- Thailand’s economic indicators significantly impact the Baht’s value. Tourism (which accounts for approximately 20% of Thailand’s GDP), export performance, manufacturing output, and inflation rates all affect THB strength.

- For the USD side, Federal Reserve policies play a crucial role. Interest rate changes, quantitative easing programs, and economic data releases like employment figures or GDP growth can cause substantial movements.

- Trade relations between Thailand and its partners, especially China and the US, create measurable effects in this currency pair. For instance, when Thailand reported stronger-than-expected export growth to China in late 2023, the Baht strengthened against the Dollar by 1.2% within a week.

- Political stability in Thailand also matters–currency markets respond quickly to changes in governance or policy direction, as seen during various political transitions over the past decade. During the 2014 political crisis, for example, USD/THB volatility increased by 15% compared to the previous quarter.

USD/THB: Essential Trading Strategies for the Thai Baht Currency Pair

USD/THB represents the exchange rate between the United States Dollar and the Thai Baht. This exotic currency pair offers traders unique opportunities to diversify their portfolios beyond major forex pairs. In this comprehensive analysis, we'll explore how this market works, key factors influencing price movements, and practical strategies for trading USDTHB live.

What is USD/THB?

USD/THB is a currency pair that shows how many Thai Baht (THB) you need to purchase one US Dollar (USD). As an exotic pair, it combines the world’s primary reserve currency (USD) with Thailand’s national currency (THB).

The Thai Baht has served as Thailand’s official currency since 1897 and is managed by the Bank of Thailand. Meanwhile, the US Dollar functions as the global reserve currency, used in international trade, commodities pricing, and foreign exchange reserves worldwide.

For those interested in USDTHB investing, this pair provides exposure to both the US economy and Thailand’s emerging market dynamics–creating diversification opportunities that many traders overlook. The combination of developed and emerging market characteristics makes this pair particularly interesting for strategic portfolio allocation.

How USD/THB Currency Quotation Works

Understanding USD/THB quotation is straightforward with a practical example. If USD/THB = 35.50, this means that one US Dollar equals 35.50 Thai Baht.

In this pairing, the US Dollar (the base currency) comes first, while the Thai Baht (the quote currency) follows. This structure indicates that the Thai Baht is relatively cheaper than the dollar in global markets.

To illustrate with a practical example: if you’re an American tourist visiting Bangkok, you’d receive 35.50 Baht for each US Dollar you exchange. The higher this number goes, the more purchasing power your dollars have in Thailand–a concept essential to understand when analyzing how to buy USDTHB effectively.

Factors Influencing USD/THB Movement

Several key factors drive USD/THB price movements:

How to Read the USD/THB Exchange Rate

Interpreting USD/THB movements helps you make informed trading decisions:

- When USD/THB rises (e.g., from 35.50 to 36.20), the US Dollar strengthens against the Thai Baht. This means one dollar now buys more baht–good news for American tourists but potentially concerning for Thailand’s export competitiveness.

- If the rate falls (e.g., from 35.50 to 34.80), the Thai Baht is strengthening against the dollar. This could reflect improving Thai economic fundamentals or declining dollar strength globally.

Understanding these movements helps predict potential future trends. For example, when Thailand’s tourism sector began recovering post-pandemic in Q2 2022, we observed gradual baht appreciation phases as foreign currency flowed back into the country, with USD/THB dropping from 38.20 to 36.45 over six months.

What is happening with USDTHB stock today? Though USD/THB is not a stock but a currency pair, its daily movements reflect the current economic conditions in both countries, central bank policies, and global market sentiment that affect all financial assets.

