- Revenue: Surpassed $650 billion in 2024, supported by inflation-driven basket size and strong grocery performance.

- Profit Margins: Maintained in the ~2.5–3% range–remarkable for the low-margin retail sector.

- Market Cap: Approximately $460 billion, making it one of the largest retail stocks globally.

- Dividend Yield: 1.5–1.6% with 50 consecutive years of dividend increases–making Walmart a Dividend Aristocrat.

Walmart Stock Strategy Guide

A comprehensive roadmap to understanding walmart stock, its investment potential, and how to buy walmart stock or trade it via different platforms like Pocket Option.

Article navigation

- Understanding Walmart Stock

- Historical Performance of Walmart Stock

- Factors Influencing Walmart Stock Price

- Why Invest in Walmart?

- Walmart Stock Price Prediction 2040: Enhanced Forecast

- How to Buy Walmart Stock

- ETF Options Featuring Walmart

- Walmart Stock Strategies

- Ongoing Monitoring Tips

- Pocket Option for Active Walmart Traders

- Risks to Consider

- Final Thoughts

Investors–from seasoned traders to beginners–are constantly searching for reliable walmart stock opportunities. This guide is designed to help you invest smartly, whether you plan to buy walmart shares outright, trade fractional amounts, or explore platforms like Pocket Option. We’ll explore WMT fundamentals, walmart stock price prediction 2040, dividend strategies, and how to use a market order effectively.

Understanding Walmart Stock

What Is WMT & Why It Matters

Walmart Inc. (NYSE: WMT) is a multinational retail powerhouse and one of the most recognizable brands globally. Having gone public in 1972, it has established a stable reputation among investors as part of the prestigious S&P 500 index. Its core operations span brick-and-mortar megastores, warehouse clubs under the Sam’s Club banner, and an expansive e-commerce presence. Walmart’s hybrid business model–bridging physical retail and digital commerce–gives it a strategic edge in responding to changing consumer habits and macroeconomic conditions.

The company’s presence in virtually every American state, as well as in over a dozen countries, makes it a resilient choice in diversified portfolio construction. Its ability to operate profitably at scale while maintaining low prices solidifies its appeal as a defensive stock with growth prospects.

“Walmart’s execution in omnichannel retail gives it a unique edge among traditional retailers,” said Neil Saunders, Managing Director of GlobalData Retail.

Fundamental Strengths

Walmart’s financial performance remains robust despite global economic uncertainties.

As per FactSet, Walmart’s long history of dividend growth positions it well for income-seeking investors in volatile markets.

Technical Snapshot

| Metric | Value | Commentary |

|---|---|---|

| 50-day MA | ~$150 | Shows short-term trend |

| 200-day MA | ~$145 | Indicates long-term direction |

| Support / Resistance | 140/160 | Useful for setting a market order |

Walmart’s Market Position & Advantages

Brick-and-Mortar + E-commerce Strategy

Walmart operates over 4,700 U.S. stores and Sam’s Club locations globally. Recent tech-forward partnerships and rapid growth in e-commerce helped it capture ~12% online grocery share in 2024.

“Walmart is now focusing more on profitability in e-commerce, marking a shift from scale to efficiency,” said John David Rainey, Walmart CFO, at the 2025 Investment Community Meeting (Reuters).

Strategic Tech Investments

- AI-driven supply chains

- In-store fulfillment for fast delivery

- $2.5+ billion tech investment in 2024 alone

Investor Advantages

- Resilience during market downturns

- Strong dividend income

- Sector leadership

- Diversified business model

Historical Performance of Walmart Stock

Key Milestones

- 2020: +25% surge post-COVID crash

- 2021–2022: Stability amid inflation

- 2023–2024: Rebounded with 18% gains

Since 2010, WMT stock has returned ~215% (with dividends) versus S&P 500’s ~200%.

According to Tickeron, WMT gained 53.9% YTD in 2025, led by a 22% jump in digital sales and strong AI-based trading signals.

Factors Influencing Walmart Stock Price

Macro-Economic Influences

- Consumer trends & spending

- Inflation & Fed interest rate policy

- Recession outlook

Company-Specific Drivers

- U.S. & international sales growth

- Delivery speed, e-commerce expansion

- Wage increases and cost controls

Analyst Opinions

- May 2025: BofA raised price target to $175

- June 2025: Jefferies cut target to $155

“Walmart leads in e-grocery and improves profitability through automation,” said Zhihan Ma, retail analyst at Bernstein (Barron’s).

