- Artificial Intelligence Platform (AIP): Introduced in 2023, AIP cut deployment times from months to hours, increasing commercial customer growth by 150% YoY.

- Healthcare: Expansion into this $30B+ market includes Mayo Clinic partnerships with 30% efficiency gains.

- International Markets: Asia-Pacific is expected to account for 25% of total revenue by 2030.

- Mid-market Adoption: Palantir has lowered entry barriers by reducing minimum contract values from $1M to $250K.

PLTR Stock Forecast 2030: Long-Term Predictions

Palantir Technologies (PLTR) has captured significant investor attention since its 2020 IPO, and many are asking: What is the PLTR stock forecast 2030? With the stock positioned at the intersection of AI, government technology, and enterprise SaaS, this forecast combines technical signals, financial data, and expert commentary to provide a realistic picture of PLTR stock price prediction 2030. Investors on Pocket Option are increasingly focused on long-term assets with disruptive potential—and Palantir fits that profile. The stock is traded on the NASDAQ under ticker PLTR, making it accessible to a wide range of global investors.

Article navigation

- Understanding Palantir’s Business Model and Growth Trajectory

- Government Contracts: The Stable Foundation

- Key Growth Catalysts in PLTR Stock Forecast Through 2030

- Commercial Sector Acceleration

- PLTR Stock Forecast 2030: Analyst Projections

- Risk Factors in PLTR Stock Prediction 2030

- Strategic Investment Approaches for Palantir Stock

- What Will Palantir Stock Be Worth in 2030?

- What is the outlook for Palantir 2025?

- What is the 10 year projection for Palantir?

- What is the price prediction for Palantir in 2035?

- How Pocket Option Empowers Investors Tracking PLTR

- Staying Ahead in the AI-Powered Market

Understanding Palantir’s Business Model and Growth Trajectory

Palantir Technologies is a data analytics pioneer operating two core platforms: Gotham for government clients and Foundry for commercial enterprises. Evaluating PLTR stock prediction 2030 starts with understanding how this dual-market strategy secures a defensible position in a $200+ billion data intelligence market.

Since 2020, Palantir has aggressively expanded into commercial sectors. This diversification is central to PLTR stock 2030 forecasts, with Pocket Option analysts projecting strong tailwinds from enterprise AI and SaaS integration.

Expert Insight: “Palantir’s dual approach—balancing government reliability with commercial innovation—makes it one of the most resilient AI infrastructure plays,” says Sarah Tomlinson, Senior Analyst at QuantMetrics.

Government Contracts: The Stable Foundation

Multi-year government contracts remain Palantir’s foundation. With average values of $48 million and an 85% renewal rate, these engagements create high switching costs and predictable revenue through 2030.

| Client Sector | Current Revenue | Projected 2030 |

|---|---|---|

| Government | 55% | 40–45% |

| Commercial | 45% | 55–60% |

Key Growth Catalysts in PLTR Stock Forecast Through 2030

Expert Quote: “AIP is Palantir’s Trojan horse—it embeds AI at the core of enterprise decision-making,” says Dr. Leon Feldman, Head of AI Strategy at Polaris Research.

Commercial Sector Acceleration

Palantir’s commercial growth rate is projected to lead all segments, growing 30–35% annually through 2030. As deployment times fall, scalability rises:

| Growth Metric | 2024 Value | 2030 Projection |

|---|---|---|

| Commercial Customers | 147 | 800–900 |

| Average Contract Value | $1.2M | $2.3M |

| Revenue CAGR | 24% | 18% |

Trader Insight: “After integrating Palantir’s solutions in our logistics firm, predictive planning improved by 40% in Q1 alone,” — Ravi Nair, Pocket Option trader.

