- Developed a proprietary voice AI platform supporting natural language processing.

- Integrated technology with major automotive and consumer electronics brands.

- Scaled revenue generation through SaaS and licensing models.

- Achieved significant year-over-year growth in enterprise licensing.

- Secured strategic partnerships with key players in the automotive AI ecosystem.

Pocket Option SOUN Stock Forecast 2030

The landscape of artificial intelligence is rapidly evolving, and SoundHound AI stands at the forefront of this revolution.</strong> As we venture into a detailed analysis of SOUN stock, we will explore its performance, potential, and the factors that may influence its trajectory through 2030. With a focus on data-driven insights and growth predictions, this article will provide investors with a comprehensive understanding of SoundHound AI and its stock forecast.

Understanding SoundHound AI and Its Stock

Overview of SoundHound AI

SoundHound AI Inc. is a pioneering company in the voice AI sector, specializing in developing innovative artificial intelligence solutions that enhance user interaction. Founded in 2005, the company has established itself as a key player in the AI market, with its technology integrating seamlessly into various applications. SoundHound AI’s commitment to advancing voice recognition capabilities positions it favorably as the demand for AI-driven solutions continues to grow. As the company expands its offerings, understanding its unique value proposition becomes crucial for assessing its stock forecast and overall market potential.

Key Achievements of SoundHound AI:

Current Stock Price Analysis

As of 2023, the current stock price of SoundHound AI reflects a combination of market sentiment and the company’s growth prospects. Evaluating the SOUN stock price involves analyzing recent trends and technical analysis to identify potential price movements. Current market conditions, including investor interest in AI stocks and competition from industry giants like Nvidia, significantly influence SoundHound’s valuation. Analysts are closely monitoring these dynamics, providing predictions for 2024 and beyond, as they aim to establish a clearer understanding of the stock’s future performance.

Key Factors Influencing Stock Price

Numerous key factors influence the price of SoundHound AI stock, including the company’s revenue growth and the overall performance of the AI market. Year-over-year comparisons and growth rates provide insight into how effectively SoundHound is capitalizing on emerging trends. Additionally, external influences such as regulatory changes, technological advancements, and competition play a vital role in shaping stock price predictions. Market analysts and investment platforms, like Motley Fool’s, often provide stock price forecasts for SOUN, which investors can use to inform their decisions on whether to buy or sell SoundHound AI stock in the coming years.

Primary Stock Drivers:

- Adoption of voice-first devices

- AI regulatory environment

- Strategic partnerships and patent acquisitions

- Integration with smart home and automotive ecosystems

- Expansion into non-English voice markets

- Scalability of AI architecture for enterprise applications

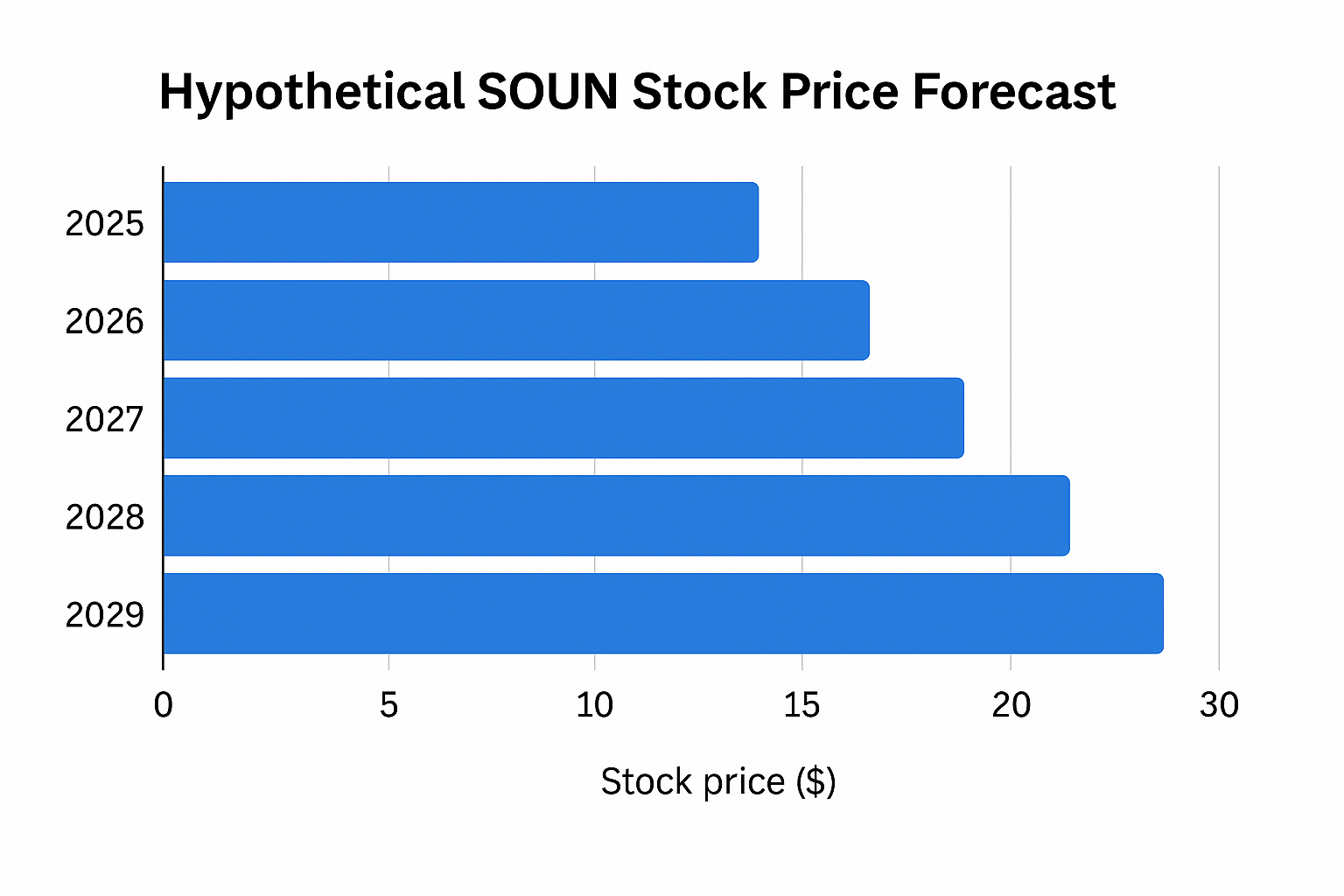

Stock Price Forecasts for SoundHound AI

2025 Price Movements

Forecasting the stock price movements for SoundHound AI in 2025 requires a comprehensive understanding of the factors that could impact its growth trajectory. As the AI market evolves, the company’s strategic initiatives and innovations in voice AI technologies will play a crucial role in shaping its stock price. Predictions indicate that sustained revenue growth and an expanding market presence could lead to a positive price target for SOUN, potentially driving the stock higher. Additionally, investor sentiment towards AI stocks, influenced by competitors like Nvidia, will be pivotal in determining the stock price trends during this period, making it essential for stakeholders to stay informed about market developments.

Expert Insight:

“If SoundHound maintains current growth velocity, its valuation could see 10x returns by 2030,” – Jon Carter, AI Market Analyst, EquityX Research.

Long-Term Predictions: 2026 to 2030

Long-term predictions for SoundHound AI from 2026 to 2030 present an intriguing landscape for investors. By considering the projected advancements in artificial intelligence and the company’s ongoing commitment to innovation, the potential for significant growth in SoundHound AI stock becomes apparent. Analysts are optimistic about the company’s ability to leverage emerging AI models and technologies to enhance its product offerings and revenue streams. The stock price forecast for 2030 suggests a bullish outlook, contingent on the company’s ability to maintain its competitive edge in the AI market. As such, investors are advised to consider both the opportunities and risks when evaluating whether to buy or sell SoundHound AI stock in the long run.