Why Invest in Walmart?

Dividend Income

Walmart has a long-standing tradition of rewarding shareholders through stable and increasing dividends. As a Dividend Aristocrat, it has increased payouts annually for over five decades. Though the current yield of 1.5–1.6% is modest, its consistency and growth offer a dependable income stream that enhances compounding over time. This makes Walmart attractive for income-focused investors, especially those pursuing defensive positions during uncertain economic conditions.

Financial Resilience

As a retailer of essential goods, Walmart thrives even when discretionary spending declines. Its broad customer base, spanning urban and rural markets, ensures diversified revenue streams. The company’s scale allows it to maintain competitive pricing, which helps retain market share during inflationary periods. Walmart was one of the few major retailers to grow its physical and digital traffic during global economic turbulence in 2024–2025.

“Walmart’s value proposition positions it well for recessionary environments where consumers become price-sensitive,” said JPMorgan retail analyst Matthew Boss (June 2025).

Future-Ready Strategy & Innovation

Walmart continues to evolve through investment in AI logistics, supply chain automation, and fintech ventures. It has implemented machine learning in store planning, real-time pricing systems, and personalized digital experiences for customers. The company is also expanding into healthcare services and digital banking, building future revenue streams beyond traditional retail.

CEO Doug McMillon emphasized in 2025 that despite cautious consumer spending, Walmart’s focus on value and tech-forward investments ensures long-term adaptability.

ESG and Corporate Responsibility

Walmart has made strides in sustainability, aiming for 100% renewable energy by 2035 and zero emissions by 2040. It also emphasizes diversity, fair labor practices, and local sourcing–factors increasingly important to modern investors.

These attributes make Walmart more than just a blue-chip stock–it’s a forward-thinking, resilient enterprise aligned with evolving market expectations.

