- Bangladesh Bank policy: interventions may strengthen or weaken the taka.

- US Federal Reserve policy: interest rate hikes often make the USD more attractive.

- Inflation in Bangladesh: rising local prices usually devalue the BDT.

- Trade balance: high import levels increase demand for USD in Bangladesh.

- Remittances: inflows from overseas workers impact the local supply of USD.

USD/BDT -- What Are the Key Debates on USDBDT Stock and How to Trade It

Wondering what are the key debates on USDBDT stock? In this article Pocket Option explains the most important points in plain language. Whether you're a beginner or exploring exotic currency pairs, here's what you need to know about USD/BDT.

What is USD/BDT and how does it work?

USD/BDT represents the exchange rate between the United States Dollar (USD) and the Bangladeshi Taka (BDT). It indicates how many takas are needed to purchase one dollar.

As an exotic currency pair, USD/BDT is less liquid than major pairs like EUR/USD but is still available on trading platforms such as Pocket Option.

Its price is influenced by Bangladesh’s monetary policy, trade deficits, and the regional demand for USD.

How does the USD/BDT exchange rate behave?

For example, if USD/BDT = 109.60, this means one US Dollar equals 109.60 Bangladeshi Taka.

If the rate rises to 111.00, the dollar is strengthening. If it falls to 108.00, the taka is gaining value.

Such movements are common in quick trading. Even minor fluctuations can offer profit opportunities.

What are the key factors moving USD/BDT?

Several real-world elements affect USD/BDT price dynamics:

For instance, if global oil prices surge, Bangladesh’s import costs rise, leading to higher demand for USD and pushing the USD/BDT rate upward.

Understanding USD/BDT price changes

A price increase from 108.50 to 110.20 signals a stronger dollar — potentially due to positive US economic data.

A drop to 107.30 could reflect stronger remittance inflows or local reforms strengthening the taka.

Traders should closely watch these trends when making short-term decisions.

