- Indonesian Economic Performance: Quarterly GDP growth figures, monthly inflation data, and weekly trade balance reports directly impact the Rupiah’s strength. For example, when Indonesia posted 5.31% GDP growth in Q2 2023, the Rupiah gained 0.8% against the Dollar.

- US Federal Reserve Policy: Interest rate decisions by the Fed dramatically influence the USD/IDR rate. A 25 basis point increase typically strengthens the Dollar by 1-2% against the Rupiah within 48 hours.

- Global Commodity Prices: As Indonesia exports palm oil, rubber, and coal, commodity price fluctuations directly affect export revenues and currency strength. When palm oil prices increased 15% in early 2023, the Rupiah gained approximately 2% against the Dollar.

- Political Stability: Indonesia’s political climate significantly impacts investor confidence. Presidential elections often create 3-5% volatility in the USD/IDR exchange rate during the campaign period.

- Bank Indonesia Decisions: The central bank’s monetary policy, particularly interest rate adjustments and foreign exchange interventions, plays a decisive role in establishing USDIDR target levels.

USD/IDR: Complete Trading Tutorial for US Dollar to Indonesian Rupiah Markets

Trading the USD/IDR currency pair provides strategic opportunities for diversifying your portfolio with Indonesia's emerging market currency. This comprehensive tutorial explains everything from basic principles to advanced trading techniques for the US Dollar to Indonesian Rupiah exchange rate on Pocket Option.

What is USD/IDR?

USD/IDR represents the exchange rate between the United States Dollar (USD) and the Indonesian Rupiah (IDR). This currency pair belongs to the “exotic” category, pairing the world’s reserve currency with the currency of Southeast Asia’s largest economy. Understanding USDIDR meaning is crucial for traders looking to diversify beyond major currency pairs.

Indonesia, with its population exceeding 270 million people, constitutes one of Asia’s fastest-growing economies. The Indonesian Rupiah functions as the official currency for the world’s largest archipelago nation, encompassing more than 17,000 islands. When trading USDIDR stock, you’re essentially speculating on the economic relationship and power dynamics between the United States and Indonesia.

How USD/IDR Currency Quotation Works (Simple Explanation)

In the USD/IDR pair, the US Dollar serves as the base currency, while the Indonesian Rupiah functions as the quote currency. The exchange rate indicates precisely how many Indonesian Rupiah you receive for one US Dollar.

For example, if USD/IDR = 15,750, this means exactly 1 US Dollar exchanges for 15,750 Indonesian Rupiah. The Indonesian Rupiah carries significantly less value per unit than the US Dollar, explaining the large numerical value in the exchange rate.

To illustrate with a practical example: If you’re traveling from the US to Jakarta, converting just $100 would provide approximately 1,575,000 Rupiah at current rates — instantly transforming you into a “millionaire” in local currency terms!

Factors Influencing USD/IDR Movements

Several critical factors affect the sentiment of USDIDR stock and drive price movements in this currency pair:

For instance, when Indonesia announced its $400 billion infrastructure investment plan in 2023, the Rupiah strengthened by 2.3% as investors anticipated accelerated economic growth. Conversely, during global market turbulence, the USD typically gains 3-5% against IDR as investors seek the American currency’s safety.

How to Read the USD/IDR Exchange Rate

Understanding USD/IDR movements becomes straightforward once you grasp the fundamental relationship between these currencies:

When the USD/IDR rate rises (e.g., from 15,750 to 16,000), the US Dollar is strengthening against the Indonesian Rupiah. This 250-point increase means the Rupiah is weakening, requiring more Rupiah to purchase one Dollar.

If the USD/IDR rate falls (e.g., from 15,750 to 15,500), the opposite occurs — the Indonesian Rupiah is strengthening against the US Dollar. This 250-point decrease means you need fewer Rupiah to buy one Dollar.

Let’s demonstrate with a specific example: If you’re monitoring the USDIDR option chain and notice the rate changing from 15,800 to 15,600, this 200-point decrease indicates the Rupiah has gained value relative to the Dollar. Had you accurately predicted this downward movement on Pocket Option, your forecast would have succeeded.

