- Over 420 million daily active users worldwide.

- AR technology adoption, positioning Snap ahead of several rivals in the tech industry.

- Revenue growth driven by advertising and AR lenses.

Pocket Option Snap Stock Price Prediction 2030

Looking for a reliable Snap stock price prediction 2030? Discover expert forecasts, growth scenarios, and learn how you can trade Snap 24/7 with Pocket Option’s $5 minimum deposit (depends on the geo and the payment method) and free demo account.

Current Snapshot of Snap Inc.

Snap Inc., best known for Snapchat, has carved out a niche in the social media and AR (augmented reality) space. Its youthful audience and innovation strategy make it both exciting and unpredictable for investors.

Recent highlights include:

“Snap has built a strong ecosystem around AR, creating one of the most unique user engagement funnels in social media.” — Bloomberg Technology, 2025

Snap’s Latest Financials

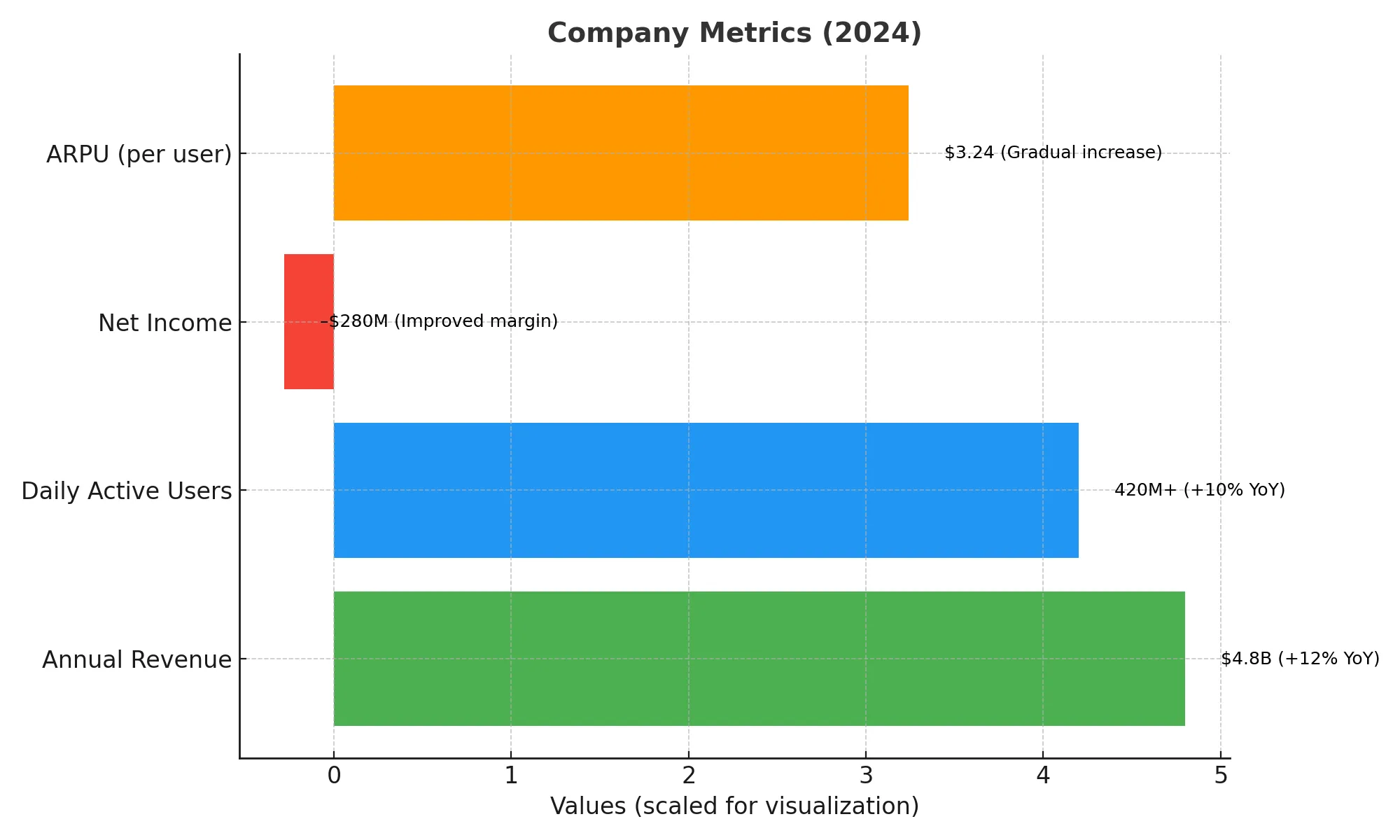

The most recent financial data reveals a mixed but evolving picture:

| Metric (2024) | Value | Trend |

|---|---|---|

| Annual Revenue | $4.8B | +12% YoY 📊 |

| Daily Active Users | 420M+ | +10% YoY |

| Net Income | –$280M (loss) | Improved margin |

| ARPU (per user) | $3.24 | Gradual increase |

💡 Snap is not yet consistently profitable but has shown improving margins and strong revenue growth, especially from international markets.

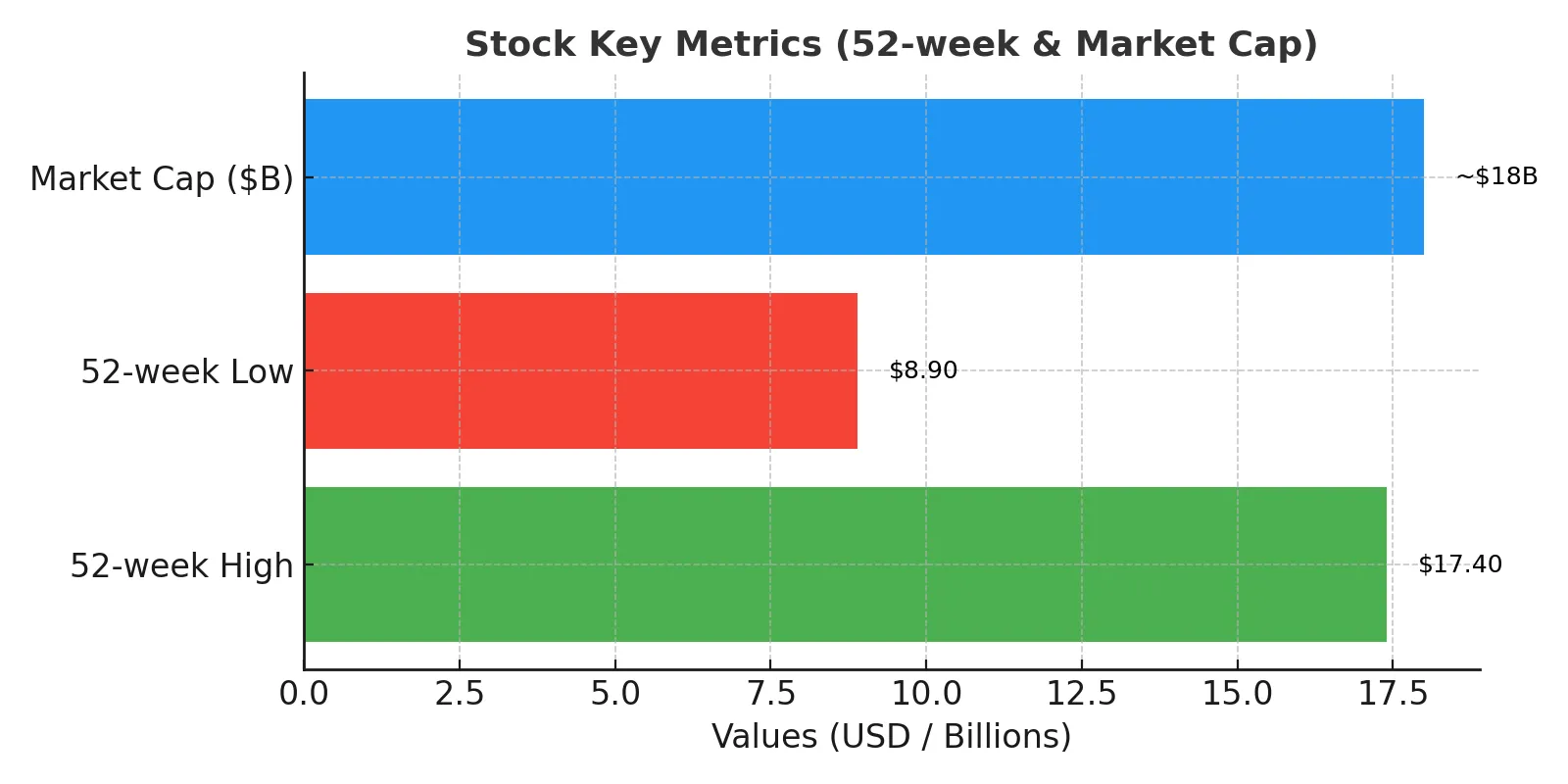

Current Snap Stock Price

As of Q3 2025, NYSE SNAP trades in the range of $11–$13 per share. This volatility reflects investor uncertainty, ad spending cycles, and market trends across the tech sector.

