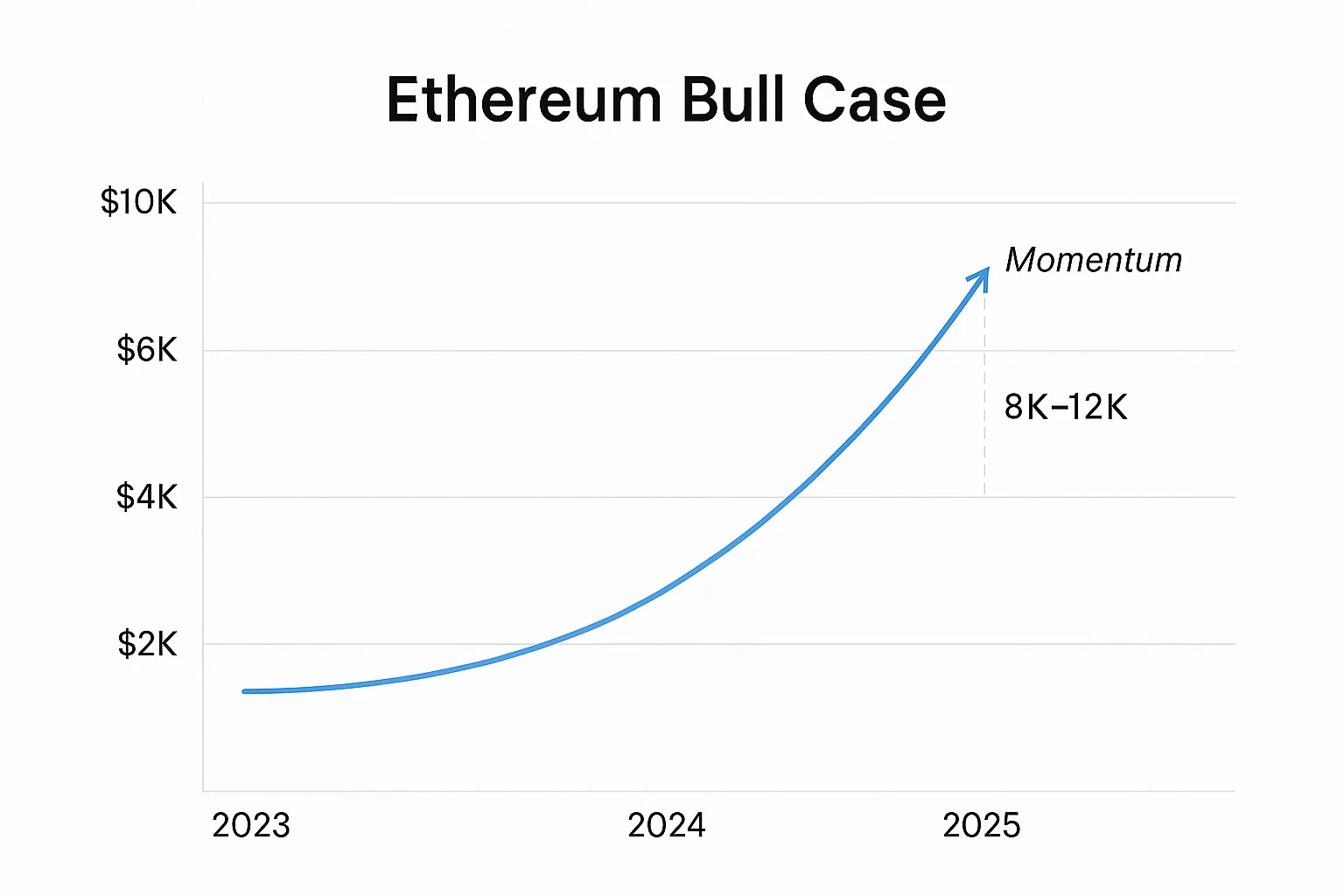

- Spot and staking-inclusive ETF inflows on traditional exchanges

- Institutional ETH accumulation accelerating

- Adoption of Surge and continued DeFi/stablecoins growth

- Technical breakout past $4k → momentum toward $8k–$12k range

Will Ethereum Hit 10k by 2025? - Complete Market Analysis

The question "Will Ethereum hit 10k by 2025?" has become central to crypto investment strategies worldwide. This comprehensive analysis explores market fundamentals, institutional developments, expert insights, and trading opportunities to determine whether can Ethereum reach $10k and how investors can position themselves today.

