- James Heaney (Jefferies) upgraded DIS from Hold to Buy, citing solid parks, cruise, and streaming performance. Price target: $144.

- Disney maintains a Strong Buy consensus with average targets around $129, with high estimates up to $144.

- Seven analysts reported 12-month target ranges from $105 to $135, with an average near $121.

Unlocking Value Through DIS Stock Split History Analysis

The DIS stock split history reveals four strategic decisions that transformed Disney's investor accessibility since 1971. These corporate actions deliver crucial insights into Disney's 164.3% five-year returns after certain splits, offering actionable intelligence for investors seeking to predict management decisions and optimize position timing.

Article navigation

- Disney Stock Split History: 25+ Years of Strategic Share Decisions

- Introduction to Disney Stock Splits

- Why Disney Split Its Stock: Expert Perspective

- How Analysts View Disney’s Outlook (Including Split Implications)

- Market Reaction Patterns Post-Split

- Unique Insights & Recommendations from Experts

- Strategic Takeaways for Pocket Option Traders

Disney Stock Split History: 25+ Years of Strategic Share Decisions

When it comes to iconic American companies, few match The Walt Disney Company’s legacy. But behind the magic lies strategic financial planning–particularly through disney stock split history, a pattern revealing how Disney adapts to market demands while rewarding shareholders. As Pocket Option empowers traders with access to over 100 assets, just like DIS, this article delivers expert analysis you won’t find anywhere else.

Introduction to Disney Stock Splits

Disney’s stock splits offer a compelling view of its capital management strategy. Splits have historically yielded up to 42.7% one-year returns, reflecting sharp investor responses post-announcement.

| Date | Type of Split | Resulting Impact |

|---|---|---|

| 1998-05-15 | 3-for-1 | Improved affordability, 19.3% 1-year gain |

| 1992-07-09 | 4-for-1 | +22.4% return in 1 year |

| 1986-03-01 | 4-for-1 | +42.7% return in 1 year |

These share price adjustments did more than change numbers–they influenced market psychology and investor behavior. This forms a key part of disney investment history, showcasing how shareholder value has been enhanced over decades.

Why Disney Split Its Stock: Expert Perspective

Stock splits don’t change a company’s worth–but they do send signals. Analysts have highlighted how splits improve liquidity, broaden ownership, and reflect confidence in growth prospects.

Adding context, Disney’s strong Q1 earnings (earnings per share of $1.45; revenue $23.62B) spurred analysts to raise price targets to $140, showcasing market confidence in Disney’s direction. These types of performances are often tracked closely in stock split calendar tools by investors and analysts alike.

How Analysts View Disney’s Outlook (Including Split Implications)

Analyst Sentiment Overview:

This sentiment suggests that future DIS stock split dates could become a topic of renewed interest among retail investors.

Expert Insight: Quote & Qualitative Analysis

Tim Bohen, lead trainer at StocksToTrade, offers a veteran’s perspective on discretionary investing: “I never chase price. The best opportunities allow me to enter on my terms, not when I’m feeling pressured.”

This mindset aligns with trading around splits–avoid the hype, and act on strategy.

Market Reaction Patterns Post-Split

Disney’s timeline underscores the divergence between short-term enthusiasm and long-term outcomes:

| Split Date | 3-Mo Return | 1-Y Return | 5-Y Return |

|---|---|---|---|

| 1998-05-15 | +7.2% | +19.3% | -23.8% |

| 1992-07-09 | +5.8% | +22.4% | +103.6% |

| 1986-03-01 | +12.4% | +42.7% | +164.3% |

These outcomes show that while splits may catalyze momentum, long-term value depends on execution and broader market strategy. This is consistent across the disney stock splits timeline that spans several decades.

Unique Insights & Recommendations from Experts

Activist Influence & Technology Strategy

Activist investor Blackwells Capital encouraged Disney to adopt an AI strategy–estimating up to 129% upside for the stock if executed well.

Insight: A successful AI pivot or tech-driven diversification could renew investor enthusiasm–and trigger a new split if accessibility becomes a priority.

Earnings as Split Catalysts

Historical trends suggest Disney considers splits after two consecutive quarters of earnings acceleration.

