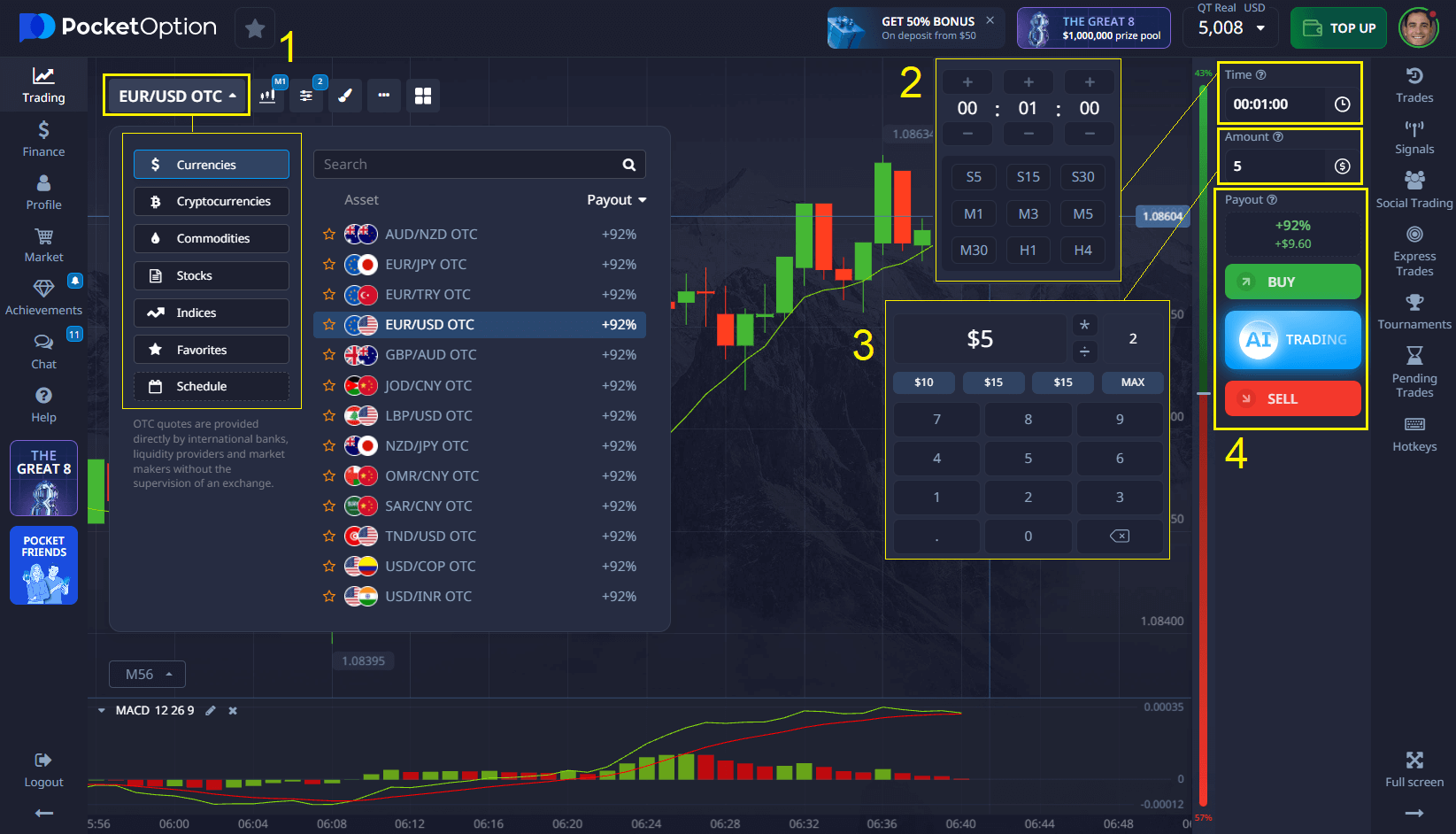

- Log into your Pocket Option account and access the trading interface.

- From the asset list, select the “Currency Pairs” category and choose EUR/USD.