Article navigation

Ethereum’s Unique Position: The Engine Behind DeFi

Ethereum isn’t just a cryptocurrency—it’s a programmable financial layer powering DeFi, NFTs, and digital assets. Standing as the second-largest cryptocurrency by market cap, Ethereum’s significance stems from its innovative blockchain technology supporting smart contracts and decentralized applications (dApps). This functionality fundamentally differentiates Ethereum from Bitcoin (BTC), which primarily functions as a digital store of value.

As Matt Hougan (Bitwise CIO) explained:

“Ethereum has the most active developers, the most active users… It is like Microsoft in the blockchain.”

Ethereum’s blockchain enables creation of decentralized financial (DeFi) applications, non-fungible tokens (NFTs), and powers the majority of global stablecoins, solidifying its importance in the expanding crypto ecosystem and validating the question: will ethereum reach 10k?

Market Trends & Institutional Momentum

ETF Push: Historic Market Validation

In July 2024, the approval of spot Ethereum ETFs in the U.S. was a historic moment. Although these products are available only via traditional exchanges and investment platforms, their approval signals institutional validation of ETH. Analysts expect these ETFs to attract billions in capital inflows—potentially influencing ETH price movements significantly.

As Galaxy Digital’s Alex Thorn noted: “It means the SEC doesn’t see ether as a security.”

This regulatory clarity supports a stronger narrative for will eth hit 10k and removes significant uncertainty that previously hindered large-scale institutional investment.

Stablecoin & DeFi Surge

Ethereum powers the majority of global stablecoins and DeFi protocols, creating inherent demand for ETH. The recent “Pectra” upgrade boosted transaction efficiency—an important factor for network scalability and value. This infrastructure growth represents a key fundamental driver supporting higher ETH valuations.

Current Market Sentiment Analysis

The current market sentiment surrounding ETH reflects a complex mix of optimism and strategic caution. Many analysts offer bullish Ethereum price predictions, fueled by anticipation of continued ETF inflows and blockchain upgrades. However, bearish viewpoints persist, influenced by regulatory uncertainties and broader economic factors affecting the crypto market.

Try Ethereum trading on Pocket Option from $1

Expert Insights: Real Quotes & Market Analysis

Geoffrey Kendrick (Standard Chartered) adjusted his forecast from $10k to $4k short-term, citing Layer-2 migration impacts on immediate price dynamics.

FT’s Mara Schmiedt suggests: “What happens if there is $20bn taken out of the market? It could be a tipping point in terms of supply and demand.”

These expert perspectives highlight the nuanced factors affecting eth to 10k scenarios, balancing technological progress against market realities.

Technical Catalysts: Network Upgrades Powering ETH

Proof-of-Stake Revolution

Ethereum’s roadmap includes Surge and sharding—crucial for scaling capabilities. The move to Proof-of-Stake already burned over 3.5M ETH since July, creating a long-term supply crunch that supports ethereum 10k scenarios. This deflationary mechanism fundamentally alters Ethereum’s economic model, potentially driving sustained price appreciation.

Scaling Solutions Impact

Layer-2 solutions are migrating significant transaction volumes, though this creates complex short-term price dynamics. The successful implementation of scaling upgrades addresses Ethereum’s primary limitation while maintaining security and decentralization—key factors for institutional adoption.

Market Cap Projections and Comparative Analysis

ETH vs. Solana: Future Potential Battle

When considering the future potential of ETH versus Solana, Ethereum boasts a robust ecosystem of dApps and NFTs, providing strong foundation for growth. Solana offers faster transaction speeds and lower fees, attracting projects focused on scalability. The Ethereum price prediction hinges on continued innovation and dominance maintenance, while Solana challenges ETH’s position through technological advantages.

XRP and Altcoin Impact on Price Dynamics

The proliferation of altcoins significantly impacts Ethereum’s price dynamics. While “Ethereum killers” like Solana pressure ETH to innovate with faster, cheaper transactions, successful altcoins can drive blockchain adoption, indirectly benefiting Ethereum’s ecosystem. Will altcoins’ success drive ETH to reach the 10k benchmark?