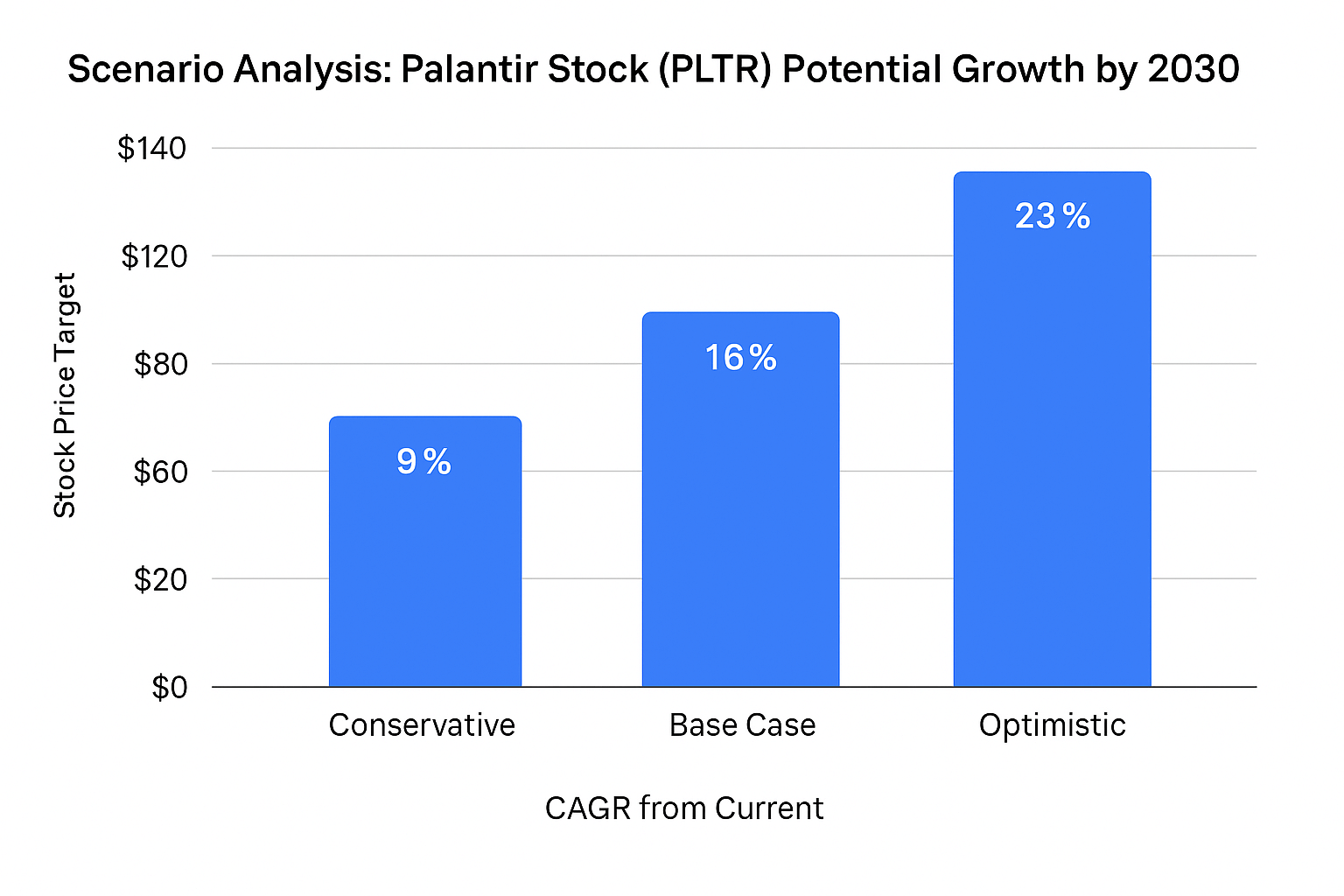

PLTR Stock Forecast 2030: Analyst Projections

PLTR stock price prediction 2030 ranges widely, with targets from $40 to $130 per share. Consensus estimates fall between $75–85. Key variables include:

- 30%+ gross margins

- Revenue scaling beyond $10B

- Free cash flow (FCF) margins increasing to 35–40%

| Scenario | Revenue (2030) | Stock Price | CAGR From 2024 |

|---|---|---|---|

| Conservative | $5.5B | $40–50 | 9% |

| Base Case | $9B | $75–85 | 16% |

| Optimistic | $13B | $110–130 | 23% |

Risk Factors in PLTR Stock Prediction 2030

Key risks to consider in any PLTR stock prediction 2030:

- Competition: Microsoft, Amazon, Snowflake could compress margins (by 5–8%).