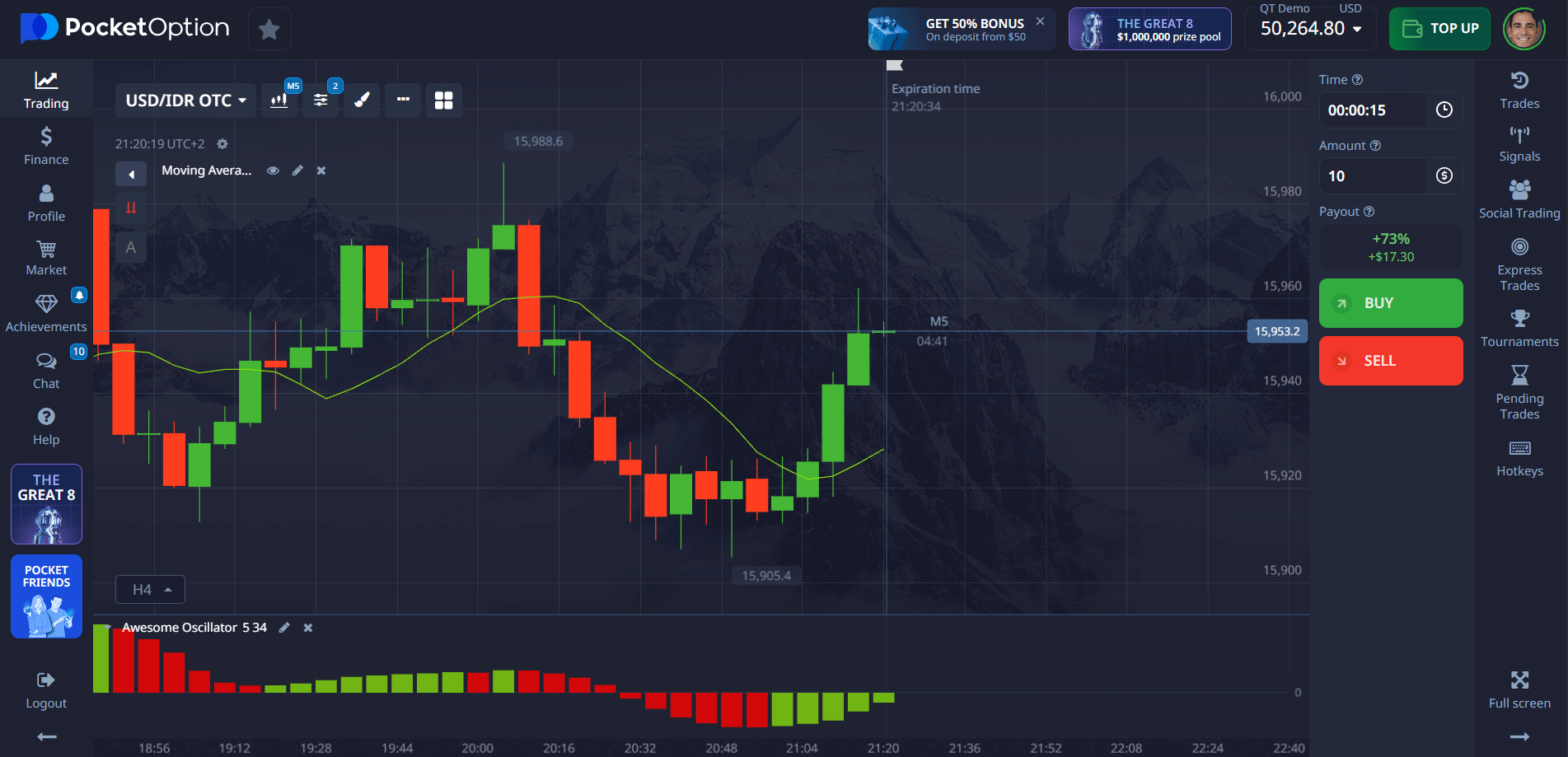

Step-by-Step Tutorial: Quick Trading on USD/IDR

Here’s a precise process to execute a trade on the USD/IDR pair using Pocket Option:

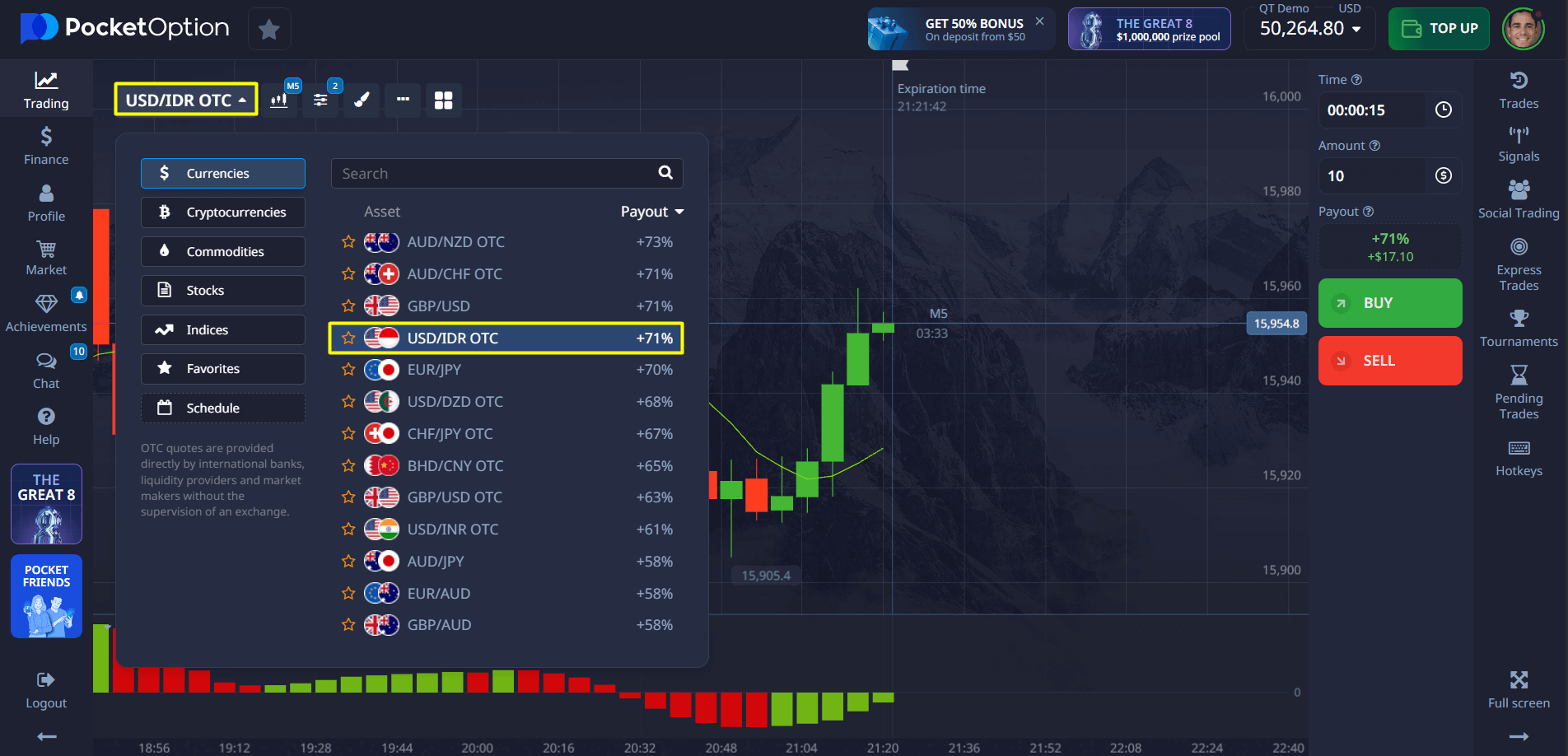

- Find the asset: Navigate to the asset list and select “USD/IDR OTC” (available during extended hours).

- Analyze the chart: Examine price movements using technical indicators like RSI, MACD, or sentiment analysis tools available on the platform.

- Select your investment amount: Choose your precise investment, starting from just $1 per trade, depending on your risk management strategy.

- Set trade duration: Specify your exact trade timeframe — ranging from 5 seconds to several hours (for OTC assets, trades can start from 5 seconds).

- Make your forecast: If your analysis indicates the USD/IDR rate will rise, click BUY. If you expect it to fall, select SELL.

- Review potential return: Before confirming, verify your potential profit percentage — up to 92% for accurate predictions.

Learning how to buy USDIDR effectively requires practice. Begin with Pocket Option by creating an account and starting with a minimum deposit of $5 (deposit may vary depending on payment methods), or test your strategies first using our comprehensive demo account that provides real trading experience without financial risk!

Try Risk-Free Trading with a $50,000 Demo Account

Uncertain about trading USD/IDR immediately? We provide a solution!

Each new user receives a fully-loaded $50,000 practice account immediately after registration. This allows you to explore multiple trading approaches, test various strategies, and fully familiarize yourself with what is USDIDR trading without risking your capital.

When ready to transition to real trading with as little as $5, you’ll unlock premium features including:

- Copy-trading from proven successful traders

- Cashback on all your trading activity

- Competitive trading tournaments with substantial prize pools

- Professional charting tools and technical indicators

- Comprehensive real-time market analysis

For those wondering how to invest in USDIDR effectively, our platform provides the perfect starting point with educational resources and practical tools.

FAQ

What are the key debates on USDIDR stock trading?

The principal debates focus on Indonesia's economic stability versus growth potential, US monetary policy impacts on emerging markets, and whether Indonesia's current account deficit creates risks or opportunities for currency traders in 2025.

What is the sentiment of USDIDR stock currently?

Market sentiment for USD/IDR fluctuates primarily based on Indonesia's manufacturing data, US Federal Reserve rate decisions, and global risk appetite, with professional traders closely analyzing the widening interest rate differential between the two economies.

How to buy USDIDR on Pocket Option?

To buy USD/IDR effectively, create an account, deposit funds, select USD/IDR from the asset list, analyze price patterns, set your precise investment amount and timeframe, then click "BUY" if your technical analysis suggests the rate will increase.

How to invest in USDIDR long-term?

For strategic USD/IDR investments, implement extended expiry times, monitor fundamental economic indicators from both economies, analyze the USDIDR option chain for market sentiment, and maintain a consistent risk management approach limiting exposure to 1-2% per position.

How to trade USDIDR during high volatility?

During volatile market conditions, reduce position sizes to 0.5-1% of your capital, utilize momentum indicators like RSI to identify overbought/oversold conditions, set wider stop-losses, and closely monitor economic releases from both the US Federal Reserve and Bank Indonesia.