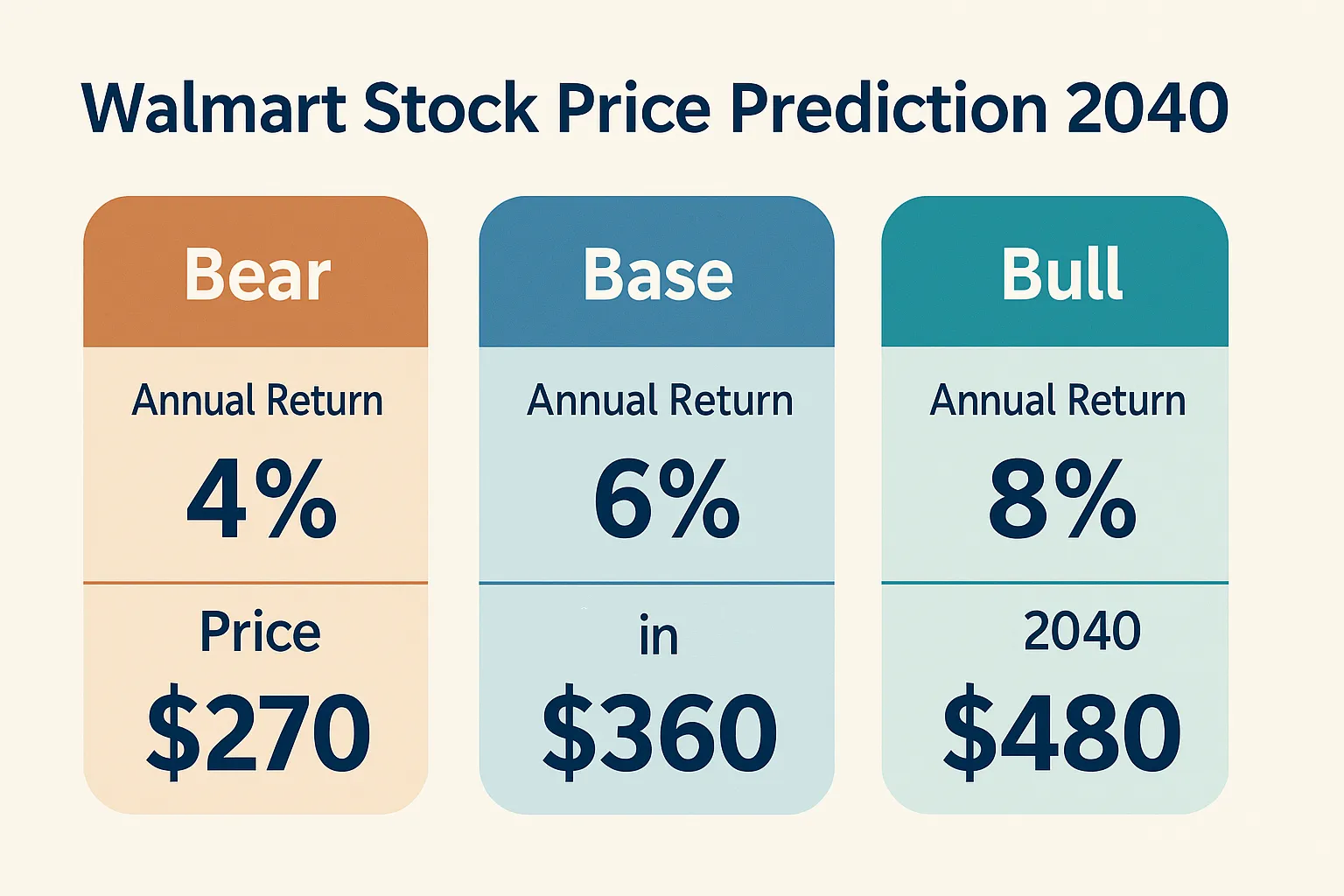

Walmart Stock Price Prediction 2040: Enhanced Forecast

📈 Updated Growth Model Assumptions

- Revenue Growth: Analysts expect a CAGR of ~4.5–5.5% through 2030, supported by e-commerce, healthcare, fintech, and automation-driven expansion.

- Earnings & Cash Flow Growth: EPS is projected to grow around 8–9% annually, thanks to operating leverage and share buybacks. Free cash flow is expected to rise 6–7.5% per year.

- Total Return Target: Including reinvested dividends, long-term investors could see annual total returns of 8–10%, with potential upside if technology and fintech businesses succeed.

| Scenario | Annual Return | Projected Price in 2040 |

|---|---|---|

| Bear | 4–6% | $400–550 (industry slowdown) |

| Base | 6–8% | $850–1,100 (steady execution) |

| Bull | 8–10% | $1,800–2,200 (tech-driven growth) |

What These Figures Mean

- Bear Case: ~$400–550 by 2040, representing weak margin expansion or e-commerce underperformance.

- Base Case (Most Likely): ~$850–1,100 — reflects current growth rates, with automation, fintech, and healthcare scaling gradually.

- Bull Case: $1,800–2,200 — assumes Walmart transforms into a digital-first, diversified platform rivaling Amazon in delivery, ads, and financial services.

Key Growth Drivers

E-commerce & Logistics

E-commerce revenue grew ~22% in 2025. With same-day delivery reaching 93% U.S. coverage and fulfillment efficiencies in dark stores, this continues to drive top-line and margin expansion.

Tech-Led Edge

AI platforms like Wallaby and Retina, plus automated warehouses, are yielding 5 billion same-day deliveries–a twofold increase from the prior year.

New Revenue Streams

Expansion into fintech (credit cards, OnePay), healthcare (clinics, Medicare Advantage), and advertising (Walmart Connect) could increase high-margin revenue contribution from low-double-digit percentages of total sales.

Shareholder Returns & Efficiency

Continued share repurchases (~3–4% annually) and disciplined capital allocation offset operational costs and improve per-share earnings.

Strategic Insights for Investors

- Balanced Exposure: The base-case forecast suggests that Walmart offers a reliable 8–10% annual return, blending stable dividends with growth.

- Growth Equity Appeal: The bull scenario positions WMT as a quasi-technology platform–ideal for investors seeking retail growth with a digital twist.

- Risk Management: Bear scenario highlights the importance of macroeconomic and competitive monitoring–especially tariffs and consumer spending shifts.

Takeaways for 2040

- Walmart’s evolution into logistics, fintech, healthcare, and digital advertising significantly heightens its long-term potential.

- With foundational revenue and cash flow growth well-supported, total return forecasts of 8–10% annually are reasonable–and potentially conservative if major new initiatives succeed.

- Investors should consider structured accumulation–such as dollar-cost averaging or tactical exposure–to balance between stable income and episodic growth opportunities on Pocket Option.