- Government Dependency: Still 40%+ of revenue.

- Regulatory Risks: GDPR and other privacy laws could limit international expansion.

Expert Insight: “The real test will be whether Palantir can retain its AI edge as cloud giants commoditize analytics,” notes Ingrid Solberg, CTO at Venture Grid.

Strategic Investment Approaches for Palantir Stock

PLTR’s beta of 2.7 indicates high volatility, making dollar-cost averaging a wise strategy. Technical accumulation levels: $15, $25, $32.

Short-Term vs. Long-Term Outlook

Short-term traders may benefit from volatility around earnings or macro news, while long-term investors should focus on AI penetration, commercial growth, and scalability over the next five years.

Allocation by Risk Profile

| Profile | Max Allocation | Diversification |

|---|---|---|

| Conservative | 1–2% | Bonds, value |

| Moderate | 3–5% | Blend |

| Aggressive | 5–8% | Growth tech |

What Will Palantir Stock Be Worth in 2030?

According to Pocket Option’s projections, Palantir stock could realistically trade between $75 and $85 by 2030, with bullish scenarios placing it as high as $130, driven by commercial AI adoption and expanding profit margins.

Could PLTR Reach a $1 Trillion Market Cap?

Some analysts project that Palantir could reach a $1 trillion market cap by 2030, based on increasing AI adoption and scaling commercial software sales. If realized, this would represent a near 60x return from 2023 levels.

What is the outlook for Palantir 2025?

By 2025, Palantir is expected to:

- Generate over $4.5B in revenue

- Improve FCF margins to 28–30%

- Reach over 350 commercial clients

This mid-decade growth sets the stage for compounding momentum toward 2030.

What is the 10 year projection for Palantir?

The 10-year PLTR stock forecast (2024–2034) anticipates:

- Revenue CAGR of 18%

- AI as core product layer across industries

- Market cap potential of $150–200 billion

What is the price prediction for Palantir in 2035?

Looking further, PLTR stock price prediction for 2035 estimates range from $140 to $180 per share, assuming continued AI market leadership, FCF efficiency, and international traction.

