- Oil prices: Colombia’s economy is oil-dependent. Lower prices reduce export income, weakening the peso.

- US interest rate decisions: Fed hikes typically boost the USD.

- Colombian economic health: High inflation or slow GDP growth pressures the COP.

- Political or social instability: Protests, elections, or unrest can cause short-term volatility.

Want to understand how the USD/COP exchange rate works, what drives it, and how to trade USD/COP successfully? This article covers the fundamentals -- from market influences to usdcop forecast trends and practical trading instructions you can follow on Pocket Option.

What is USD/COP?

USD/COP refers to the exchange rate between the United States Dollar (USD) and the Colombian Peso (COP). It shows how many pesos are needed to buy one dollar. This currency pair is widely followed by those interested in Latin American financial markets and global US dollar strength.

As an emerging market currency, the COP is susceptible to domestic political changes, commodity prices, and international capital flows. For traders wondering how to invest in USDCOP, understanding these dynamics is key.

How Currency Quotes Work (Simple Breakdown)

Imagine USD/COP = 3,900. That means 1 USD equals 3,900 Colombian Pesos. The COP is the weaker currency in this pair.

Example: You’re exchanging 100 USD in Bogotá — you get 390,000 COP. If the rate rises to 4,100, your dollar buys more pesos, signaling that the COP has weakened.

Factors Affecting USD/COP Movement

These variables are key when forming any accurate USDCOP forecast, particularly in times of geopolitical or energy market shifts.

How to Read USD/COP Rate Changes

If the rate moves from 3,900 to 4,050, the USD is strengthening. A drop to 3,750 suggests the COP is gaining ground.

- USD/COP up = stronger USD, weaker COP

- USD/COP down = stronger COP, weaker USD

Understanding these moves is crucial when assessing what are the key debates on USDCOP stock — such as whether policy tightening or external trade conditions are driving the rate.