- Analyze the market using technical indicators or economic news to form a directional forecast.

- If you believe the euro will strengthen against the dollar, select “Buy.” If you expect it to weaken, select “Sell.”

- Enter your trade amount, set the contract’s expiration time, and confirm your trade.

Currency Pairs: Market Structure, Types, and Trading Dynamics

Currency pairs are the foundation of the forex market. Understanding how they function and what drives their movement is essential for building a successful trading strategy. In this guide, we’ll explore the types of currency pairs, the factors influencing their value, and proven strategies to trade them effectively in today’s dynamic market environment.

Article navigation

- What Are Currency Pairs?

- What Is a Currency?

- Types of Currency Pairs

- How the Forex Market Works

- How Currency Pairs Are Quoted

- Key Drivers of Currency Value

- Choosing the Right Currency Pair

- Understanding Correlation Between Pairs

- Smart Strategies for Trading Currency Pairs

- Trader Stories: Real-World Examples

- Trading Currency Pairs with the Right Platform

- Final Thoughts: Build Expertise One Pair at a Time

What Are Currency Pairs?

In the forex market, currencies are traded in pairs — a base currency and a quote currency. For instance, in EUR/USD, the euro is the base and the dollar is the quote. The exchange rate tells you how much of the quote currency you need to buy one unit of the base.

What Is a Currency?

A currency is a monetary system used in a particular country. In forex, currencies such as USD, EUR, and JPY dominate trading volumes. Central banks influence currency values through interest rate changes, inflation control, and economic policy. Currency performance also reflects broader macroeconomic conditions such as unemployment levels, geopolitical stability, and trade dynamics.

Expert Insight:

“To trade currency pairs successfully, you must treat them as expressions of economic relationships, not just numbers.” — Marcus Bellamy, Forex Analyst, FXStreet

Types of Currency Pairs

| Category | Description | Examples |

|---|---|---|

| Major Pairs | Include USD, high liquidity | EUR/USD, USD/JPY |

| Minor Pairs | No USD, moderate liquidity | EUR/GBP, AUD/NZD |

| Exotic Pairs | One major + emerging currency | USD/TRY, EUR/SEK |

Major pairs typically feature the lowest spreads and highest volume. Minor pairs offer more diversification but can have wider spreads. Exotic pairs demand a deeper understanding of geopolitical and local economic risks due to their sensitivity to news and policy shifts.