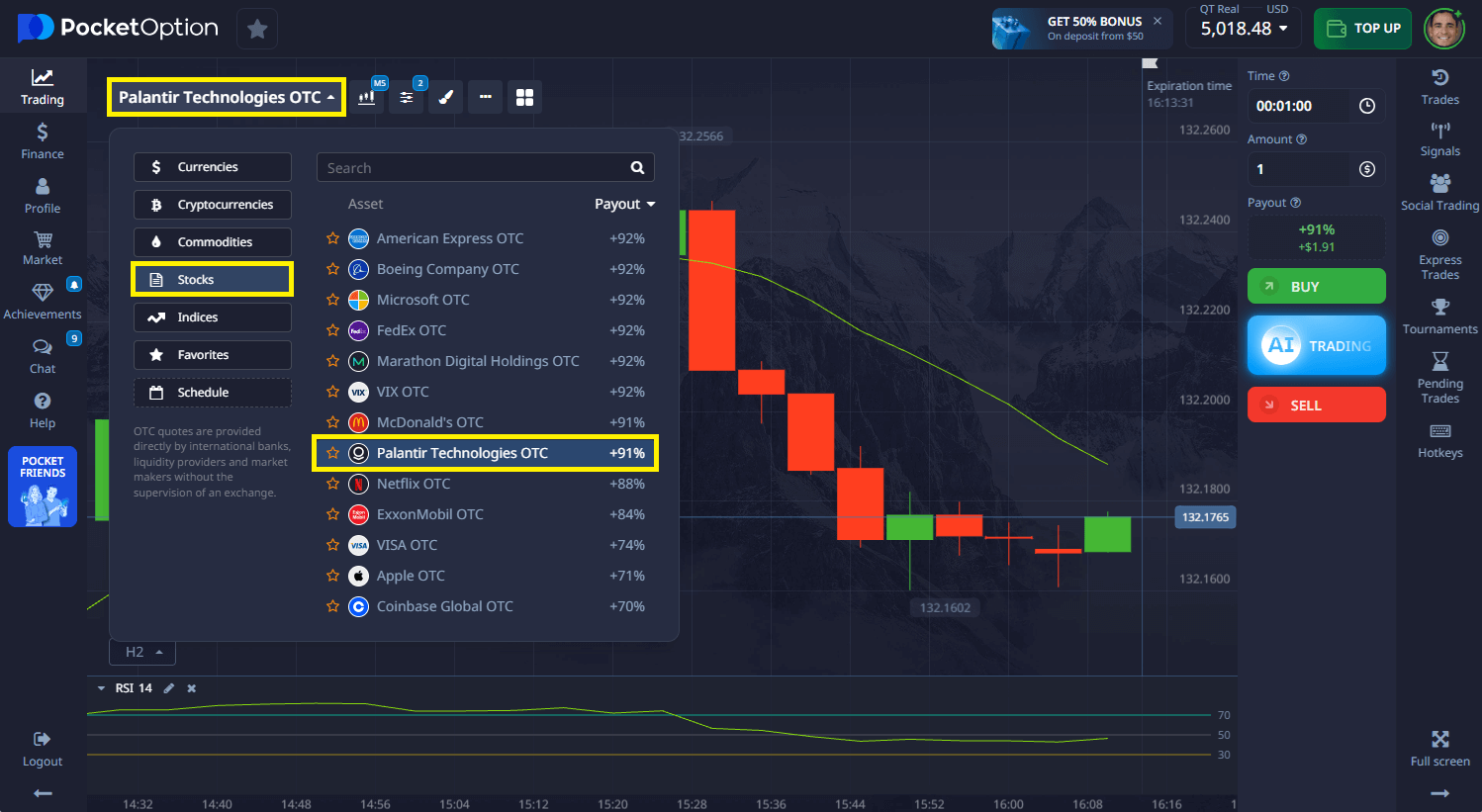

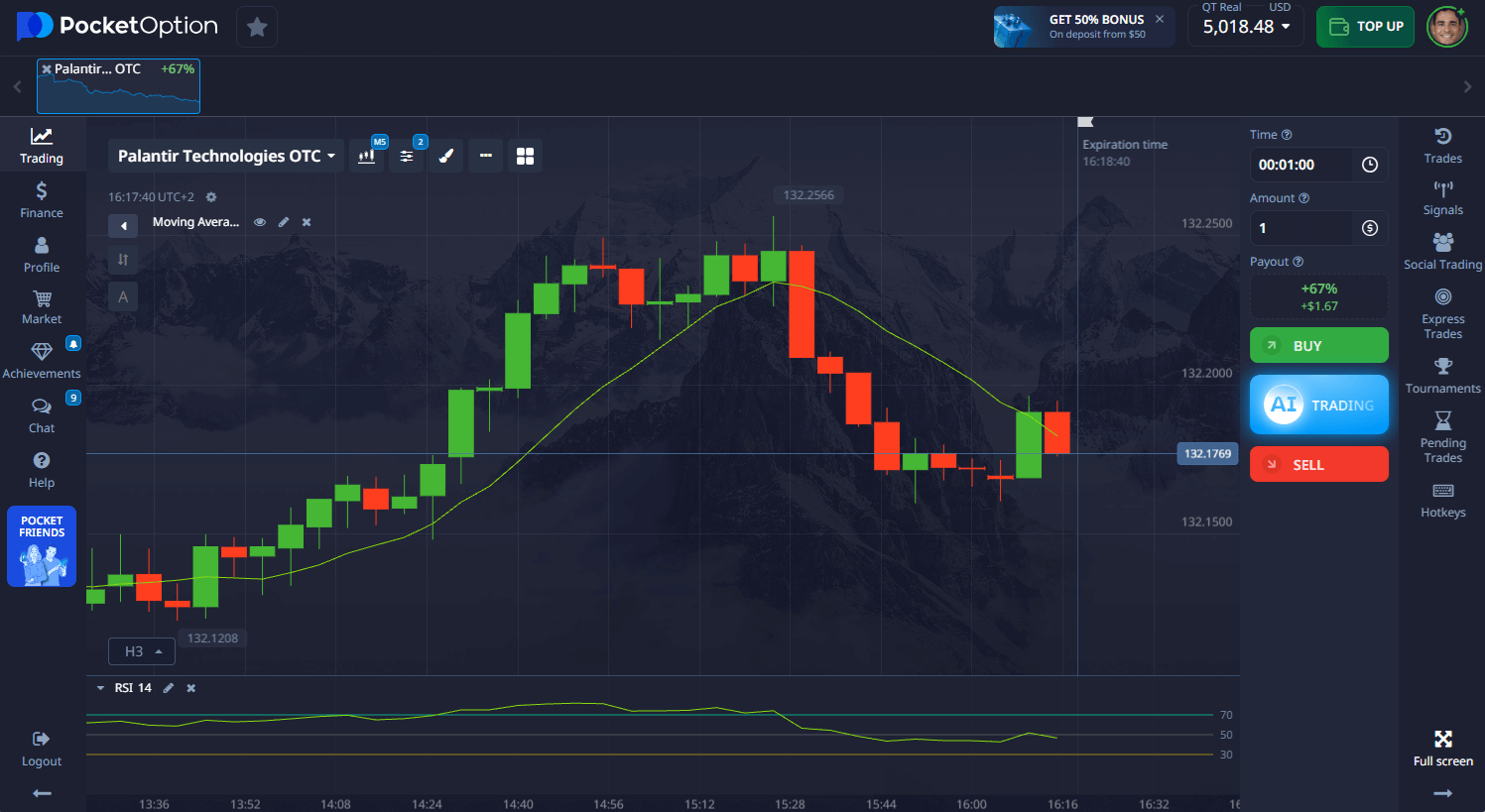

How Pocket Option Empowers Investors Tracking PLTR

Investors following PLTR’s long-term trajectory benefit from more than just analysis — they need tools that provide actionable trading opportunities. That’s where Pocket Option excels. As a dynamic trading platform, it enables users to monitor, analyze, and actively trade assets like Palantir stock with speed and precision.

Here’s why Pocket Option is a top choice for tech-savvy investors:

- Trade PLTR in Real Time: Pocket Option supports trading on Palantir stock with just a few clicks. Simply search for PLTR in the asset list and configure your trade — ideal for quick entries and exits.

- Quick Trading Interface: Use the intuitive Buy/Sell layout to speculate on short-term price movements based on your analysis of PLTR’s trend.

- $50,000 Demo Account: New to the platform? Practice your strategy risk-free with a generous demo balance — ideal for testing entries during earnings or forecast cycles.

- Copy Trading: Access top-performing strategies from global traders and apply them to high-growth stocks like PLTR.

- Market Signals: Get notified of technical setups and market shifts that affect PLTR and other AI-driven stocks.

- Mobile and Desktop Access: Stay connected to market movements anywhere you go.

