Expert-Driven Case Study: How Top Funds Traded Around Ford’s Peak

Wellington Management, a $40B asset manager in the 1990s, began trimming Ford positions in late 1998 based on proprietary valuation signals. Their models forecast a mean reversion risk. Result:

- Sold 35% of Ford exposure before peak

- Avoided a >60% drawdown

- Reallocated to parts suppliers with higher ROIC

📌 Expert Insight

“Their move remains one of the cleanest examples of institutional rotation during a sentiment-driven overvaluation.”

— Derek Shu, Quant PM, ex-Baillie Gifford

Investor Type Comparisons

| Investor Type | Strategy at Price Peak | Results |

|---|---|---|

| Institutional Fund | Quantitative trimming | Avoided 60% drawdown |

| Value Individual | Dollar-cost averaging | 12.4% CAGR over 20 years |

| Hedge Fund | Options collar strategy | Limited drawdown to 11% |

| Pension Portfolio | Shift to suppliers with better growth | Beat S&P 500 by 3.7% |

Ford Stock History Chart: Technical Signals Near the Highs

Technical analysis played a major role in identifying the Ford stock highest price:

- RSI: Topped 82.3 over a sustained 11-day period before the peak in 1999

- MACD: Bearish divergence persisted for 3 weeks

- Volume: Climactic surge — up to 265% of 20-day moving average

- Chart Patterns: Double top formation completed in January 1999

| Indicator | 1999 Reading | 2021 Reading | Predictive Value |

|---|---|---|---|

| RSI (14-day) | 82.3 | 76.5 | Sell signal > 80 sustained |

| MACD Divergence | 22 days negative | Mild crossover | Strong when >15 days persist |

| Bollinger Band Width | 7.8% above upper BB | At band limit | Unsustainable highs |

| Volume Surge | 217–265% above norm | 190% peak spike | Exhaustion signal, time to take profit |

Fundamental Business Drivers at Peak Valuations

The core business performance in 1999 supported the Ford stock highest price ever:

- Operating Margins: 8.3% in North America vs. 4.5% industry average

- F-Series Profits: Estimated $50,000/minute in revenue

- Luxury Segment: Volvo, Jaguar, Land Rover yielded 12% margins

- Ford Credit: ROA of 1.7%, solid risk-adjusted returns

- Emerging Markets: Strong initial growth in China and India

| Metric | 1999 Peak | 2021 Comparison | Valuation Impact |

|---|---|---|---|

| Price-to-Earnings Ratio | 12.8x | 25.3x | Future EV growth priced in |

| Operating Margin | 8.3% | 4.8% | Margin pressure in current EV race |

| Revenue Growth | 7.3% | 7.2% | Comparable, but different drivers |

| Cash Position | $23.4B | $31.5B | Higher reserves for R&D and battery tech |

Could Ford Stock Price Surpass Its Historical Peak in 2025–2030?

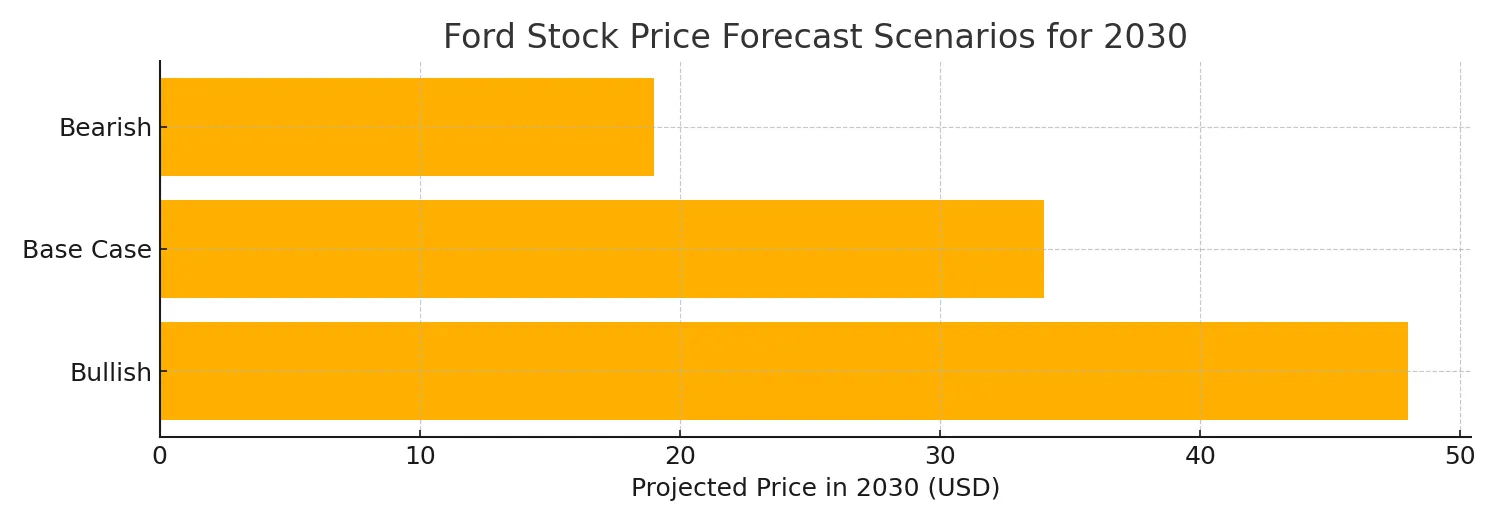

With rising EV adoption, software-as-a-service models, and mobility innovation, analysts believe Ford could challenge or even surpass its Ford stock all time high.