How the Forex Market Works

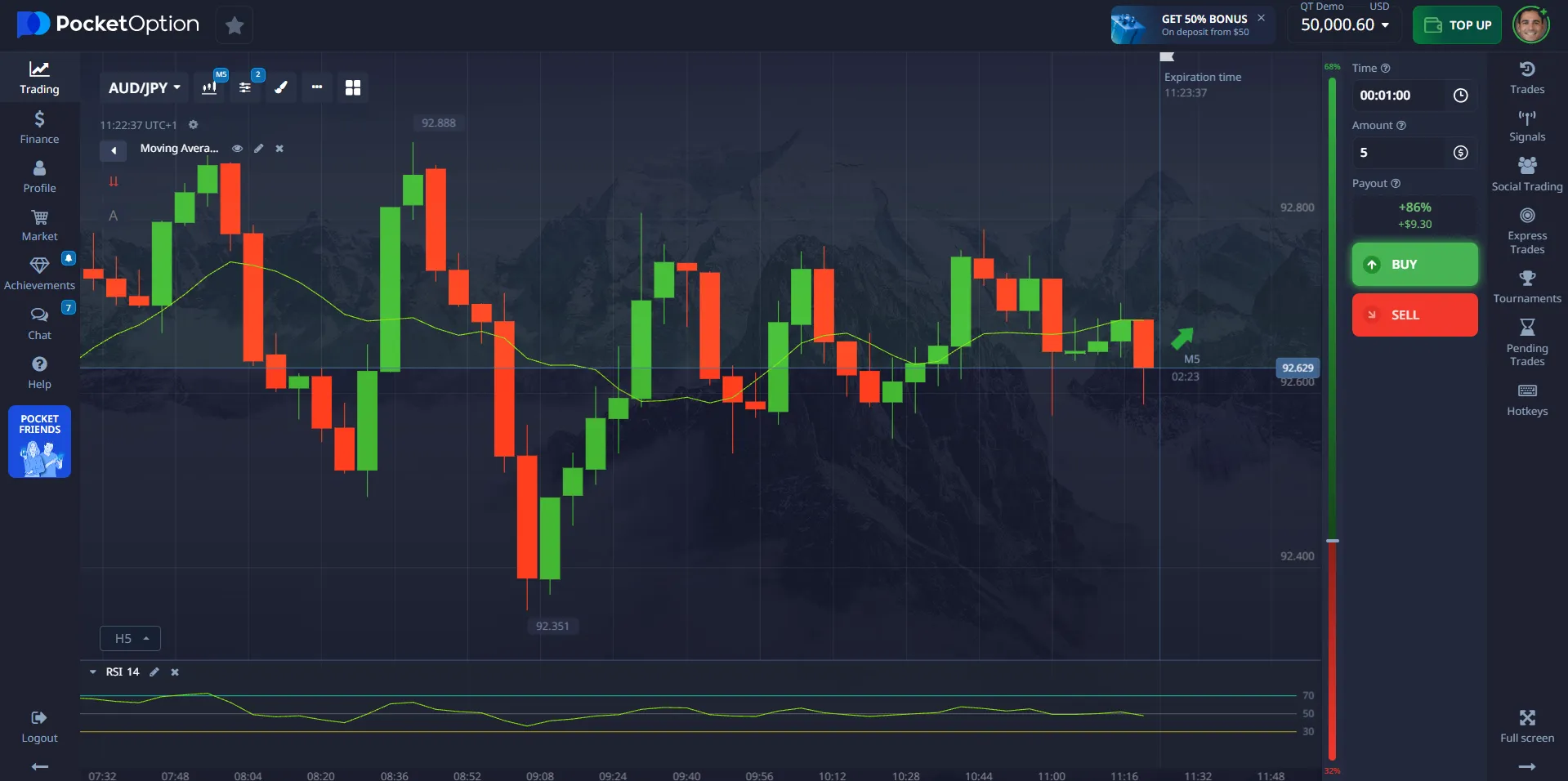

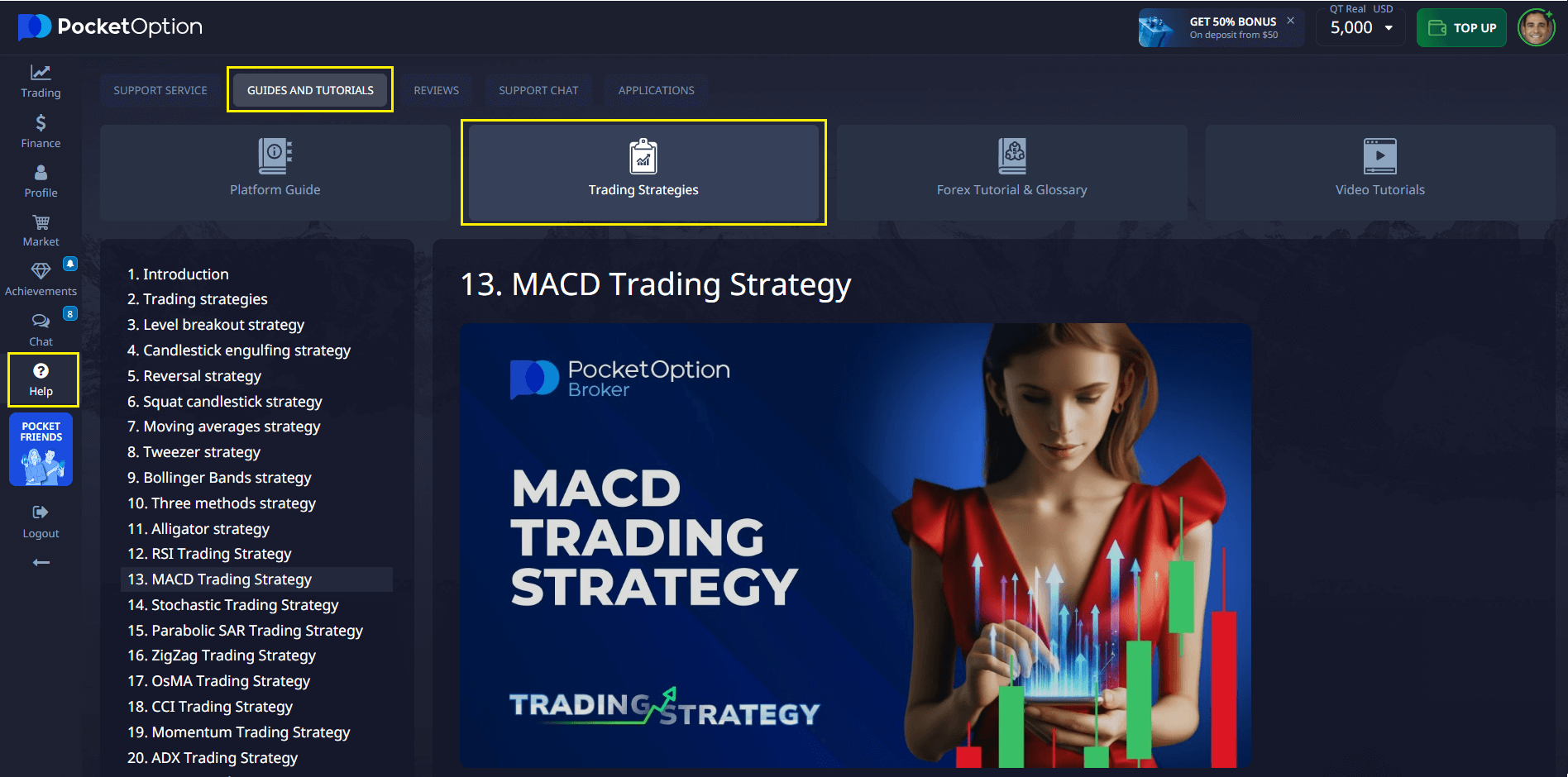

Example: Trading a Currency Pair on Pocket Option

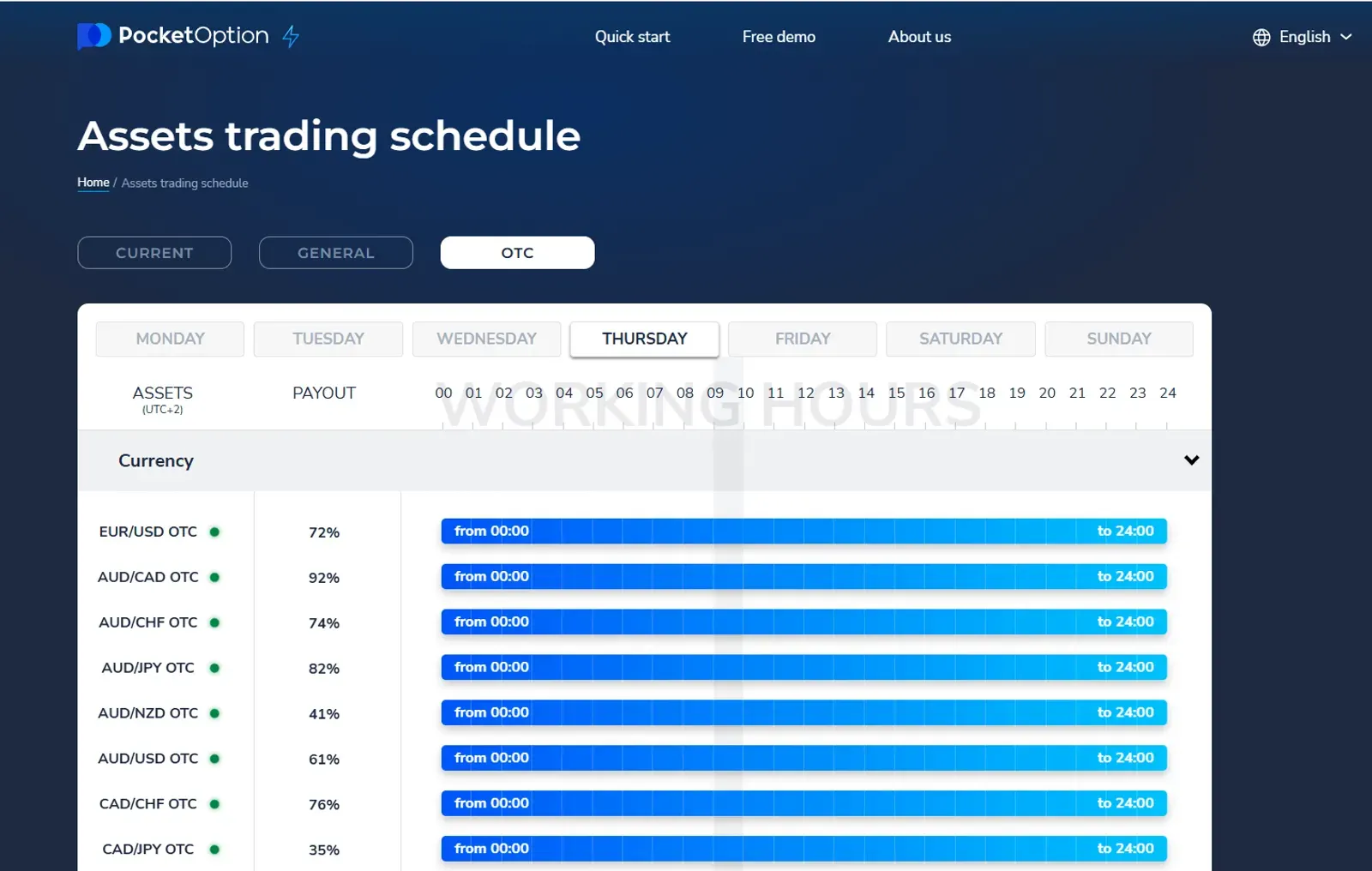

On Pocket Option, you trade contracts based on your prediction of how the price of a currency pair will move — not by purchasing actual currencies. At Pocket Option you can also trade 24/7 using OTC assets. Here’s how a trade might look using EUR/USD:

If your prediction is correct at the end of the selected time frame, your trade finishes in-the-money, resulting in a fixed payout. This intuitive process allows you to take advantage of currency movements with precision and speed.