How to Buy Walmart Stock

Investing in Walmart stock can be a straightforward process, even for beginners. Follow this step-by-step guide to get started and make informed decisions:

Step 1: Choose a Brokerage Platform

Select a reputable brokerage that offers access to U.S. stock markets and supports fractional share purchases. Popular options include Fidelity, Robinhood, E*TRADE, and others. Each platform has its unique features, such as commission-free trading or user-friendly mobile apps.

Step 2: Set Up Your Account

Open your account by completing a digital application. You’ll need to provide some basic information, such as:

- Full name and date of birth

- Contact details

- Employment and financial status

- Social Security Number (for U.S. residents)

Once approved, you can deposit funds via bank transfer or debit card.

Step 3: Learn the Basics of Orders

There are two main types of stock purchase orders:

- Market Order: Buys the stock at the current market price immediately.

- Limit Order: Sets a specific price at which you want to buy; the order executes only if the market reaches that price.

For beginners, market orders offer simplicity, while limit orders provide more control over your entry point.

Step 4: Buy Full or Fractional Shares

If WMT’s full share price feels too high, consider fractional shares. This allows you to invest with as little as $5–$10 and still gain exposure to walmart stock.

Step 5: Monitor and Adjust

Track your portfolio performance through your brokerage dashboard. Use watchlists, set price alerts, and read news updates related to WMT. Adjust your strategy based on financial goals, market conditions, and risk tolerance.

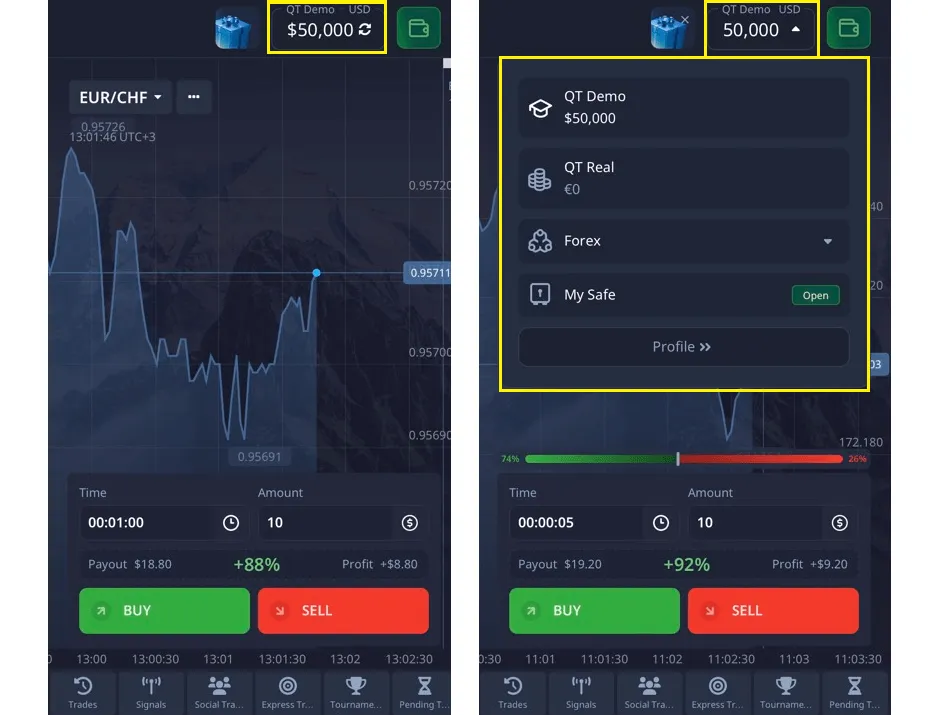

Note: Walmart is not directly tradable on Pocket Option. However, you can practice similar strategies on the platform using 100+ available assets, including blue-chip equities.

Platform Comparison

| Brokerage | Fractional Shares | Fees | Tools | Mobile App |

|---|---|---|---|---|

| Fidelity | Yes | $0 | Advanced | Excellent |

| Robinhood | Yes | $0 | Basic | Very Good |

| Pocket Option | No (CFD/24-7) | $0 | AI, Copy Trading | Excellent |

| E*TRADE | Yes | $0 | Pro-Level | Good |

Note: Walmart stock is not currently available for direct trading on Pocket Option. However, the platform offers access to 100+ assets, including many leading companies, via quick trading tools.

