- Argentina’s Inflation Crisis: With inflation rates regularly exceeding 100% annually (reaching 211.4% year-over-year in December 2023), the Peso continually loses purchasing power, driving the USD/ARS rate higher.

- Monetary Policy Decisions: The Central Bank of Argentina’s interest rate adjustments and currency intervention strategies directly impact exchange rates. When the central bank raises rates above 100%, it attempts to strengthen the Peso temporarily.

- Political Transitions: Government changes, like President Javier Milei’s election in late 2023, trigger significant market reactions as traders assess potential economic reform impacts.

- US Federal Reserve Policy: American interest rate decisions create ripple effects across emerging markets. When the Fed raises rates, capital typically flows toward dollar-denominated assets, pressuring the Peso downward.

- Agricultural Export Performance: Argentina’s economy relies heavily on agricultural exports, particularly soybeans, corn, and wheat. Harvest results and global commodity prices influence foreign currency inflows and, consequently, the Peso’s valuation.

The USD/ARS currency pair represents one of the most dynamic and opportunity-rich forex markets available today. For anyone monitoring what is happening with USDARS stock today, this comprehensive breakdown will equip you with essential knowledge about Argentina's currency situation and how to potentially capitalize on its market fluctuations through the Pocket Option platform.

What is USD/ARS?

USD/ARS represents the exchange rate relationship between the United States Dollar (USD) and the Argentine Peso (ARS). This quote shows exactly how many Argentine Pesos are required to purchase a single US Dollar. In this pairing, USD functions as the base currency, while ARS serves as the quote currency.

This particular currency pair stands out due to Argentina’s turbulent economic landscape, characterized by chronic inflation rates exceeding 100% annually, frequent currency devaluations, and ongoing economic restructuring efforts. For Pocket Option traders, USD/ARS offers distinctive trading potential because of its heightened volatility and predictable reactions to Argentine economic announcements and policy shifts.

How the USD/ARS Currency Quote Works (Simple Explanation)

When examining a USD/ARS quote displaying “USD/ARS = 950.25,” this indicates that purchasing one US Dollar requires 950.25 Argentine Pesos. This relationship demonstrates the significant value disparity between these currencies, with the Peso being substantially weaker than the Dollar.

To illustrate with a practical example: if you exchanged $100 USD while visiting Buenos Aires, you would receive approximately 95,025 Argentine Pesos. This dramatic difference reflects the Peso’s severe long-term depreciation resulting from Argentina’s persistent inflation challenges and economic instability.

Factors Influencing USD/ARS Movement

Several critical elements drive USD/ARS exchange rate fluctuations:

For example, in February 2024, when Argentina released inflation data showing a slight monthly decrease, the USD/ARS experienced momentary stabilization as markets cautiously responded to potential improvement signals.

How to Read the USD/ARS Exchange Rate

Interpreting USD/ARS price movements is essential for effective trading decisions:

When the USD/ARS rate climbs from 950.25 to 975.50, this indicates the Dollar strengthening against the Peso. This movement means the Argentine currency is depreciating, requiring more Pesos to acquire one Dollar.

Conversely, if the rate decreases from 950.25 to 925.00, the Peso is gaining value against the Dollar. In this scenario, fewer Argentine Pesos are needed to purchase a single Dollar.

Consider this scenario: following a successful implementation of anti-inflation measures, you might observe the USD/ARS rate dropping from 955.00 to 930.00. This 25-point decline signals improved market confidence in the Argentine economy and its currency. Such movements typically coincide with positive economic indicators or successful government stabilization efforts.