The forex market operates 24/5, supporting high-volume trading across the globe. Unlike stock trading, forex is decentralized and involves direct transactions between participants — from central banks and institutional investors to individual traders.

Many modern trading platforms allow traders to speculate on currency movements through derivative contracts, without the need to own the underlying asset. This model enables swift execution, hedging capabilities, and the opportunity to profit from both rising and falling markets.

How Currency Pairs Are Quoted

Prices move in pips — 0.0001 for most pairs, 0.01 for JPY pairs. For example, a change from 1.1200 to 1.1205 in EUR/USD is a 5-pip move. The spread, or the difference between bid and ask prices, is your trading cost.

Understanding quote conventions also involves recognizing direct vs. indirect quotes, and the impact of decimal pricing or fractional pips — critical for scalping strategies and precision-based execution.

Key Drivers of Currency Value

Currency pairs react to:

- Interest Rates: Central banks adjust interest rates to control inflation and stimulate growth; rate differentials create yield opportunities

- Inflation and Economic Growth: Low inflation and steady GDP growth tend to support a currency

- Trade Balances: A surplus usually indicates foreign demand for the local currency

- Political Developments: Political uncertainty or reform can drastically affect investor confidence

Professional traders use economic calendars, central bank statements, and geopolitical updates to inform their trade entries and exits.