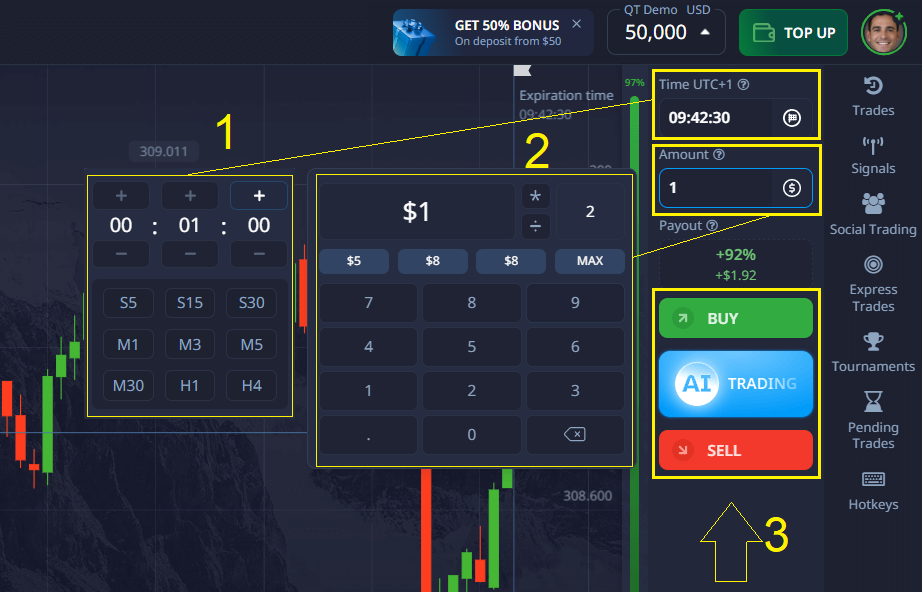

How to Trade PLTR on Pocket Option:

- Open the Pocket Option platform.

- Use the search tool or asset list to find PLTR.

- Choose your trading type (Quick Trading is available in most regions).

- Set investment amount, expiration time, and risk controls.

- Confirm the trade and monitor performance.

Whether you’re an active trader or a long-term investor, Pocket Option provides a flexible gateway into tech stocks like Palantir — helping you act quickly when it matters most.

Staying Ahead in the AI-Powered Market

As Palantir Technologies continues to evolve within the AI and big data sectors, its long-term outlook remains a compelling option for forward-thinking investors. PLTR’s expanding commercial footprint, growing AI integration, and financial momentum all point toward a future of strategic opportunities — especially for those equipped with the right tools.

Platforms like Pocket Option help turn forecasts into action by providing accessible analytics, signals, and real-time monitoring for assets like PLTR. Whether you’re tracking price breakouts, exploring copy trading, or refining your entry points, having a trusted platform is essential in navigating fast-moving markets.

Join the conversation and explore more insights in our community!

FAQ

What factors will most influence the PLTR stock forecast 2030?

Commercial customer growth rate, AI platform adoption, free cash flow margin expansion, and competitive moat sustainability will determine Palantir's 2030 valuation. The shift from government to commercial revenue mix will be particularly critical for achieving analyst targets.

Is Palantir profitable now, and how will that affect PLTR stock 2030 value?

Palantir achieved GAAP profitability in 2023 with 22% free cash flow margins. Analysts project these margins reaching 35-40% by 2030, potentially supporting a premium valuation multiple of 15-20x sales versus today's 10-12x.

How does government contract dependency impact PLTR stock prediction 2030?

While government contracts provide stable revenue (95% renewal rates), they grow more slowly (8-10% annually) than commercial contracts (30-35%). Reducing government dependency from 55% to 40% of revenue by 2030 supports higher growth projections.

What role will artificial intelligence play in PLTR stock forecast 2030?

AI represents Palantir's primary growth catalyst, with its AIP platform reducing implementation time from months to hours. Proprietary AI capabilities create defensible competitive advantages that justify premium valuations if sustained through 2030.

How should investors approach volatility when considering PLTR stock 2030 positions?

Investors should use dollar-cost averaging during 20%+ corrections, maintain strict position sizing (1-8% depending on risk tolerance), and utilize covered calls to generate income. Pocket Option provides volatility metrics to help identify optimal entry points through market cycles.