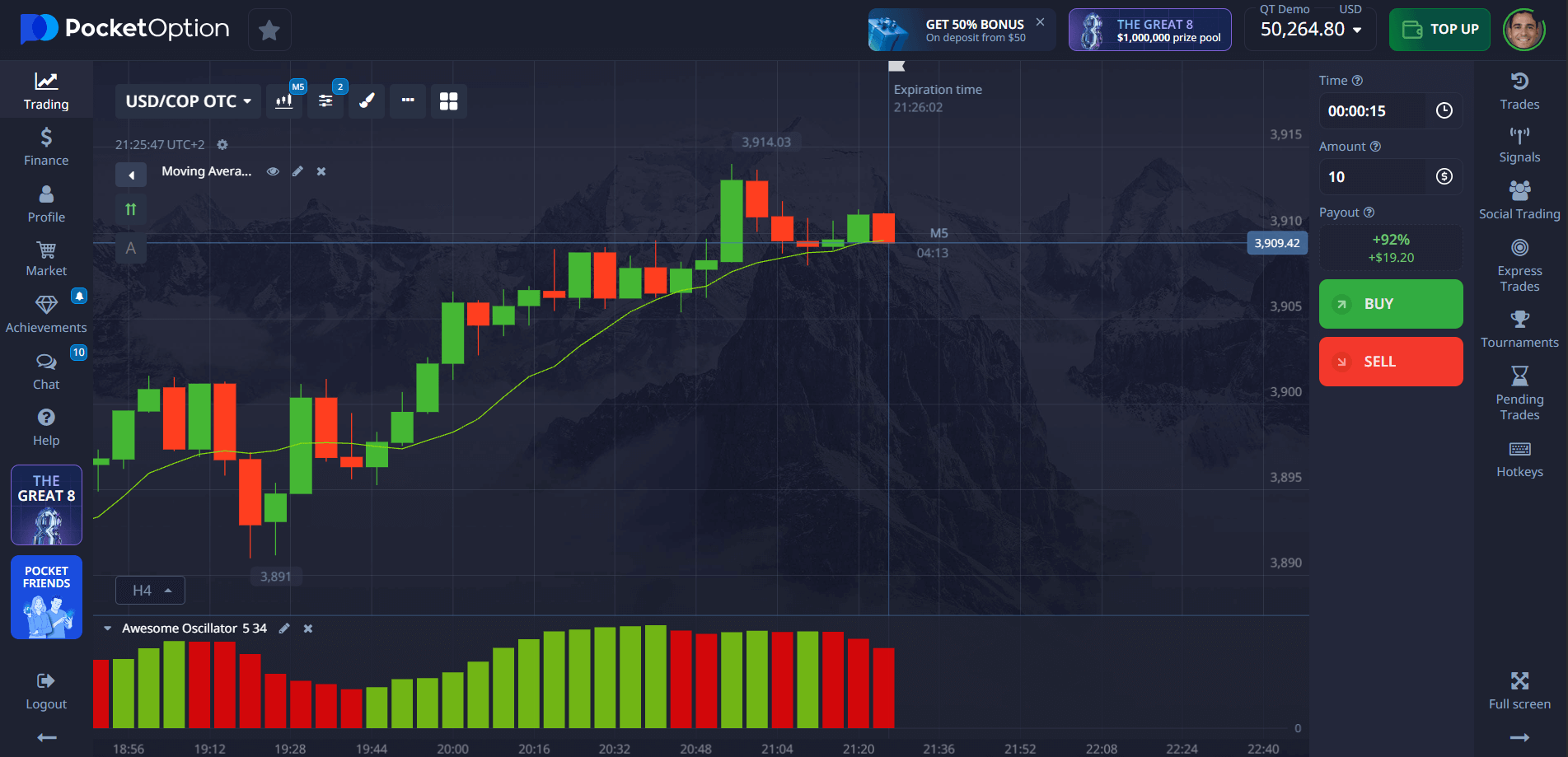

Instructions: How to Trade USDCOP with Quick Trading

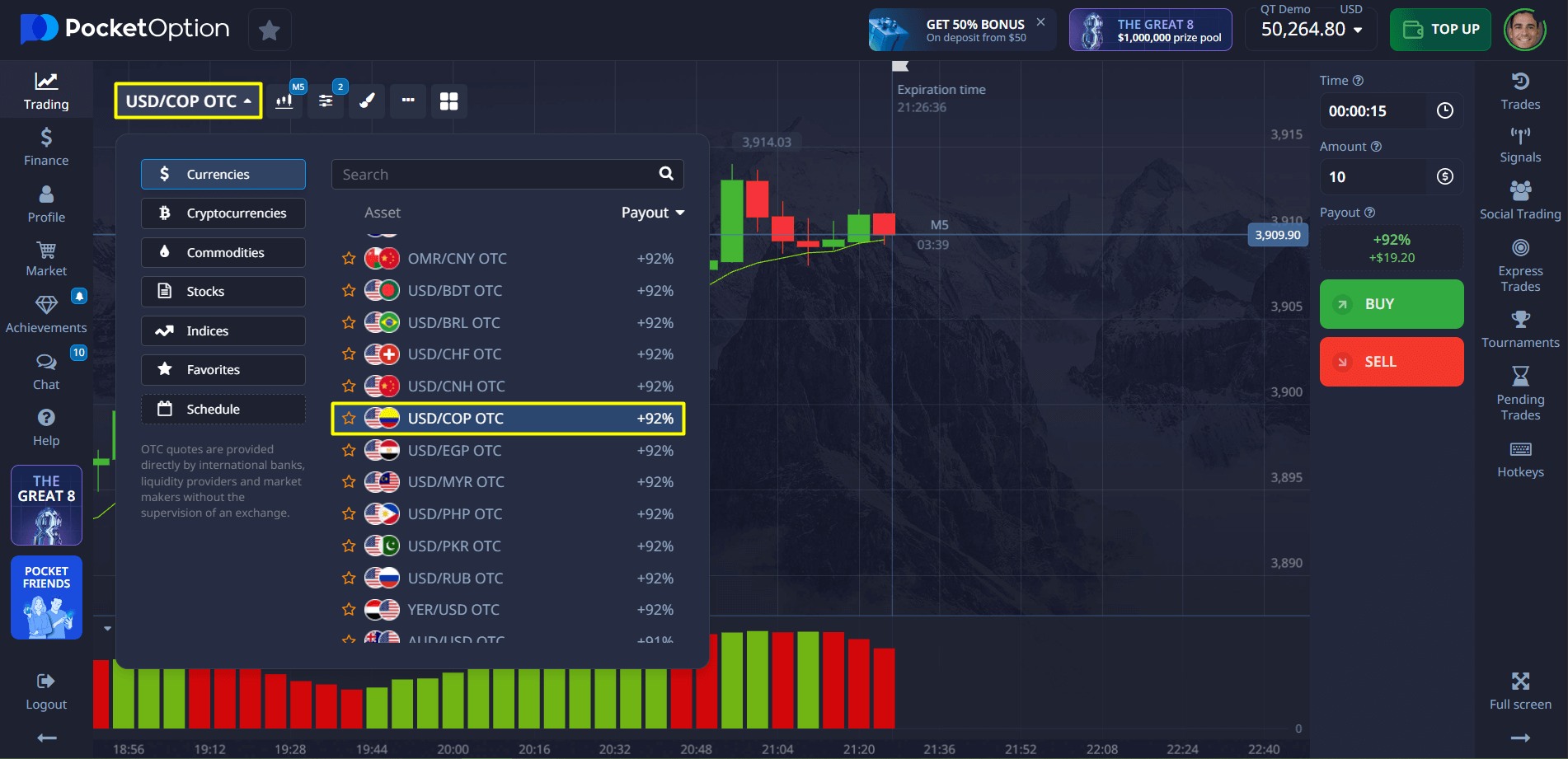

Follow this step-by-step approach to learn how to trade USDCOP on Pocket Option:

- Find the asset: Locate USD/COP OTC on the trading platform.

- Analyze the chart: Use indicators and sentiment tools to develop your forecast.

- Set your amount: Start with just $1 if you’re cautious.

- Choose duration: For OTC assets, select a time frame of 5 seconds or more.

- Place your forecast: Click BUY for upward movement, or SELL if you expect a decline.

- Review potential return: Up to 92% payout shown before trade confirmation.

Try the $50,000 Demo Without Risk

Still exploring how to buy USDCOP or build confidence before using real money? Get instant access to a Pocket Option demo account with $50,000 in virtual funds.

- Monitor USD/COP behavior in real time

- Test different trading strategies

- Learn the interface and indicators

Once you’re ready to switch, deposit as little as $5 (amount may vary by method) and unlock features like:

- Copy Trading

- Cashback on trades

- Tournaments and leaderboards

- Full trading tool access

Conclusion

The USD/COP pair is influenced by macroeconomic indicators, oil market developments, and national policy decisions. Traders looking to form a reliable USDCOP forecast must evaluate both domestic trends in Colombia and external forces like US interest rates. With tools like sentiment indicators and demo accounts, Pocket Option offers a convenient entry point for those learning how to invest in USDCOP and participate in real market debates.

FAQ

What is USD/COP in trading terms?

It's the exchange rate showing how many Colombian Pesos equal one US Dollar.

How to buy USDCOP?

On Pocket Option, select USD/COP, set your amount and time, then forecast the direction.

How to invest in USDCOP safely?

Start with a demo account or small real trades from $5 and follow market trends.

What influences USD/COP rates?

US monetary policy, oil prices, Colombian inflation, and political events.

How to trade USDCOP as a beginner?

Follow simple steps on Pocket Option's Quick Trading interface and use support tools.