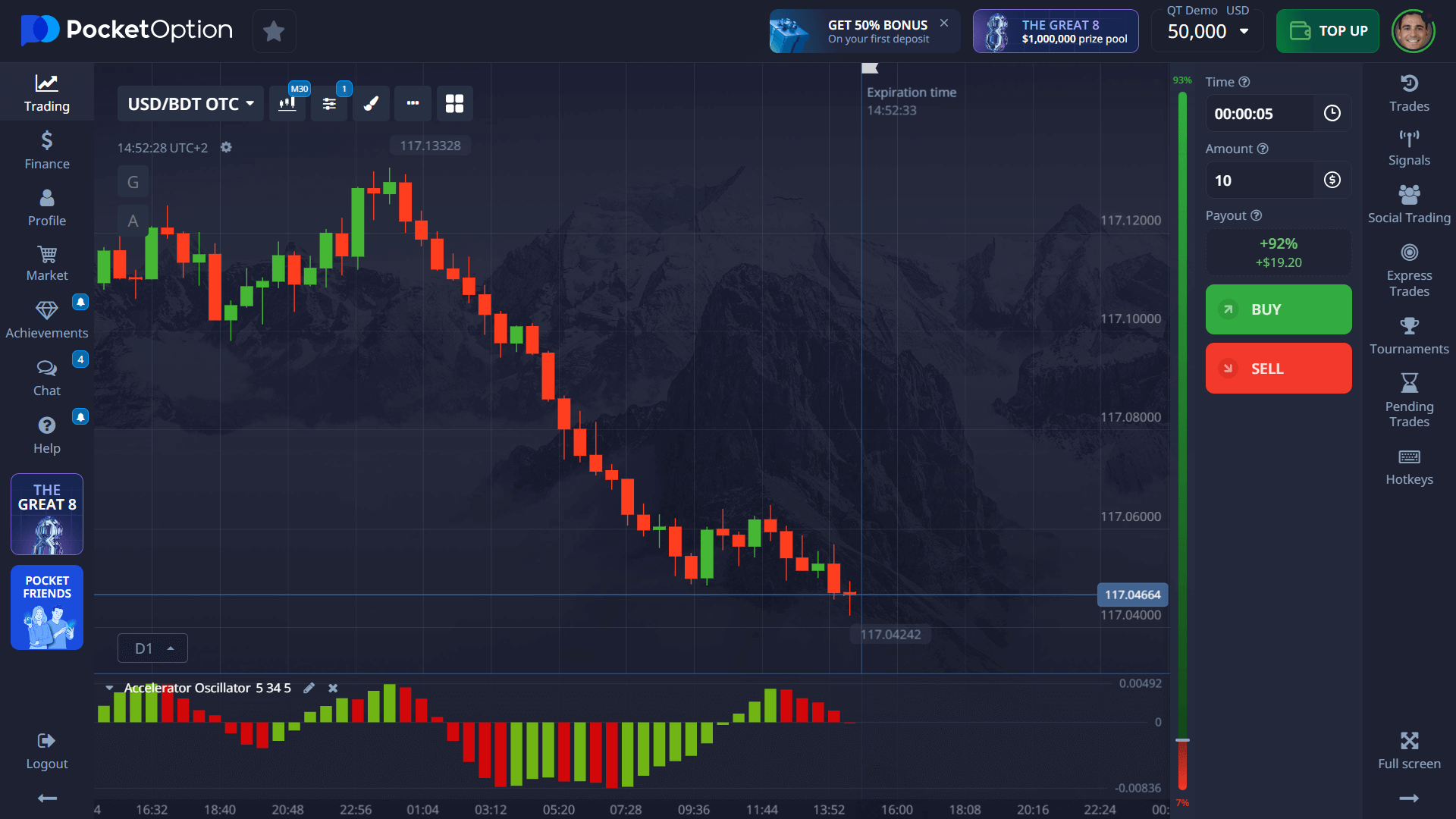

USD/BDT Tutorial: Quick Trading Step-by-Step

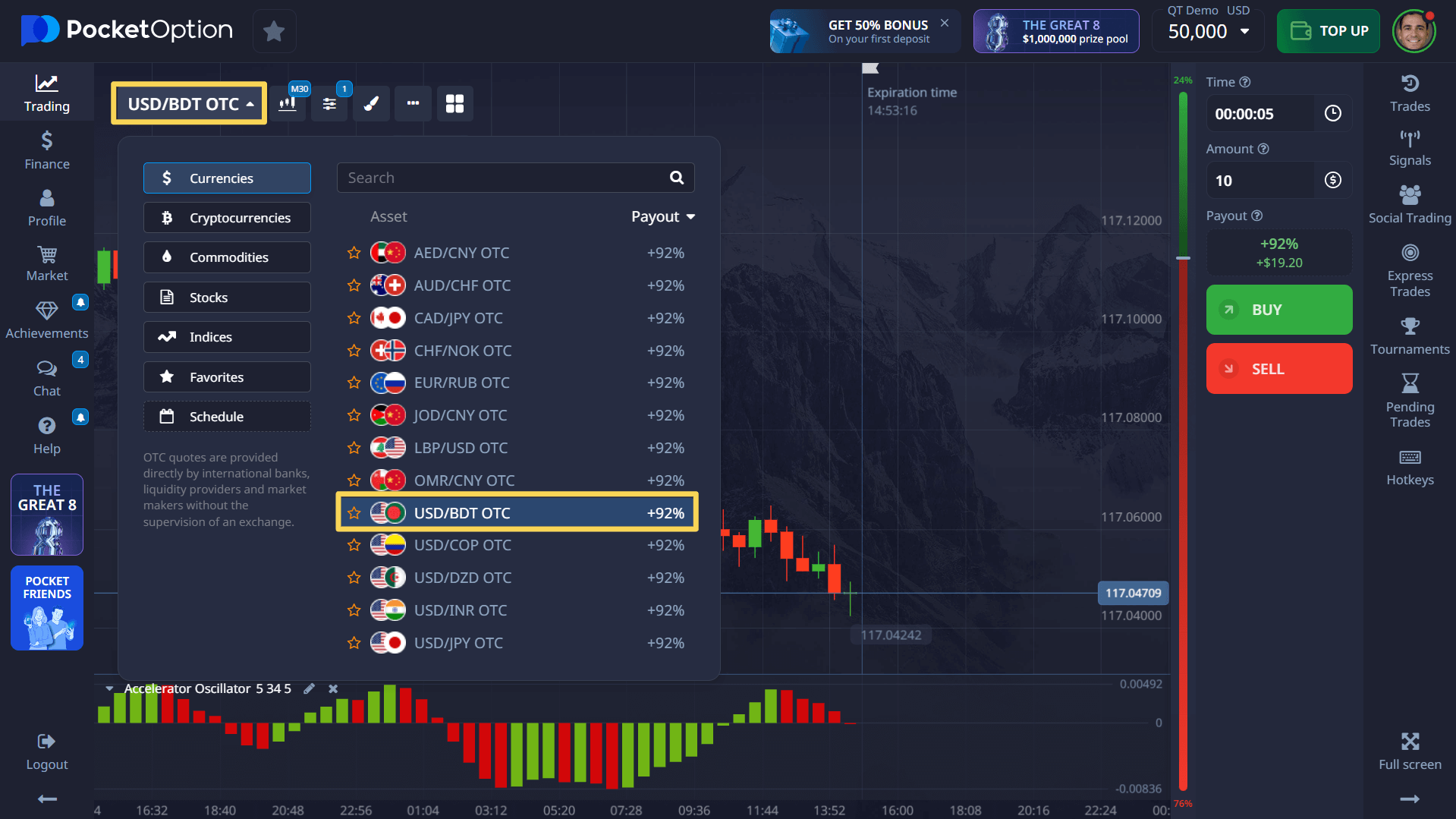

- Open the asset list and select USD/BDT OTC.

- Check the chart — use tools like trend lines or sentiment indicators.

- Set your trade amount — start with just $1.

- Choose your trade time — from 5 seconds and up (5-second durations available only for OTC).

- Make your prediction:

- Click BUY if you expect the rate to go up.

- Click SELL if you expect it to go down.

If your forecast is correct at expiration, you can earn up to 92% return. (The exact figure is displayed before confirmation.)

You can register in seconds and start with just $5 (deposit may vary depending on payment methods). Or try the platform with a demo account — no risk involved.

Try without risk — $50,000 demo account for USD/BDT

Want to explore USD/BDT before trading live? Sign up and receive $50,000 in demo funds instantly.

Use the demo to test strategies, understand asset behavior, and practice with real market data.

When you’re ready, switch to a live account and access additional features:

- Copy Trading with top-performing users

- Cashback rewards

- Trading tournaments

- Full access to all assets and indicators

FAQ

What are the key debates on USDBDT stock?

The key debates on USDBDT stock include central bank influence over the Taka, limited market transparency, and volatility caused by trade imbalances and global monetary policy shifts.

How to buy USDBDT?

You can buy USDBDT on Pocket Option by selecting the asset, choosing the trade amount and duration, and making a forecast.

How to invest in USDBDT?

Start by using the demo mode to understand how the asset behaves. Then, follow major economic indicators and trade with a live account as you gain confidence.

How to trade USDBDT efficiently?

Monitor news from the US and Bangladesh, use technical indicators, and analyze patterns regularly to build effective strategies.

Is USDBDT a good pair for beginners?

Yes, it's accessible on Pocket Option and offers exposure to an exotic currency with clear trading tools and a user-friendly interface.