- Income (sales, interest, dividends)

- Cost of Goods Sold (COGS)

- Operating expenses (salaries, rent, marketing)

- Taxes and interest payments

PNL What Is Finance: Understanding Profits and Losses in Finance and Trading

In the world of finance and trading, understanding "pnl que es finanzas" is fundamental. This term, which translates to profits and losses in finance, is a cornerstone for decision-making in investments, business performance, and personal financial health. Whether you manage a corporate balance sheet, trade on platforms like Pocket Option, or handle a household budget, your ability to interpret PNL data can determine your success.

Article navigation

- Definition and PNL Meaning in Finance

- P&L Meaning and What is P&L in Accounting

- What is PNL in Finance: Practical Importance

- Pocket Option and PNL Tracking

- Types of PNL: Realized vs Unrealized

- How to Calculate PNL: P&L Example

- Expert Opinions on the Use of PNL

- PNL and Financial Statements: What is a PNL in Finance

- Expanded Example: PNL Accounting in a Company

- How Traders Use PNL: What is PNL in Finance

- Key Financial Metrics that Complement PNL

- PNL in Personal Finance: PNL in Personal Finance

- Practical Tips to Maximize PNL

- Common Mistakes in Interpreting PNL

- PNL Reporting Frequency

- Expert Recommendations for Using PNL

- Why You Should Understand PNL What is Finance

What Does PNL Mean in Finance?

“Pnl que es finanzas” refers to the net result of all income and expenses over a specific period. It is a financial statement that answers a key question: did your activity generate profits or losses? From Wall Street analysts to individual traders, tracking PNL is vital.

Definition and PNL Meaning in Finance

PNL (Profit and Loss), or in Spanish, “pnl significado finanzas”, shows the financial outcome of operations. In accounting, it is part of the income statement. A positive PNL indicates profitability; a negative one indicates losses. The pnl accounting generally includes:

P&L Meaning and What is P&L in Accounting

The term P&L is simply the abbreviation for Profit and Loss. In accounting, the P&L represents one of the most fundamental financial statements. “What is P&L in accounting” refers to the document that summarizes income, costs, and expenses over a period. It serves to assess whether a company is profitable and to what extent.