| Year | Projected Price Range (USD) | Growth Catalyst |

|---|---|---|

| 2026 | 5.00 – 7.20 | AI deployment in consumer tech |

| 2027 | 6.50 – 9.00 | Voice commerce adoption |

| 2028 | 8.00 – 11.00 | Global partnerships |

| 2029 | 10.50 – 14.30 | Enhanced NLP engines |

| 2030 | 13.00 – 17.50 | Broad market integration |

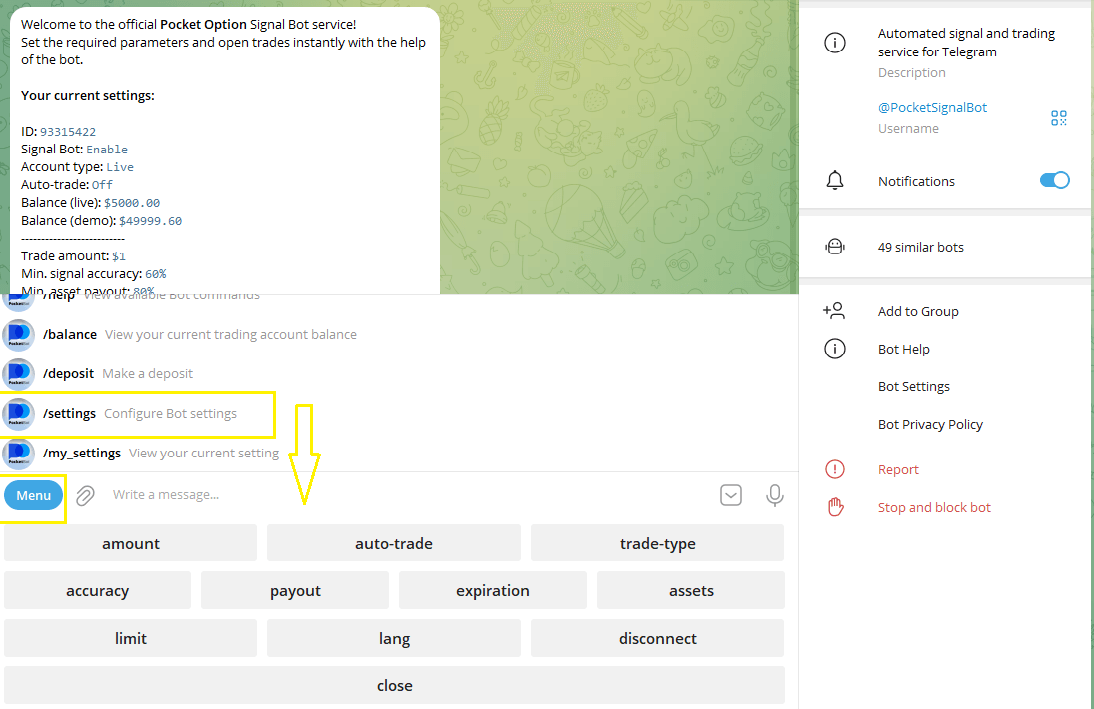

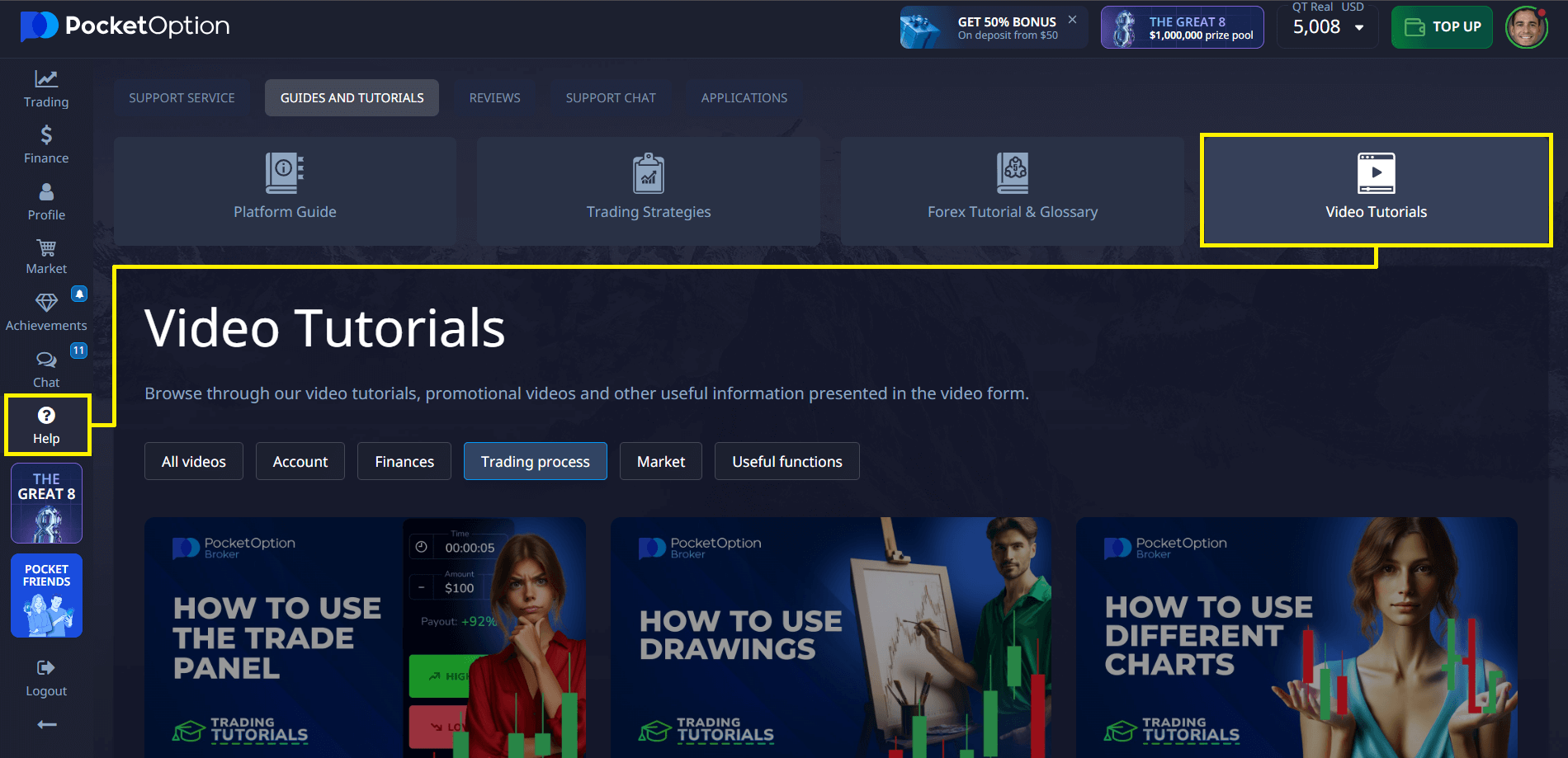

Connecting with Pocket Option: Smarter Trading for AI Stocks

For investors tracking soun stock forecast 2030 or exploring soun stock prediction 2030, Pocket Option offers a practical gateway to apply your insights in real trading environments. The platform supports:

- Intuitive user interface for novice and advanced traders

- Real-time analytics and economic calendar integration

- Support for crypto, stocks, and commodities in one account

- Bonus programs and social trading features

- Mobile trading for flexible portfolio management

- AI signals and copy trading to enhance entry strategy

💡 Did You Know?

Pocket Option also offers educational materials and training resources tailored to help investors interpret stock forecasts like those for SOUN and translate them into actionable trades.

Final Thoughts

SoundHound AI’s long-term trajectory continues to generate discussion in the investment world. With the ongoing development of AI technologies and growing applications in everyday industries, keeping an eye on soun stock price prediction 2030 remains critical for strategic planning. The convergence of innovative tech, market positioning, and economic sentiment will play defining roles in this stock’s decade-long performance.

💬 Discuss this and other topics in our community to gain deeper insights and trading confidence!

FAQ

What factors most significantly impact the SOUN stock forecast 2030?

The most influential factors for SoundHound's long-term outlook include voice AI market growth (projected at 16-20% CAGR), the company's technological differentiation sustainability, revenue diversification across automotive, restaurant, and enterprise sectors, path to profitability timeline (expected 2025-2027), and potential industry consolidation scenarios. Competitive dynamics with both tech giants and specialized AI startups will also significantly influence outcomes.