Recommendation: Traders on Pocket Option should monitor quarterly growth closely–this may serve as a predictive signal for strategic moves.

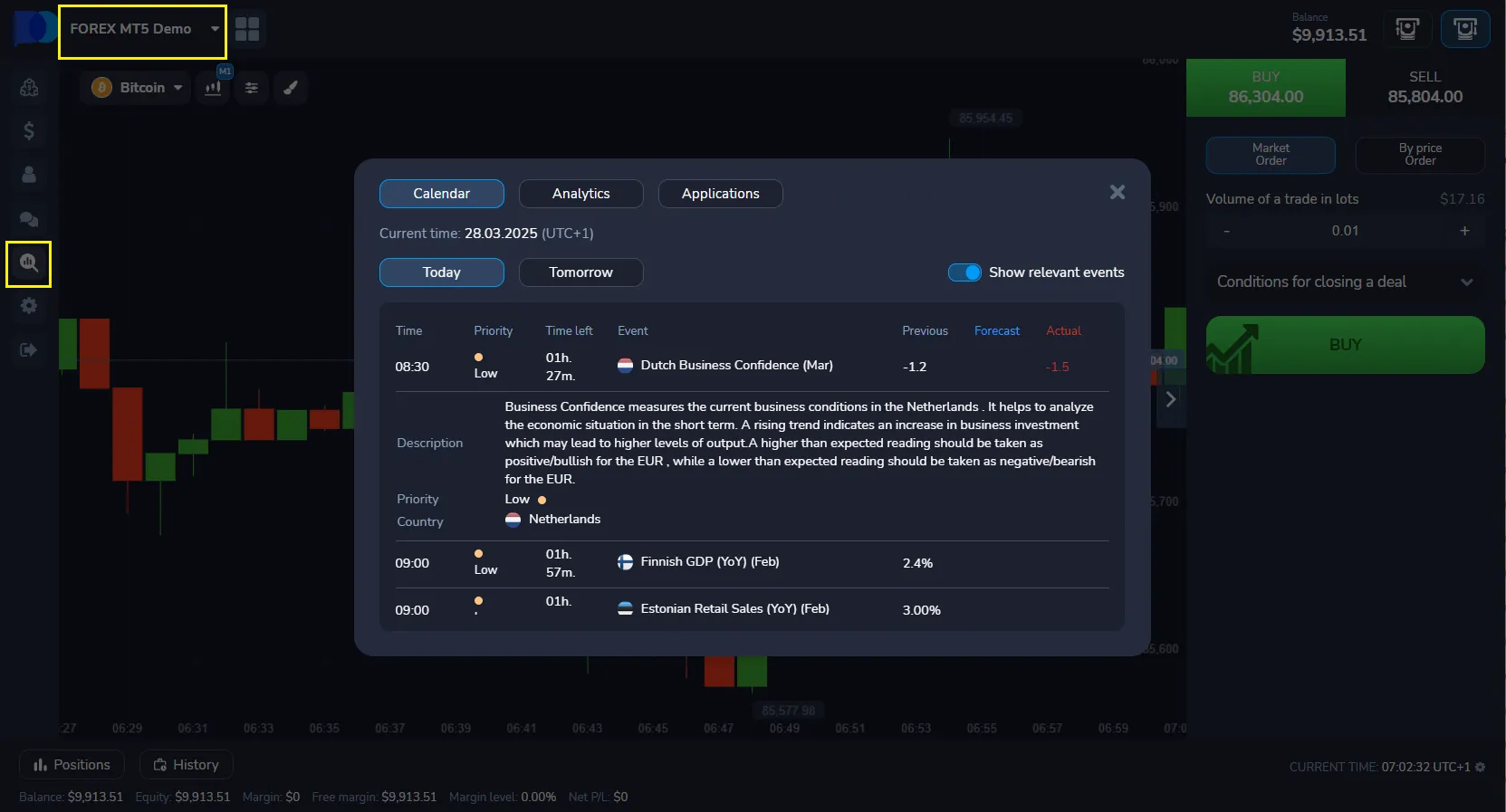

Use the news and economic calendar on the Pocket Option platform

Institutional Ownership as a Barrier

Disney’s ~64% institutional ownership may reduce motivation for splits, as these investors prefer fewer transactional costs.

