- High interest rates penalize slower-growth stocks.

- U.S. drug pricing reforms (e.g., Medicare price negotiations) increase uncertainty.

- R&D inefficiencies — rising development costs without proportional success rates.

- Capital outflows into tech and AI — traditional pharma struggles for attention.

Why is Pfizer Stock So Low: 2025 Perspective

Pfizer stock has dropped despite its pharma leadership. This article examines the main reasons behind the decline, including COVID-19 revenue loss, patent expirations, and market changes.

Article navigation

- Historical Trends: Pfizer’s Stock Price Trajectory

- Main Reasons Behind Pfizer’s Decline

- Market Pressures

- Acquisitions and Market Reaction

- Financial Overview: Is Pfizer Fundamentally Weak?

- Future Outlook: Growth Potential vs. Risk

- Pocket Option: Trading Opportunities on Pfizer

- Conclusion: What’s Next for PFE?

Historical Trends: Pfizer’s Stock Price Trajectory

Between 2020 and 2021, Pfizer stock surged — largely due to the success of its Comirnaty vaccine. But starting in 2022, the trend reversed.

Pfizer vs. Market: Price Change Overview

| Year | Pfizer | S&P 500 | Pharma Sector |

|---|---|---|---|

| 2020 | +11.2% | +16.3% | +9.7% |

| 2021 | +60.4% | +26.9% | +18.2% |

| 2022 | –13.1% | –19.4% | –3.8% |

| 2023 | –44.5% | +24.2% | +2.6% |

| 2024 | –15.2% | +9.8% | –3.1% |

After the pandemic-driven surge, market interest waned significantly. This is a major reason why Pfizer stock is so low.

Main Reasons Behind Pfizer’s Decline

1. Sharp Drop in COVID Revenue

Pfizer saw record earnings from its vaccine and Paxlovid in 2021–2022. But demand fell sharply post-pandemic.

| Year | COVID Revenue | Total Revenue |

|---|---|---|

| 2021 | $36.8B | $81.3B |

| 2022 | $56.7B | $100.3B |

| 2023 | $12.5B | $58.5B |

| 2024 | $8.0B | $63.6B |

Investors now judge Pfizer by how well it can replace COVID-related revenues — a big reason why is PFE stock down.

2. Patent Cliff and Generic Threats

Several top-selling drugs are losing patent protection, paving the way for generics and revenue declines.

| Drug | Patent Expiry | 2023 Revenue | Revenue Risk |

|---|---|---|---|

| Eliquis | 2026 | $7.2B | High |

| Ibrance | 2027 | $4.9B | Medium |

| Xeljanz | 2025–2027 | $1.7B | Medium |

Market Pressures

Acquisitions and Market Reaction

Since 2022, Pfizer has acquired several biotech firms to expand its pipeline — but investor response has been mixed.

| Acquisition | Year | Price | Sector |

|---|---|---|---|

| Seagen | 2023 | $43B | Oncology |

| Arena Pharma | 2022 | $6.7B | Immunology |

| Biohaven | 2022 | $11.6B | Neurology |

Challenges:

- Premium deal prices

- Increased debt burden

- Short-term EPS dilution

Financial Overview: Is Pfizer Fundamentally Weak?

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Revenue | $100.3B | $58.5B | $63.6B |

| EPS (Adj.) | $6.58 | $1.84 | $2.38 |

| Free Cash Flow | $29.3B | $12.4B | $14.1B |

| Dividend | $1.64 | $1.64 | $1.68 |

Massive drops in EPS and cash flow (–50%+) are key reasons why Pfizer stock is so low, despite a strong dividend.

Future Outlook: Growth Potential vs. Risk

Pfizer’s pipeline includes over 30 late-stage projects — from obesity drugs to RSV vaccines and cancer therapies.

Top prospects:

- Danuglipron (obesity, Phase 2, potential $10B+)

- Abrysvo (RSV vaccine, approved)

- Padcev (oncology, from Seagen deal)

Still, the market remains skeptical about Pfizer’s ability to fully offset the lost COVID revenue.