ETF Options Featuring Walmart

| ETF Symbol | Focus | Walmart Weight |

|---|---|---|

| SPY | S&P 500 Index | ~0.6% |

| VTI | Total U.S. Market | ~0.5% |

| XRT | Retail Sector | ~4% |

| RSP | Equal-weight S&P 500 | ~0.3% |

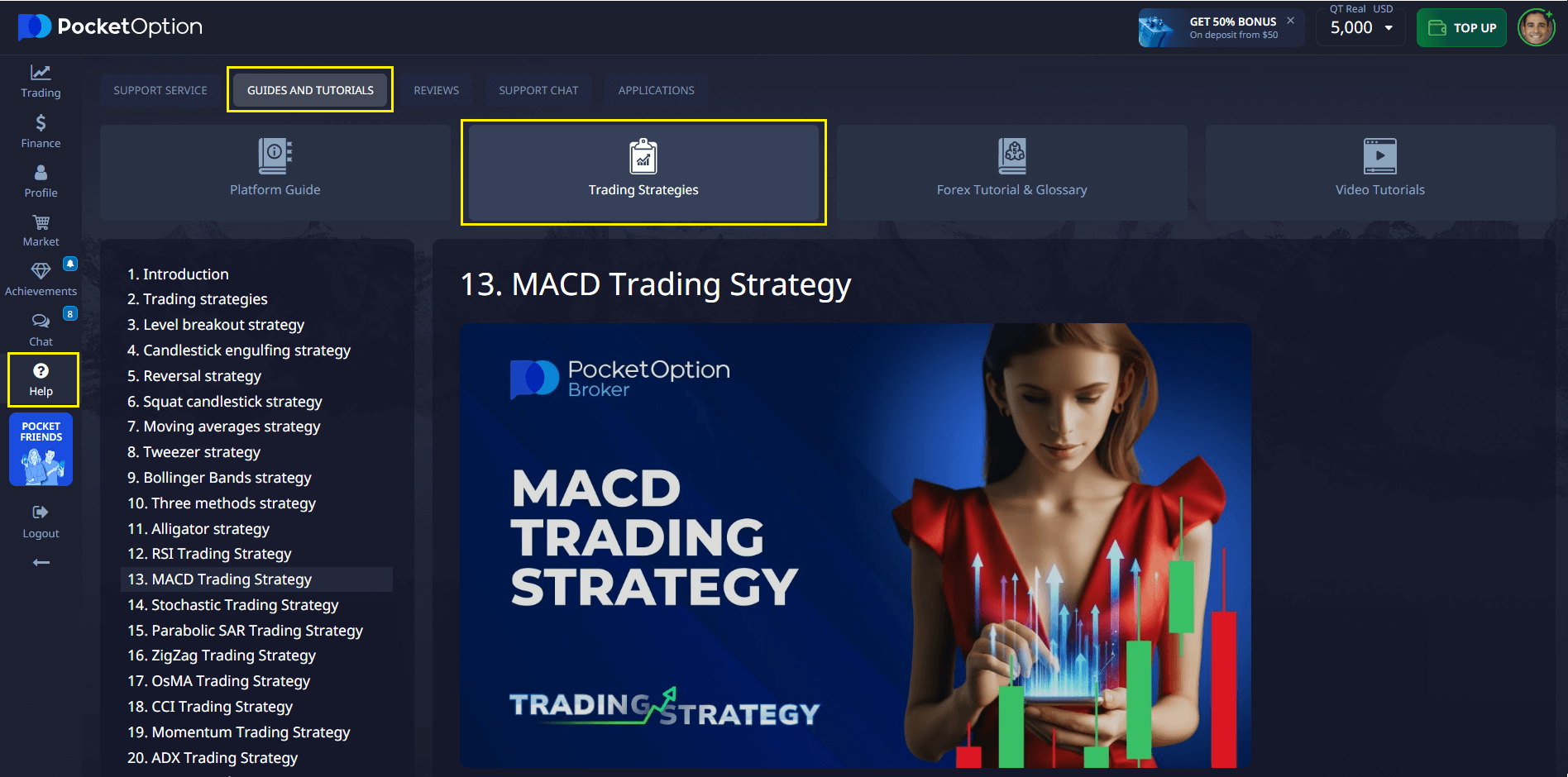

Walmart Stock Strategies

For Beginners

- Research WMT & market trends

- Start with ETFs or fractional shares

- Use Pocket Option’s tutorials to learn market dynamics

Dollar-Cost Averaging

A consistent monthly investment strategy that helps smooth entry over time and build long-term wealth.