How reliable are long-term stock forecasts for companies like SoundHound?

Long-term forecasts inherently contain significant uncertainty, especially for emerging technology companies. Rather than single-point predictions, experienced investors use scenario analysis with probability distributions. Pocket Option's analytical models suggest that SOUN stock predictions for 2030 should be viewed as a range of potential outcomes (conservative: $15-20, base case: $30-40, optimistic: $55-70) rather than precise targets.

What investment strategy is recommended for SOUN through 2030?

A staged entry approach is typically most effective, starting with 30% of your planned allocation and adding during key validation points or market pullbacks. Position sizing should reflect the speculative nature (typically 0.5-3% of portfolio depending on risk tolerance). Regular thesis review against predetermined milestones helps maintain discipline through volatility while allowing adaptation to new information.

How does voice AI technology evolution affect SOUN's long-term prospects?

Voice technology is expected to evolve from simple command recognition to contextual understanding and multimodal integration by 2030. SoundHound's competitive position depends on maintaining technological differentiation while expanding domain expertise. Investors should monitor the company's R&D investments, patent portfolio growth, and adoption metrics across key verticals as indicators of future market leadership potential.

What are the biggest risks to consider in a SOUN stock forecast 2030?

Key risks include technological disruption from alternative approaches, execution challenges in scaling across multiple verticals, competitive pressure from resource-rich tech giants, capital requirements and potential dilution, and evolving regulatory frameworks for AI technologies. Establishing clear risk monitoring protocols and decision triggers helps investors distinguish between temporary setbacks and fundamental thesis breaks.