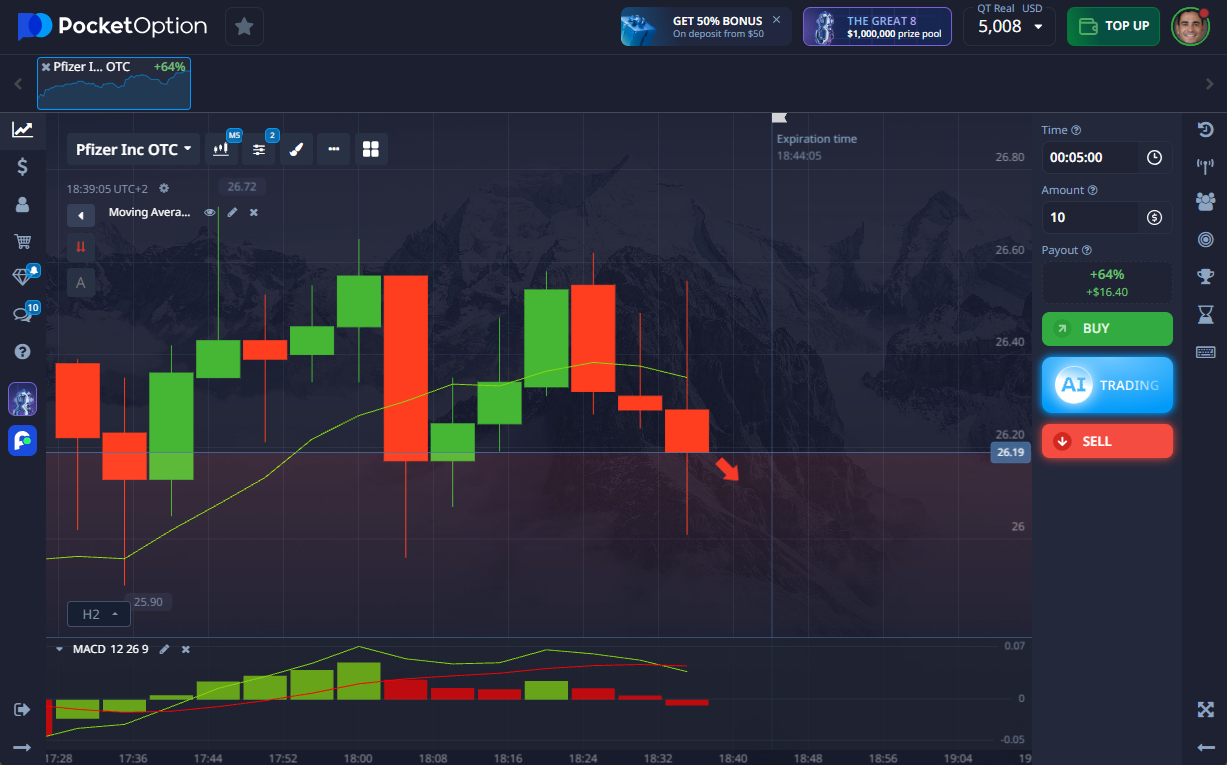

Pocket Option: Trading Opportunities on Pfizer

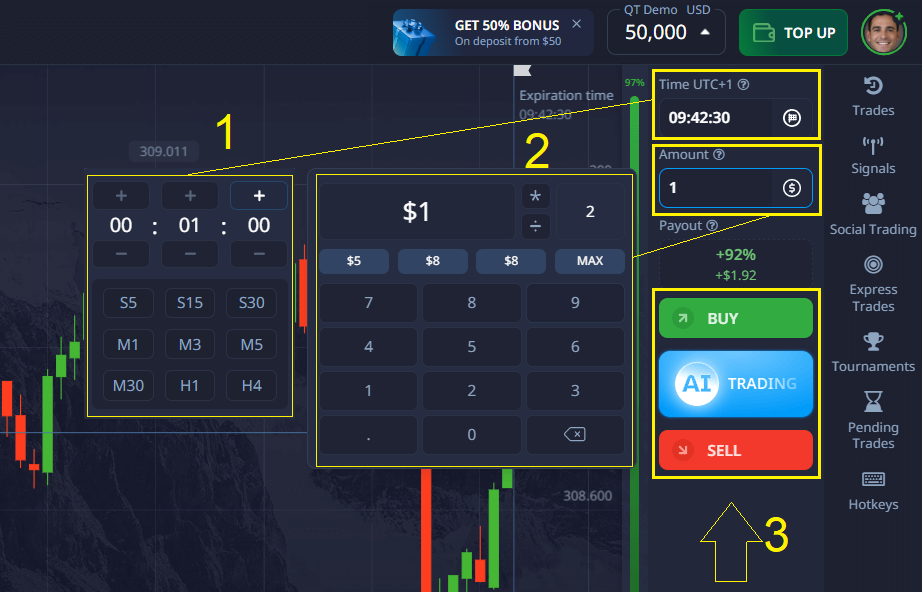

Looking to trade the current PFE drop? Pocket Option offers flexible tools for short-term stock predictions:

Available features:

- Quick and Express trades on Pfizer

- Live PFE quotes

- Flexible timeframes (30 seconds to hours)

- Built-in indicators (RSI, MACD, EMA, etc.)