Choosing the Right Currency Pair

| Factor | Why It Matters | Example Pairs |

|---|---|---|

| Volatility | High risk, high reward | GBP/JPY, EUR/NZD |

| Spread | Lower spread = lower cost | EUR/USD, USD/CHF |

| Trading Hours | Align with active sessions | USD/JPY (Asia), EUR/USD |

| Correlation | Manage risk across positions | AUD/USD & NZD/USD |

Traders should adapt pair selection based on their risk appetite, time commitment, and strategy complexity. Top-tier platforms offer filtering tools that help customize trading watchlists using real-time data.

Understanding Correlation Between Pairs

Currency pairs often exhibit correlation:

- Positive: EUR/USD & GBP/USD

- Negative: EUR/USD & USD/JPY

Understanding correlation helps avoid overexposure and creates opportunities for hedging. For example, if two pairs have a strong inverse correlation, trading both simultaneously can neutralize market noise.

Many trading platforms offer dynamic correlation matrices and visual heatmaps — useful tools for managing multi-asset strategies.

Smart Strategies for Trading Currency Pairs

- Trend-Following: Best for EUR/USD, USD/JPY — use moving averages and MACD

- Breakouts: Use on GBP/USD around news events — look for volume spikes and resistance levels

- Mean Reversion: Favor range-bound pairs like EUR/CHF — deploy Bollinger Bands and RSI

- Carry Trades: Trade high-yield vs. low-yield currencies — suited for long-term positions with interest rate differentials

Strategy performance improves with a consistent trading routine, backtesting, and refined entry/exit criteria.

Expert Insight:

“No strategy fits all pairs. Tailor your approach based on pair personality and session activity.” — Lucia Grant, Head of FX Education, TradeTech

Trader Stories: Real-World Examples

Anna, a technical trader, focused on EUR/GBP. She developed a range strategy that relied on Bollinger Bands and RSI signals. Her 68% accuracy over 30 trades shows the power of understanding pair rhythm and respecting key support/resistance levels.

Jason, a macro trader, used AUD/USD to exploit commodity price correlations. He timed entries after key Australian economic releases and used Fibonacci retracements. With consistent risk management, he averaged a 1.9% return per trade.

