- Interest Rate Differentials: When the US Federal Reserve raises rates while the Bank of Japan maintains low rates, the dollar typically strengthens against the yen. The current interest rate gap between these economies is one of the most significant factors traders monitor.

- Economic Indicators: GDP growth, employment figures, and inflation metrics from both countries directly impact exchange rates. For example, strong US employment data often strengthens the dollar against the yen.

- Risk Sentiment: The yen traditionally serves as a “safe haven” currency. During global economic uncertainty, investors often flock to the yen, strengthening it against the dollar. This makes the USDJPY meaning particularly important during market volatility.

- Trade Balance: Japan, being export-dependent, sees its currency affected by trade surpluses or deficits. A strong export performance can strengthen the yen against the dollar.

- Government Policies: Interventions by the Japanese Ministry of Finance or the US Treasury can significantly impact exchange rates. Japan has historically intervened when the yen weakens too rapidly.

USD/JPY: What Makes This Currency Pair an Essential Trading Asset

USD/JPY, often called "the ninja" by traders, represents one of the most traded currency pairs in the forex market. If you're new to trading or looking to expand your portfolio, understanding this pair is crucial for your trading journey.

What is USD/JPY?

USD/JPY represents the exchange rate between the United States dollar and the Japanese yen. As one of the world’s most liquid currency pairs, it brings together two major economies: the largest economy (USA) and the third-largest economy (Japan).

This pair belongs to the “majors” category in forex, meaning it’s among the most traded currencies globally. The high trading volume typically results in tighter spreads and excellent liquidity, making it popular among beginners and experienced traders alike.

The USDJPY sentiment often reflects broader market attitudes toward risk, economic outlooks for both countries, and global financial stability. Understanding this sentiment provides valuable insights when developing your trading strategy.

How Currency Quotation Works in USD/JPY

When you see USD/JPY = 149.50, it means that 1 US dollar can be exchanged for 149.50 Japanese yen. The US dollar is the base currency (the one you’re buying or selling), while the Japanese yen is the quote currency (the price you pay or receive).

In this arrangement, the yen is the cheaper currency on a per-unit basis. To put this in perspective, imagine you’re traveling to Japan with $100. At a rate of 149.50, you would receive ¥14,950 in exchange — quite a lot of yen for shopping in Tokyo!

This quotation makes it easy to understand the relative value between these two important currencies, which is essential for making informed trading decisions when learning how to trade USDJPY.

Factors Influencing USD/JPY Movement

Several key factors drive the USDJPY forecast and price movements:

How to Read the USD/JPY Exchange Rate

Understanding price movements in USD/JPY is straightforward once you grasp the relationship:

When the USD/JPY rate rises (e.g., from 149.50 to 152.75), the dollar is strengthening against the yen. This means you can get more yen for each dollar, making Japanese goods cheaper for Americans.

When the USD/JPY rate falls (e.g., from 149.50 to 145.25), the yen is strengthening against the dollar. Americans would get fewer yen for their dollars, making Japanese exports more expensive in the US market.

If you’re planning how to invest in USDJPY, these price movements offer trading opportunities in both directions. The USDJPY price forecast analysis helps traders determine potential future movements based on technical and fundamental factors.

Step-by-Step Tutorial to Quick Trading on USD/JPY

How to buy USDJPY on Pocket Option is simpler than you might think:

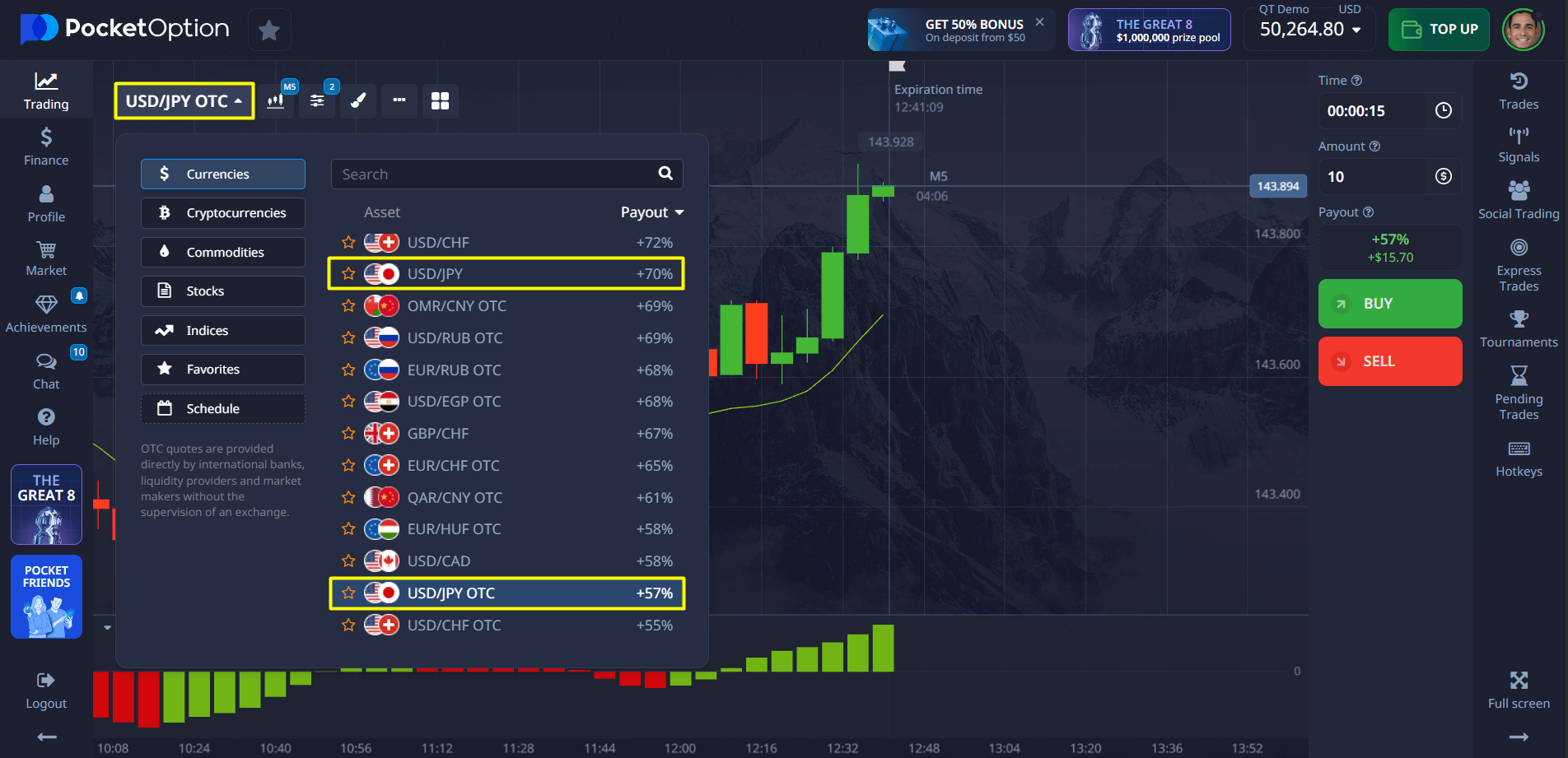

- Find the asset: Search for “USD/JPY” or “USD/JPY OTC” in our asset list. The OTC version allows extended trading hours beyond regular market sessions.