- 52-week high: $17.40

- 52-week low: $8.90

- Market capitalization: ~$18B

📊 Analysts view Snap as a “growth bet” rather than a stable cash-flow company, with heavy reliance on future AR monetization.

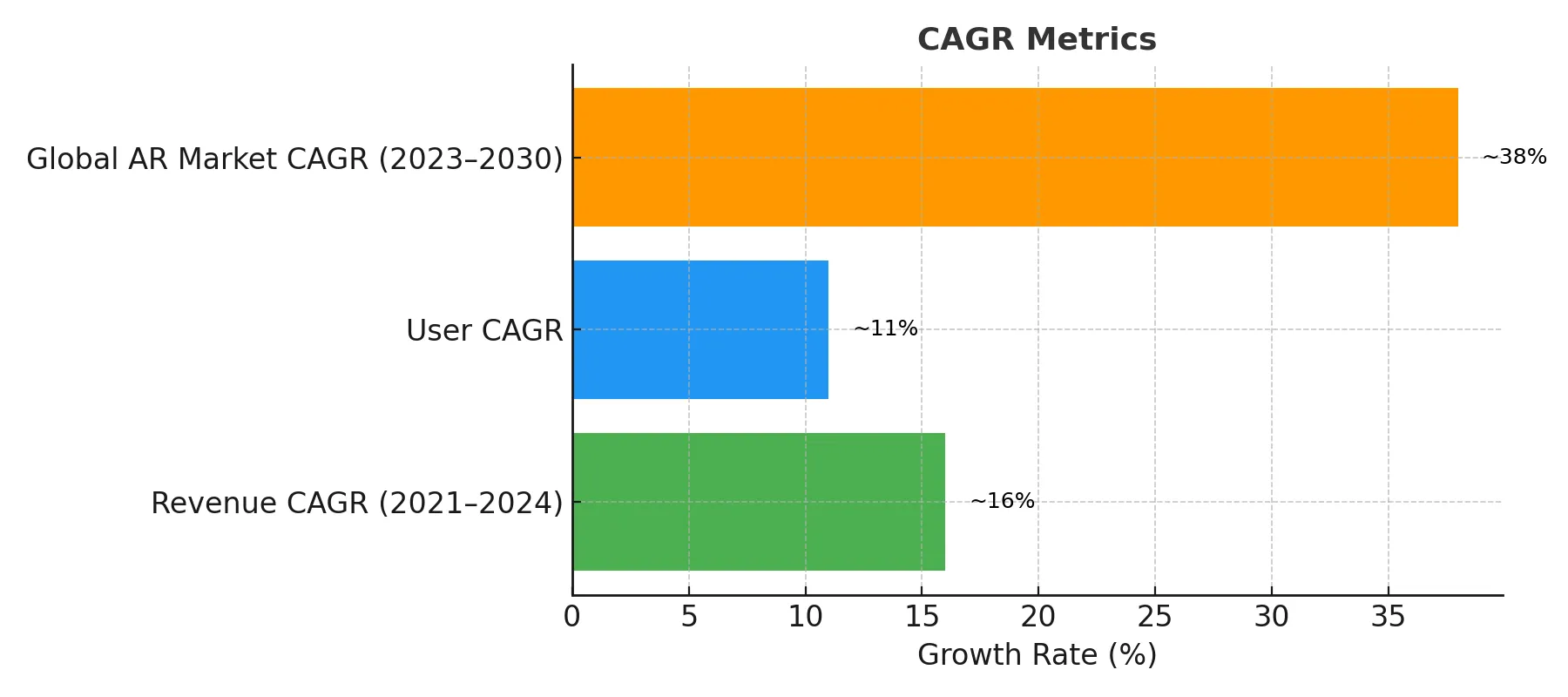

Growth Rate Analysis

Predicting SNAP future price requires understanding growth rates:

- Revenue CAGR (2021–2024): ~16%

- User CAGR: ~11%

- Global AR market CAGR (2023–2030): ~38%

This creates a bullish case where Snap benefits from AR adoption — but also a bearish case if monetization lags behind.