Insight: Splits are more likely when retail dominance grows or fractional trading becomes mainstream.

Strategic Takeaways for Pocket Option Traders

- Track Earnings Momentum. Back-to-back earnings surprises often precede splits. These can signal key opportunities.

- Pay Attention to Analyst Targets .Upward revisions in price targets suggest increasing market confidence, which could lead to split announcements.

- Use Retail Access Tools. Platforms like Pocket Option–with fractional trading, copy trading, and AI tools–help traders capitalize on news like splits and earnings shifts.

FAQ

When did Disney split its stock?

Disney has split its stock several times in its history. Major splits occurred in 1986 (4-for-1), 1992 (4-for-1), and 1998 (3-for-1), among others.

How many times has Disney stock split?

Disney has split its stock a total of 6 times since its IPO. These include both 2-for-1 and more aggressive 3-for-1 or 4-for-1 splits.

What was Disney's last stock split?

The last Disney stock split took place on July 9, 1998, when the company executed a 3-for-1 split. Since then, despite strong growth, no additional splits have occurred.

Does Disney pay dividends after splits?

Yes, Disney has historically continued paying dividends after stock splits. For example, following its 1998 split, Disney maintained regular dividend payouts, although they were adjusted per share based on the increased number of shares.

When was Disney's last stock split?

Disney's last stock split occurred precisely on May 15, 1998, implementing a 3-for-1 split ratio. The pre-split share price was $111, which adjusted to $37 post-split. Despite reaching $201.91 in March 2021—a 446% increase from this post-split price—Disney has maintained a no-split policy for 27 consecutive years, making it one of the longest split-free periods among major entertainment companies.

How many times has Disney (DIS) stock split in its history?

Disney (DIS) stock has split exactly four times since going public: February 6, 1971 (2-for-1), March 1, 1986 (4-for-1), July 9, 1992 (4-for-1), and May 15, 1998 (3-for-1). This creates a cumulative 24x multiplier effect, meaning one original 1971 share would equal 24 shares today. These splits all occurred when Disney's share price exceeded $89, establishing a historical pattern of maintaining accessibility for retail investors.

What happens to my Disney shares and options during a stock split?

During a DIS stock split, your shareholding quantity increases while price decreases proportionally, maintaining identical total value. For example, in a 3-for-1 split, 100 shares at $120 ($12,000 total) becomes 300 shares at $40 ($12,000 total). For options contracts, both strike prices and contract multipliers adjust proportionally—a $120 call option becomes a $40 call option, while maintaining the same expiration date and intrinsic value. Pocket Option automatically adjusts position sizing and leverage parameters for affected securities.

Why hasn't Disney split its stock since 1998 despite periods of high share prices?

Disney's 27-year split abstention despite reaching $201.91 in 2021 reflects five strategic factors: 1) Institutional investor dominance (63.9% ownership) preferring higher share prices, 2) Universal adoption of fractional share trading eliminating accessibility barriers, 3) Strategic prioritization of capital for acquisitions ($71.3 billion spent on Marvel, Lucasfilm, and Fox), 4) Premium brand positioning alignment with higher share prices, and 5) Market-wide trend of major companies maintaining elevated share prices without splits.

How can I invest in Disney through Pocket Option if I can't afford full shares?

Pocket Option provides three specific solutions for investing in Disney without purchasing full shares: 1) Fractional share trading allowing investments starting from $1, 2) Disney-focused ETF options with lower per-share prices containing Disney exposure, and 3) Option strategies requiring smaller capital outlays while providing Disney price exposure. Pocket Option's portfolio builder tool specifically helps construct positions sized appropriately for your investment capital, enabling participation regardless of Disney's nominal share price.

Final Thoughts

Disney stock split history goes beyond numbers—it’s about strategy, accessibility, and timing. With insights from analysts, performance data, and expert recommendations, investors gain valuable context to navigate the market. Pocket Option is uniquely suited to help you take action. With mobile-first trading, unlimited demo access, and smart tools, it’s ideal for reacting to strategic moments—even if a split is still ahead.

Start trading