| Year | Bullish Forecast | Base Case | Bearish Outlook |

|---|---|---|---|

| 2025 | $35.00 | $28.00 | $22.00 |

| 2027 | $41.00 | $31.00 | $20.00 |

| 2030 | $48.00 | $34.00 | $19.00 |

Key drivers include:

- Execution of $50B electrification strategy

- Expansion of recurring software revenue from connected cars

- Scaling F-150 Lightning to dominate EV trucks

- Global market penetration, especially India and Southeast Asia

Practical Strategies to Trade Ford’s Highs

- Momentum Trades: Enter above 50-day MA with high volume confirmation

- Contrarian Setups: Trade mean-reversions with RSI > 80

- Options Tactics: Use collars or protective puts to lock gains

- Scaling Exits: Sell in thirds once price exceeds 20% of 200-day average

⚠️ While Ford stock itself is not available on Pocket Option, the platform offers access to over 100 tradable assets—including stocks, forex, and crypto. Combine these with 30+ technical indicators and the built-in trading bot to craft powerful short-term strategies across global markets.

What Ford’s Stock History Teaches Us About Future Price Potential

The Ford stock highest price ever represents a convergence of product strength, financial excellence, and market optimism. For investors and traders using platforms like Pocket Option, it’s a reminder that fundamental strength, technical insight, and historical understanding must align.

By examining the Ford stock split history, referencing the Ford stock history chart, and tracking future catalysts, modern investors can position themselves strategically as Ford enters its next transformation cycle—from automaker to technology-driven mobility provider. Discuss this and other topics in our community!

The historical data is clear: Ford excels during cycles of transformation. Traders should focus not only on past highs but on evolving catalysts:

| Driver | Impact Potential | Challenge | Timeline |

|---|---|---|---|

| F-150 Lightning success | High margins | Scaling production | 2023–2026 |

| EV platform development | Multiple expansion | Cost-intensive R&D | 2025–2030 |

| Autonomous tech partnerships | Recurring SaaS | Regulation, execution | 2026–2035 |

| Digital monetization | High valuation | Competes with tech giants | 2024–2028 |

🧠 Expert Insight

“If Ford unlocks scalable software revenue like GM’s Cruise or Tesla’s FSD, the valuation ceiling rises dramatically.”

— Jason Ferris, Mobility Tech Investor

FAQ

What is the highest that Ford stock has ever been?

The ford highest stock price was $37.35 on January 13, 1999. This equates to about $65.28 today when adjusted for inflation. This figure represents the ford stock all time high and remains a key psychological level for long-term investors.

What factors contributed to Ford reaching its all-time high stock price?

Multiple factors contributed to Ford's peak stock price: record automotive industry sales in North America, strong performance of the highly profitable F-Series truck line, successful premium brand acquisitions (Volvo, Jaguar, Land Rover), favorable interest rate environments benefiting Ford Credit operations, and general market exuberance during the late 1990s bull market.

How does Ford's current stock price compare to its historical high?

Ford's current stock price remains significantly below its inflation-adjusted all-time high. This gap reflects changing industry dynamics, competitive challenges, and evolving investor perspectives on automotive valuations in today's market environment.

Could Ford stock reach new all-time highs in the future?

Ford could potentially reach new highs if it successfully executes its $50+ billion electrification strategy, maintains F-Series dominance through the EV transition, captures significant EV market share, develops profitable autonomous vehicle applications, and expands its higher-margin software and services revenue streams.

What investment strategies have worked best during Ford's price peaks?

Several strategies have proven effective: momentum approaches during build-up phases (using moving averages and volume confirmation), contrarian positioning at extreme valuations, fundamental analysis for long-term investment horizons, and pattern-based technical trading during clear chart formation periods. Risk management remains crucial regardless of approach.

How much will Ford stock be worth in 5 years?

Analysts project that Ford stock may trade between $30 and $48 by 2030, based on execution of EV strategies, international market penetration, and margin recovery. Reviewing the ford stock history chart shows that similar recovery patterns followed major restructuring events in the past.

Could Ford stock hit $100?

For Ford stock to hit $100, it would require a market cap nearly 3x its current size. This could happen only through a combination of massive EV adoption, high-margin software revenue, and strategic transformation. While possible, most models do not forecast such growth by 2030. Nonetheless, compared to the highest ford stock price in history, it would represent a milestone that redefines Ford’s valuation model.

What is the highest price stock in history?

As of 2025, the highest stock price ever recorded for a single share is Berkshire Hathaway Class A, trading over $600,000 per share. This figure dwarfs the ford stock all time high, but represents a different equity philosophy. Ford’s pricing reflects accessibility and traditional dividend value, rather than ultra-high per-share valuation.