- Each Bitcoin transaction includes the sender’s and receiver’s wallet addresses.

- The blockchain is immutable — entries cannot be deleted or altered.

- Anyone can track transactions using blockchain explorers.

Is Bitcoin Traceable: Transparency, Risks, and Investor Insights

Is Bitcoin truly anonymous, or does every transaction leave a digital footprint? This article explores the often misunderstood question of 'is Bitcoin traceable', breaking down blockchain mechanics, privacy layers, and offering actionable investor insights for both beginners and experienced traders.

Article navigation

Understanding Bitcoin’s Pseudonymity: Beyond Myths

Bitcoin is often portrayed as anonymous. In reality, it is pseudonymous. Every transaction is recorded on the blockchain — a public ledger accessible to anyone. The wallet addresses, though not directly linked to personal identities, are permanent and can be traced through transaction patterns.

How Blockchain Transparency Works

Thus, ‘is Bitcoin traceable’ is not merely a theoretical debate. It has tangible implications for privacy and regulatory compliance. For instance, law enforcement agencies frequently use blockchain data to investigate fraud, tax evasion, and illicit financial activities.

Practical Examples of Bitcoin Traceability in Action

Consider the well-known Silk Road case. Authorities traced Bitcoin movements from the marketplace’s wallets to several conversion points. Despite the use of mixing services, they eventually identified key wallets and seized assets.

Another example is the 2021 Colonial Pipeline ransomware attack, where the FBI traced ransom Bitcoin payments using blockchain analytics and recovered part of the funds.

These cases show that while Bitcoin offers a layer of obscurity, sophisticated tools can often lift the veil. Traders should be aware that their Bitcoin transactions are part of a visible chain, even if intermediated through third parties.