What is PNL in Finance: Practical Importance

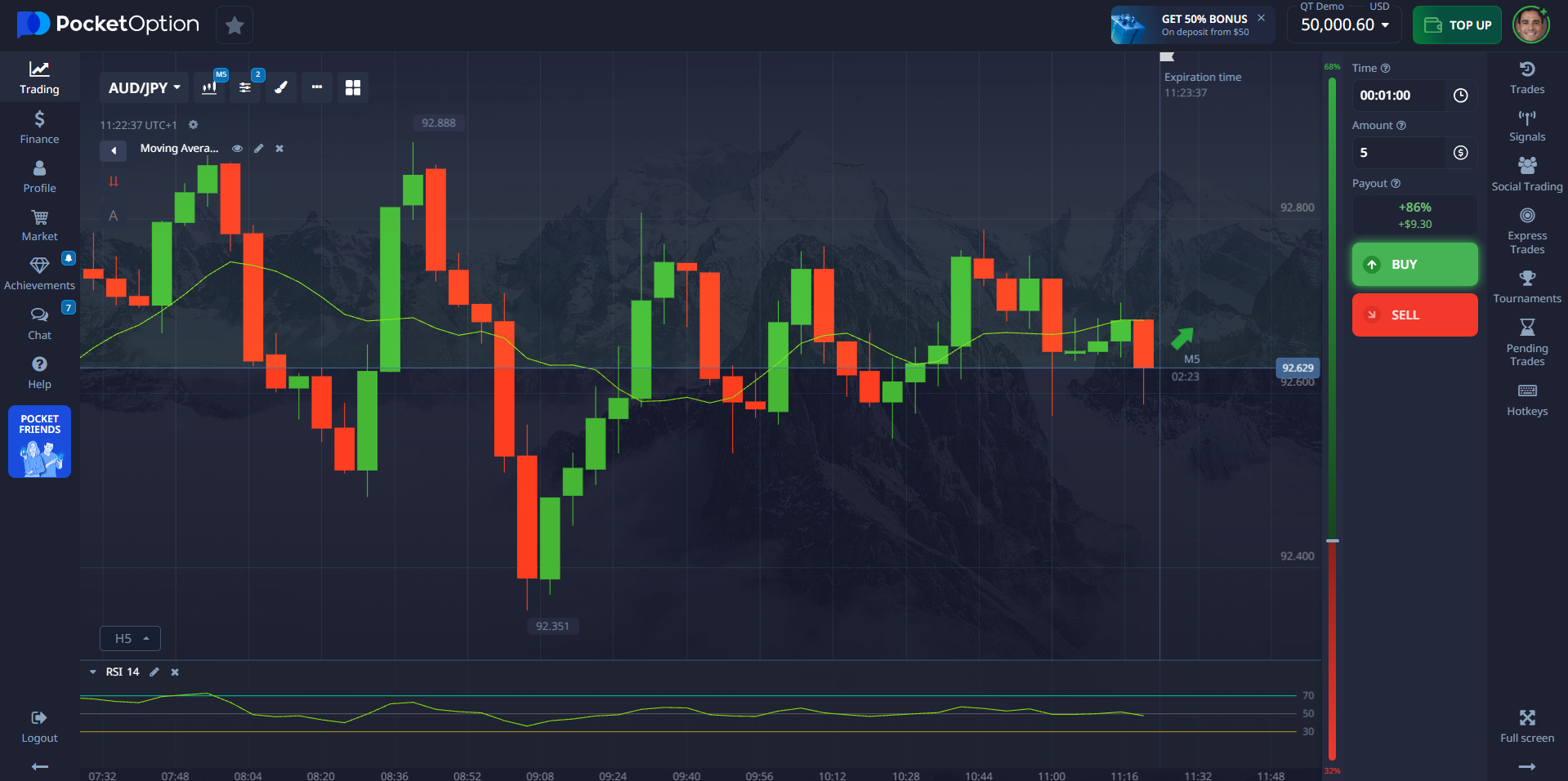

For investors and traders, understanding “what is pnl in finance” means knowing how to interpret the success or failure of operations. On platforms like Pocket Option, traders consult PNL panels to track their performance. The platform allows users to maintain a trading journal, analyze patterns, and refine strategies based on historical profit and loss data.