Short-Term Trading

Trade Walmart 24/7 with Pocket Option’s AI bots, copy trading tools, and tournaments.

Expert traders recommend combining technical patterns with sentiment data from tools like Tickeron or Pocket Option’s social trading feed.

Ongoing Monitoring Tips

Track your walmart shares regularly:

- Watch earnings and analyst upgrades

- Use technical tools (MA, RSI, support/resistance)

- Monitor global consumer demand

Morgan Stanley anticipates modest top-line growth (+2.7%) in upcoming quarters, signaling margin trends will be the market’s main focus.

Pocket Option for Active Walmart Traders

Pocket Option lets users engage with 100+ global assets 24/7, including major company stocks like Walmart:

- AI Trading and Signal Bot

- Copy Trading & Tournaments

- Mobile-first design

- Instant deposits + bonuses

- Multilingual support

Interactive copy-trading and AI tools make it ideal for high-frequency or event-driven Walmart stock plays.

Risks to Consider

- Wage growth → margin pressure

- Global slowdowns affecting discretionary retail

- Tech rivalry from Amazon, Alibaba

- Regulation on AI/automation in logistics

Oppenheimer warns investors to prepare for possible forward guidance withdrawal amid geopolitical and supply chain risks.

Final Thoughts

Walmart remains a pillar of stability and growth in both traditional and digital retail sectors. Whether you seek to invest long-term or trade actively, WMT deserves a place in your portfolio. Share this guide with fellow investors and revisit often as your strategy evolves. 😊

FAQ

What are the best tools for Walmart stock strategy guide?

Top tools include technical analysis platforms (e.g., TradingView), AI-powered bots from Pocket Option, and financial news aggregators like MarketWatch. Pocket Option also offers smart tools like Copy Trading and real-time performance trackers.

Can beginners succeed with Walmart stock strategy guide?

Yes, beginners can succeed by starting with fractional shares or ETFs that include WMT. Pocket Option’s demo account and learning resources are ideal for practicing without financial risk.

How much money do I need to trade Walmart stock?

Depending on your brokerage, you can start with as little as $1 using fractional shares. On Pocket Option, trades can be placed with minimal capital through active asset contracts.

What are common Walmart stock trading mistakes?

Common pitfalls include overtrading, ignoring macroeconomic signals, and failing to monitor earnings or guidance revisions. Not diversifying beyond WMT is another risk.

How to start trading Walmart stock for beginners?

To begin trading Walmart stock, first open a brokerage account with a platform such as Pocket Option, Fidelity, or Robinhood. After your account is set up, fund it and decide on your trading strategy—whether you prefer a long-term buy-and-hold approach or a more active trading style. It's highly recommended to use demo tools and educational resources to practice and understand the market before making live trades. Regularly monitor your investment’s performance and fine-tune your strategy to stay aligned with your financial goals.

Can stock price predictions really extend meaningfully to 2040?

While specific price targets 15+ years forward carry inherent uncertainty, structured analysis of business evolution drivers yields valuable insights. Focus on understanding potential value creation mechanisms rather than precise numerical predictions. The most useful approach combines quantitative modeling with qualitative assessment of how fundamental industry transformation might reshape Walmart's business model and competitive positioning.

What represents the greatest threat to Walmart's long-term valuation?

Beyond obvious competitive pressures, Walmart faces the "digital centralization paradox" -- as commerce platforms consolidate, consumers increasingly resist single-ecosystem dominance. Additional critical risks include demographic shifts away from mass consumption models, regulatory constraints on data monetization, margin erosion from specialized competitors, and potential failure to effectively deploy capital across transformation initiatives.

How might Walmart's revenue composition change by 2040?

The Walmart of 2040 will likely derive under 50% of revenue from traditional merchandise sales. The company's evolution points toward a diversified model where healthcare services could contribute 15-20% of revenue, advertising/data businesses 10-15%, financial services 5-10%, and marketplace commissions rather than direct sales comprising most remaining revenue. This shift from direct retail to platform economics represents the central value creation opportunity.