- No need to buy shares — trade price direction only

Why use Pocket Option:

- No broker account needed

- $5 minimum deposit (varies by method)

- $50,000 demo account to practice safely

Additional tools include:

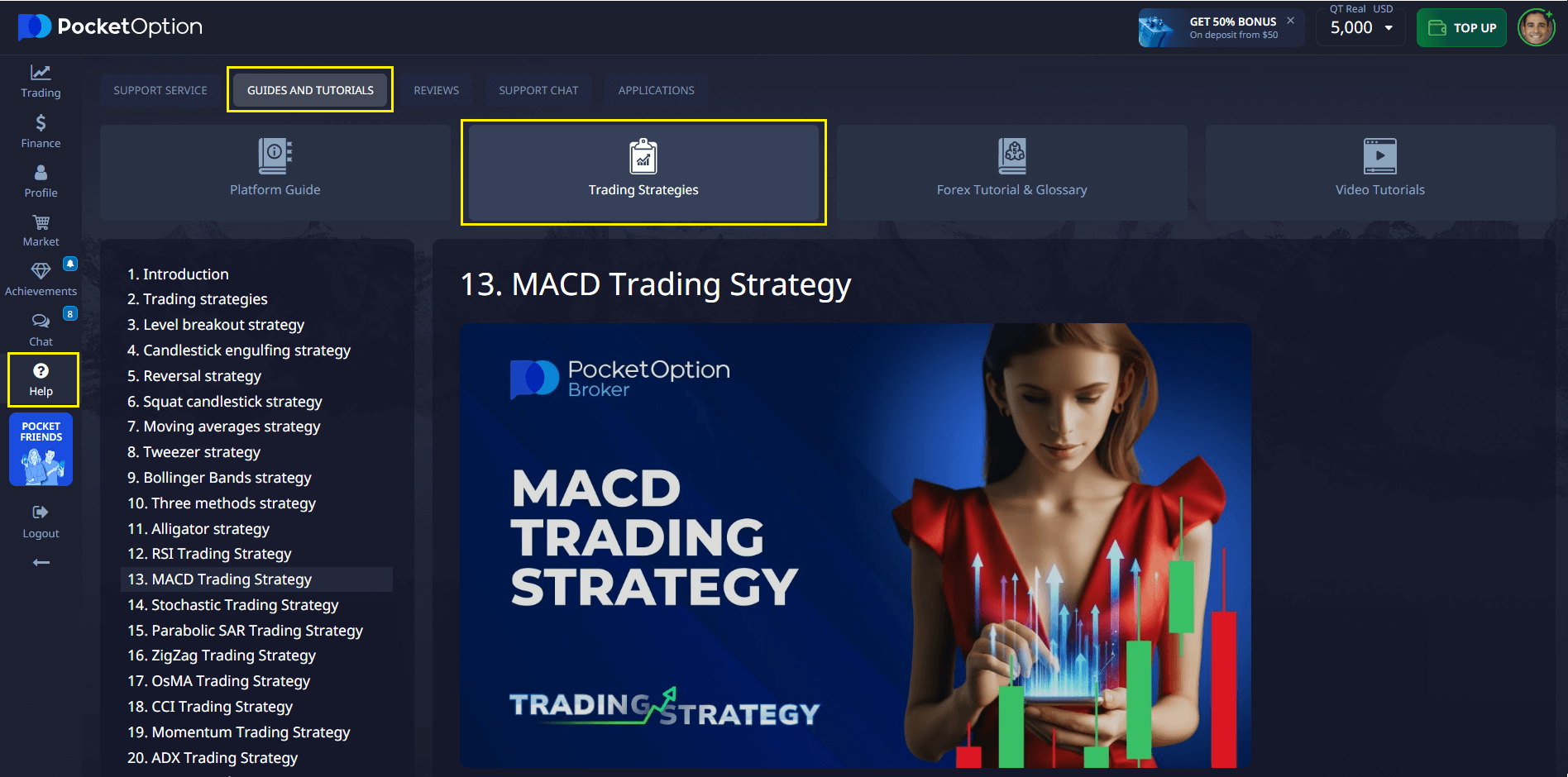

- News & signals — get real-time Pfizer stock updates

- Social trading — follow top traders

- Analytics & references — improve strategy with up-to-date data

- Video tutorials and strategy guides — apply proven methods to current conditions

Conclusion: What’s Next for PFE?

Pfizer stock remains under pressure due to a combination of lost COVID revenue, patent cliffs, and merger-related losses. However, the company retains a stable balance sheet and is investing heavily in R&D.

Why is Pfizer stock so low? The answer lies in both external market shifts and internal strategic headwinds.

What to consider:

- Dividend yield and long-term stability

- High short-term volatility risk

- Pipeline progress will be key for recovery

Pocket Option allows traders to monitor these assets in real time and act on short-term movements with flexible trade setups.

FAQ

Why is Pfizer stock so low?

Due to a sharp drop in COVID revenue, upcoming patent expirations, and weak near-term results from new drugs.

Is a Pfizer rebound expected?

Partially — if new product development succeeds and earnings stabilize. A return to pandemic-era highs may take years.

Is Pfizer’s dividend safe?

Yes, for now. The payout ratio is manageable, and dividend growth continues.

Can I trade Pfizer on Pocket Option?

Yes, it's available via Quick Trading, Express, and MetaTrader with technical tools and signals.

Is there an alternative to buying Pfizer shares?

Yes — you can forecast price movements without owning shares using Pocket Option's platform.