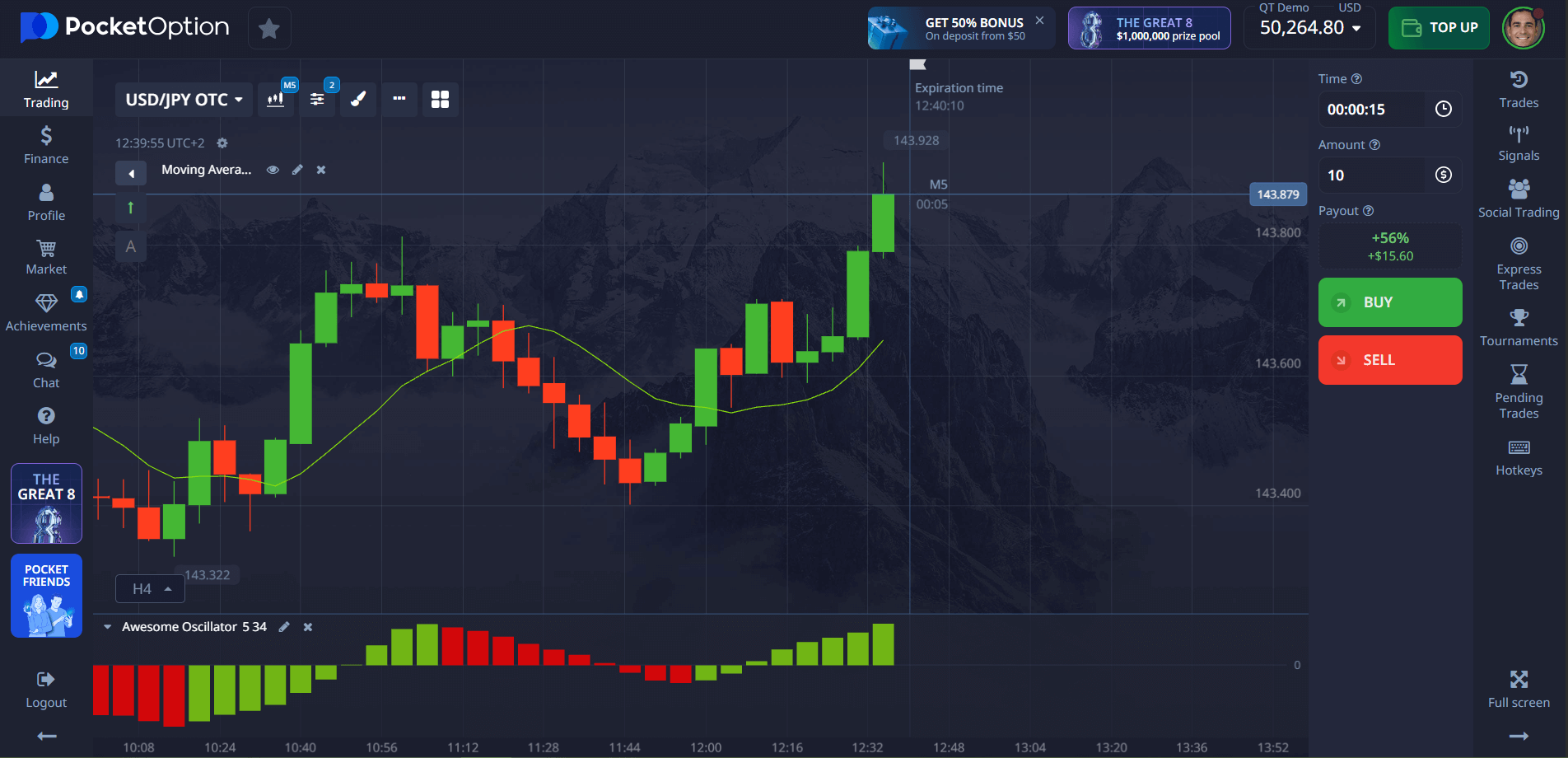

- Analyze the chart: Take a moment to observe recent price movements. You can use our built-in indicators or check the sentiment analysis to see what other traders are doing.

- Select your investment amount: Start with as little as $1 per trade, allowing you to manage risk effectively while learning.

- Choose your timeframe: Set a duration for your trade from 5 seconds and upward (for OTC assets, shorter timeframes are available).

- Make your forecast: If you believe the price will rise, click BUY. If you think it will fall, select SELL.

- Track your results: Watch as the trade unfolds and see if your forecast was correct. Successful forecasts can earn you up to 92% profit (the exact percentage is displayed before you enter the trade).

Ready to try your hand at trading? Sign up today and start with just $5 (deposit may vary depending on payment methods) or practice risk-free on our demo account!

Try Without Risk — $50,000 Demo Account

Uncertain about how to buy USDJPY? Start your trading journey without financial risk! After registration, you’ll receive $50,000 in virtual funds to practice trading strategies, learn platform features, and gain confidence before trading with real money.

The demo account lets you:

- Practice trading in real market conditions

- Test various strategies without risking capital

- Get familiar with platform tools and features

- Build confidence before investing actual funds

When you’re ready to transition to a real account (starting from just $5), you’ll unlock premium features including:

- Copy-trading from successful traders

- Cashback on trades

- Exciting trading tournaments with real prizes

- Advanced analytical tools and indicators

FAQ

What makes USD/JPY popular among traders?

USD/JPY offers excellent liquidity, tight spreads, and represents two major economies, making it ideal for both beginners and experienced traders.

When is the best time to trade USD/JPY?

The most active periods are during the overlap of Asian and European sessions (3-7 AM EST) and European and US sessions (8 AM-12 PM EST).

How does the interest rate differential affect USD/JPY?

Higher US interest rates compared to Japan's typically strengthen the dollar against the yen, causing USD/JPY to rise.

Is USD/JPY suitable for beginners?

Yes, its high liquidity, predictable patterns, and abundant analysis resources make it an excellent starting point for new traders.

What's the minimum amount needed to start trading USD/JPY on Pocket Option?

You can start with a real account deposit of just $5 (deposit may vary depending on payment methods) or practice with a $50,000 demo account for free.