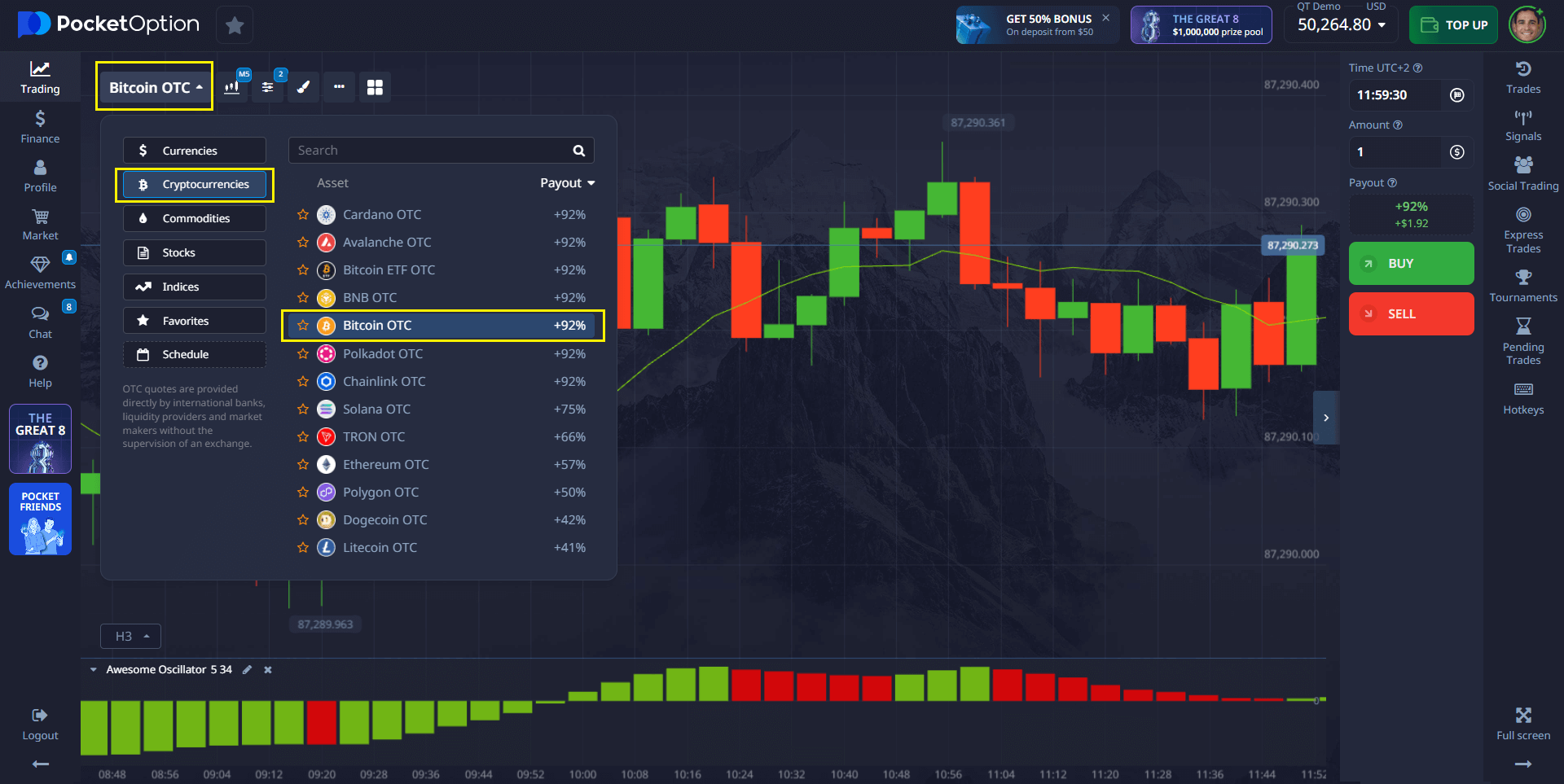

Bitcoin Quick Trading on Pocket Option

The Pocket Option platform allows traders to trade Bitcoin without owning it. Simply forecast whether the price will rise or fall and choose a time frame. If your forecast is correct, you can earn up to 92% profit! Start trading with as little as $5 (deposit amount may vary depending on your payment method) in just 30 seconds!

Does Privacy Still Exist in Bitcoin Transactions?

Privacy-conscious investors often ask ‘is Bitcoin tracable’, confusing Bitcoin with privacy coins like Monero or Zcash. Unlike these coins, Bitcoin lacks built-in privacy features.

Still, users try to increase privacy by:

- Using new addresses for each transaction.

- Leveraging mixers (though these carry legal and security risks).

- Transacting through decentralized exchanges.

However, these methods are not foolproof and might attract additional scrutiny.

Comparing Privacy Coins and Bitcoin

| Aspect | Bitcoin | Privacy Coins (e.g., Monero) |

|---|---|---|

| Blockchain Visibility | Fully transparent | Obfuscated transaction data |

| Identity Link Risk | Moderate (with analytics) | Low (by design) |

| Legal Scrutiny | Increasing | High in some jurisdictions |

Investor Considerations When Trading Bitcoin

Investors should assess the implications of Bitcoin traceability:

- Transparency enhances market trust but limits privacy.

- Assess your risk appetite. If traceability concerns you, consider diversifying with privacy coins—while remaining aware of the legal landscape.

- Stick to regulated exchanges with KYC procedures to ensure compliance.

Risk Mitigation Tips

- Check the platform’s privacy and reporting policies.

- Avoid using Bitcoin for sensitive or anonymous deals.

- Keep records for tax and compliance purposes.