List: Key Growth Drivers

- Expansion of AR features inside Snapchat.

- Partnerships with advertisers for immersive campaigns.

- International user base expansion (India, Latin America).

Snap Stock Forecasts

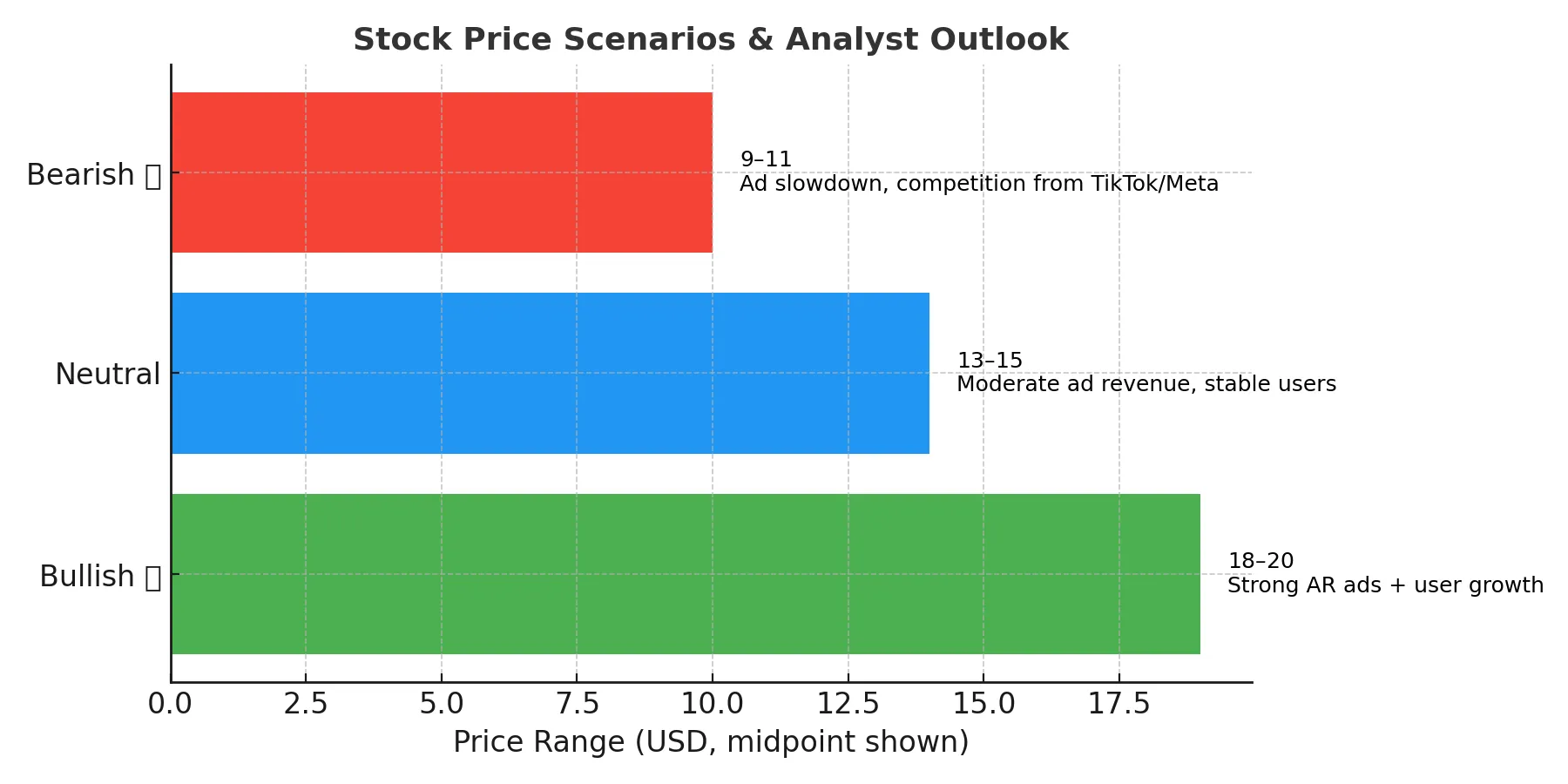

Snap Stock Price Prediction for 2025

By 2025, forecasts center around:

| Scenario | Price Range | Analyst Outlook |

|---|---|---|

| Bullish 🚀 | $18–$20 | Strong AR ads + user growth. |

| Neutral | $13–$15 | Moderate ad revenue, stable users. |

| Bearish 📉 | $9–$11 | Ad slowdown, competition from TikTok/Meta. |

“If Snap can scale AR monetization and maintain double-digit user growth, the stock could outperform peers.” — Morgan Stanley, 2025