Step-by-Step Tutorial: Quick Trading on USD/ARS

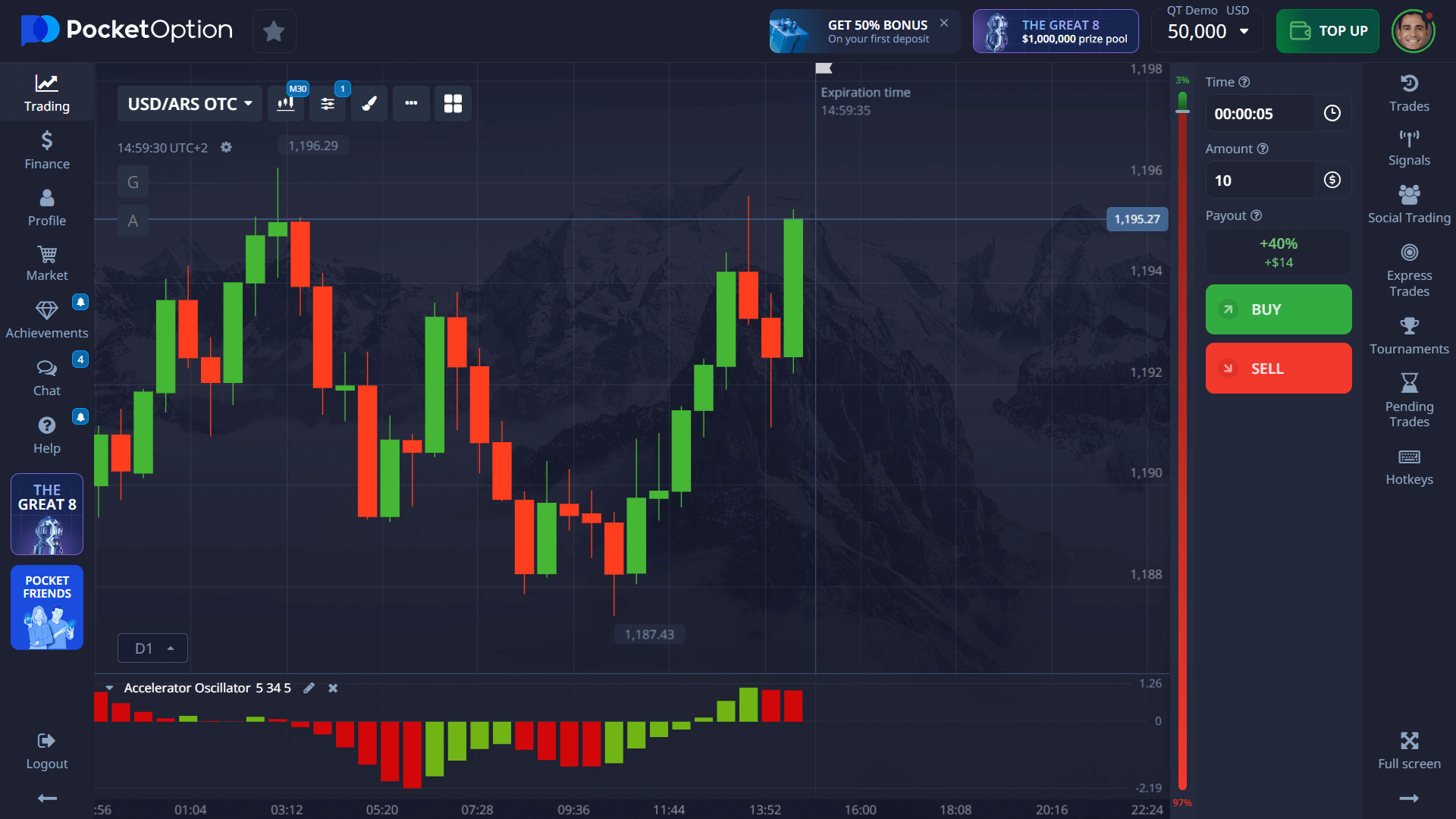

Here’s a precise walkthrough for executing USD/ARS trades on the Pocket Option platform:

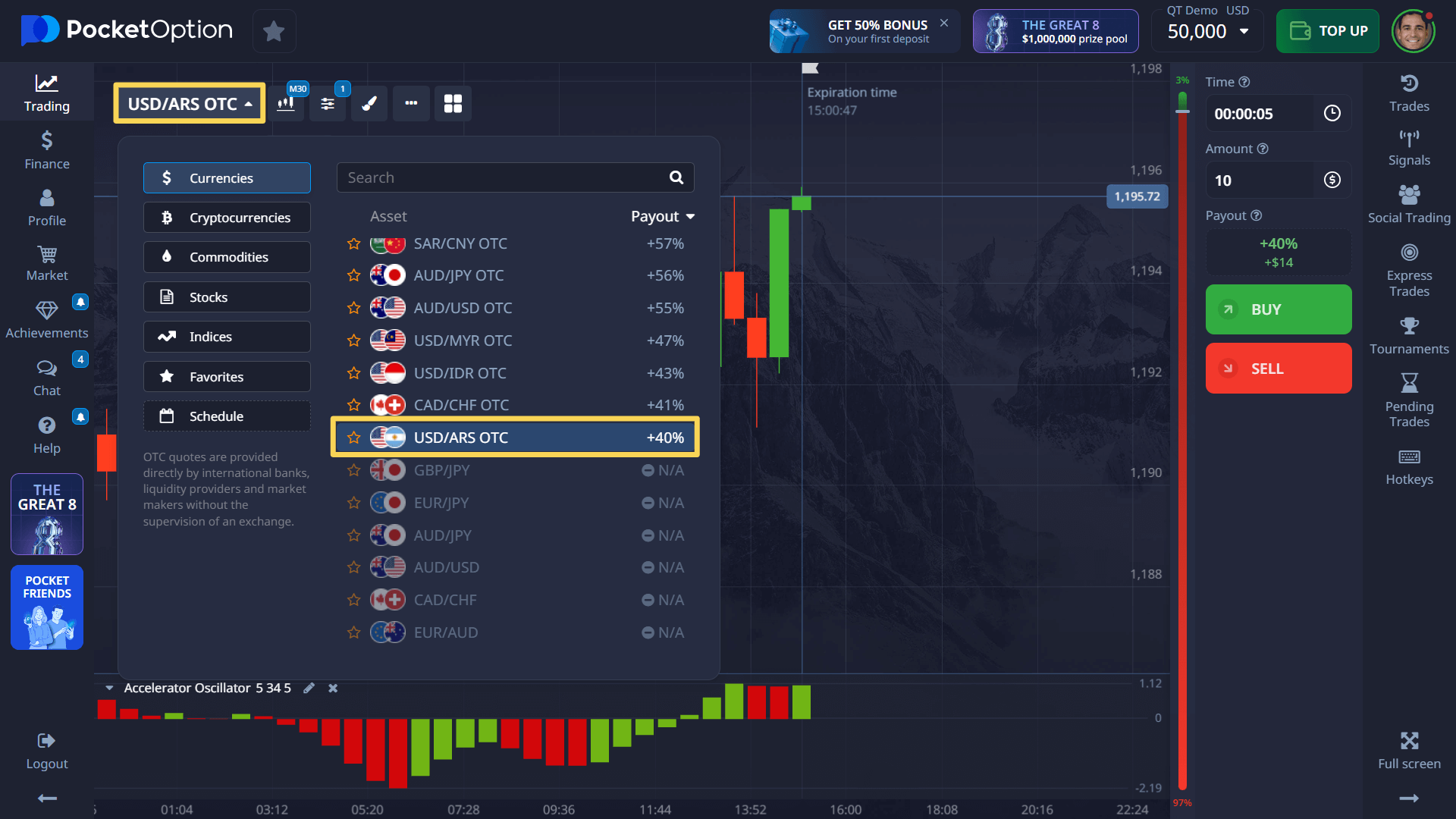

- Locate the asset: Enter “USDARS OTC” in the search field of your asset selection panel.

- Examine market conditions: Review the price chart using technical analysis tools like Bollinger Bands or Moving Averages. Alternatively, reference the platform’s sentiment meter showing the percentage of traders anticipating price increases versus decreases.

- Determine investment size: Select your position size starting from just $1, based on your risk management strategy.

- Define time parameters: Choose your trade duration, with options beginning from 5 seconds for OTC assets (this ultra-short timeframe is specifically available for over-the-counter assets).

- Enter your forecast: Based on your analysis, select BUY if you expect the USD/ARS rate to rise, or SELL if you anticipate a decline by the end of your selected timeframe.

- Review potential returns: Before confirmation, note your potential profit — typically up to 92% of your investment amount for accurate forecasts (exact percentage displayed before trade execution).

How to buy USDARS on Pocket Option? The process is remarkably straightforward — simply create your account, fund it with a minimum deposit of $5 (deposit may vary depending on payment methods), and you can immediately begin trading this high-volatility currency pair. Alternatively, start with risk-free practice using our comprehensive demo environment.

Try Without Risk — $50,000 Demo Account

Uncertain about trading USD/ARS immediately with real funds? Begin with our risk-free alternative!

Every new Pocket Option registration includes immediate access to a fully-equipped $50,000 practice account. This provides the ideal environment to develop your USD/ARS trading approach without financial exposure. Test various strategy combinations, familiarize yourself with platform functionalities, and build trading confidence before transitioning to live market participation.

When ready for real-market trading (with deposits starting at just $5), you’ll unlock these premium features:

- Social trading capabilities allowing automatic replication of experienced traders’ positions

- Performance-based cashback rewards on trading activity

- Competitive trading competitions featuring substantial prize pools

- Professional-grade technical analysis tools and custom indicators

- Comprehensive educational resources including strategy webinars and market analysis

How to invest in USDARS effectively? Start by utilizing our demo account to master the specific characteristics of this volatile pair before committing real capital.

FAQ

How do I buy USD/ARS on Pocket Option?

Register on Pocket Option, make a deposit, find USD/ARS in the asset list, set your investment amount and timeframe, then make your directional forecast by selecting BUY for upward movement or SELL for downward movement.

How to invest in USDARS for beginners?

Begin with Pocket Option's demo account to practice risk-free, study Argentina's economic indicators (especially inflation data), start with minimal position sizes when trading real funds, and utilize technical indicators to identify optimal entry points.

What is happening with USDARS stock today?

USD/ARS isn't a stock but a currency pair whose current movements are primarily influenced by Argentina's ongoing economic reforms, monthly inflation reports, and central bank policies aimed at stabilizing the peso.

How can I use USDARS marketwatch data effectively?

Track Argentina's monthly inflation releases, monitor central bank interest rate decisions, follow political developments affecting economic policy, and stay informed about Argentina's IMF negotiations to make informed trading decisions.

How to trade USDARS during high volatility periods?

During major economic announcements or political developments, consider using smaller position sizes, implementing wider stop-loss parameters, and focusing on longer timeframes that filter out short-term market noise.