Will Ethereum Hit 10k: Scenarios & Timeline

| Scenario | Timeline | Price Projection |

|---|---|---|

| Bull Case | 2025 Target | $8k–$12k |

| Base Case | 2026–2028 | $10k post-2026 |

| Bear Case | 2028+ | $3k–$5k |

Bull Case (2025 Target Achievement)

Under optimal alignment of factors:

The $10k target becomes achievable within 2025 under these bullish conditions.

Base Case (2026–2028 Realistic Timeline)

More conservative projections suggest:

- Moderate ETF adoption and gradual institutional inflows

- Steady network upgrades implementation

- Price growth to $6–8k by 2025, $10k reached post-2026

- Sustained but measured growth trajectory

Bear Case (2028+ Extended Timeline)

Potential headwinds could delay milestones:

- Regulatory delays affecting institutional adoption

- Increased competition from alternative blockchains

- ETH range-bound between $3k–5k

- 10k remains long-term potential beyond 2028

Long-term Predictions: Beyond 2025

Price Predictions for 2030: Will ETH Surpass 20k?

Looking toward 2030, some analysts suggest ETH could surpass $20k under continued evolution addressing scalability challenges. Factors include increased blockchain adoption, continued DeFi and NFT growth, and potential institutional investment through Ethereum ETFs driving demand.

However, regulatory uncertainties and competition from cryptocurrencies like Solana pose risks. What price of Ethereum can we expect then? Analyst insights vary widely, highlighting inherent difficulty in long-term predictions for volatile crypto markets.

Potential Market Changes Leading to ETH All-Time Highs

Сould Ethereum hit 10k? Several catalysts could drive ETH to new all-time highs:

- Increased institutional adoption beyond current ETF offerings

- Continued innovation in DeFi and NFT ecosystems

- Ethereum’s successful scalability improvements

- Potential shift in Bitcoin dominance toward diversified altcoin portfolios

Strategic Trading Recommendations & Opportunities

Key Monitoring Points

Track major developments:

- Regulatory shifts and ETH upgrade schedules signal trading opportunities

- On-chain metrics: Burn rates, gas fees, and staking ratios offer predictive value

- ETF inflow data and institutional adoption metrics

- Network activity and developer engagement levels

Risk Management Considerations

Strategic positioning requires careful analysis of:

- Market cycles and regulatory environment changes

- Technical milestone achievement and implementation success

- Competitive landscape evolution and altcoin performance

- Macroeconomic factors affecting crypto market sentiment

Staking Opportunities: When to Stake on Ethereum

Deciding when to stake involves maximizing rewards while minimizing risks. Staking involves locking up ETH to support the network and earn rewards. Optimal timing often coincides with:

- Anticipated bullish trends or high network activity

- Increased staking rewards during network growth periods

- Strategic accumulation phases before major upgrades

ETH could reach a price of 10k! – but timing and positioning remain crucial for capitalizing on this potential.

Trading Platform Considerations

Real User Feedback on Market Access

International traders report varied experiences with different platforms:

- “Trading execution quality varies significantly across platforms”

- “Demo accounts essential for testing ETH volatility strategies”

- “Fast execution crucial during major crypto news events”

Expert recommendations emphasize:

- Utilizing demo environments for strategy testing

- Monitoring ETH price reactions during upgrade announcements

- Implementing proper risk management during volatile periods

Final Verdict: Will Ethereum Hit 10k?

Probability Assessment

- YES – Under Bullish Alignment: ETF success, technological advancement, and favorable macro conditions could drive ethereum to $10k by 2025.

- LIKELY – In Extended Timeline: Moderate adoption and steady progress suggest $10k achievement in 2026–2028 timeframe.

- UNCERTAIN – If Headwinds Persist: Regulatory challenges, competitive pressure, or technical setbacks could delay the milestone significantly.

While many investors are asking, will Ethereum hit 10k today, the reality is more nuanced. Market volatility, macroeconomic factors, and news cycles can trigger short-term price spikes, but sustained movement to such milestones typically requires strong institutional backing and technical confirmation. As always, trading decisions should be grounded in solid analysis rather than hype.