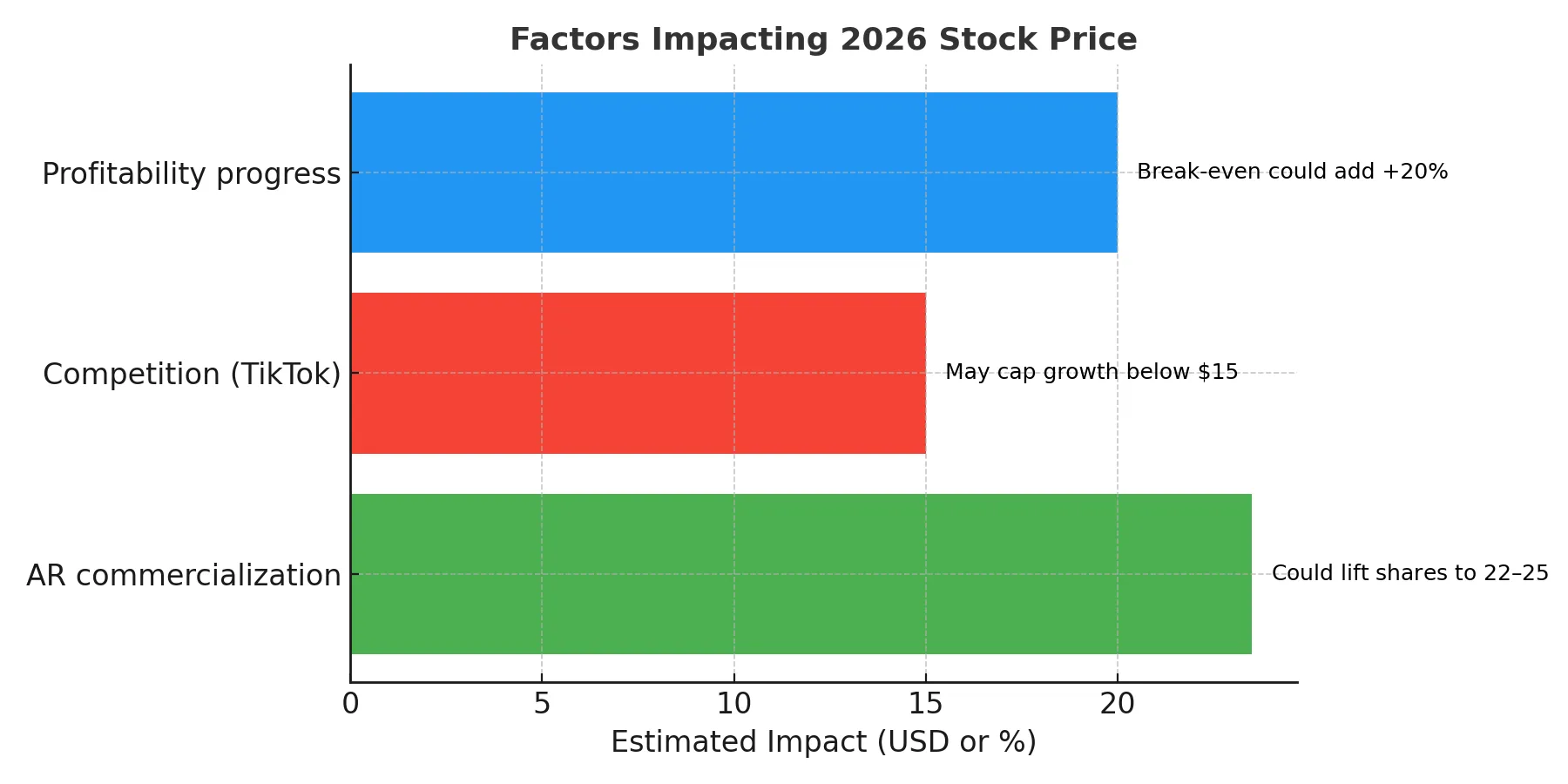

Snap Stock Price Prediction for 2026

In 2026, analysts expect Snap to either consolidate its AR dominance or struggle if competition ramps up.

| Factor | Impact on 2026 Price |

|---|---|

| AR commercialization | Could lift shares to $22–$25. |

| Competition (TikTok) | May cap growth below $15. |

| Profitability progress | Break-even could add +20%. |

⚖️ Consensus forecast (2026): $16–$20.