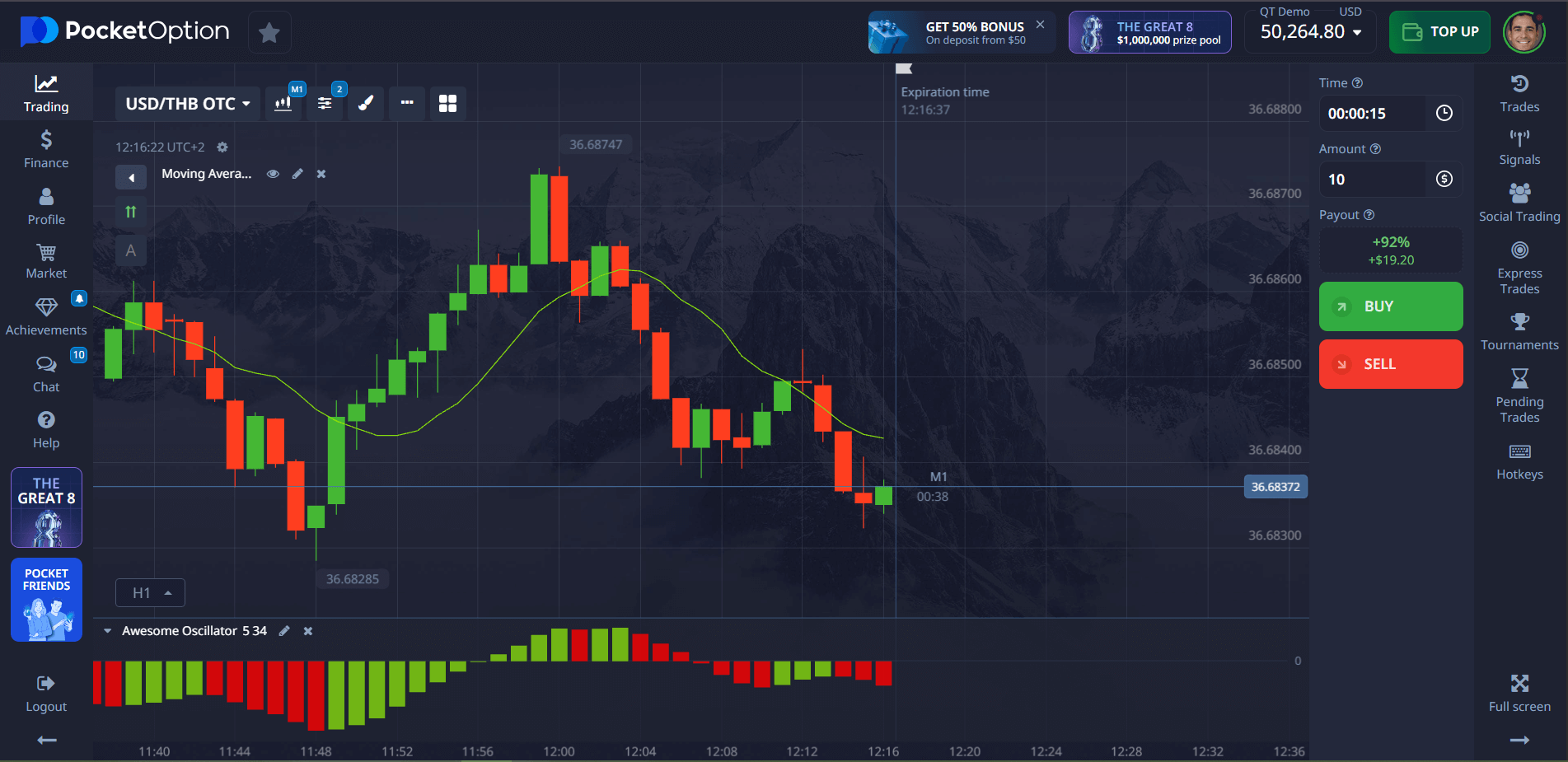

Step-by-Step Quick Trading Example on USD/THB

Here’s how to trade USDTHB with Pocket Option:

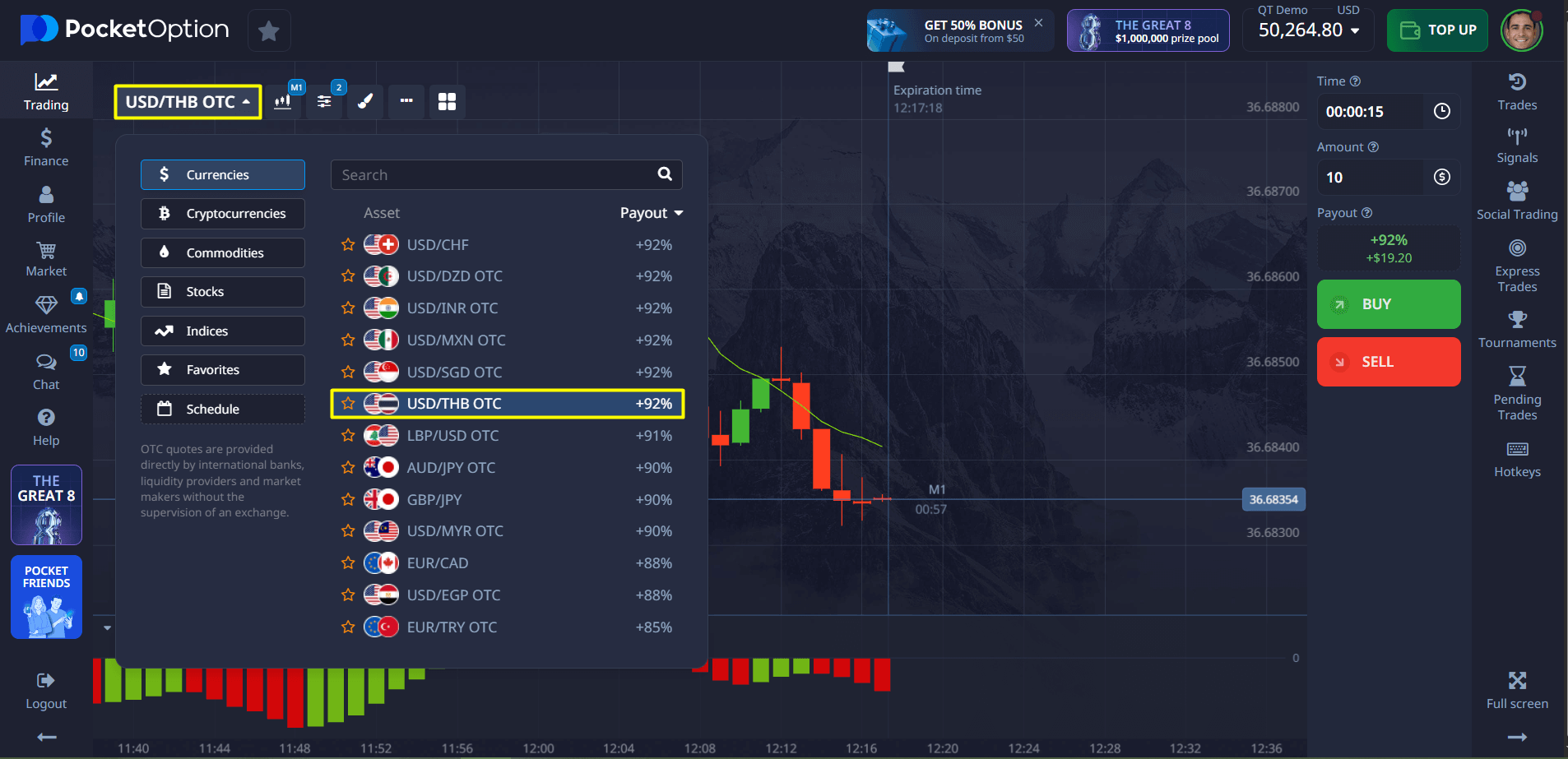

- Locate USD/THB in our asset list (search for “USD/THB” or find it under Forex pairs)

- Examine the price chart–consider using technical indicators like RSI or MACD to identify potential entry points, or check our market sentiment tool which shows current trader positions

- Select your investment amount (starting from just $1)

- Choose your trade duration–from 5 seconds and upward (for OTC markets you can start from as little as 5 seconds)

- Make your forecast:

- If you expect USD/THB to rise, click BUY

- If you anticipate a decline, select SELL

- Confirm your trade and monitor its progress on the live USD/THB chart

With accurate prediction, you can earn returns up to 92% (the exact percentage is displayed before you confirm).

Registration takes just minutes, and you can start with a minimal deposit of $5 (deposit may vary depending on payment methods) or test your strategies on our demo account first without risking real capital!

Try Risk-Free Trading: $50,000 Demo Account

Uncertain about how to invest in USDTHB? Start with our comprehensive demo account!

Upon registration, you’ll immediately receive $50,000 in virtual funds to practice trading USD/THB and other assets without risking real money. This allows you to test various strategies, understand market behaviors, and build confidence before committing actual capital.

When you’re ready to transition to real trading with as little as $5, you’ll unlock additional platform features:

- Copy-trading from experienced traders

- Cashback on your activity

- Trading tournaments with prize pools

- Educational resources and analytical tools

- Personal account manager support

FAQ

What is the best time to trade USDTHB live?

The most active trading hours are during the Asian session (2:00-10:00 GMT) when Thai markets are open, though USD/THB can be traded 24/5 on Pocket Option.

How volatile is USD/THB compared to major pairs?

USD/THB typically shows moderate volatility compared to major pairs, making it suitable for traders who prefer less erratic price movements while still offering profit opportunities.

What is happening with USDTHB stock today?

USD/THB is a currency pair, not a stock, and its movements reflect relative economic performance between the US and Thailand, central bank policies, and global market sentiment.

How to invest in USDTHB for beginners?

Start with our demo account, learn basic technical analysis, understand the economic calendars of both countries, and begin with small positions to minimize risk.

How to buy USDTHB with minimal risk?

Use our platform's risk management tools like stop-loss, start with smaller investments, and consider longer timeframes which often show clearer trends for more predictable outcomes.