- US Federal Reserve Decisions: When the Fed raised interest rates from near-zero to over 5% during 2022-2023, the USD/INR rose from approximately 74 to 83, demonstrating the direct correlation between higher US rates and dollar strength.

- Indian Economic Performance: Quarterly GDP growth in India (7.8% in Q1 FY2023-24) directly affects rupee valuation. Strong economic data typically strengthens the rupee, pushing USD/INR lower.

- Oil Price Fluctuations: With India importing 85% of its oil needs, every $10 increase in crude oil prices widens India’s current account deficit by approximately 0.4% of GDP, typically weakening the rupee and raising USD/INR rates.

- Foreign Investment Flows: In 2023, when foreign investors poured over $15 billion into Indian markets, the rupee demonstrated periods of relative stability despite global dollar strength.

- Central Bank Interventions: The Reserve Bank of India frequently intervenes in currency markets, using its $600+ billion forex reserves to manage excessive rupee volatility and maintain economic stability.

USD/INR Currency Pair: Master US Dollar to Indian Rupee Trading Fundamentals

Venturing into forex trading with the USD/INR pair opens doors to one of the most dynamic emerging market opportunities. Whether you're new to currency trading or looking to diversify your portfolio, understanding this unique pairing between the world's largest economy and India's growing financial landscape can provide valuable trading opportunities.

What is USD/INR?

USD/INR is a currency pair representing the exchange rate between the United States Dollar (USD) and the Indian Rupee (INR). This pair precisely measures how many Indian Rupees are required to purchase one US Dollar. The USDINR meaning in trading contexts reflects the economic relationship between two significant economies — America and India.

For traders on Pocket Option, this currency pair offers specific opportunities to capitalize on economic disparities, interest rate differentials, and geopolitical developments affecting both nations. Understanding what is USDINR trading gives you access to a market that responds distinctly to both global trends and region-specific catalysts in the Asian markets.

How Currency Quotation Works (Simple Explanation)

Let’s decode the exact mechanics of USD/INR quotations with a practical example: If the USD/INR rate is 83.50, this means 1 US Dollar equals exactly 83.50 Indian Rupees. In this relationship, the Indian Rupee functions as the quote currency, while many traders mistakenly refer to this as a stock (though it’s actually a currency pair, not an equity instrument).

This exchange relationship mirrors everyday purchasing decisions. Consider purchasing imported American electronics in India — the price in rupees fluctuates based on the USD/INR exchange rate. When the dollar strengthens, these products become more expensive for Indian consumers, requiring more rupees for the same item.

Factors Influencing USD/INR Movement

Several precise economic indicators drive USDINR target movements:

How to Read USD/INR Exchange Rates

Interpreting USD/INR movements is fundamental for making informed decisions on how to invest in USDINR:

When the USD/INR rises from 83.50 to 84.20, the US Dollar has strengthened by approximately 0.84% against the Indian Rupee. This means the base currency (USD) now purchases more of the quote currency (INR) — specifically, 0.70 rupees more per dollar.

Conversely, if the rate falls from 83.50 to 82.80, the dollar has weakened by about 0.84% against the rupee. Now you need fewer rupees (0.70 less) to buy one dollar.

Consider this practical trading scenario: If you exchanged $10,000 when the rate was 83.50, you’d receive ₹835,000. If the rate later moved to 84.20 and you converted your rupees back to dollars, you’d only get $9,916 — experiencing a $84 loss due to the rupee’s depreciation.

Understanding these precise movements is essential when developing strategies for how to trade USDINR effectively, as even small percentage changes can significantly impact larger positions.