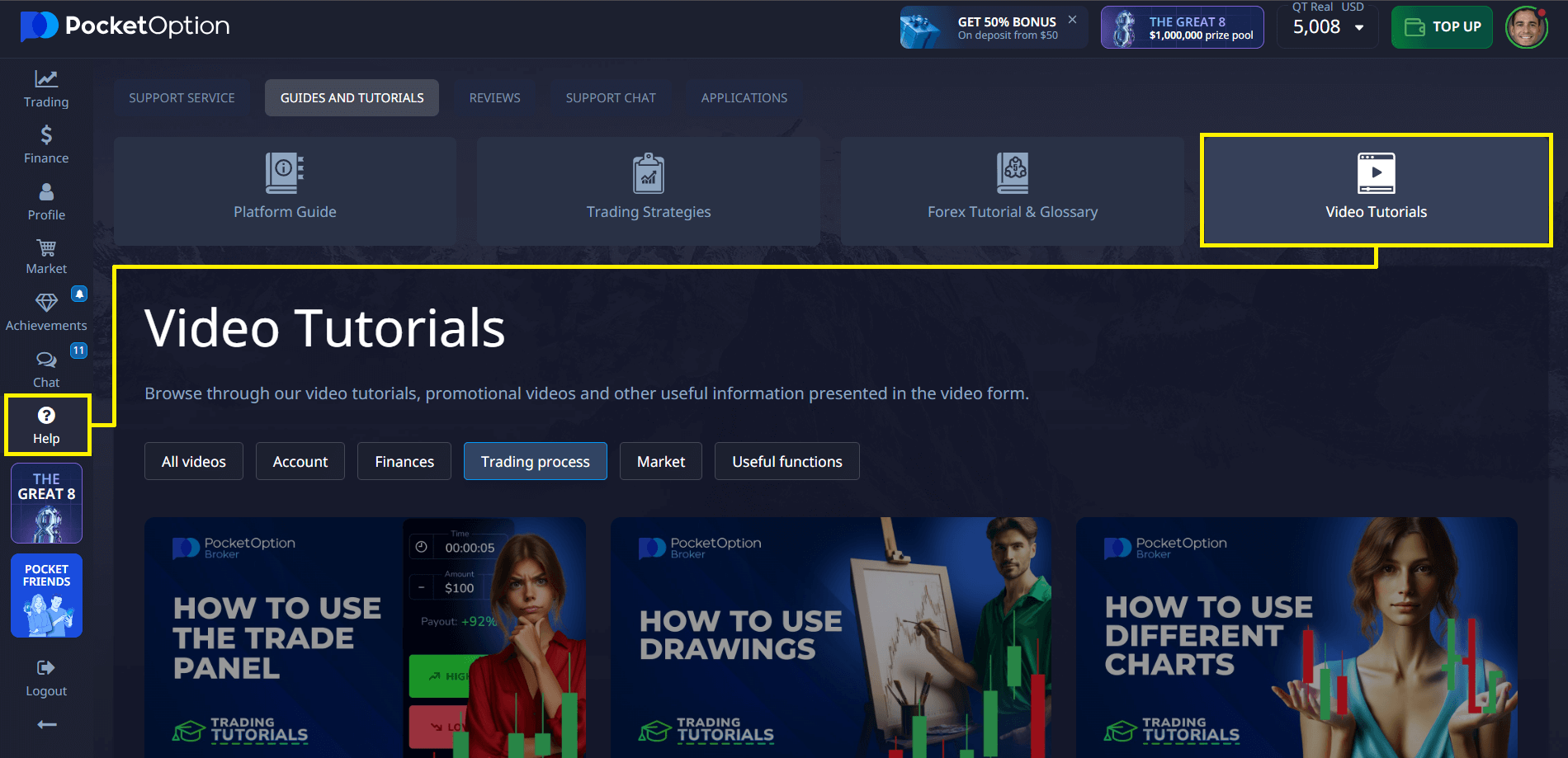

Pocket Option’s Free Educational Resources

Pocket Option provides comprehensive tools and a Free Education section to help you develop the most profitable trading strategy. All educational materials will be available to you as soon as you register:

Conclusion

The question ‘is Bitcoin traceable’ has a complex answer. Bitcoin’s blockchain is inherently transparent, making it partially traceable by design. Understanding this transparency is critical to avoiding misconceptions. Rather than a flaw, Bitcoin’s traceability can be seen as a feature that enhances market trust, accountability, and regulatory alignment. Always approach Bitcoin trading with clear awareness of these dynamics and integrate privacy strategies where appropriate—but never assume total anonymity.

FAQ

Is Bitcoin truly anonymous?

No, Bitcoin is pseudonymous. While your name isn’t attached to a wallet by default, transactions are publicly recorded and can be analyzed.

How do authorities trace Bitcoin transactions?

They use blockchain analytics tools to monitor addresses, cluster transactions, and connect wallets to identities via exchanges or service providers.

Can mixing services make Bitcoin untraceable?

Mixers attempt to obfuscate transactions but are not foolproof. They can attract legal risks and do not guarantee anonymity.

Does Pocket Option support anonymous Bitcoin trading?

Pocket Option operates under strict compliance standards, requiring user verification to meet global regulations. Bitcoin trades on the platform are subject to these standards.

Is Bitcoin tracable on all platforms?

Yes, because the blockchain itself is public. Regardless of the platform used, all Bitcoin transactions are recorded and traceable through blockchain explorers.