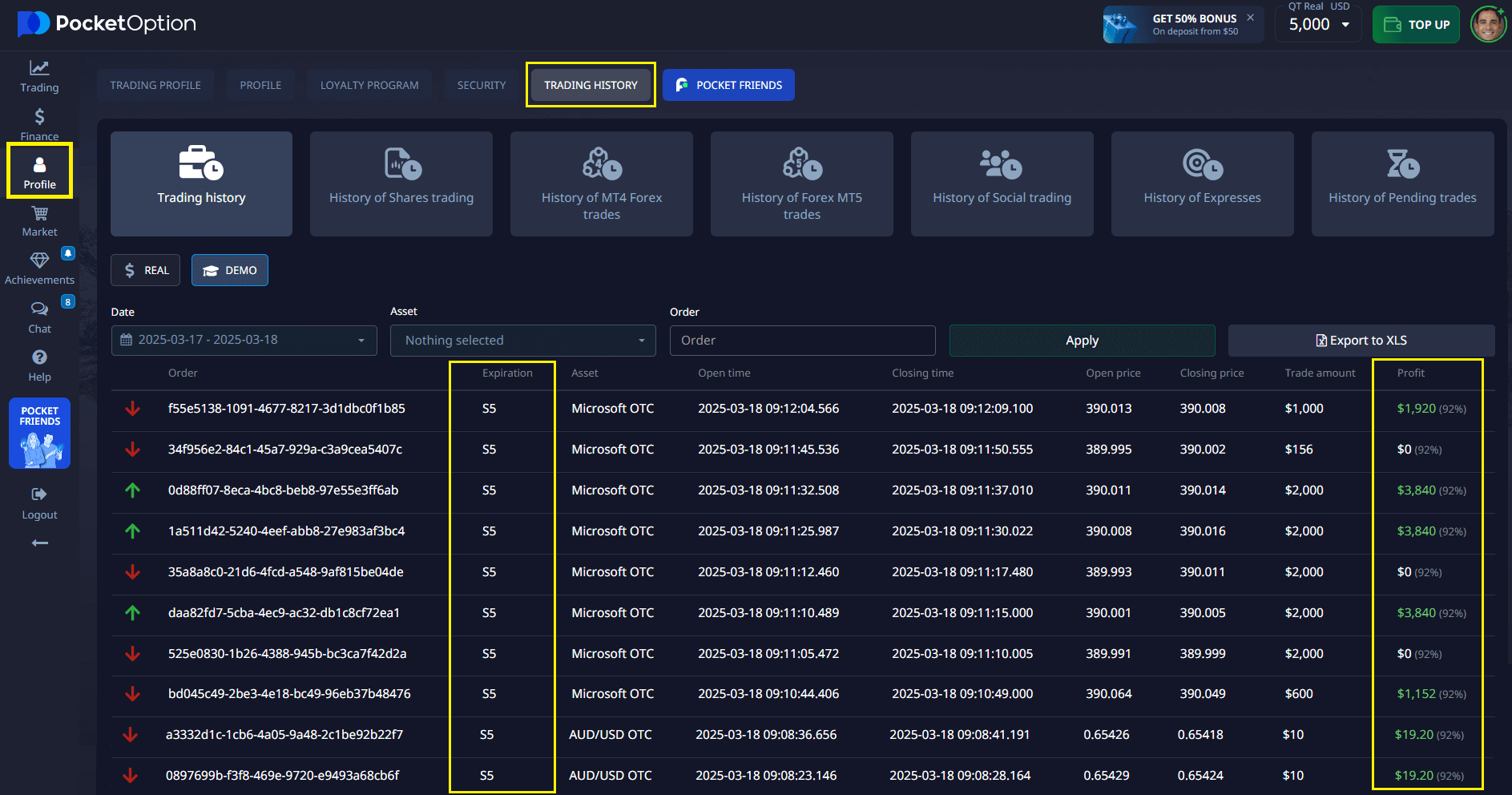

Pocket Option and PNL Tracking

Pocket Option offers an integrated PNL journal that helps traders evaluate their “pnl finance” metrics. This feature allows:

- Daily, weekly, and monthly PNL summaries

- Strategy testing based on historical results

This makes it easier for users to understand “what pnl means in finance” through direct experience.

Types of PNL: Realized vs Unrealized

| Type | Description |

|---|---|

| Realized PNL | Profit or loss from closed trades; confirmed income or expense |

| Unrealized PNL | Fluctuating profit/loss on open positions according to the market |

Understanding both helps traders and accountants evaluate real results and performance.

How to Calculate PNL: P&L Example

Let’s see a “P&L example” using trading:

- Buy 100 shares at $10

- Sell at $13

- Realized PNL = (13 – 10) * 100 = $300

If the shares are still held and the current price is $12:

- Unrealized PNL = (12 – 10) * 100 = $200

This calculation is essential for both short-term trades and long-term investments.

Expert Opinions on the Use of PNL

- According to Investopedia, tracking realized and unrealized PNL helps identify inefficiencies. Bloomberg analysts highlight the importance of constant PNL monitoring for asset managers. Harvard Business Review notes that companies with high PNL accuracy outperform their peers by 18%.

- Financial analyst Juan Hernández, a regular contributor to El Economista, states: “A correct interpretation of PNL not only improves risk management but also optimizes long-term profit margins. It is a language that every disciplined investor must master.”

- Professor Ana María Ruiz, from the Autonomous University of Madrid, adds: “PNL is not just a result. It is an X-ray of financial behavior. Teaching students to read a PNL correctly is like giving them a map to navigate the real economy.”

PNL and Financial Statements: What is a PNL in Finance

“What is a pnl finance” can also refer to a complete income statement. Companies prepare it monthly, quarterly, or annually. It helps stakeholders understand income sources, cost structure, and net profits.