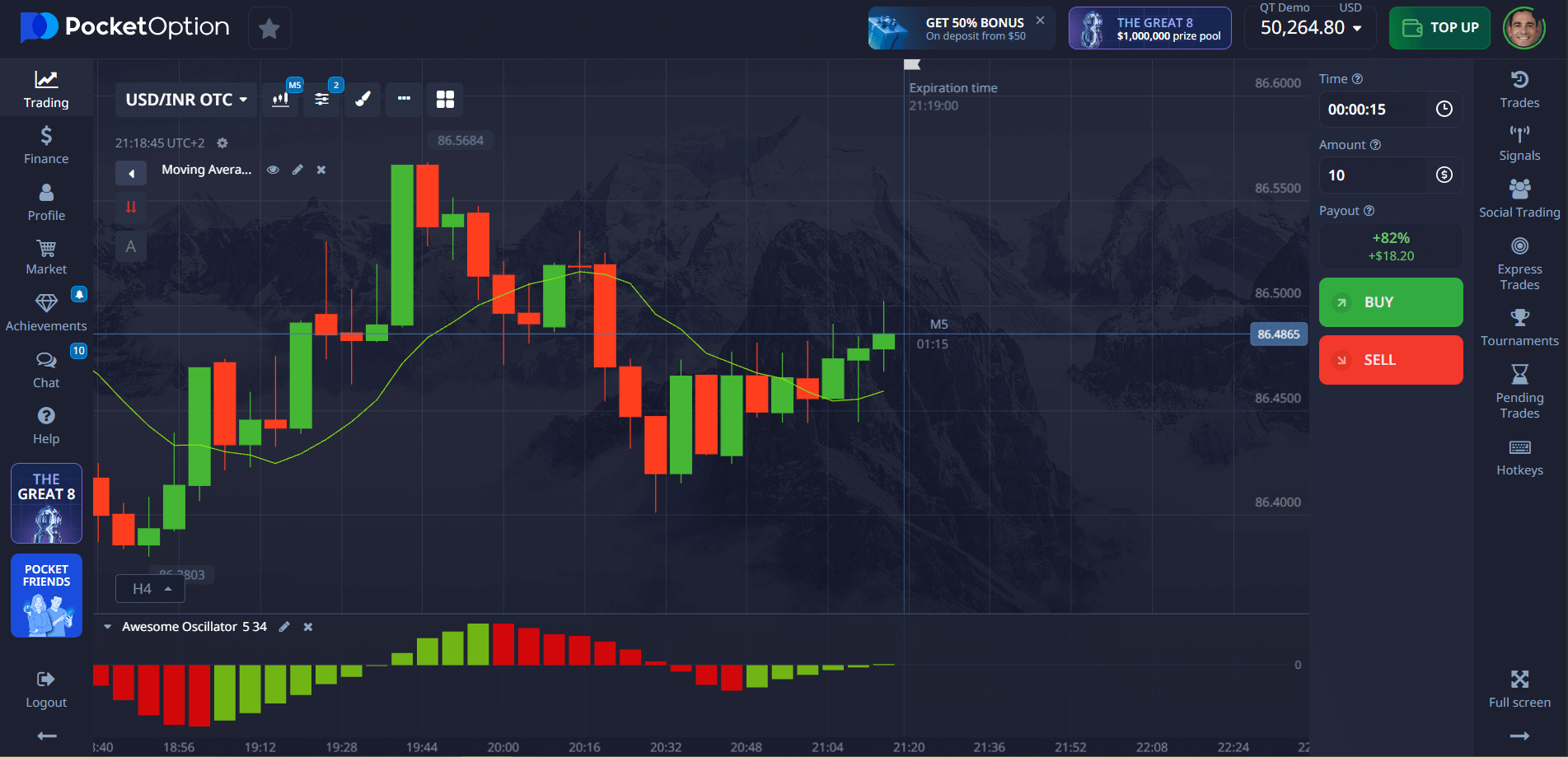

Step-by-Step Tutorial: Quick Trading USD/INR on Pocket Option

For traders wondering exactly how to buy USDINR, follow these practical steps:

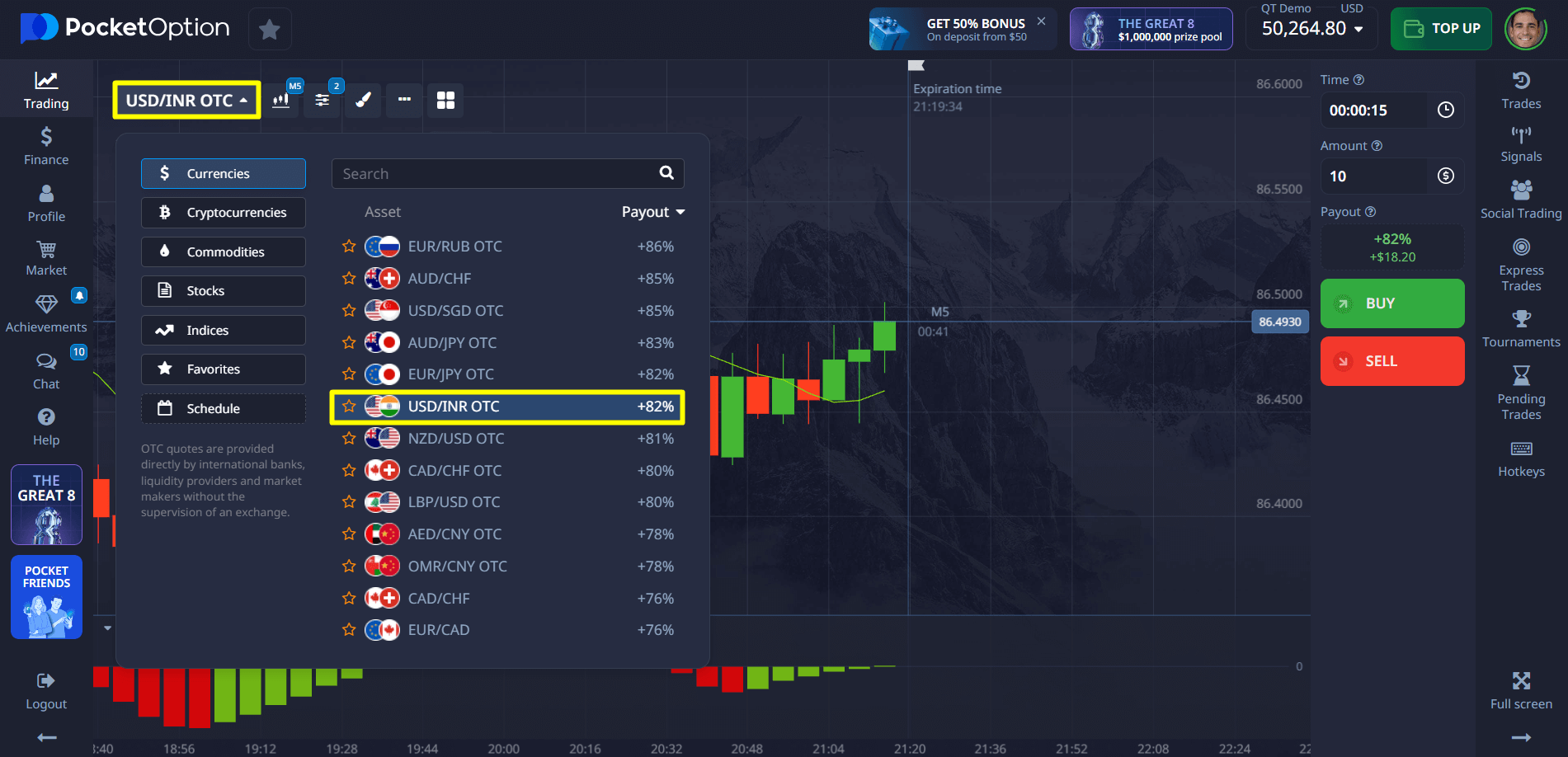

- Locate the asset: Search specifically for “USD/INR OTC” (available during off-market hours) in the asset selection panel

- Analyze current patterns: Examine the price action using technical indicators like RSI, MACD, or Bollinger Bands to identify potential entry points, or check the platform’s sentiment indicator showing the percentage of traders buying versus selling

- Determine investment size: Set your trade amount starting from $1, with recommended position sizing of 1-5% of your trading capital for risk management

- Select precise expiration: Choose when your trade concludes — from 5 seconds for OTC assets to longer timeframes for more measured price movements

- Execute your forecast: Based on your analysis, select either BUY if you anticipate price appreciation or SELL if you expect depreciation by expiration

Before execution, you’ll see your potential return calculated — typically between 75-92% on successful forecasts depending on market conditions and chosen timeframe.

Begin trading with Pocket Option through a straightforward registration process and start with a minimal initial deposit from $5 (deposit may vary depending on payment methods), or first explore all features with our comprehensive practice account!

Try Risk-Free: $50,000 Demo Account Waiting for You

New to the USDINR option chain and its trading mechanics? Pocket Option provides every new user with a substantial $50,000 practice account instantly upon registration.

This comprehensive demo environment allows you to:

- Experiment with different entry/exit points and timing strategies without financial exposure

- Observe how USD/INR responds to various economic releases and market conditions

- Master the platform’s technical analysis tools and charting capabilities

- Develop confidence in executing trades before committing actual capital

When ready to transition to live trading with a minimum deposit starting from $5, you’ll gain access to premium features including:

- Copy Trading capabilities allowing you to mirror strategies of proven performers

- Tiered Cashback program returning a percentage of your trading volume

- Competitive trading tournaments offering substantial prize pools

- Enhanced analytical tools and exclusive market insights

FAQ

What exactly does USDINR mean in trading terminology?

USDINR represents the exchange rate between the US Dollar and Indian Rupee, specifically indicating how many rupees (currently around 83-84) are required to purchase one US dollar.

How can I start trading USD/INR with minimal investment?

You can begin trading USD/INR on Pocket Option with as little as $5 (deposit may vary depending on payment methods), or first practice using the comprehensive $50,000 demo account to refine your strategy.

What factors most significantly impact USDINR target movements?

Interest rate differentials between the US and India, inflation data from both economies, crude oil price fluctuations, and foreign institutional investment flows are the primary drivers of USD/INR movements.

When is the optimal time to trade USDINR?

The USD/INR market shows highest liquidity during Indian market hours (3:45 AM - 11:00 AM GMT) and the US-India market overlap period, though OTC options provide 24/7 trading opportunities.

Is it possible to trade the USDINR option chain during weekends?

Yes, Pocket Option offers USD/INR OTC (Over The Counter) trading during weekends, which follows alternative pricing models compared to traditional exchange markets.