- Oil prices: Canada’s economy is tied to oil exports. Falling prices usually weaken the CAD.

- Monetary policy: Interest rate changes by the Fed or Bank of Canada affect currency strength.

- Trade dynamics: US-Canada trade agreements or tariffs impact the usdcad pair.

- Economic indicators: GDP growth, jobs data, and inflation reports from both nations move the rate.

USD/CAD -- learn how this pair moves and how to trade it step-by-step

If you're looking to understand the USD/CAD pair, this article will walk you through what drives the usdcad trend, how to analyze its volatility, and how to execute a successful usdcad trade on Pocket Option!

What is USD/CAD?

USD/CAD shows how many Canadian Dollars (CAD) are needed to buy one US Dollar (USD). As a major usdcad pair in forex, it is impacted by oil prices, interest rate decisions, and trade flows between the U.S. and Canada.

This pair is often chosen by traders who seek to benefit from macroeconomic differences or volatility caused by North American economic reports.

How Currency Quotes Work (Simple Breakdown)

Example: USD/CAD = 1.37. This means 1 USD equals 1.37 CAD. In this case, the CAD is weaker.

Real-life analogy: If you exchange 100 USD, you’ll receive 137 CAD. If the rate moves to 1.40, your dollar buys more — a sign of CAD weakness.

Factors Affecting USD/CAD Movement

All these elements can contribute to rapid usdcad volatility, especially around major news events.

How to Read USD/CAD Rate Changes

If the rate rises from 1.37 to 1.39, the USD is gaining strength. If it falls to 1.34, the CAD is appreciating.

- Upward move = stronger USD / weaker CAD

- Downward move = stronger CAD / weaker USD

These movements are key to any informed usdcad prediction, whether you’re trading on technical signals or macro trends.

Instructions: How to Trade USD/CAD with Quick Trading

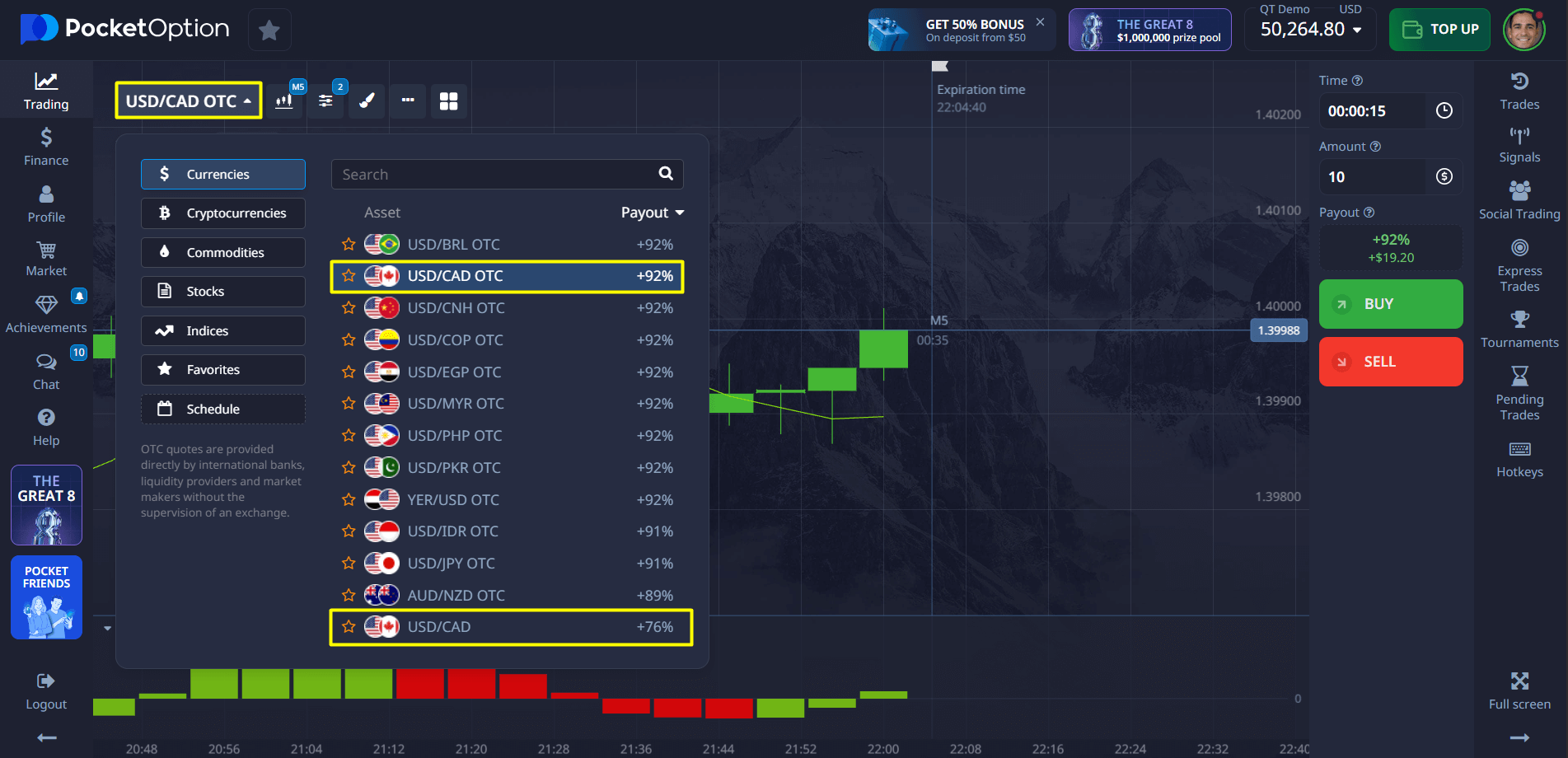

Here’s how to open your first usdcad trade on Pocket Option:

- Select the asset: Choose USD/CAD or USD/CAD OTC.

- Analyze the chart: Use indicators or monitor trader sentiment.

- Set your trade amount: Start from just $1 if you prefer low-risk trades.

- Pick a duration: OTC trades allow 5 seconds or longer.

- Place your forecast: Press BUY if expecting the rate to rise, SELL if expecting a fall.

- Check returns: Up to 92% payout displayed before confirming the trade.

Try the $50,000 Demo Without Risk

Not ready to commit real funds? Open a demo account and receive $50,000 in virtual currency.

- Explore how the usdcad pair responds to economic news

- Test strategies and refine your usdcad prediction

- Understand risk-free how the market behaves

Later, move to a live account starting from $5 to access:

- Copy Trading tools

- Cashback on trades

- Tournaments and seasonal events

- Live tracking of usdcad stock trends and forecasts

Conclusion

The USD/CAD pair offers actionable opportunities based on oil markets, interest rates, and global trade sentiment. With the right usdcad prediction tools and an understanding of what drives the usdcad trend, you can engage in both short-term and long-term trades confidently. Pocket Option offers demo practice and live execution with low entry barriers — ideal for new and experienced traders monitoring usdcad stock dynamics.

FAQ

What does USD/CAD represent?

It's the exchange rate between the US Dollar and the Canadian Dollar.

How to buy USD/CAD?

On Pocket Option, choose USD/CAD, set your trade size and time, then forecast direction.

How to invest in USD/CAD?

You can invest through demo practice or real-money trades starting from $5.

What drives USD/CAD volatility?

Oil prices, interest rate changes, and economic data from the US and Canada.

What's the best time to trade USD/CAD?

During the overlap of US and Canadian market hours, typically 13:00--17:00 UTC.