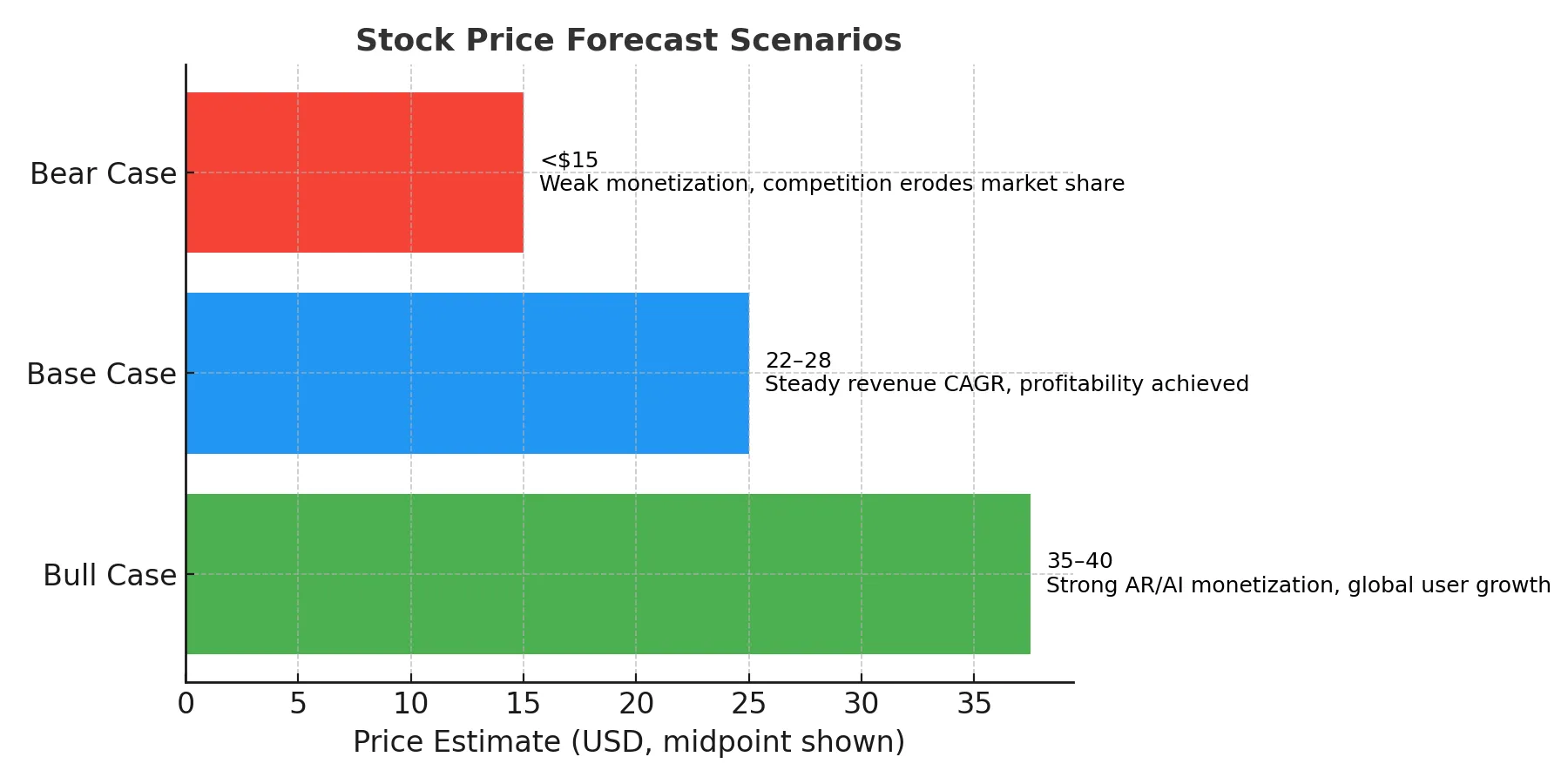

Snap Stock Price Prediction 2030 (Long-Term)