Trading Currency Pairs with the Right Platform

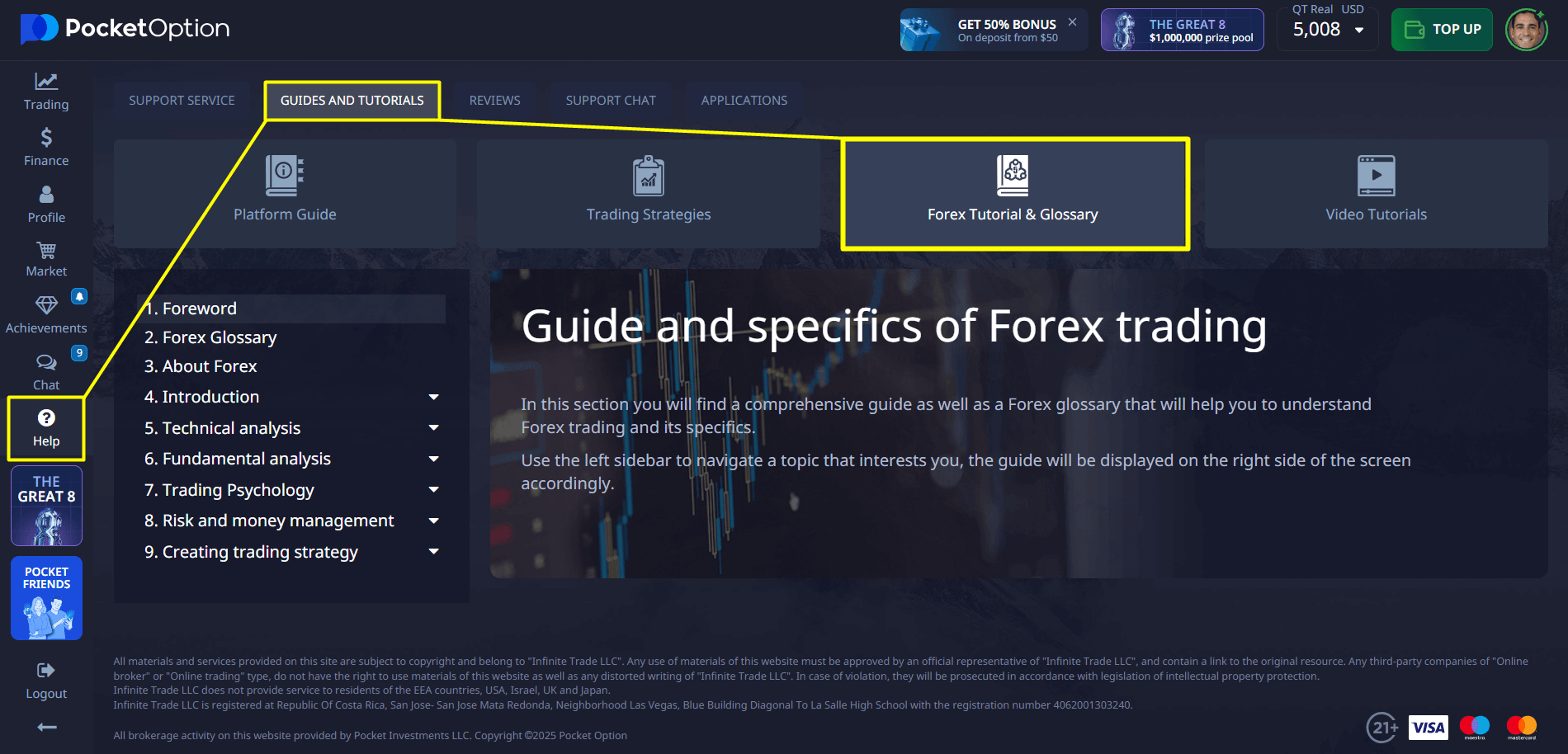

While the theory and strategy behind currency trading are universal, the tools available on your platform make a significant difference. A well-equipped platform should offer:

- Access to major, minor currency pairs and exotic pairs

- Real-time quotes and multi-timeframe charting

- Economic news feeds and trading signals

- Demo accounts and backtesting functionality

Choosing the right trading interface can empower your decisions and simplify complex analysis. Evaluate platforms based on usability, toolset, and execution quality.

Final Thoughts: Build Expertise One Pair at a Time

Forex Currency pairs offer a window into global economics. Understanding their behavior, trading with discipline, and leveraging high-quality tools can turn insights into results.

Successful trading starts with deliberate practice. Focus on one or two pairs, learn their reactions to different news, test in demo mode, and only then scale.

Start with one pair. Master its rhythm. Test. Improve. Then scale. Discuss this and other topics in our community!

FAQ

What are the most stable currency pairs?

EUR/USD, USD/CHF, and AUD/USD are considered stable due to high liquidity and moderate volatility.

Should beginners avoid exotic currency pairs?

Yes. Exotic pairs have wider spreads and faster, less predictable moves — not ideal for learning.

How do I know which currency pairs to trade?

Choose based on volatility, session, strategy style, and your risk tolerance. Track behavior with a journal.

Can I trade currency pairs without leverage?

Yes. Pocket Option allows flexible leverage settings or none at all.

Do currency pairs behave the same every day?

No. Behavior changes based on sessions, news, and liquidity. Tracking and reviewing patterns is essential.

What are the 7 major currency pairs?

The 7 major currency pairs list are the most traded in the forex market and all include the US dollar as either the base or quote currency. These are: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD.

What are the 28 currency pairs?

The 28 currency pairs refer to all the possible combinations of the 8 major currencies: USD, EUR, GBP, JPY, CHF, CAD, AUD, and NZD. When each currency is paired with the others (excluding duplicates and reversals), it results in 28 unique forex pairs used by many traders for diversification and strategy development.

How to read currency pairs for beginners?

To read currency pairs as a beginner, start by recognizing that the first currency is the base and the second is the quote. The pair’s price shows how much of the quote currency is needed to buy one unit of the base currency. For example, if EUR/USD is 1.1000, it means 1 euro equals 1.10 US dollars. If the price rises, the base currency is strengthening; if it falls, it’s weakening.