Expanded Example: PNL Accounting in a Company

| Category | Amount ($) |

|---|---|

| Income | 100,000 |

| Cost of Goods Sold | 40,000 |

| Operating Expenses | 30,000 |

| Taxes | 10,000 |

| Net Profit | 20,000 |

This is the core for evaluating corporate performance.

How Traders Use PNL: What is PNL in Finance

In trading, “what is pnl in finance” involves evaluating each transaction. Traders rely on this metric to:

- Set stop-loss and take-profit levels

- Optimize portfolio allocation

- Measure risk-adjusted returns

Key Financial Metrics that Complement PNL

| Metric | Description |

|---|---|

| ROI | Return on Investment – net profit / total investment |

| Sharpe Ratio | Risk-adjusted return indicator |

| Success Rate | Percentage of profitable trades |

| Drawdown | Maximum drop from peak PNL |

Expert Opinions on the Use of PNL

According to Investopedia, tracking realized and unrealized PNL helps identify inefficiencies. Bloomberg analysts highlight the importance of constant PNL monitoring for asset managers. Harvard Business Review notes that companies with high PNL accuracy outperform their peers by 18%.

PNL in Personal Finance: PNL in Personal Finance

Understanding “pnl in finance” personally can improve budget planning. It shows:

- If you live within your means

- How much you can save/invest

- If you are progressing towards your financial goals

Use tools like the Pocket Option journal or apps like Mint and YNAB.

Practical Tips to Maximize PNL

- Record every income and expense

- Use trading journals (like in Pocket Option)

- Diversify your investments

Common Mistakes in Interpreting PNL

- Ignoring transaction fees

- Confusing gross profit with net profit

- Overestimating future performance based on unrealized gains

PNL Reporting Frequency

Expert Recommendations for Using PNL

- Adopt complementary metrics like the Sharpe ratio and drawdown for a holistic view.

- Integrate PNL analysis into your weekly routine, even if you are a long-term investor.

- Use platforms like Pocket Option not only to trade but to reflect on each trade: its profit, its loss, and its context.

Why You Should Understand PNL What is Finance

In summary, “pnl que es finanzas” is not just an accounting term; it is a key tool for understanding performance, managing risks, and guiding future decisions. Whether you are a beginner or advanced trader on Pocket Option, or managing your family budget, PNL is an essential resource. Make PNL a central part of your financial strategy and you will be better prepared to face the challenges and opportunities of today’s market.

FAQ

How is PnL calculated in trading?

In trading, PnL is typically calculated by subtracting the purchase price from the selling price and multiplying the result by the number of units traded. This calculation can also include additional factors such as commissions and taxes.

Why is PnL important for investors?

PnL is crucial for investors as it provides a clear picture of an investment's performance, helping them assess the profitability of their portfolio and make informed decisions about future investments.

How often should PnL be analyzed?

The frequency of PnL analysis depends on the context. Companies often review PnL statements quarterly or annually, while traders might analyze their PnL daily or even in real-time for active trading strategies.

Can PnL be manipulated?

Although PnL should reflect accurate financial information, there are cases where it can be manipulated through creative accounting practices. That is why it is important to understand PnL in context and often in conjunction with other financial metrics.

How is the PnL calculated?

The calculation of PnL depends on the context: In trading: PnL = (Selling price - Purchase price) × Position size. In companies: Total revenue - Operating costs - Cost of goods sold - Taxes. For example, if you buy 100 shares at $10 and sell them at $13: Realized PnL = (13 - 10) × 100 = $300.

What is PnL in trading?

In trading, PnL refers to the profits or losses that a trader obtains from their trades. It can be: Realized: closed trades with confirmed profit or loss. Unrealized: potential changes in the value of open positions. Traders on platforms like Pocket Option use PnL to analyze their performance and improve their strategies.

What is PNL in accounting and finance?

In accounting and finance, the PNL (Profit and Loss) is the income statement that summarizes all the revenues, costs, and expenses of a company over a period. It is essential for understanding financial performance and making informed decisions. This document is known as "pnl accounting" and is regularly prepared to measure profitability.

What is PnL in finance?

The PnL in finance, also known as "pnl what is finance," represents the net profits or losses derived from income and expenses over a specific period. It is an essential tool for assessing whether an activity, company, or investment is being profitable.