Here’s where it gets exciting: the Snap stock price prediction 2030 is highly polarized.

| Forecast Type | Price Estimate | Conditions |

|---|---|---|

| Bull Case 🚀 | $35–$40 | Strong AR/AI monetization, global user growth. |

| Base Case | $22–$28 | Steady revenue CAGR, profitability achieved. |

| Bear Case 📉 | <$15 | Weak monetization, competition erodes market share. |

“Snap has the potential to be a $30+ stock by 2030 if AR becomes mainstream. But execution risk is very high.” — Goldman Sachs Equity Research

💡 Expert Insight: Long-term investors should balance Snap exposure with other tech industry stocks to mitigate volatility.

Factors Influencing Snap’s Future

Market Trends

- Growth in digital advertising.

- Rising demand for immersive AR experiences.

- Macroeconomic cycles influencing ad budgets.

Company Performance

Snap’s ability to control costs, grow ARPU, and scale globally will directly shape the Snapchat stock forecast.

Technology Innovation

Snap remains a leader in AR. If it integrates AI into AR filters and shopping, adoption could accelerate significantly.

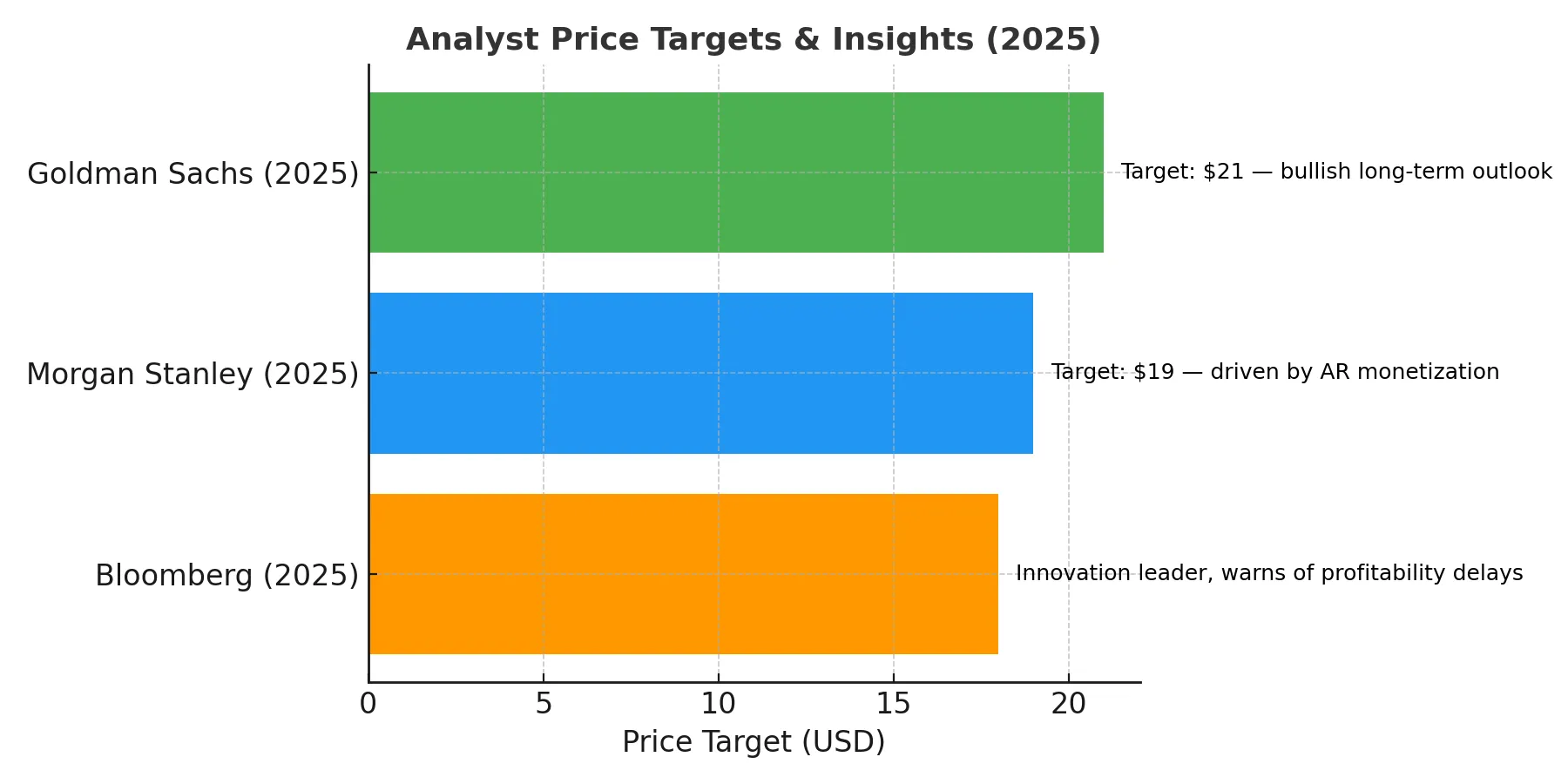

Expert Predictions and Insights

- Bloomberg (2025): Sees Snap as an “innovation leader” but warns about profitability delays.

- Morgan Stanley (2025): Sets price target of $19, driven by AR monetization.

- Goldman Sachs (2025): Price target $21 with bullish long-term outlook.

📊 Average 12-month price target (consensus): $18.50

Risks vs Opportunities

List: Major Risks

- Heavy competition (TikTok, Meta, YouTube Shorts).

- Profitability uncertainty.

- Market downturn reducing ad budgets.

List: Major Opportunities

- AR market boom.

- Expansion into e-commerce + AI.

- Monetization of new demographics (Gen Z, Gen Alpha).

Trader Reviews of Pocket Option

💬 “Pocket Option’s demo helped me practice Snap trades before risking money. Perfect for testing strategies.” — Michael R.

💬 “I love using Social Trading on Pocket Option to copy trades of pros when volatility spikes on Snap.” — Sofia L.

💬 “The AI Trading feature gives me better entry signals on stocks like SNAP.” — Daniel M.

Why Trade Snap with Pocket Option?

Pocket Option offers unique advantages for traders following Snap stock price prediction 2030:

- Trade 100+ assets (including OTC Snap) 24/7.

- Start real trading with just $5 (depends on the geo and the payment method) deposit.

- Free unlimited demo account for practice.

- AI Trading & Telegram Bot for automation.