Looking further ahead, the discussion around can Ethereum reach $100,000 or ethereum price prediction $100,000 becomes highly speculative, yet not impossible. If Ethereum continues to dominate DeFi and successfully implements its roadmap, such as Surge and Danksharding, and if Ethereum reaches 5k within 2025, then a climb toward 10k in 2025 and beyond becomes a credible scenario. But the journey to six-figure ETH likely hinges on mass adoption, global regulation, and economic shifts.

Strategic Positioning Summary

When will Ethereum hit 10k? The convergence of institutional validation through ETFs, technical improvements addressing scalability, and Ethereum’s established DeFi foundation creates compelling long-term value proposition. Use strategic analysis to monitor, analyze, and position for Ethereum developments through both short-term volatility opportunities and long-term accumulation strategies.

Whether achieved in 2025 or beyond, Ethereum’s fundamental utility, institutional adoption trajectory, and technical evolution support the can ethereum reach 10k thesis while requiring careful risk management and strategic patience.

The question isn’t just about price targets—it’s about positioning for the evolution of programmable money and decentralized finance infrastructure that Ethereum continues to pioneer.

FAQ

Is Ethereum reaching $10,000 a realistic price target?

Ethereum reaching $10,000 is certainly possible given its expanding utility, growing adoption trajectory, and evolving supply dynamics. This price target would give Ethereum a market capitalization of approximately $1.2 trillion, which is substantial but not unprecedented in global financial markets. The probability and timeline depend on multiple factors including institutional adoption acceleration, technological development milestones, regulatory clarity, and broader market conditions.

What specific technological improvements could drive Ethereum to $10,000?

Key technological catalysts include comprehensive scaling solutions like sharding and Layer 2 networks (Arbitrum, Optimism, Polygon), which directly address Ethereum's throughput limitations. The completed transition to proof-of-stake has dramatically reduced energy consumption while simultaneously decreasing new ETH issuance by approximately 90%. Additionally, the EIP-1559 fee-burning mechanism creates deflationary pressure during periods of high network activity, potentially reducing total supply over time.

How does competition from alternative blockchains affect Ethereum's chances of reaching $10,000?

Competition from alternative smart contract platforms like Solana, Avalanche, and BNB Chain creates legitimate pressure on Ethereum's market dominance. However, Ethereum's substantial network effects, unparalleled developer ecosystem, and first-mover advantage provide significant competitive moats. The emerging multichain landscape may see Ethereum maintaining its position as the primary settlement layer and security backbone while other specialized chains serve specific application niches.

What timeframe might be realistic for Ethereum to potentially reach $10,000?

Projected timeframes for Ethereum to reach $10,000 vary significantly among analysts. Optimistic scenarios suggest 1-2 years during favorable market conditions and accelerating institutional adoption, while more conservative estimates indicate 3-8 years as institutional capital gradually enters the ecosystem. Some skeptics contend that structural limitations and competitive pressures may prevent Ethereum from ever achieving this price milestone regardless of timeframe.

How should strategic investors position themselves if they believe Ethereum will reach $10,000?

Investors with conviction about Ethereum's potential to reach $10,000 should develop strategies aligned with their individual risk tolerance, time horizon, and capital availability. Long-term investors might implement systematic dollar-cost averaging and validator staking for yield generation. More active traders could utilize technical analysis on platforms like Pocket Option to navigate inevitable volatility. All approaches should incorporate clear risk management frameworks, including appropriate position sizing and diversification across multiple assets and investment strategies.

How high can Ethereum go realistically?

Realistically, Ethereum could reach between $8,000 and $12,000 in a bullish scenario by 2025, supported by factors such as increased institutional adoption, spot ETF inflows, and network upgrades like Surge. Longer-term projections suggest Ethereum could potentially surpass $15,000 if DeFi, stablecoins, and tokenization continue gaining traction. However, reaching beyond $20,000 would likely require mass adoption, regulatory clarity, and Ethereum maintaining dominance over competing smart contract platforms.

How much will Ethereum be worth in 10 years?

Estimating Ethereum's value in 10 years involves considerable uncertainty, but some long-term forecasts range from $20,000 to over $100,000 per ETH. These projections depend on Ethereum becoming the global standard for decentralized applications, financial infrastructure, and tokenized assets. While can Ethereum reach $100,000 is a speculative question, sustained innovation, successful scaling, and global integration into finance and tech ecosystems could make such valuations possible by 2035.