- Social Trading to copy expert.s.

- Tournaments with prizes.

- Bonuses and promo codes to boost capital.

FAQ

What will Snap stock be worth in 2030?

Based on expert forecasts, the Snap stock price prediction 2030 ranges between $22 and $40, depending on AR monetization, global user growth, and competition in the tech industry. Bullish scenarios suggest Snap could reach the higher end if it becomes a leader in augmented reality, while bearish forecasts place it below $15 if growth slows.

Is Snap a good investment long-term?

Yes, but with conditions. Snap’s innovative role in social media and AR makes it attractive for those who want to invest in Snap with a long horizon. However, it remains a high-risk, high-reward stock. Analysts from Goldman Sachs and Morgan Stanley highlight that while Snap has strong growth potential, profitability delays and fierce competition could limit upside.

Will Snap reach $100 by 2030?

Unlikely. Most Snapchat stock forecast models suggest a realistic price ceiling of $35–$40 by 2030 under bullish conditions. For Snap to reach $100, it would need massive revenue expansion, far beyond current market projections. While a breakthrough in AR or AI monetization could shift the outlook, such a jump is considered highly speculative.

What macroeconomic factors could most significantly impact Snap's 2030 valuation?

Critical macroeconomic variables include digital advertising industry growth rates, technology regulatory developments, interest rate environments affecting discount rates, and broader technology adoption curves. Global economic growth patterns will particularly affect Snap's international expansion potential, which represents a major component of long-term growth projections.

How should investors use Pocket Option tools to develop their own Snap stock forecasts?

Pocket Option provides analytical frameworks for constructing custom valuation models with personalized assumptions. Investors should leverage these tools to develop scenario analyses that test how specific variables impact potential outcomes. This approach transforms generalized forecasts into actionable investment theses tailored to individual perspectives on Snap's business evolution.

Should You Invest in Snap?

The Snap stock price prediction 2030 is filled with both opportunities and risks. Snap’s focus on AR and innovation makes it one of the most dynamic players in the social media and tech industry.

Start trading